Blackbaud Financial Edge NXT

14 Reviews 4/5 ★ ★ ★ ★ ★A cloud-based financial management system for non-profit organizations with accounting and budget management tools.

Product Overview

Blackbaud Financial Edge NXT is a total cloud accounting solution designed to meet the unique needs of nonprofits and government entities. Built on Blackbaud’s expertise and experience of over three decades, Blackbaud Financial Edge NXT delivers all the tools NPOs need to manage financial reporting, monitor and track program success, support fundraising efforts, and ensure overall integrity for the organization.

Blackbaud Financial Edge NXT can help streamline financial processes at organizations, freeing users to spend more time and resources driving the mission forward. The cloud platform is fast, secure, and always current.

Pros

- Cloud accounting solution

- Comprehensive training resources

- Modules for accounts payable, receivable, etc

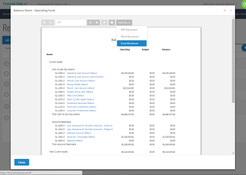

- Financial reporting tools

Cons

- Custom reports are limited

- Inability to drill-down on report line items

Target Market

Medium to large non-profit organizations that require a detailed and customizable accounting solution.Features

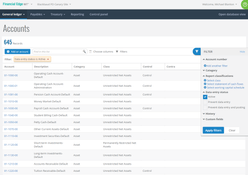

- General ledger

- Advanced security

- Allocation management

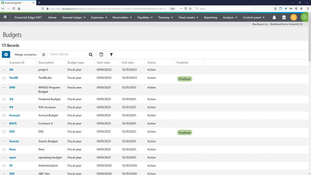

- Budget management

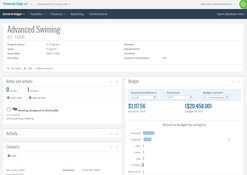

- Projects, grants, and endowments

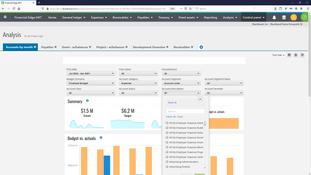

- SKY reporting and dashboards

- Working capital management

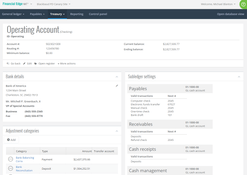

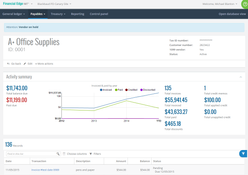

- Accounts payable

- Accounts receivable

- Cash management

- Expense management

- Purchase orders

Other Modules

- Accounting queue

- Consolidation management

- Fixed assets

- Payroll

Integration and Support

SKY API®

SKY API provides open APIs, allowing for more customization, integration, and extended functionality. These are protected by industry-standard authorization and authentication tools. With SKY API and Blackbaud’s modern developer portal, in-house developers or consultants can quickly get started using the available endpoints of Blackbaud Financial Edge NXT® and other Blackbaud solutions.

Integration with Blackbaud Raiser’s Edge NXT®

Blackbaud Financial Edge NXT was designed from the ground up alongside Blackbaud Raiser’s Edge NXT. Together, the two provide the leading ERP solution for nonprofit organizations. When reviewing donations, users can access constituent data from Blackbaud Raiser’s Edge NXT, automate gift entry while retaining control of posting, and ensure the integrity of their data by eliminating manual entries. All are pre-integrated but highly configurable.

Training from Blackbaud University

Blackbaud Financial Edge NXT packages come standard with basic self-guided online training. More advanced options are available through our Blackbaud Learn® subscription offerings. Blackbaud University courses are CPE accredited, and users can choose from over 40 online instructor-led classes.

Product Overview

Developer Overview

Related Products

User Reviews of Blackbaud Financial Edge NXT

Write a Review- Education Services

- 51-250 employees

- Annual revenue $10M-$50M

Very user friendly, intuitive and easy to use

Very user friendly, intuitive and easy to use. I set up my accounting staff of two who have limited accounting experience and within a matter of minutes they had mastered the basic functions.

Pros

Accessible wherever I am. Information at my fingertips.

Cons

Multiple step processes sometimes don't seem necessary. Would like, for example, ability to attach support for JE's right from the edit page, it would be fantastic if they could go right with the line entry with the specific debit and credit

- Professional Services

- 11-50 employees

- Annual revenue $1M-$10M

Edge NXT bridges reporting gaps

Edge NXT bridges reporting gaps. Reports should be reported for specific audiences. With Edfg NXT, I can easily report to auditors, grant agencies and internal customers.

Pros

I like the ease of navigation the most. Everything is located where I would intuitively think I would find it.

Cons

Currently, the modules in the database version are not yet in NXT.

- Family Services

- 51-250 employees

- Annual revenue $10M-$50M

One of the biggest dislikes is the support

There are several functionalities that it doesn’t have so we still have to do a lot of things on spreadsheets. One of the biggest dislikes is the support. We can rarely get in touch with someone when we have an issue or they direct us back to the website.

- Family Services

- 251-1K employees

- Annual revenue $50M-$100M

I paid more money for better work but it was totally wasted

I paid more money for better work but it was totally wasted money. couldn’t use NXT for 2 years. I regret so much.

