QuickBooks Online Review: Features, Pros, Cons

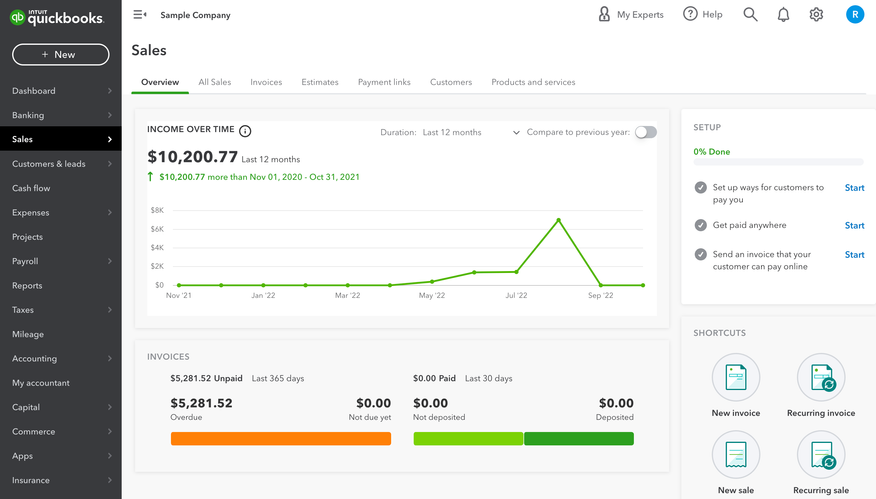

Many users are upset by Intuit’s forced move to subscription pricing. That said, we liked its custom invoicing and reporting capabilities. QuickBooks is the most widely used financial software, allowing unlimited invoicing even at basic subscription levels while offering bank reconciliation and scalability.

We dislike QuickBooks Online’s limit of 25 concurrent users, its absence of advanced inventory features, and the requirement for some accounting knowledge to use it effectively.

- Customizable invoicing

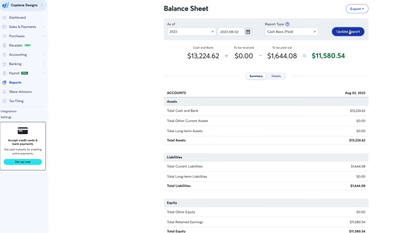

- Extensive pre-built and custom reports

- Automatic exchange rates

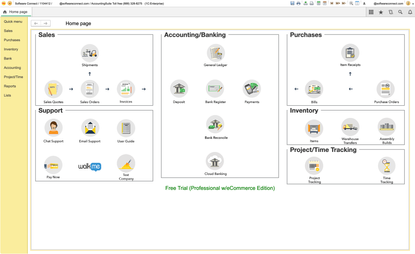

- Over 750 eCommerce, PoS, payroll integrations

- Affordable for NPOs

- Comparatively expensive

- Few industry-specific features

- Limited users per plan

- Requires accounting expertise

- Developer Intuit

- Client OS Web

- Deployment Cloud Hosted

What Is QuickBooks Online?

The QuickBooks Online app is the most popular financial software on the market. The cloud-based accounting software makes bookkeeping easier, whether you’re tracking sales and expenses, managing customers, or sending invoices.

Intuit has discontinued most of its QuickBooks Desktop products, steering users toward QuickBooks Online’s subscription model. If you’ve been wondering whether it’s worth making the switch (or sticking with it), we put it to the test. Here’s what we found.

Our Ratings

| Usability - 7 | Requires basic knowledge of accounting concepts; strong global search function; not great for companies requiring multi-entity accounting and global consolidation; users report encountering numerous glitches that are not resolved in updates. |

| Support - 6.5 | Offers 24/7 live chat support for all plans; offers phone support 5 am-6 pm PST Mon-Fri and 7 am-4 pm Sat-Sun; provides additional guidance via webinars, tutorials, and resource center; reaching an actual customer support agent can be difficult; users cite that issues are not always resolved after contacting support. |

| Scalability - 7 | Scalable platform with over 750 integrations; offers iOS and Android apps capable of basic bookkeeping; lacks industry-specific services. |

| Security - 10 | Supports multi-factor authentication and two-step verification; allows you to export customers, employees, vendors, and financial data to Excel. |

| Value - 6.5 | Monthly subscription fees support a limited number of users; lower level plans do not have basic inventory management; many users are upset over forced move to subscription pricing; only allows one company per subscription; invoicing and billing for unlimited clients. |

| Performance - 8 | Dashboards update instantly with new invoices and bills; can take QuickBooks online up to 5 minutes to process and parse uploaded bills; slight delay when reviewing transactions. |

| Key Features - 10 | Easy to implement recurring invoices and bills; allows users to add new customers during the billing process; bank reconciliation layout is simple and intuitive; provides robust custom reporting. |

Who Uses QuickBooks Online?

