FreshBooks Review: Features, Pros, Cons

We like FreshBook’s ease of use, recurring invoicing, and customizable payment terms. We also thought its time tracking feature was a nice touch, automatically syncing with your billing.

However, it limits the number of billable clients and internal users who can access the software. Organizations with more complicated business models and multiple product lines should choose an alternative.

- Customizable payment terms

- No setup costs

- Recurring invoicing

- Strong mobile app

- Unlimited invoices, expenses, estimates

- Client-based pricing

- No bulk invoice creation

- Limited report customization

- Limited inventory management

- Additional users and client fees

- Developer FreshBooks

- Client OS iOS, Android, Web

- Deployment Cloud Hosted

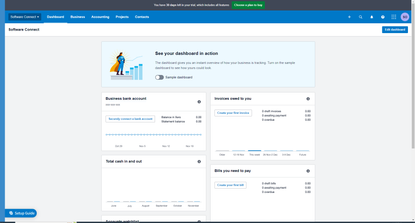

What Is FreshBooks Accounting?

FreshBooks is a simple cloud accounting software that allows you to invoice clients, track expenses, and accept payments via credit card and bank transfer. It includes functionality for time tracking, project management, and accounts payable and receivable. FreshBooks allows you to track sales tax and generate summary reports.

Our Ratings

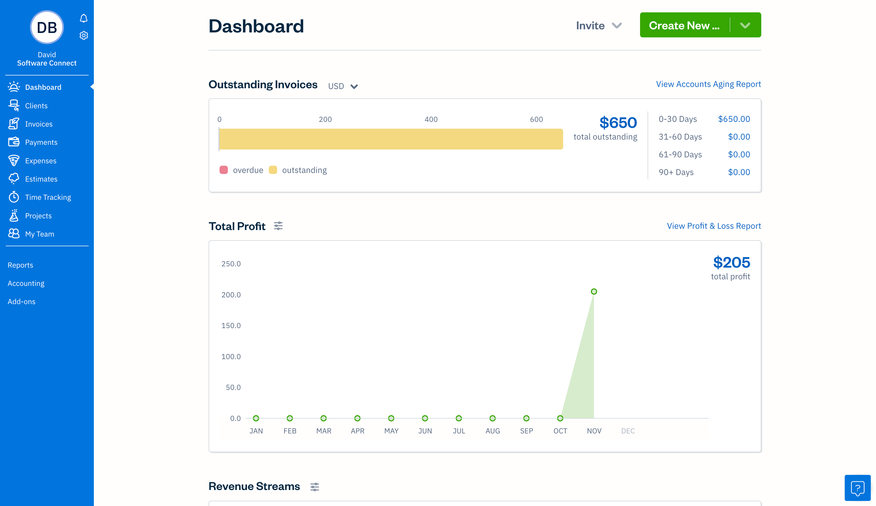

| Usability - 8.5 | Navigable, user-friendly interface; displays total profit and spending dashboards in clear, succinct format; offers point-and-click capabilities to enter data directly into invoice and bill templates; cannot enter vendor address and contact info from New Bill screen. |

| Support - 8.7 | Email and phone support offered 8 am - 8 pm Mon-Fri; support responds to all emails within 90 minutes or less; excellent in-app guidance provides context to accounting processes; no live chat support. |

| Scalability - 6.5 | Not a great solution if your company grows in size; strict limits on number of users and billable clients; includes mobile apps for iOS and Android. |

| Security - 10 | Requires multi-factor authentication; exports client data in CSV format; exports invoices, estimates, and bills in PDF format; has user permissions for admins, managers, employees, contractors, and accountants. |

| Value - 8.1 | Additional fees for each user and billable client added to lower level plans; additional fees for charging client cards, subscription-based billing, virtual terminal; offers unlimited invoices and bills at basic level, unlike Xero. |

| Performance - 10 | Functionality was fast and responsive; invoice, expense, and time tracking dashboards update instantaneously with new entries; seamless conversion of estimates and proposals to invoices or projects; generate invoices directly from billable time entries. |

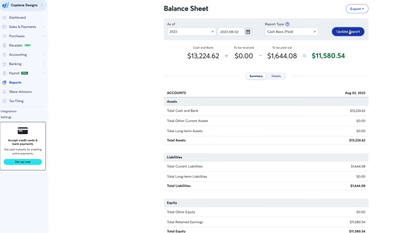

| Key Features - 8 | Straightforward invoice and expense creation with a clean layout; offers built-in timer and manual log time tracking; easily create client checkout links; limited customization for canned reports (general ledger, profit and loss, cash flow, etc.) |

Who Uses FreshBooks Accounting Software?

