The Best Cloud Accounting Software

We researched and tested the best online accounting software for small businesses and mid-sized companies. Compare these cloud solutions for important features and pricing below.

- Customizable payment terms

- No setup costs

- Recurring invoicing

- Hundreds of third-party add-ons available

- Feature sets for multiple industries

- Highly customizable

- Customizable invoicing

- Extensive pre-built and custom reports

- Automatic exchange rates

Web-based accounting software helps small businesses and medium-sized companies complete financial tasks from any device with an internet connection.

We used our advanced review methodology to test the most popular online accounting software for features like invoicing, reporting, and payment processing.

- FreshBooks: Best Overall

- NetSuite: Best ERP System

- QuickBooks Online: Best for Small Businesses

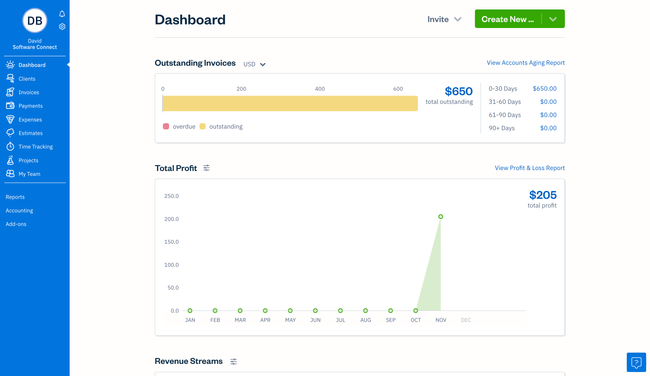

FreshBooks - Best Overall

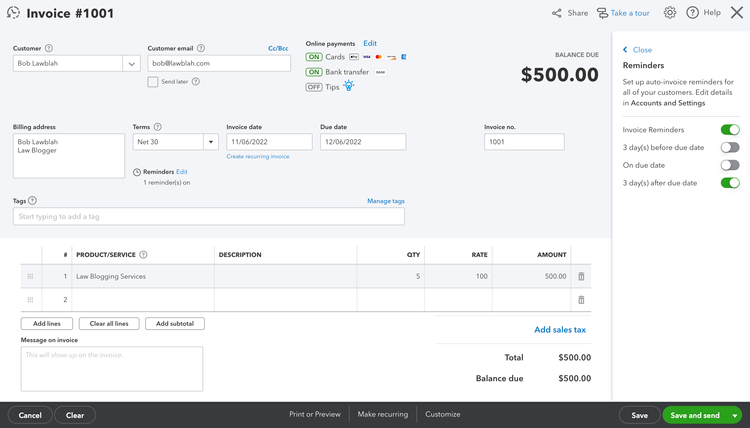

FreshBooks stands out as the best overall accounting system for its robust invoicing features. You can easily create, customize, and send invoices, and set up online payments and recurring billing. The online payments are processed via the FreshBooks payment module, which works with all major credit cards and Apple Pay at a rate of 2.9% + $0.30 per transaction.

In 2024, FreshBooks introduced several enhancements, including a partnership with Gusto for FreshBooks Payroll. This partnership allows U.S. businesses to handle payroll, tax filings, and labor compliance within the platform. Additionally, FreshBooks integrates with over 100 third-party apps, though its integration with point-of-sale options is limited.

Pricing starts at $19 per month for five billable clients. While this might be an attractive entry point for many, the platform has limitations, including limited inventory management and report customizations. We also wish there was an option for bulk invoicing for businesses that handle high volumes of invoices.