We recommend Intuit’s QuickBooks Online for small to mid-level companies in the accounting, information technology, and professional services industries. With a basic, well-rounded feature set, QuickBooks Online is great at general accounting operations but lacks industry-specific functions. Bottom line, it’s a solid solution for service-based businesses that don’t track inventory in their books.

What Features Are Missing?

- Industry-specific features: QuickBooks Online takes a generalized approach to accounting. For example, there are no industry-specific editions for manufacturing or healthcare. NetSuite might be a better option if you want a platform with more out-of-the-box capabilities.

- Unlimited user access: Many accounting solutions allow unlimited user access to their platforms. However, QuickBooks Online caps the number of concurrent users (or users that require access at the same time). Though users can share the same logins, this will ultimately impact your audit trail. Furthermore, QuickBooks Online performs best when five or fewer users access the software simultaneously.

QuickBooks Online Pricing

| Plan | Pricing | Features |

| Simple Start | $35/month |

|

| Essentials | $65/month (Up to 3 users) | Includes Simple Start features and:

|

| Plus | $99/month (Up to 5 users) | Includes Essential features and:

|

| Advanced | $235/month (Up to 25 users) | Includes Plus features and:

|

Payroll is available as an add-on to any version of QuickBooks Online, starting at $50/month plus $6/employee/month. The Payroll Premium package is $85/month plus $9/ employee/month. The Payroll Elite plan is $130/month plus $11/employee/month.

When Do I Upgrade from QuickBooks?

If your inventory is getting more complicated, whether that means tracking serial numbers, FIFO costing, or managing stock across multiple bins, QuickBooks Online might start feeling a bit limited. In that case, you’ll likely want to go with a product like NetSuite or Acumatica for more advanced inventory management.

Is QuickBooks A One-Time Purchase?

No. QuickBooks Online requires an ongoing monthly subscription to gain access to the software. Because the platform is cloud-hosted, you’ll need internet access to activate and maintain QuickBooks Online support and services. It starts at $15/month for the Self-Employed plan and $30/month for Simple Start.

How Long Does It Take To Learn QuickBooks Online?

Users without accounting knowledge may need several weeks or months to achieve proficiency in QuickBooks. On the other hand, users familiar with bookkeeping concepts will master the software more quickly. Intuit even offers a 2-day class and certification exam to boost your credibility as an accountant.

Does QuickBooks Do Taxes?

QuickBooks does sales tax calculation within the software but doesn’t handle tax filing directly. In QuickBooks, you can organize income and business expenses into tax categories and share your books with your accountant. You can then download your reports for use in another tax filing program. The QuickBooks Self-Employed and TurboTax Self-Employed bundle allows you to export your tax info directly to TurboTax.

Alternatives

Summary

We recommend QuickBooks Online for small to medium-sized companies in the professional services, accounting, and information technology sectors. Service-based organizations that regularly invoice the same clients weekly or monthly and don’t track inventory in their books will benefit most from the platform.

However, QuickBooks’ monthly subscription fees might prove cost-prohibitive to smaller companies. Because the platform is more of a generalized accounting solution, we don’t recommend it for companies needing industry-specific features. Better-suited options include NetSuite or QuickBooks Enterprise.

We think QuickBooks Online is a great choice for its custom financial reporting and over 750 integrations, which help the software scale with your growing business.

User Reviews of QuickBooks Online

Write a Review- Accounting

- 1-10 employees

They forgot who their main customer base is

It was originally designed for small companies; if you have a big company, you will look elsewhere. I used to install AGRIS for agricultural companies, and that was the go-to, and QBs is just a simple accounting program, and they have gotten too much ego and forgotten who their main customer base is.

Cons

Expensive Too many features for small companies Terrible customer support

- Government

- 1-10 employees

QuickBooks Online Review

I have been a Quickbooks Desktop Pro user for ten plus years. However my current version began producing fatal errors and I reached out to explore their online set up. In the original desktop version of Quickbooks you could set up multiple entities under the one platform. I have multiple fuinding sources that we track as separate companies. With the new online version, I would have to buy a subscription for each entity. This was in no way feasible for our small department.