We recommend FreshBooks for freelancers and independent contractors in the service industry. Solopreneurs and microbusinesses with 2-5 employees will benefit from the software’s streamlined approach to invoicing and billing. FreshBooks is accessible for non-accountants, using plain language to describe financial processes and simplify invoicing, expense tracking, and reporting.

FreshBooks Invoicing

We like that FreshBooks allows you to enter data directly into the invoice template without navigating to a separate window or screen to preview the final look. You can click the Settings icon to indicate whether you want to accept online payments, make the invoice recurring, or customize the style.

You can choose from three default invoice templates with six theme colors, two font types, and the option to upload your logo in GIF, JPEG, PNG, or TIFF format.

Here’s how to create an invoice in FreshBooks:

- Click on Invoices in the left menu.

- Select the + New Invoice card on the Invoices dashboard.

- Choose a client (or + Create a Client) and update your issue date and due date.

- Add a unique invoice number.

- Click the Add a Line button to Import Unbilled Time and Expenses, add an existing Item or Service, Create a new Item, and Add Taxes.

- Add a Discount, Apply Credit, Request a Deposit, or Add a Payment Schedule in the Subtotal and Total Areas.

- Click the Save button to create a draft or the Send To… button to invoice your client by email or generate a link to share.

Billing in FreshBooks

Like the invoicing process, generating a new bill in FreshBooks is as easy as clicking and typing. You input data directly into a bill template and can easily attach receipts and other documents. You can click the Settings icon to indicate your preferred language and currency, including USD, CAD, EUR, etc.

We like that FreshBooks displays your total outstanding and overdue in a clear and eye-catching way on the Bills dashboard. Most people using FreshBooks are not accountants, so avoiding jargon and concisely presenting information is vital. We also like that you can upload your bill in JPEG, PNG, or PDF formats directly into the system.

However, we would like to see a way to add Vendor billing and contact information directly from the New Bill template. As it is now, you can only input the Vendor’s name. However, you can always revisit your Vendors later to add more profile details.

Billing in FreshBooks looks like this:

- Click Expenses in the left menu, then click the Bills option.

- Select the + New Bill card on the Bills dashboard.

- Click Add Vendor to type in a new company or choose from a list of previously-entered vendors.

- Specify the Issue Date, Due Date, and Bill Number if needed.

- Select the Add a Line button to enter details about your bill in the Description field.

- Add a Category, specify the Rate and Quantity, and Add Taxes.

- Click the Save button.

FreshBooks Time Tracking

FreshBooks benefits consultants by allowing them to track time and billable minutes easily. In time tracking settings, you can establish whether you want to track time entries by duration or by start and end time.

A built-in timer allows you to assign a client or project, add a service, and describe your work. You can also log time manually.

- Click Time Tracking in the left menu.

- Select the + New Entry button.

- Choose a client or project in the Add a client or project field or start typing to Create a New Project or New Client.

- Select the Add a service field to add a previously-entered service or type to add a new service.

- Enter billable time in the HH:MM field.

- Input the date and add notes if necessary. The billable checkbox is automatically checked.

- Click the green checkmark button to commit the tracked time to your records.

This entry will display on your Time Tracking dashboard as unbilled. You can click the Generate Invoice button at the top of the page to invoice your client for your time.

What Features Are Missing?

- Reporting customization: FreshBooks offers standard accounting reports like the balance sheet, profit and loss, cash flow statement, general ledger, and bank reconciliation summary. However, filters to customize reports only include date range and account type.

- User access: FreshBooks might not be for you if you have multiple employees on your accounting team. It limits you to one user in all plans except Select tier, which allows for two. Each additional team member you add to FreshBooks incurs a $10/month charge.