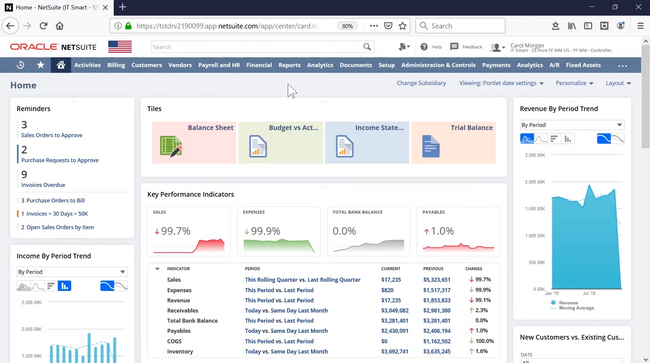

NetSuite - Best ERP System

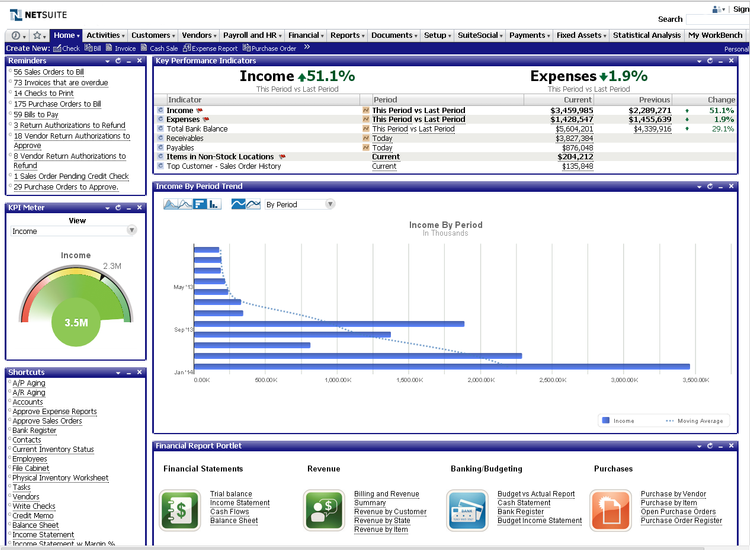

NetSuite is a solid ERP system with strong accounting capabilities. Its general ledger management includes a customizable chart of accounts, flexible financial period close options, multi-currency support, and automated bank reconciliation.

NetSuite also provides advanced cash management features, offering visibility into bank and credit card data to improve your cash flow forecasts. The platform consolidates financials for multi-entity or multi-department organizations and has clean dashboards for presenting graphs on revenue trends, profit margins, and accounts receivable and payables.

While NetSuite delivers advanced tools and capabilities beyond many lower-cost alternatives, its user interface can be complex and may require time to navigate efficiently. Additionally, businesses will need to engage with a consultant or hire internal IT staff to fully utilize its extensive and customizable features.

QuickBooks Online - Best for Small Businesses

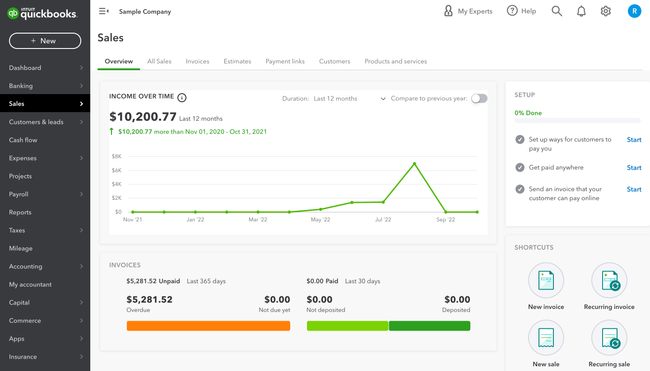

QuickBooks Online offers efficient invoicing capabilities that help small businesses get paid faster and maintain a healthy cash flow. The system provides a handful of pre-designed invoice templates, allowing you to customize layouts, logos, colors, and fonts to reinforce your brand identity.

QuickBooks Online also simplifies billing with features such as a mobile-optimized app, online pay now buttons, recurring invoices, and automated payment reminders. It integrates with popular payment gateways like Stripe, Square, and PayPal, each with varying transaction fees. Additionally, you can use QuickBooks own payment gateway with with fees ranging from 1% to 3.5% per transaction.

However, pricing may be a consideration for very small teams and freelancers. Subscription costs range from $35 to $235 per month, which can become a significant expense over time, particularly for growing businesses that require additional features or add-ons. However, QuickBooks typically has special sales and pricing for new users.

Odoo

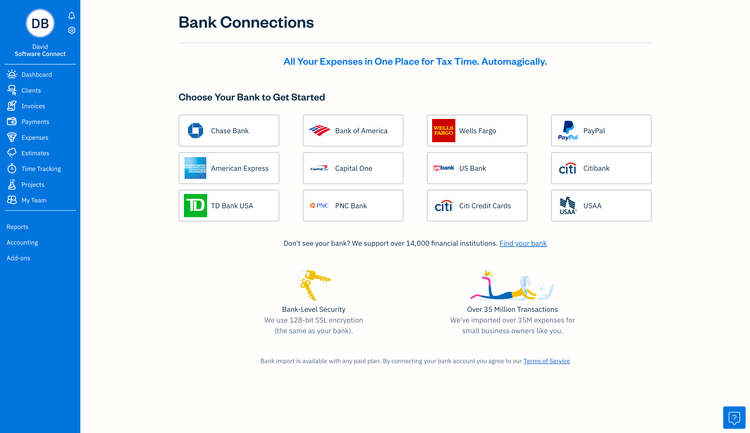

Odoo Accounting provides a comprehensive feature set that covers accounts payable and receivable, bank synchronization, and financial reporting. The tax report module makes tax reporting easy by enabling you to pre-configure your location and required reports so tax time is a breeze.