- Property Management

- 1-10 employees

QuickBooks Online Review

I am currently using a Desktop version from 2020 and was advised I would need to move to their online version. When I went to review the software, I found it was missing many key modules that are needed to run my business. I was only able to run one business under the software (I have 3) and I was not able to track by classes. When I inquired about how I could get those features, they began discussing enormous additional fees. It felt like a complete “cash grab” and I will be moving to a new software

- Healthcare

- 1-10 employees

QuickBooks Online Review

We were using Quickbooks Desktop but they began discontinuing features to push us to the online version, specifically the automatic downloads from the bank. We made the switch online to assure we could continue to operate the business but our fees nearly doubled and the system was extremely complicated to understand. I never felt like I was doing the bank downloads correctly and would find information duplicating in our ledger. For double the price, I expected a better system. We decided to part ways with Quickbooks.

- Distribution

- 1-10 employees

QuickBooks Online Review

The software works fine to manage our general accounting but when you get into more specific industry needs, it falls short. We are shippers and our customers want the freight built into the sell cost on their invoices. Quickbooks makes you keep a separate line item for freight. We have to go line by line and calculate the freight into each line item. Not only is this process tedious but also makes us vulnerable to mistakes.

- Distribution

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

The system works fine managing my general accounting, but no matter how many times I ask for support, there is no way to create commission reports. I have contracted salespeople, and I need to be able to track who they sold to and how much and generate commission reports from that data. Quickbooks allows me to calculate the totals but not run any reports to track efficiencies.

- Property Manager

- 1-10 employees

QuickBooks Online Review

I currenlty use Quickbooks Desktop Pro to manage the financial records for several HOA’s. In the desktop version I am able to set up the individual entities and manage the separate ledgers. When I was advised I had to move to their online version, I had no issue until they told me, for each association, I would have to get a separate subscription. I have over 10 clients. There is no way I could afford what that would cost compared to my current cost.

- Professional Services

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

I thought the software would be the perfect solution to manage my four accounts. I have multiple business pursuits that I track across separate bank accounts. They aren’t anything big but I still need to generate a P&L for my accountant at the end of they year. I could not believe how complicated the software was. It was nearly impossible to navigate simple financial records. On top of that, the pricing was not feasible. I am not sure this is a software for a small business owner.

- Speciality Contractor

- 1-10 employees

QuickBooks Online Review

I have used Quickbooks Desktop for 20 plus years and have never had an issue with the software. However when they migrated us to the online version, we found it was a completely different software. Many of the core functionalties we require to operate our business were gone; things as simple as customizable invoices. Support was no help. They kept moving us to “upgraded” versions that never really solved the issues. It’s almost like they are developing the software as they go. A huge dissapointment.

- Tooling

- 1-10 employees

QuickBooks Online Review

The system works fine for general accounting but it is limited in any features beyond accounting. The inventory module is very limiting and it does not allow you to track quantity pricing and quanitty costs on incremental breaks and units. This is essential to our business. I need to see the quanity sold and at what cost I sold it for. I have resorted to Excel but as you can imagine this is very time consuming.

- Import/Distribution

- 1-10 employees

QuickBooks Online Review

The system works really well to handle our bookkeeping and reporting. The reports are easy to generate and read, better than any other system I have come across. However, when I tried to utilize the software to run the rest of my business, mainly needing purchaing and inventory, I felt lost. I spent a whole day trying to figure out how to create a PO but it was so overly complicated, I decided I could not use that module for day to day use.

- Accounting

- 11-50 employees

QuickBooks Online Review

I have used Quickbooks Desktop for 20 plus years. I thought nothing when they moved us online; I figured we would feel no effect on the front end. However, the online version is completely different. I reached out to support to discuss how to view multiple books at the same time. We use that for reporting purposes. The support person had no answer. It was as if she knew less about the software than I did.

- Retail

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

I feel like Quickbooks has forgotten about the little guy. I have been a Quickbooks Desktop user for 30 plus years. I am uncomfortable going online but they offered no other options. I use the system for managing a simple check register and they told me my only options were quadruple the pricing of my current system. I had no choice but to move to a new software.

- Construction

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

I was using just the basic accounting features, but as a specialty contractor, I rely on job costing. I reached out to add job costing and project tracking, and my pricing went up 100%. On top of that, the job costing features did not seem to understand the construction business, so my pricing doubled for an inadequate tool.

