The Best Energy Trading Risk Management Software

Get the best software for your business. Compare product reviews, pricing below.

The value of energy assets are growing every day thanks to new renewable sources of power thriving around the world. It’s no surprise many companies are beginning to invest more in the trade of energy commodities. Financial markets are hard enough to navigate even with risk management tools. Since the energy sector is changing rapidly, the trading of related commodities needs additional help.

What is Energy Trading Risk Management (ETRM) Software?

Energy trading risk management (ETRM) software is made to ease the analysis and trade of assets on financial markets. This solution is similar to commodity trading risk management (CTRM) software, except the commodity is exclusively energy assets. Energy producers, suppliers, and consumers can all benefit from ETRM software to guide data-driven decisions moving forward in volatile market spaces.

ETRM software primarily focuses on:

- Physical energy production operations

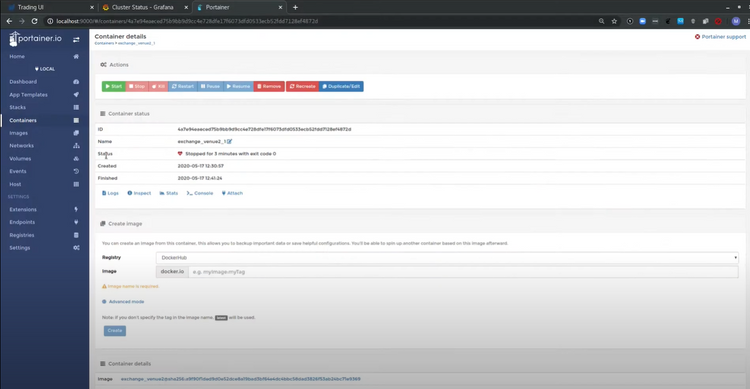

- Risk and trade management

- Financial operations

Features of ETRM Software

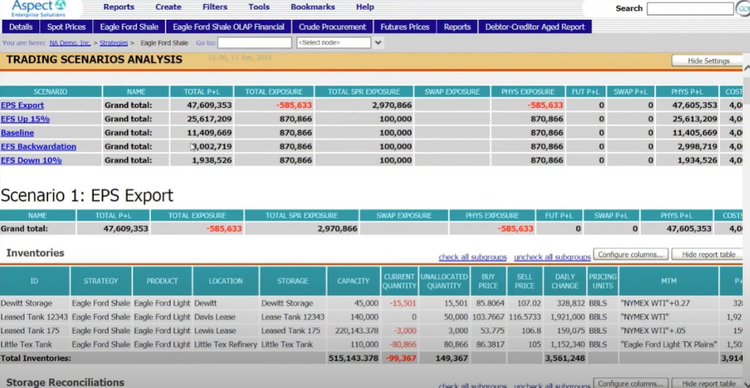

- Asset analysis: Perform in-depth analysis of energy-related commodities to determine their value

- Artificial intelligence forecasting: Predict the performance of energy commodities using advanced artificial intelligence (AI) tools

- Risk factor monitoring and reporting: Review real-world variables in real-time to determine risk factors before making any investment decisions; generate simple reports to share with other decision makers

- Trade validation: Use extra security measures to properly validate all trades to avoid accidents and fraudulent transactions

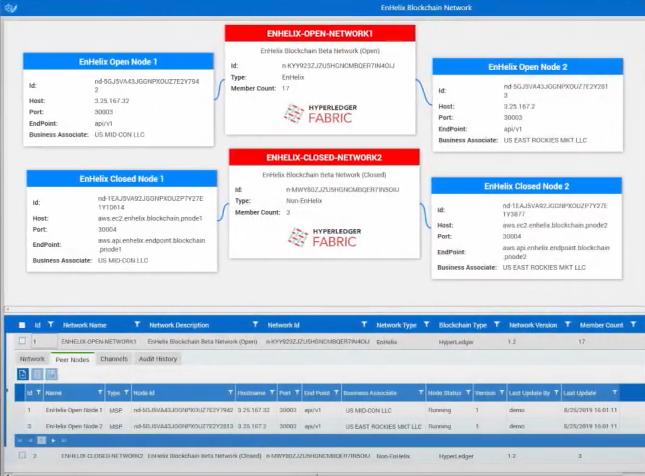

- Blockchain technology: Speed up new and amended trade orders by developing an automatic blockchain to accurately record transactions

- Trade contract management: Organize all your trade contracts in one easy-to-access location

- Financial accounting: Ensure you meet the bottom line by reviewing economic models made with enterprise resource management tools

- Product scheduling: When dealing with physical energy assets, such as oil and gas, arrange for the timely transportation from pipelines to storage units

ETRM Software Benefits

Using ETRM software can lead to reduced risk and maximized profits, along with many other benefits:

Energy Risk Savings

Energy supply and demand is changing the whole world over. Investors in energy are dealing with an incredibly volatile market full of risks. For risk managers, this means taking these new trends and technologies into account before making any important trade decisions. Analyzing risk lets you make more informed decisions when it’s time to make a trade.

Commodity prices can change in an instant. Instead of manually tracking every change in spreadsheets, an ETRM system automates the process. You can input multiple variables to get instantaneous information about potential futures.

More Secure Trading Practices

Every digital interaction you have with a trade partner is an opportunity to lose valuable data. Blockchain technology can preserve transaction data between different partners, like traders and banks. And as a bonus, blockchain reduces paperwork!

Additionally, trade validation provides extra security. This is the final step before reaching a trade agreement, and the last chance your energy commodity company has to make any adjustments.

Stay Ahead of Changing Regulations

Energy commodities are tightly controlled by regulatory compliance. New political regulations, mostly set by organizations like the Council for European Energy Regulators (CEER), the International Maritime Organization (IMO), and the Federal Energy regulatory Commission (FERC) in the United States, mean energy companies need to adapt fast. ETRM software helps energy professionals keep up with changing regulations.

Knowing different regulations pays off when dealing with cross-border power transactions. For example, if the EU announces plans to update their regulations on crude oil trading, you can adapt your trading schedule based on when the new regulations go into effect.

Streamlined Back Office Practices

Every energy-related commodity company relies on a mixture of front-office, mid-office, and back-office procedures to run. Back-office tasks in particular often involve manual labor or repetitive calculations which can take up a lot of valuable time from your workforce. Fortunately, automating the back-office is possible with ETRM software.

Instead of manually calculating risk based on a spreadsheet, traders can plug the numbers into a fully integrated ETRM solution. Then, an AI or algorithm can calculate risk in real-time in order to provide an accurate assessment. Relying on analytics tools results in fewer errors and faster results. ETRM systems also include tools for accounting and reporting, common causes of lost time in back-office settings.

What Commodities are Covered by ETRM Software?

Generally, the commodities which can be analyzed with ETRM include:

- Electric power

- Renewables (solar, wind, etc)

- Natural gas

- Crude oil

- Refined oil products

- Plastics

- Chemicals

- Metals

- Agriculture

How your ETRM solution functions will depend on the commodity you trade. The analytical features you need to measure the risk of crude oil trades will be much different than those of natural gas. ETRM software can be customized to fit your exact requirements.