The Best Accounting Software for Nonprofits

Nonprofit accounting software helps businesses manage their funding, grant budgeting, and donations. We’ve reviewed the top platforms for organizations of various sizes and sectors, including education, faith-based, and healthcare.

- Collect donations from desktops, tablets, and mobile devices

- Track real-time donation, registration, and RSVP metrics

- Integrates well with other software

- Comprehensive training resources

- Extensive reporting tools

- Modules for accounts payable, receivable, etc.

- Low hardware and training costs

- Straightforward payroll module

- Intuitive for new users

Accounting software for nonprofits handles financials, invoicing, and donation and grant management for organizations. Using our advanced review methodology, we ranked the top systems below.

- MIP Fund Accounting: Best Overall

- Blackbaud Financial Edge NXT: Best Grant-Specific Budgeting

- AccuFund Accounting Suite: Best for Educational Organizations

- Aplos Fund Accounting: Best for Faith-Based Organizations

- FastFund Accounting: Best for Small Municipalities

- Sage Intacct: Best for Multi-Entity Organizations

- Fund EZ: Best for Grant Reporting

- Multiview ERP: Best for Healthcare Nonprofits

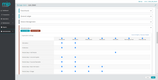

MIP Fund Accounting - Best Overall

MIP Fund Accounting, formerly Abila MIP or Sage 100 MIP, is our best overall pick because of the depth and breadth of its features. These include complex fund accounting, procurement, and budgeting. MIP also covers payroll, HR, timekeeping, fixed asset management, and grant management through 25 modules.

We like that the platform can track unlimited funds, including advanced audit reporting and fraud deterrence. Its flexibility in deployment, with options for cloud-based, on-premise, or self-hosted systems, allows organizations to tailor the software to their specific operational needs. One drawback of the system is that users report it’s not user-friendly, specifically with reporting functions. To combat this, MIP Fund Accounting does offer webinars, guides, and training to help familiarize users with the software.

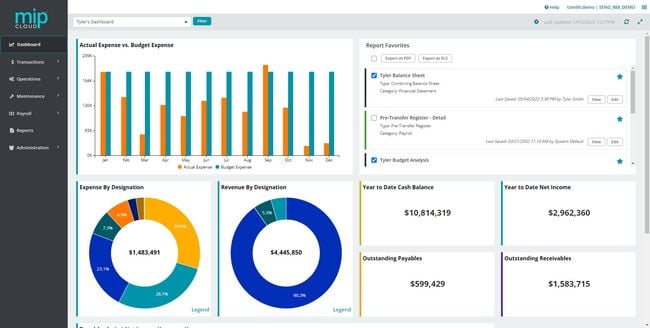

Blackbaud Financial Edge NXT - Best Grant-Specific Budgeting

Blackbaud Financial Edge NXT is adept at grant and fund-specific budgeting capabilities. The platform aids grant management by offering detailed tracking and reporting capabilities, allowing nonprofits to monitor spending, compliance, and performance against specific grant requirements. We like that users can create a separate financial record for each restricted fund, enabling transparent usage tracking and reporting.

Blackbaud Financial Edge NXT also provides granular tools for tracking transactions by net asset class, maintaining a clean account structure for capturing program, grant, and department info. It ensures compliance through user-specific access rights and approval controls. In this way, Blackbaud Financial Edge NXT provides secure data management and enhances strategic decision-making based on accurate financial data. While its grant budgeting tools are effective, we found the lack of payroll and HR modules to be a drawback at its high price point.

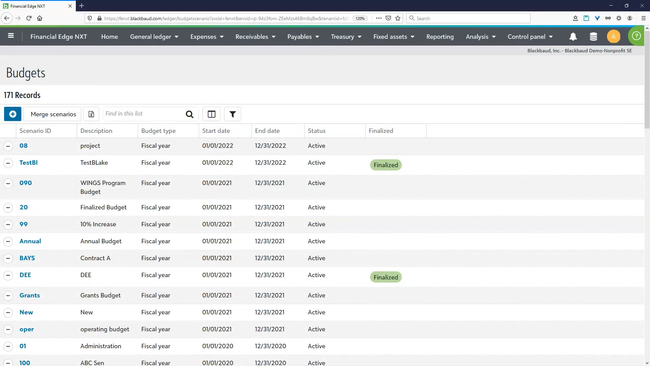

AccuFund Accounting Suite - Best for Educational Organizations

AccuFund Accounting Suite is well-suited for educational nonprofits such as private, charter, and universities. It includes grant, budget, and allocation management to help schools enhance their financial performance. For instance, the budget development module supports unlimited cycles and budgeting at any organizational level. Organizations can better allocate their expenses through budget management for every program.