- Manufacturing

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

Our company opened its doors with Quickbooks Desktop back in 1992. We loved the program, but with the recent requirement to move online, we reluctantly switched and completely hated their new online version. Not only is it nearly triple the price, but it is also complicated, offering so many obsolete features that we do not use. When I try to contact support, either by telephone or through their chat box, it takes hours to get a response. When I finally get a response, the support person seems to know less about the software than I do!

- Real Estate

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

We were desktop users for many years and never had any issues. When we made the switch to online, we could not believe how hard the system was to learn. It was not the same “Quickbooks” at all. The interface is very cumbersome, and there is nothing easy or fun about working in the software. To top it off, for our very basic bookkeeping needs, they are charging $60 per month. We had to search for a new software.

QuickBooks Online Review

I just hate hate hate hate it. They now try to sign me up for extra $50/month to answer my questions.

Pros

My tax accountant is a QuickBooks expert & can login to help me occasionally.

Cons

The extra apps they want me to use are put in my face constantly. The cost is prohibitive.

- Real Estate

- 1-10 employees

QuickBooks Online Review

The pricing for the new online system does not support small businesses. I am a one-man show with very simple needs, basically tracking a ledger for tax reporting. I have two businesses, and when upgrading to their online version, I paid almost $1,000 a year. I don’t care how long I have been a Quickbooks user; I had to look for a new system.

It has been a horrible experience

Instead of making my work easier, the software has created more work than necessary. Trying to do any type of reconciliation with the bank is near impossible, taking numerous steps. My register is so messed up and incorrect that it will take hours to fix. I am trying to move to a new software but I need to first fix the disaster in Quickbooks before I try migrating over any data. It has been a horrible experience.

It has been an overall nightmare and we are moving on

We were pushed to use the Online version, despite trying to pivot to the Enterprise version. We payed extra to have job costing and project managenent capabilites. However, we were continually locked from using the project managenent features. They assigned us an Account Manager who advised that we needed to upgrade our payroll, of course paying more, and then we would be able to use the project management module. How does that make sense? Our account manager seemed to understand the software even less than we did. It has been an overall nightmare and we are moving on from Quickbooks.

The online version is cumbersome

I hate the online version. Quickbooks Desktop was such an easy to use program. I wish they would go back to that system. The online version is cumbersome; tasks that would take me minutes on Desktop now take me hours. I used to be able to do all my invoicing in 20-25 minutes. Last Friday I spent 4 hours. My monthly billing use to take a few hours. This past month took me 3 days. So now the time I could spend making money, I am trying to figure out how to use this darn program.

Cons

Not user-friendly!

We found ourselves extremely limited

We were excited to move to the Online version especially since I do most of my work after hours at home. However, once we got into the system, we were disappointed. It was in no way the same software. We found ourselves extremely limited, no longer able to customize how we distribute our invoices. We needed to invoice our customers by department but instead it defaulted us to invoices by date. We tried working with support but they told us there was no solution to the issue.

- Construction & Engineering

We tried the Online version and it was horrible

We have been a Desktop Premier user for years but as they slowly began phasing the system out, including pulling modules, we tried the Online version and it was horrible. It in no way resembles the Desktop interface and has a fraction of the functionalities. We are a construction company and we would have been left with manually generating job cost reports, let alone manually managing every aspect of project management. It was not even an option to use Quickbooks anymore.

It was in no way the same as their original desktop

As a financial advisor I have been recommending Quickbooks Desktop and helping my clients set up it up for years. With the transition to their online version, I have dozens of clients coming to me for help. They do not operate in internet-friendly areas and cannot use an online version. I also tried their online version, and it was horrible. It was in no way the same as their original desktop, lacking in functionalities, and the interface is not user-friendly.

I am no longer a Quickbooks user

I have been a Quickbooks Desktop user for many, many years. I am a small bookkeeper with 2-3 clients, and I loved the software. Every three years I would just buy their new version for a few hundred dollars, with no additional fees. When they began transitioning everyone to the online version, I was willing to see what the system offered. Not only was it a completely different system, but they told me I had to now pay $1,200 a year! I am no longer a Quickbooks user.

- Industrial Conglomerates

We ended up having to move to a different system

We are using the software for our bookkeeping and it works fine for the financial management but we when we reached out to see if they had any additional features for manufacturers, we found it very limited. We need the ability to track time, scan QR codes for production traceability, and allocate material. It did not any offer any of thise functionalities. We explored other Quickbook’s versions and there was not a product in the Quickbooks family that could support a job shop efficinelty. We eneded up having to move to a different system.