For accounting, Odoo includes features like easy cost tracking, recurring invoice management, and auto-synchronization of bank feeds. It supports multiple currencies and payment methods, including credit cards, digital wallets, and online banking. With connections to over 15,000 banks worldwide, Odoo makes tracking your transactions easy.

Not everything with Odoo is great, while creating an invoice, the form layout was counterintuitive, particularly on mobile devices. Its bank reconciliation layout also could use some work as line items were not displayed as a direct one-to-one comparison, making the process a bit confusing.

Xero

Xero is a user-friendly accounting software you can test out with a free trial. It displays outstanding invoices and upcoming bills in a clear, tabular format, making financial tracking straightforward. The system includes in-app guidance for beginners to accounting and has an extensive library of videos and best practice guides. While Xero lacks its own built-in payment gateway, it integrates with over 1,000 third-party apps, including Square, PayPal, Venmo, Apple Pay, and Google Pay.

The software includes over 50 pre-built report templates, covering important financial statements such as profit and loss, balance sheets, aged receivables/payables, and cash flow reports. These reports can be customized with layout adjustments, filters, and other parameters. However, invoice customization is more limited compared to QuickBooks Online or Freshbooks, allowing you only to make minor changes such as modifying the page margins, fonts, logos, and columns and adding a single custom field.

Unlike many competitors, Xero has no user cap, allowing unlimited users for each subscription. However, the basic plan lacks multi-currency support and bulk reconciliation features, which may be an inconvenience to businesses with high transaction volumes. Additionally, the entry-level plan imposes limits on the amount of invoices and bills you can send each year

Sage Intacct

Sage Intacct delivers AI-powered accounting and ERP capabilities that support businesses from the get-go and scale with you as your business grows. Its adaptability makes it great for business any stage of growth, offering automated accounts payable and a general ledger equipped with AI anomaly detection.

The system features a sophisticated general ledger with a multidimensional chart of accounts, enabling efficient financial management across various entities. This makes it ideal for international and multi-department organizations. A real game changer for Sage Intacct is its ability to handle currency conversations and generate consolidated reports without waiting for month-end closings.

Sage Intacct includes editable invoice templates with Microsoft Word and integrations with payment processors like Paya and EBizCharge for credit cards, debit cards, and eCheck Payments. However, implementation, support, and customizations typically require assistance from a value-added reseller (VAR). While VARs provide industry expertise and localized support, their quality and costs can vary.

Zoho Books

Zoho Books stands out for its automated report generation, allowing you to schedule and email reports at pre-determined intervals. It gives you access to over 50 financial reports, including aging summaries, balance sheets, and profit and loss statements. Additionally, Zoho Books offers 21 invoice templates with options to edit colors, adjust fonts, and set the page orientation to your liking. They even include invoice templates for retail businesses with point-of-sale styled invoices.

Unlike Xero, FreshBooks, or QuickBooks Online, Zoho Books offers a free plan for one user and one accountant. However, it doesn’t have a built-in payment gateway, so you’ll need to integrate with third-party services. Zoho apps are also highly interdependent — meaning if you need more than just Zoho Books and Zoho Inventory, you’re better off getting the Zoho One bundle for full functionality starting at $37 per employee per month.

CustomBooks

CustomBooks, formerly known as AccountingSuite, is made for cloud and online banking, offering connections with over 15,000 bank and credit card institutions to sync your bank transactions automatically. Bank reconciliation in the system is pretty straightforward, and you can even manage all your transactions directly from the system without having to go on your banking app. This means you can transfer funds between accounts and automatically make payments to vendors for any extra work.

It offers a seamless billing process, automatically updating inventory records and making adjustments during invoicing. You can personalize your invoices to fit your business’s branding and style. And you can edit the templates with custom product fields, promise dates, or dropship specifications.

However, there are some areas for improvement. The user interface could be more streamlined by reducing the amount of dropdowns and extra windows to improve navigation. Additionally, there is no dedicated mobile app, so accessing the system on mobile devices can be tricky with smaller font sizes and some links not working properly.