We also like AccuFund’s modular structure, which helps organizations tailor the system to their specific workflows by selecting a few modules and adding more as their needs evolve. This flexibility is further enhanced by the option for either cloud-based or on-premise deployment to best fit nonprofit schools’ infrastructures and operations. We also like its grants management module, which streamlines the entire process from application through reporting. However, one drawback to AccuFund is that it can be difficult to export data to Excel, specifically budgets.

Aplos Fund Accounting - Best for Faith-Based Organizations

We found Aplos Fund Accounting best for small-midsized churches because of its user-friendly UI and donor management. Aplos covers donation tracking and event registration, providing integrated online donation forms and detailed reporting capabilities. It also features a donor database with customizable profiles, segmentation tools, and integration with email providers for personalized communication. We like its straightforward design for users like volunteer church treasurers who don’t have extensive accounting backgrounds.

We also like Aplos’ ability to manage various funds, each with specific restrictions and reporting requirements. Its true fund accounting allows these organizations to accurately track and report on each fund separately, ensuring compliance and maintaining donor trust. With over 70 built-in customizable reports, organizations can get granular insights into all aspects of their financial performance. However, we wouldn’t recommend Aplos for large nonprofits that require more comprehensive features like payroll or project management.

FastFund Accounting - Best for Small Municipalities

FastFund Accounting is a good option for government agencies and municipalities. It can create custom reports to help organizations comply with NPO fiscal requirements. These include multi-year and budget reports that comply with FASB 116 and 117. It also generates IRS Form 990, 990-EZ, and 990-N filings for tax compliance, which are essential for municipalities.

We also like FastFund’s payroll module, which can handle various tax-exempt statuses of employees, highly relevant for nonprofit organizations. Unfortunately, this module comes at an extra cost on top of the main system, with its lowest price being $50/month for 1-2 employees. Beyond payroll, FastFund provides fundraising CRM and fund accounting modules, including general ledger, accounts payable and receivable, and direct and indirect cost allocations.

Sage Intacct - Best for Multi-Entity Organizations

Sage Intacct because of its advanced financial management features and built-in HR and payroll modules. Specifically, its multi-entity consolidation helps nonprofits with multiple locations consolidate their financial data into one centralized dashboard. Along with grant management, budgeting, and nonprofit revenue recognition, these modules can all enhance nonprofits’ financial management.

Additionally, Sage Intacct’s nonprofit management module includes data tracking for projects to gain insight into performance. The fundraising module streamlines the donation process, allowing organizations to grow relationships with their stakeholders, donors, and volunteers. Overall, Sage Intacct’s strong financial features, combined with its nonprofit management, make it a good option for multi-entity organizations. However, one drawback is that the system comes with a steep price, making it suitable for only larger nonprofits.

Fund EZ - Best for Grant Reporting

We included Fund EZ because it provides specialized functionalities tailored to the complexities of grant and program reporting. This capability is crucial for nonprofits that rely heavily on grants and must ensure compliance with funders’ reporting requirements. We like that users can generate detailed reports by grant, program, and other dimensions without requiring manual adjustments.

Fund EZ provides a comprehensive suite of reports essential for nonprofit management, including transaction journals, payables and receivables aging reports, detailed general ledger entries, trial balances, and purchase order details. It also offers advanced reporting for budget comparisons, encumbrance tracking, and various financial statements compliant with nonprofit accounting standards, such as FASB 117. This being said, its custom reporting capability is only available with the Pro add-on, which will cost more than the standard system. Organizations must schedule a quote for pricing.