No Job Costing capabilities

We were operating on Quickbooks Desktop and had no real issue moving to the online version until we discovered it was a completely different system. It is fine for general accounting and building estimates but it offers absolutely no job costing. We are a specialty contractor; we rely on job costing to run our business. We are now scrambling to find a new system. I wish we would have known this prior to switching over.

Cons

No Job Costing capabilities

- Building Materials

- 11-50 employees

- Annual revenue $1M-$10M

We struggled to generate our packing slips

When we lost support on our Desktop version, we were not concerned about the transition to Online until we learned the system is completely different. As a distributor, we lost all of our core operating tools. We were limited by order entry, invenotry management, and any type of shipping monitoring. We struggled to generate our packing slips and found ourselves paying for the software but having to do continual work arounds outside of the program. We were many years a Quickbooks user but could not run our business on the online version.

- Family Services

The support is horrible

The support is horrible! They promise one thing, but then do another. The payroll module stopped tracking accumulated vacation and sick time. Trying to get the issue corrected took hours. THey also stopped recognizing key users. The system suddenly identified past employees as users and locked us out of the system. It was a nightmare. Again support was less than helpful!

I was willing to give the online version a try but then they started price gouging me

The new online version seeems to be pushing small businesses off the software. I was willing to give the online version a try but then they started price gouging me. I signed up for $35/month. Before I knew it, I was paying $90/month. When I reached out to support, they were able to get me back down to $45/month but I lost key functionalities I use to run my business. I asked if they had any desktop versions they were still supporting and they told me for $2,000/year I could stay on dekstop. I used to pay $600/year. I could no longer continue to use their software.

- Machinery

- 1-10 employees

- Annual revenue $0-$1M

We have found the system almost unusable

I have been a QuickBooks user for 10 plus years but with the migration to their Online version, we have found the system almost unusable. There are constant updates and with any new update, we have to re-learn the software. I don’t have the time to sit and learn software every few months. My CPA is equally as frustrated, constantly having to correct the books. She advised we get off QuickBooks immediatley.

My annual costs nearly tripled

When I had to move to the online version, my annual costs nearly tripled. The increase was already frustrating but then the system was not even remotely similar to the desktop version. I felt like I needed to take a class to even understand how to navigate through it. I lost all editing capabilities on my estimates and invoices and overall it felt like I lost control of my company information.

- Professional Services

- 11-50 employees

- Annual revenue $1M-$10M

The new online version doesn't feel like they understand accounting

The original Quickbooks was a great, easy to use accounting software. The new online version doesn’t feel like they understand accounting/bookkeeping at all. Previoulsy when I was journaling it was a continous action. Now with each entry I am having to stop, go back, re-click. It is a cumbersome and I am contunually days behind on my entires because of the lack of continuity with the software. I am also not able to tag my expenses or track by department. Overall I am very frustrated and dissapointed in what the Quickbooks is turing into.

- Construction & Engineering

A completely different system

I was a Quickbooks Desktop user for 20 plus years. When they discontinued support on my Desktop version and moved me online, it was a completely different system! It had no tools to support the construction industry and when I reached out to support, they told me to have those capabilities, I would need to switch to their Enterprise version. The pricing was outrageous. They have stopped embracing small businesses.

- Specialized Consumer Services

- 1-10 employees

- Annual revenue $0-$1M

Complicated user interface and not set up for government needs

The system is complicated and not user firendly at all, especially for a government entity. We recently had Auditors come in and they told us we need to get off the system immediatley. Our books were a mess and trying to navigate the system for any type of required reports was near impossible. They agreed that the interface is not user-friendly at all.

Cons

Complicated user interface and not set up to support the needs of a government entity

We have decided to move off Quickbooks

We had no issue making the transition to the Online version, expecting a similar program to our desktop version but we have found the upgrade difficult to navigate. If I pull up the General Ledger, it lists all of our transactions but when I try to individually search withdraws or checks, it only goes back a few months. I have no idea how to find these transactions and am overall frustrated with the software. We have decided to move off Quickbooks, tired of fighting with the system daily.

- Hotels, Restaurants & Leisure

- 1-10 employees

- Annual revenue $0-$1M

My accountant told me I need to get off the system immediately

When we made the switch to the Online version, we found the system very different and have encountered many errors across our books. When I did my taxes this year, my accountant told me I need to get off the system immediately. All of our line items were classified incorrectly and our checking statements never balance. Trying to correct the inaccuracies has been a very time-consuming and laborsome effort.

