QuickBooks vs. FreshBooks

No matter the size of your business, bookkeeping software is a must-have. QuickBooks Online and FreshBooks are two of the most popular accounting software for small businesses looking for a cloud-based platform.

They boast exceptional tools for streamlining critical business tasks like cash flow, budgeting, customer billing, and keeping track of your company’s financial health. Freelancers and startups will appreciate FreshBooks for its ease of use and lower price, as it streamlines basic tasks for those with less accounting experience. On the other hand, QuickBooks offers more advanced features and superior scalability.

These products have many similarities and key differences you need to know about before making a purchase. Read on to discover which product is the best accounting system for your business.

About QuickBooks Online and FreshBooks

QuickBooks Online and FreshBooks are popular cloud-based accounting software for small businesses. Intuit QuickBooks has been around since 1992, and its Online system has become the leader in small business accounting software, currently controlling 81% of the accounting software market share. While not nearly as popular, FreshBooks has found its niche in the startup and freelance side of the market since its founding in 2004.

QuickBooks vs. FreshBooks: Software Overview

Features

Both of these online accounting tools offer a variety of features to help you effectively manage your business. These features include:

| Features | QuickBooks | FreshBooks |

|---|---|---|

| Accounts payable | X | X |

| Invoicing | X | X |

| Expense Tracking | X | X |

| Reports | X | X |

| Double-Entry Accounting | X | X |

| Estimates | X | X |

| Time Tracking | X | |

| Milage tracking | X | |

| Inventory Management | X | |

| 1099 Contractor Management | X | |

| Integrations | Over 750 | Over 100 |

| Users | Up to 25 | Up to 2 |

QuickBooks Online has more robust features if you’re a growing small to midsize business. Its wide feature sets, like financial planning, inventory, and project profitability, will scale up with companies as they grow and better meet their needs. This is also true due to the several hundred third-party integrations available, while FreshBooks has a little over 100.

In contrast, FreshBooks offers a simple to-set-up software with a more user-friendly interface. It stands out with its automated timekeeping and mobile invoicing that help freelancers get paid efficiently and accurately. FreshBooks will be a better fit if you’re a startup business that only requires invoicing and basic bookkeeping.

Integrations

QuickBooks Online has integrations with over 400 software tools to help you manage your business. Integrations with online payment platforms like Shopify and PayPal are critical tools for e-commerce businesses.

FreshBooks has over 100 free and paid software integrations. Free apps like the Income Importer allow you to import income from credit card processing platforms like Square and Stripe. Visit the FreshBooks website for the most up-to-date list of their official software integrations.

Ease of Use

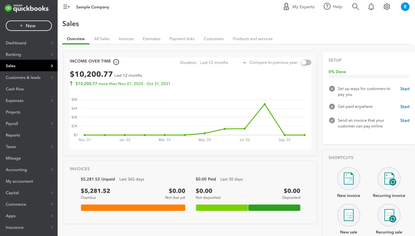

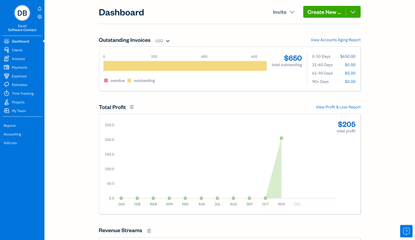

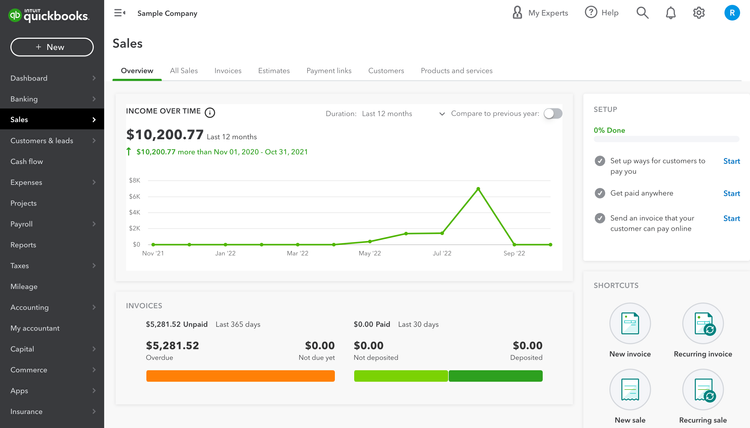

QuickBooks Online is made for accountants and has a large feature set, especially for higher-tiered plans. This can lead to new users being overwhelmed, as there is much to learn, especially for non-accountants. Small business owners will have to take time to learn all of the features necessary to run their company and additional modules if they are required to scale up later on.