Multiview ERP - Best for Healthcare Nonprofits

Multiview ERP offers an extensive general ledger (GL) module that integrates with your EMR system for seamless revenue data collection. This is essential for nonprofit healthcare organizations, as it combines financial data for patient care with organizational transactions for full visibility. The GL also provides complete drill-down functionality with document management, letting you see associated invoices or records for each entry. It helps eliminate manual cross-referencing and jumping back and forth from your EMR.

The general ledger also has a full audit trail and approval processes. You can track all activity within the system, whether it’s posting journal entries, deleting a transaction, or any other change. Also, configure workflows so specific individuals or departments can approve financial actions. This gives you an extra layer of security to prevent user errors or identify suspicious activity. With a complete audit trail and validations, you can achieve greater nonprofit accounting transparency.

Multiview ERP’s general ledger can manage financials for multi-entity organizations. This is crucial for larger hospital systems to maintain accurate finances across several clinics and medical centers. The system segregates each entity’s data so you can assess individual business units without lumping them all together. Because of its extensive feature set, we wouldn’t recommend Multiview for smaller, single-entity nonprofit clinics.

What is Nonprofit Accounting Software?

Nonprofit accounting software is a type of nonprofit software designed to meet the unique reporting, fundraising, and compliance needs of nonprofit organizations. As opposed to a general-purpose accounting solution, this software helps nonprofit organizations (NPOs) manage fund sources and further their organization’s mission by properly using available funds. This can sometimes be marketed as fund accounting software.

Most NPOs’ operating expenses are entirely from funds, grants, and donations. A customizable solution can automatically account for and allocate funds from grants and donations, allowing your organization to focus on actual outreach rather than behind-the-scenes administrative tasks.

NPOs are responsible for keeping detailed records of their donations, funding sources, and earnings. Without meticulous recordkeeping, NPOs can be subject to audits, fines, or other legal consequences. Nonprofit accounting features enable NPOs to manage their funding sources fully, ensuring every dollar and donor is accounted for while their accounts are accurate through proper bank reconciliation. This includes the financial management of online donations from crowdfunding or foreign sources, which must be reported along with an NPO’s main funding.

Note: Operating a faith-based organization? A specific church accounting software may be more appropriate for your needs.

Key Features

Nonprofit accounting software options allow nonprofits to accurately manage the complex financial needs of organizations of any size. Rather than depending on a general-purpose business accounting solution with basic accounts receivable (AR) and payable (AP) functionality, organizations prefer using nonprofit accounting software. These include industry-specific functions, primarily fund accounting and the real-time collection of donations.

Here’s a breakdown of the ways these functions meet the needs of an NPO:

- Fund Accounting: A self-balancing set of accounting tools allowing the reservation of cash and non-cash assets for specific purposes or activities. Includes fund class designations, hierarchical fund management, and encumbrance management.

- Invoicing: Helps customers pay your organization for goods and services you’ve rendered them. Includes automatic payment reminders, credit card payment processing, and notifications.

- Reporting: Create earning and expense reports to fully account for an organization’s funding, complete with detailed filtering options using transaction codes. For use across departments, financial statements and reports can be exported in different formats including CSVs, Microsoft Excel files, and PDFs.

- Donation management: Track donations and pledges from donors and fundraising campaigns. Measure and anticipate inbound donations, process recurring donations with ACH or credit card payments, corporate donations, matched gifts, individual giving, and any other source of contributions to ensure accurate allocations.

- Grant management: Track an application’s status from the initial submission to acceptance. When grants are awarded, funds can automatically be distributed to designated departments.

Primary Benefits

Streamlined Tax Preparation

Nonprofit accounting solutions will help streamline your tax preparation and filing process. You’ll want to ensure your business is staying compliant and up to date with the latest IRS tax regulations, including IRS Form 990, which federal tax-exempt organizations require.

Set Up Recurring Giving from Donors

As individuals begin to see supporting an NPO as an investment, the more open they’ll be to recurring giving options. Donor-advised funds (DAF) let the donor receive an immediate tax deduction and even get involved in recommending grants to the organization of your choice. These types of funds grew by 9% in 2022, having increased yearly since 2009.