The payroll feature is wonderful

The payroll feature is wonderful; it is easy to set up new employees on auto pay and track the overall payroll. However it lacks many features important to a subcontractor business. It does not allow progressive invoicing nor can it track time across an extended period. If I enter time and jobs completed for an employee over a week’s period, it will only save one day. This has caused a great deal of manual processes and double entry.

Pros

Not built to support the needs of a subcontractor

Cons

Easy to use payroll module

The online version was completely different

I had been using Quickbooks Desktop since 2000 and loved the program. When my computer blew up, I called to re-buy the desktop version but they told me I had to move online. I figured if it was the same system, I guess I could consider an online setup. The online version was completely different. I am confused at how to complete simple steps. It took me an hour the other day to find a customer’s phone number. I had an issue with an invoice and called their support line and the person on the other end told me it would be $600 to fix it. I told him I would call him back. I did my own research on a fix and it turns out it was a very easy fix. After that I did not trust Quickbooks and moved off their system.

Time for a new software

They keep changing the format and with the changes we lose certain capabilities. When you reach out to support they tell you, to regain those lost tools you have to upgrade. I have upgraded and the format was changed again! I no longer can attach PO numbers to invoices and are limited by the edit lines. And of course when calling I am told an upgrade is my only option. I just paid them over $500 and now I will need to pay close to $1,000. Time for a new software.

The amount of daily manual processes we have is overwhelming

The software is a great accounting software but beyond that really offers few feature sets. The amount of daily manual processes we have is overwhelming. We are a retailer and have to track live inventory outside of the program. When we are making a quote, we have to manually compile all material information, with no communication to the inventory if it becomes an order. We also have little ability to manage sales margins or markups.

Not User Friendly

I have been a Quickbooks Desktop user for 10 plus years and when prices more than doubled to stay on the Desktop, I looked into Quickbooks Online. It was a completely different interface and not in a good way. I feel I am somewhat tech savvy and I was lost as to how to navigate the system. It also was missing key features to operate a business that were easily available in Desktop. When I tried to speak with Support they just kept directing me to higher priced version

Pros

Not User Friendly

Extremely frustrating customer service

I tried the software for my construction business and found it to be clunky. It felt built more for a retail or accounting business. It lacked the project centric focus that is required in doing any type of construction accounting. I realize they have add-on’s but it becomes cost prohibitive for a small business like myself. I also found their customer service to be extremely frustrating.

Our process is very confusing

For a holding company with multiple subsidiaries, Quickbooks has not been a great fit. For each entity, we have had to set up a new Quickbooks, creating a very disjointed work flow. Overall our process is very confusing. Though the software may be a good fit for a solo entity, trying to utilize it for multi entity accounting has been less than streamlined.

I feel like my information is being held hostage

I was using Quickbooks Pro but was told I needed to switch to the Online version. I was charged $300 and then they added an additional charge for $500. When I pushed back on the additional charge, they informed me I could not access my software and data until I paid the extra fee. I feel like my information is being held hostage. I would never have agreed to switch.

Consistently running into glitches in the software

We are consistently running into glitches in the software. When we reach out to support, it never seems like they have an answer. The biggest concern is with our profit and loss statments being off. As a governement entity, it is imperative our numbers are accurate. Without support being able to offer us any long term fix, we had to look into other software.

the software is not built for companies that require multi-entity accounting

The software is not built for compnaies that require multi-entity accounting with the ability to also then consolidate for reporting. We are using the program for our client who has 15 separate entities and we currently have shared files, across the same system, not able to report the entites separately. They also require the ability to consolidate the entities and the software is just not abe to support those capabilites.

The interface is dated and the inventory feature is lacking

The interface is dated and the invenotry feature is lacking. As a manufacturer, inventory control is essential to our decision making and in QB Online our inventory count is consistently off. We have resorted to using a multitude of spreadsheets to try to maintain some level of accuracy. The system is just not up to the level of competency our size business needs to be successful.

If you aren't an accountant, the system is very hard to understand

If you aren’t an accountant, the system is very hard to understand. I have been on a trial for the last 3 months and I am at the point where I just have to find something new. If I make one error, and don’t immediately recognize it, everything I have been working on for the day is ruined. I want to easily set up categories and track expenditures alongside those categories but the system is so complex, I have no idea what I am looking at.