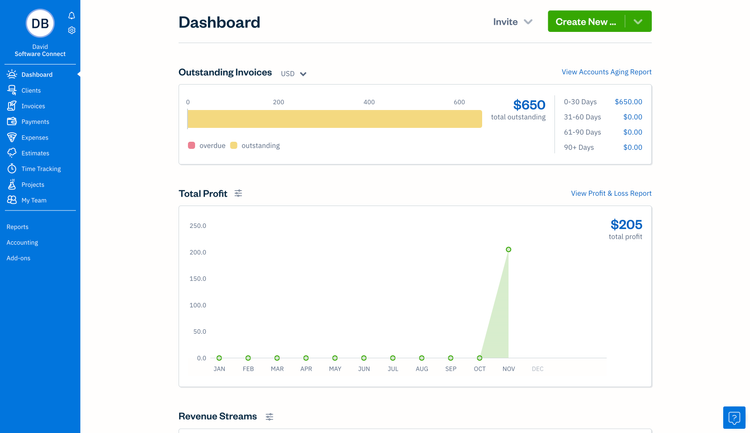

In contrast, FreshBooks offers a simple and easy-to-use interface, making it much easier for new business owners to learn. Its homepage has intuitive navigation and it keeps its layout simple. This, paired with its smaller feature set, will help non-accounting users immediately get on their feet for desktop or mobile invoicing.

Scalability

For small to medium-sized businesses that intend to grow, QuickBooks is the best option for your accounting needs. QuickBooks offers a much greater number of software integrations to increase functionality as the demands of your business change. In addition, all their plans include support for an unlimited number of billable clients.

Freshbooks is a great solution for freelancers and small business owners who do not anticipate sudden or explosive growth. While FreshBooks has reduced functionality compared to QuickBooks, its simplicity makes it ideal for small operations. Another downside to FreshBooks is that the base product only allows one user unless you go to the next price tier. Finally, Freshbooks only initially includes support for 5 billable clients, whereas QuickBooks is unlimited from the start.

Pricing

QuickBooks Online has several different product tiers businesses can select. The four main plans are Simple Start, Essentials, Plus, and Advanced. The base plan is $35/month, and the highest-priced plan is $235/month. QuickBooks has a free 30-day trial and often offers discounts, so check the QuickBooks website for the latest pricing details. It must be noted, however, that QuickBooks is known to raise its prices, especially in recent years.

FreshBooks also has a range of products to meet your small business’s accounting needs. There are also four options: Lite, Plus, Premium, and Select. The base plan is $19/month, and the highest-priced plan is $60/month. The FreshBooks pricing plans allow you to pay on a monthly or annual basis, which will provide extra savings. FreshBooks also offers a free 30-day trial, and there are often discounts on their monthly pricing. See the FreshBooks website for discounts and feature lists.

QuickBooks vs. FreshBooks: Which is Best?

When to choose QuickBooks

- You need many features and integration options

- You plan to grow your business and need a scalable solution

- Your business sells products

- You’re comfortable using a more complex solution

When to choose FreshBooks

- You need a basic all-in-one accounting software

- You’re a solopreneur comfortable with your company’s size

- You’re a service-based business

- You want software that’s easy to set up and use

The software you choose will ultimately depend on your company size and business needs. If you require simple accounting software with a more beginner-friendly interface or have a smaller number of billable clients, FreshBooks will be the best accounting software. On the other hand, you should choose QuickBooks if your company sells a high volume of products, you have plans to grow, or you need many software integrations.

Alternatives

Xero

Xero is a strong alternative to both systems, serving over 4.2 million global subscribers. It is an accounting system for small businesses that offers bank reconciliation, invoicing, and basic inventory management. Its lowest price plan starts at $15/month.

Zoho Books

Zoho Books is an easy-to-use accounting system with a simple design for startups. It comes with a free plan for new users and can integrate with dozens of other Zoho products for scalability.