Striven

Striven is a fully integrated ERP system with strong accounting tools designed for business’s of all sizes. It includes features like AP/AR, revenue tracking, online banking, and a general ledger. Striven has built-in support for multi-currency transactions, making it useful for companies operating across multiple countries.

Striven can generate a wide span of financial reports, including cash flow statements, balance sheets, and profit and loss reports. It can also generate custom reports, automate invoicing, send payment reminders, and manage vendor bills electronically. However, Striven may not be the best fit for businesses requiring complex tax calculations or advanced budgeting and forecasting capabilities, as these functions would require integration with third-party applications.

Multiview ERP

Multiview ERP is a complete ERP system suited best suited for medium to large businesses. It offers customizable invoice templates that include item descriptions, payment terms, costs, and deadlines.

Multiview’s robust general ledger enables you to generate custom reports for in-depth analysis across various dimensions, including time, cost, and product performance.

However some users have reported that the implementation process is time-consuming and challenging, even with dedicated support from Multiview. Additionally, you’ll need to consult Multiview directly to receive pricing on the system.

What Is Online Accounting Software?

Online accounting software is a type of application hosted on remote servers providing financial tools like billing, invoicing, and reporting.

Unlike offline, on-premises solutions, cloud accounting tools are not installed or maintained on individual desktop computers. They operate under a Software as a Service (SaaS) model, meaning users can access and use the software via the internet, often through a web browser.

Key Features

| Feature | Description |

|---|---|

| Online Invoicing and Billing | Automates the billing process, allowing for creating, sending, and managing invoices online. |

| Financial Reporting and Analysis | Generates detailed financial reports such as profit and loss, balance sheets, and cash flow statements, offering insights into financial performance. |

| Expense Tracking | Enables tracking and categorizing business expenses, making monitoring spending and managing finances easier. |

| Bank Reconciliation | Automatically syncs with bank accounts and credit cards to match transactions for accurate financial records. |

| Tax Preparation and Compliance | Helps prepare tax returns and ensures compliance with laws by keeping up-to-date with the latest tax rates and regulations. |

| Multi-user Access | Allows multiple users to access financial data simultaneously, with customizable permission levels to maintain security and control. |

| Data Security and Backup | Provides security measures, including encryption and backups, to protect financial data from unauthorized access and loss. |

| Integration with Other Tools | Offers integration with various business tools and systems such as payroll, CRM, and eCommerce platforms. |

| Mobile Access | Includes mobile apps or mobile-friendly web interfaces to manage finances on the go. |

| Payment Processing | Facilitates the acceptance and processing of online payments directly within the software, supporting various methods such as credit cards, bank transfers, and digital wallets. |

Benefits

- Accessibility: Being cloud-based, accounting software allows users to access financial data and tools from anywhere with an internet connection, facilitating remote work and business management on the go.

- Cost Efficiency: Typically reduces upfront costs associated with traditional software, such as installation and maintenance fees, since the cloud provider manages these aspects.

- Scalability: Easily scales with the growth of a business, offering flexible plans and features that can be adjusted as business needs change.

- Real-Time Data: Offers live financial information, allowing for timely decision-making.

- Data Security: Often provides high levels of security and regular backups, safeguarding against data loss and unauthorized access, although the level of security can vary between providers.

- Automatic Updates: Software updates are automatic and managed by the service provider, ensuring access to the latest features and security enhancements without additional effort or cost.

Drawbacks

- Dependence on Internet Connectivity: Requires a stable and reliable internet connection for access, which can be a significant limitation in areas with poor connectivity.

- Ongoing Subscription Costs: While initial costs may be lower, the subscription-based pricing model can become a recurring expense that adds up over time.

- Data Security Concerns: Despite high-security standards, storing sensitive financial data on external servers can raise concerns about data privacy and control, especially given varying regional regulations.

- Limited Customization: Some cloud accounting solutions may offer less flexibility for customization compared to traditional, on-premises solutions, potentially not meeting specific business needs.

- Learning Curve: Transitioning from traditional accounting practices to cloud-based systems may require staff training and an initial adjustment period.

- Potential for Service Outages: Relies on the service provider’s ability to maintain uptime; any outages or disruptions in the service can temporarily halt access to financial data and tools.