The system is so limited with its permissions

The system is so limited with its permissions. I can’t give access to an employee to create say their own purcahse order or sales ticket withouth them being able to see every aspect of the software, including the finances for the business. In trouble shooting, Quickbooks will ask for money but the problem does not get solved. This is causing a large amount of duplicate work across our departments.

- Internet Software & Services

It has been nothing short of a nightmare

We were on Quickbooks Desktop but as they discontinued the software, we were forced to make the move to the Online version. It has been nothing short of a nightmare. We have poured continual funds into trying to make the software work but at this point, our information is such a mess, we won’t even open the program. Our taxes have been delayed by it, with categories and line items randomly duplicated.

- 1-10 employees

- Annual revenue $0-$1M

The ease of entry on QuickBooks is super easy to understand

QuickBooks is more user friendly than sage but that comes at a comprimise. If you do not have much book keeping understanding, you can make errors without even realizing it. I have worked with a few small businesses who end up making big mistakes towards the end of the year.

One thing I did not like about QuickBooks is their reporting format to show debit and credits.

However, the ease of entry on QuickBooks is far better than Sage and is super easy to understand.

Pros

Very intutive interfaces

Cons

can make mistakes without realizing it.

One of the worst experiences with customer support

This is the one of unfriendliest computer software or computer applications I ever used. One of the worst experiences with customer support representatives also.

Pros

Nothing

Cons

This is the one of unfriendliest computer software or computer applications I ever used. One of the worst experiences with customer support representatives also.

Absolutely Horrible

When trying to learn more about QuickBooks all they would do is try to sell me. I asked questions and it seemed no one knew anything about accounting. I ended up going with Striven.

Pros

No pros for QuickBooks

Cons

Terrible support. No one understood accounting. They only tried to sell.

- Construction & Engineering

The customer service is a joke

QBO is only convenient for invoicing customers and viewing most of your transactions. (They don’t always come through the way they are supposed to) The software is not perfect and hard to learn even with professional assistance. Customer service is basically non-existent. So if you have a question or concern, you receive no help from Intuit. The software favors the customers over the merchant. I have had a couple instances with customer chargebacks and disputes. Intuit does not even alert the merchant of a declined ACH bank transfer unless the funds entered your account and were pulled back out. If the transaction was declined initially, you wouldn’t know, unless you are savvy enough to check your Merchant Page. Which is a totally separate web page from your company login. Very dissatisfied with QBO and Intuit Customer Service reps that barely understand the program themselves. I would recommend another software for smaller businesses.

Pros

Being able to link your bank accounts is handy. However, Intuit does not have every bank or credit card type available to link. You will have to manually download or add transactions if you have a less than mainstream bank or credit card type.

Cons

The customer service is a joke. The software is problematic with refunds, manually added transactions, and glitches. If a customer files a chargeback, it is automatically pulled and held at Inuit for months and months with little communication options for the merchant.

Customer service doesn't understand English concepts

Don’t waste your time. Customer service doesn’t understand English concepts. Took 30 minutes just to get rep to understand problem. Rep then wastes another 20 minutes at same point i had been stuck at without knowing what to do. Finally asked for a supervisor and was parked on hold for 15-20 minutes before I hung up and canceled the charge.

Pros

A great way to waste time by talking to customer service

Cons

Customer service not understanding English concepts. It should never take 30 minutes for any rep to understand why someone is calling them.

QuickBooks Online Review

It is absolutely brilliant as an accounting software

- Professional Services

- 1-10 employees

- Annual revenue $1M-$10M

QuickBooks Online Review

The support is terrible and it doesnt meet my job costing needs.

QuickBooks Online Review

We hate Quickbooks Online. I don’t know if we aren’t on the right version but none of the information is where we need it to be

QuickBooks Online Review

cost prohibitive for the functionality I get with it.

QuickBooks Online Review

The solution is too expensive. We pay $600 annually for it and can’t figure out why it could possibly cost this much

QuickBooks Online Review

It was great for core accounting, but limited when we needed it to do more complex tasks

QuickBooks Online Review

Their customer service is awful, when I spend an hour on the phone on hold with them it’s a waste of my day, the price continues to go up and is too much.

- Professional Services

- 11-50 employees

- Annual revenue $1M-$10M

QuickBooks Online Review

Quickbooks online doesn’t fit our needs on the invoicing because you can’t customize invoices. We bill on milestone, % based invoicing, and QB’s only does product invoicing.