FreshBooks Pricing

| Plan | Pricing | Features |

| Lite | $21/month or $226.80/year (5 billable clients) |

|

| Plus | $38/month or $410.40/year (50 billable clients) | Includes Lite features and:

|

| Premium | $65/month or $702/year (unlimited billable clients) | Includes Plus features and:

|

| Select | Custom pricing (Allows access for 2 users) | Includes Premium features and:

|

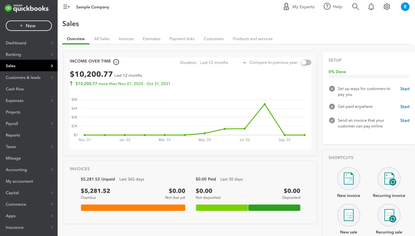

FreshBooks vs. QuickBooks Online

FreshBooks, starting at $21 per month, is more affordable than QuickBooks Online, which begins at $30 per month. However, QuickBooks’ Advanced plan supports up to 25 concurrent users. FreshBooks only permits one user, charging an extra $11 per month for each additional team member. FreshBooks is well-suited for solopreneurs and microbusinesses of two to five employees, whereas QuickBooks’ more advanced features best serve small to mid-market companies with 50 to 200 employees.

Is there a FreshBooks payroll feature?

FreshBooks does not have a module for built-in payroll processing, but you can integrate a third-party add-on like Gusto. Gusto is a comprehensive platform that includes hiring, onboarding, and compliance support. Additionally, Gusto can handle quarterly 941 filings and annual W-2s and 1099s.

Can FreshBooks connect to your bank account?

FreshBooks connects with over 14,000 different financial institutions, including Bank of America, Chase, Citibank, PayPal, and Wells Fargo. Linking your bank account is as simple as clicking the Settings icon and selecting Bank Connections. From there, you choose your bank and enter your login credentials. Finally, select the account you want and click Import.

Does FreshBooks handle taxes?

FreshBooks tracks sales tax and helps you reconcile 1099-K forms with your earnings. However, FreshBooks does not track income tax. Instead, your accountant can calculate this using the journal entries in your chart of accounts.

Alternatives

Summary

We recommend using FreshBooks if you’re self-employed, a consultancy, or a microbusiness in the service sector. FreshBooks creates a direct pipeline from converting proposals and estimates to invoices and projects.

However, if you are a fast-growing company, there might be better options than FreshBooks. Limits on billable clients and users can be particularly problematic for businesses with multiple employees.

If your company plans to remain relatively small, it’s hard to beat the simple, comprehensive package of features the software has to offer. Overall, Freshbooks is a smart, affordable choice for small business owners new to accounting.

User Reviews of FreshBooks

Write a ReviewWith FreshBooks, you can choose clients from your rundown

With FreshBooks, you can choose clients from your rundown or include another client and data. Solicitations enable you to include errands for administrations, including the rate, time, and things, including the cost per thing and amount. You can include customized takes note of the receipt or in your email.

Business owners be aware freshbooks is not compatible with Internet Explorer

Business owners be aware freshbooks is not compatible with Internet Explorer so any customers using Internet Explorer will not be able to view except or look at their estimates or invoices. I work with a lot of older clientele and retired persons. Asking them to update their browser from Internet Explorer to Chrome is completely unacceptable as it confuses the customer exceptionally. I’ve even lost clientele because of this.

Freshbooks is ridiculously easy to use

Freshbooks is ridiculously easy to use and takes care of a lot for you.

The dashboard lets you see outstanding invoices and your total profit for the year. There are also different advanced reports available.

If you want to try it for free for 30-days, they have a trial.

They've been with me from the beginning

I love Freshbooks. I’ve been using them ever since I started my web design and marketing business a few years ago. They’ve been with me from the beginning and they meet all of my needs and some.

It’s obviously meant for smaller businesses, a lot of freelancers. If you have a large business or a lot of specific accounting needs, for example, if you have a team that requires payroll, then Freshbooks probably isn’t a good fit for you.

If you want something simple to invoice your customers and track your profit and loss, track your expenses, collaborate with your teams, and track your time and be able to bill your clients by billed hours, I don’t see why you would pick anything other than Freshbooks.

Freshbooks has changed the game of freelancing for me

When I send work to my clients, and they are not responding quick enough for my liking, then I’m not getting paid. Emailing them to follow up is counter-intuitive because you become annoying. But you are trying to do your clients a service while also getting paid!

Freshbooks has changed the game of freelancing for me. I’ve never enjoyed bookkeeping but doing the admin part of my business (invoicing client, tracking expenses, tracking down clients who haven’t paid me) with Freshbooks has been so helpful to me.

I really enjoy going into Freshbooks and clicking “send invoice”. I advise you check it out. They’re doing great things for the freelance community.