Stay Current with Nonprofit Buying Trends

Our recent fund accounting buyer trends report analyzed the reasons NPOs buy nonprofit accounting software and detailed their most desired features. By reviewing over 500 notes from discussions with NPOs of all sizes, we identified key purchasing trends to help NPOs make the best purchasing decisions:

- 37 percent of surveyed NPOs are replacing aging or dating systems—a statistic eight points higher than for general accounting software and 16 points higher than any other software category. For many NPOs, tight budgets and a “make do with what you have” mentality keeps organizations from using outdated software solutions and equipment that are well past their prime. Some NPOs continue to rely on applications that are nearly 30 years old.

- 21 percent of buyers are seeking better features, including mobile apps and online fundraising capabilities with cloud accounting. Modern nonprofit accounting software can help build custom fundraising campaigns that account for all online giving and manage digital and mobile donations, which can’t be easily integrated with many legacy systems.

- 23 percent of NPOs want a cloud-based software solution. Cloud software enables organizations to keep everything online and accessible through any web browser while reducing costs. Since cloud solutions are offered on a subscription basis, the software allows for lower upfront pricing and better long-term budgeting due to a predictable ongoing cost structure.

Use Software Developed for Your Industry

Though general-purpose accounting software is often less expensive than industry-specific solutions, NPOs must work harder to make general solutions fit their unique needs. For example, there needs to be ways to differentiate different donation types, like money from grants versus donors. Unfortunately, general accounting solutions don’t offer ways to manage separate funds. This results in organizations trying to make square pegs fit in round holes, relying on a patchwork of solutions, and following online tutorials to make general-purpose software work for the NPO.

Take Advantage of Easy-to-Use Systems

Unless you’re a power user or an accountant, business accounting software can be difficult to use. Most end-users lack accounting experience. This is most apparent at smaller, volunteer-run nonprofits that “do the books” manually or with Excel spreadsheets. Cloud-based nonprofit accounting software solutions are far more user-friendly than their previous counterparts, enabling users to tap into easy-to-use web-based interfaces to carry out their accounting work.

Custom software solutions save time for nonprofits by performing the exact tasks necessary to run your NPO. Automation tools from these solutions fill out tax forms, track donations, or simply check your bank account all from one source.

How to Choose

The software your organization needs depends on several factors, such as what your NPO does. Do you mostly perform outreach? Organize charity events? Both? Different accounting solutions can better accommodate your needs.

Depending on the size of your organization, you’ll have a varying level of functionality needs:

Small and Local Organizations

Start-ups and other small nonprofit organizations want to ensure their basic needs are met while keeping costs down as much as possible. This requires basic income and expense tracking in a general ledger, managing your money via bank reconciliation, and using proper reporting tools to stay compliant with the IRS. Ease of use is critical here, as smaller organizations won’t have the funds or personnel to dedicate to advanced accounting processes.

Industry-specific solutions (software developed with nonprofits in mind) can start around $75/month. Small businesses wanting to stay below that total may need to consider a more generic software such as Xero or Sage 50c.

Mid-sized Nonprofit Organizations

Mid-sized NPOs have a tricky balance to maintain. They’re too big for small-scale solutions but not large enough for enterprise-level software. They need something in between. Fortunately, customizable NPO accounting software can hit that sweet spot. In addition to the functionality described above, you’ll need extra features. For example, if you receive any money from grants and need to allocate expenditures to them appropriately, you’ll want to ensure your software has fund accounting functionality.

Your organization may also be growing and adding on paid staff members (rather than being fully volunteer-run), meaning payroll and time tracking are features you can no longer ignore. Both fund accounting and payroll are functionalities that can be bought as stand-alone or add-on software features to existing accounting packages. Looking for a fully integrated (all-in-one) option will be the better long-term option to avoid integration issues and paying multiple software vendors a month.

Large Nonprofits

Larger nonprofit organizations need enterprise-level software with advanced accounting features and large donor management databases. This level of organization will want to ensure board members have full clarity of the organization’s finances through proper bookkeeping, cash management, and reporting. Forecasts will be far more important in predicting the health of your organization in the following year.

Unlike the accounting needs of similarly sized for-profit organizations, larger NPOs focus heavily on fundraising campaigns and customer relationship management (CRM) to ensure continued support of satisfied donors in the long run.