- Hotels, Restaurants & Leisure

- 251-1K employees

- Annual revenue $50M-$100M

QuickBooks Online Review

Has ease of access, user friendly system, straightforward reports but missing intercompany communication, consolidated options, and is restricting with certain reports

QuickBooks Online Review

Date and check numbers all run together. I can’t open the next month without opening the next month, but then I can’t go back to the previous month. I’ve never been able to get the system to print a check

- Industrial Conglomerates

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

There’s too many factors involved to do e-commerce. There’s too many duplications of invoices within the system which causes a major accounting issue.

QuickBooks Online Review

I dislike the reporting for Quickbooks Online since it seems to give false data. Even if we run two reports on the same thing, we get completely different figures.

- Professional Services

- 1-10 employees

- Annual revenue $0-$1M

They said I would need to keep the solution for a full year

The only reason I went with Quickbooks online is because they don’t offer a desktop version for MAC in Canada. They gave me 60% off of their montly price for the first year so I was paying $12 per month. Now they want me to pay $27 per month plus tax so $31 per month for another year. They said I would need to keep the solution for a full year at that price before they could consider a discount again and I feel like they are holding me hostage.

- Professional Services

QuickBooks Online Review

We just did our first year end with them and the system doesn’t allow you to make any changes or modifactions to the payroll module or T4 and doesn’t allow us to pay the housing allowment, we ended up having to do everything manually

The online edition is frustrating to work with

The online edition is frustrating to work with. When our business was on the desktop version, it was easy to use. However, since I could not upgrade my desktop 2015 version to be compatible with MAC, I had to use QB Online which puts erroneous numbers into the program.

QuickBooks Online Review

They forced me to go online in order to keep up with exchange rates, I prefer to have it behind my fire wall at home and can’t do that. I’m royally pissed with them.

- Insurance

- 11-50 employees

- Annual revenue $1M-$10M

QuickBooks Online Review

Everything has to be done manually for reporting and it doesn’t provide good enough tracking on how to gather data for reports.

- Professional Services

- 51-250 employees

- Annual revenue $10M-$50M

QuickBooks Online Review

Quickbooks online has little to no controls or reporting and I find myself having to dump data into Excel

- Construction & Engineering

QuickBooks Online Review

The problem is it doesn’t split between residential and commercial and it would cost me an insane amount of money to upgrade

- Retailing

QuickBooks Online Review

There is no way to successfully track inventory and it is an old system not suited for our needs

- Diversified Consumer Services

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

the QB online requires a bit of a learning curve

QuickBooks Online Review

I love Quickbooks Online because it allows me to use it remotely. It’s a simple accounting program that integrates with a lot of other programs.

- Media

- 1-10 employees

- Annual revenue $0-$1M

QuickBooks Online Review

Great solution.

- Construction & Engineering

- 251-1K employees

- Annual revenue $100M-$250M

QuickBooks Online Review

Quickbooks online has always had limitations that the desktop had answers for specific industries, being able to access it from anywhere has been the driver to use the online version

The whole accounting system, I liked it

It was really good. The whole accounting system, I liked it. We just couldn’t afford it as a small organization with virtually no extra spending cash. I’d highly recommend it to other companies.

Pros

I liked how it compiled the information and retrieved it when searched for.

Cons

N/A

- Health Care Providers & Services

I needed to share it with my accountant and my COO

Used QuickBooks since 2000, I am familiar with the program. It was a big selling point. I have a MAC computer so using QB Online is useful. Not much else available on a Mac computer. I wanted to stay with my HP or PC-based Quickbooks, but I needed to share it with my accountant and my COO so I had no choice but to use the QuickBooks Online. One of my big problems that I’ve had is I use Windstream. It will go down a lot and be slow so I can’t access QB.

Pros

It's better than hand balancing a check-book, that is for sure.

Cons

Hard to pinpoint as I do not use a lot of the features. I mostly use it for accounting just to keep track of everything.

It's so much better to have everything available to me and the employees online

It’s so much better to have everything available to me and the employees online. Additionally, my with mobile phone I can add the Quickbooks app and review invoices, etc… The integration to payroll systems such as ZenPayroll allow me to run payroll right off my phone… Finally, there’s the project management apps that are available such as BigTime. All of these applications integration with Quickbooks and it makes things easier to manage.

- Professional Services

- 51-250 employees

- Annual revenue $10M-$50M

QuickBooks Online Review

It looks like it will fit our needs considering the relatively small size of our company

Pros

that it is web based