Pros

Do not know about NXT even though I purchased it two years ago.

Cons

No training and help from FE. Their customer service is very poor. They just want to sell NXT.

Blackbaud Financial Edge NXT Review

Basic accounting package. Seems to be working fine for us.

Cons

Distribution table work needs to improve.

- Diversified Consumer Services

- 51-250 employees

- Annual revenue $10M-$50M

Blackbaud Financial Edge NXT Review

I really like Financial Edge, used it for years, does what we need it to do

Pros

Cost competitive and flexible to use

Cons

I would like to see the ability to attach a PDF invoice to a record

- Health Care Providers & Services

- 1K-5K employees

- Annual revenue $500M-$1B

It's very easy to navigate and fix errors in journal entries

Financial Edge integrates well with Raiser’s Edge. We use the General Ledger feature of FE. Data entry is easy and the reports available make it easy to report to the Board.

Pros

It's very easy to navigate and fix errors in journal entries.

Cons

We have to manipulate our data in a .csv file before importing it into FE and sometimes there are errors that you have to pull multiple reports to find.

- Family Services

- 51-250 employees

- Annual revenue $10M-$50M

The NXT interface is very easy to navigate

Financial Edge is a robust accounting software. We use the general ledger, accounts payable, and treasury features. The NXT interface is very easy to navigate, allows for rich report creation and customization in a pretty easy-to-use format, and is adding other efficiency-enhancing features like connecting a bank feed for ease of transaction matching and reconciliation.

Pros

I use the reporting features of Financial Edge NXT, and have been very pleased with the improvements NXT offers over Financial Edge 7 in this arena. I also love how quick and easy it is to retrieve information about accounts and drill down to specific journal entries when needed.

Cons

We've been using NXT for a little over a year. Originally there were not many features in NXT and it didn't feel like great value at the time, but now it's finally starting to feel worth the added cost for the upgrade.

The ease in access from any device

Financial Edge handles our accounts payable/receivable and billing for our organization. It’s database integrates with a product called Raider’s Edge which handles income through direct donation and sustained giving. FENXT lives in a hosted environment and is displayed using a cleanly built web platform-making it accessible from anywhere there is an internet connection.

Pros

The ease in access from any device and the crystal clear way the information is displayed and accessible. The system is constantly being updated and improved without the user needing to run or backup databases.

Cons

I would like to see improvements in reporting and the ability to create unique reports within NXT itself.

- Diversified Consumer Services

- 11-50 employees

- Annual revenue $1M-$10M

Much easier to navigate than the traditional database

Financial Edge NXT has some great functionality that streamlines the usage of the system which is great. I am looking forward to the continued roll out of improvements that are coming, especially credit card reconciliation help!

Pros

It is much easier to navigate than the traditional database.

Cons

Much of the functionality that we need is not available yet but with time, it should grow into a phenomenal system for us.

- Education Services

- 11-50 employees

- Annual revenue $1M-$10M

Blackbaud Financial Edge NXT Review

One of the best financial systems I have used in the Non-Profit world. It is straightforward and really meets our needs.

Pros

The flexibility in financial reporting.

Blackbaud Financial Edge NXT Review

Blackbaud’s Financial Edge (FE) is a robust example of accounting software. It will do most of what more expensive products will do. Where it could use more development is in the two areas of drill-down capabilities within canned reports, and a more user friendly report writer than Crystal Reports.

Pros

The best feature of FE is it's ability to be viewed by an unlimited number of readers. For a public agency this is key to transparency.

Cons

As mentioned above, the inability to drill-down on report line items is a disappointment.

- Consumer Goods

- 11-50 employees

- Annual revenue $1M-$10M

Blackbaud Financial Edge NXT Review

We purchase Financial Edge which is a grant based accounting system. Our purchase included General Ledger, A/P, A/R, Web Purchasing, Purchase Orders, Budget Management and Cash Management modules.

Pros

The software is easy to configure and does a great job in charging transactions to multiple grant funding sources. Standard grant allocations can be configured to automate data entry. Web based requisitions are reviewed and approved on line then quickly converted to purchase orders. Lengthy journal entry or A/P distributions calculated in Excel can be easily uploaded to eliminate data entry. Our staff found it very easy to use in most areas.

Cons

The standard reports are not that great. Custom reports can be written from within the software that are linked to data exported from the databases. The process in too time consuming. You have to re-export every time there is any change to the data. We wrote our key reports with Crystal Reports and directly accessed the database instead. The SQL databases are a bit difficult to figure out for non I.T. people but once you have everything linked the reports run quickly.

- Real Estate

- 11-50 employees

- Annual revenue $1M-$10M

Blackbaud Financial Edge NXT Review

The Financial Edge software works well for governmental accounting. It has fund accounting options as well as grant tracking abilities. The number of reports available is endless.

Pros

The fund accounting and grant management systems work well for us. Also, the budgeting tools are flexible and can be managed at various levels.

Cons

We have had problems implementing the payroll system. The allocation of accrued paid time off by grant and by project has been difficult.