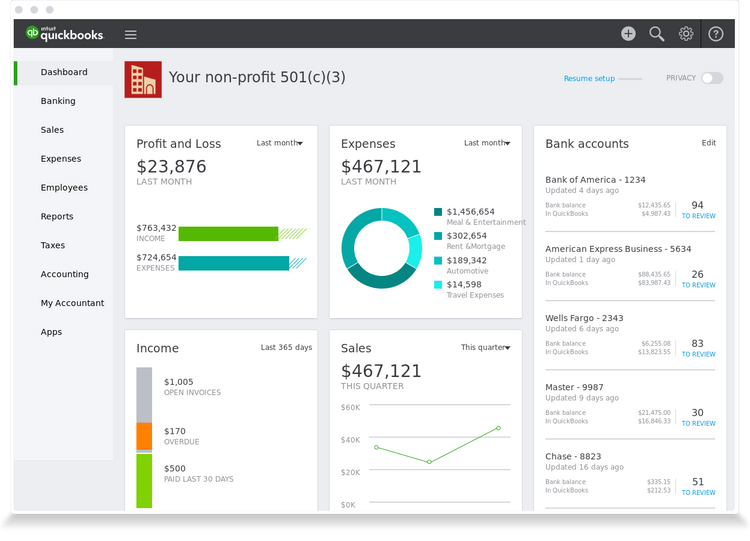

Is QuickBooks a Nonprofit Accounting Software?

A nonprofit organization can successfully use certain QuickBooks products from Intuit. The solution can support tracking budgets by programs or funds, donor management, grant management, financial reporting, bank reconciliations, and more.

QuickBooks offers two desktop solutions that are built with nonprofits in mind:

- QuickBooks Premier Nonprofit Edition

- QuickBooks Enterprise Nonprofit

QuickBooks Premier offers various editions that you can choose from, depending on your industry. The Nonprofit Edition provides custom features to:

- Create a chart of accounts the way IRS Form 990 requires

- Draft reports to view money contributed and spent by donor or grant

- Plan budgets based on fundraising allocations

- Organize tax forms for donors, vendors, and employees

This version of QuickBooks is limited to a maximum of 5 users.

QuickBooks Enterprise Nonprofit includes features similar to its Premier counterpart but includes access for up to 30 users. Key reports include budget by programs, statements of financial income and expense, statements of functional expenses, donors and grant statements, large donor statements, and statements of financial position.

Will QuickBooks Online Work For Nonprofits?

QuickBooks Online can be used in a nonprofit setting, but you’ll want to make sure your staff can put up with the “for-profit language” of the program. The dashboard mentions profit and loss, sales, and other terms not commonly used in nonprofit environments. At this time, there is not a nonprofit edition of QuickBooks Online.

Current versions of Quickbooks must instead be customized to enable nonprofit-specific functionality. For organizations, this requires savvy Quickbooks experts capable of customizing the software to meet their organization’s particular needs. Many NPOs instead look to adopt new nonprofit accounting software solutions that work out of the box.

For organizations set on sticking with QuickBooks Online, Intuit has been recommending QuickBooks Online as the accounting system for nonprofits. The solution has one of the lowest cost of entry points, starting at $20/month for the self-employed version or $90/month for the Plus version.

Frequently Asked Questions

Is there free nonprofit accounting software?

ZipBooks and Wave provide free accounting tools suitable for nonprofits, offering invoicing, expense tracking, and financial reporting functionalities.

Other options like Sage Intacct, QuickBooks Online, Aplos, and Xero, though not free, offer specialized features to support nonprofits in managing their finances, tracking funds, and preparing accurate financial statements.

What accounting software do charities use?

How do I set up an accounting system for a nonprofit?

Setting up an accounting system for a nonprofit involves:

- Identifying financial transactions and creating a customized chart of accounts that reflects the organization’s structure and funding sources.

- Choosing suitable nonprofit accounting software that aligns with operational needs and reporting requirements.

- Implement a system for accurately tracking and managing donations, grants, and expenses.

- Establishing internal controls and financial policies to ensure transparency and compliance.

- Training internal teams on the new system to ensure efficient and consistent use.