Offline vs. Cloud-based Accounting Software

Offline accounting software differs from cloud-based solutions in many ways:

| Feature | Offline Accounting Software | Cloud-Based Accounting Software |

|---|---|---|

| Accessibility | Limited to devices with the software installed, requiring physical presence or a local network. | Accessible from any device with an internet connection, offering flexibility to work from anywhere. |

| Data Storage | Data is stored locally on the user’s device or an on-site server. | Data is stored on remote servers managed by the software provider. |

| Cost | Often involves a one-time purchase price, with potential additional costs for updates, maintenance, and hardware. | Typically uses a subscription-based model with ongoing fees that cover software updates, maintenance, and storage. |

| Data Backup and Recovery | User’s responsibility, requiring manual setups for backup and recovery processes. | Automatic backups and data recovery services are usually provided, reducing the risk of data loss. |

| Updates and Upgrades | Requires manual downloading and installation of updates; significant upgrades might require additional purchases. | Automatic updates and new features covered by the service provider without additional costs. |

| Collaboration and Sharing | Can be cumbersome, often requiring a local network or physical data transfer for sharing. | Designed for easy collaboration, allowing multiple users to access and work on the same data simultaneously from different locations. |

| Security | Depends largely on local security measures, which might be less robust than those of cloud-based solutions. | High-level security features are typically provided, though there are concerns about data privacy and reliance on the provider’s security measures. |

| Scalability | Scaling up may require hardware upgrades or additional software licenses. | Easily adjusts to business growth, with flexible subscription plans to accommodate more users, storage, or features. |

2025 Cloud Accounting Trends

-

AI Automation: AI is changing the way accountants and businesses handle daily accounting tasks by automating data entry, reconciliations, and forecasting by reducing manual errors and streamlining mundane tasks. Companies like Intuit QuickBooks Online are doubling down on AI by integrating features like automated invoices and bill payments that help small businesses manage cash flow without much human effort.

-

Cybersecurity Improvements: As cyber threats become more sophisticated, cloud accounting providers are prioritizing security with AI fraud detection, multi-factor authentication, and zero-trust frameworks. By 2025, 80% of enterprises are expected to adopt advanced cybersecurity strategies to protect their cloud infrastructure and online systems, including accounting software.

-

Integrations: With businesses demanding seamless integration between accounting software and other business tools such as CRM, payroll, and inventory systems, accounting providers are driven to increase their integration capabilities. Systems like Xero, Sage, and Odoo are expanding their integration ecosystems, allowing businesses to connect accounting with hundreds of third-party applications for a more unified workflow.

-

Mobile First Accounting: As businesses increasingly rely on mobile technology, cloud accounting software is evolving to provide users with full mobile functionality. QuickBooks and FreshBooks have improved their mobile apps with biometric authentication, digital payment gateways, and mobile receipt scanning. Making it easier for business owners to manage expenses, invoices, and cash flow from anywhere.

Pricing

Online accounting software pricing can vary widely based on several factors, reflected in the monthly subscription rates that range from as low as $9 to upwards of $375 per user. This is influenced by various elements like user count, required functionality and features, and the scale of business operations.

-

For smaller setups (1-4 users), accounting software covers basic bookkeeping, invoicing, and expense tracking—ideal for freelancers and small businesses. Pricing starts at $10 and goes up to $200 per month.

Examples: QuickBooks Online, Xero Starter, Wave (free with paid add-ons). -

For growing businesses (5-9 users), mid-tier accounting software includes multi-user access, payroll, inventory management, and advanced reporting. Pricing ranges from $100 to $600 per month. Examples: QuickBooks Online Advanced, CustomBooks, Zoho Books.

-

For larger businesses (10+ users), enterprise and integrated accounting software provides full financial management, automation, multi-entity accounting, and integrations. Pricing starts at $500 and can exceed $3,000 per month.

Examples: NetSuite (base cost + $120/user/month), Sage Intacct ($400–$5,000+ per month, varies by modules), Acumatica (custom pricing).

Frequently Asked Questions

What is the easiest online accounting software?

Xero and FreshBooks are frequently highlighted for their user-centric design and intuitive functionalities. Xero has a fairly comprehensive feature set, which provides expense management, bank reconciliation, and multi-currency accounting.

FreshBooks, on the other hand, is often praised for its simplicity and focus on small businesses and freelancers. It offers straightforward invoicing, expense tracking, and time management tools.

What is the most-used cloud accounting software?

QuickBooks Online is the most popular cloud accounting software solution, particularly among small to medium-sized businesses and accounting professionals. It offers a suite of features like invoicing, expense tracking, payroll, and reporting.

Its popularity is attributed to its extensive ecosystem of integrations and mobile app. QuickBooks Online’s widespread adoption is also supported by strong brand recognition and a reputation for reliability in the accounting software market.