Fund EZ

A full accounting software system designed by Fund EZ Development for startups and small organizations.

Product Overview

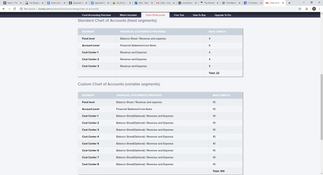

Fund EZ software is a cloud-based solution tailored for medium to smaller non-profits. It allows for the customization of accounts and reports and offers advanced reporting modules for additional customization. It offers ease of use, even for those users without a strong accounting background, and its effective management of multiple funding sources. The software provides reporting capabilities, automatic backup and saving features, and continuous updates to improve functionalities.Pros

- Offers a customizable chart of accounts

- Cloud-based platform allows remote access

- Flexible data filtering and exporting (Excel, tab-delimited)

Cons

- Exact pricing details not provided by the developer

- Limited built-in help options

- Customizing reports is challenging

Target Market

Small to mid-sized NPOs, including those in healthcare, animal welfare, higher education, faith-based ministries, and civic and social organizations, with 11-500 employees and an annual revenue ranging from $1 million to $50 million.Features

- Daily transaction journal reports

- Balance due and aging reports for payables and receivables

- Columnar consolidating financial statements

- Standard nonprofit financial statements

- FASB 117 financial statements

- Custom financial statements

- Pre and post allocated financial statements

- Budget comparison reports with variances

- Budget comparison reports with unexpended amounts

- General ledger detail and summary reports

- Encumbrance ledgers and PO reports

- Trial balance reports

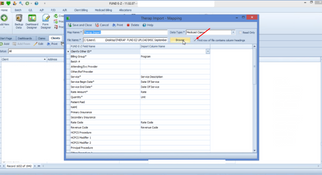

Accounts Payable

- Manage vendors, add/edit accounts payable invoices for purchases, charge invoices to an unlimited number of funds or control accounts.

- Utilize direct allocations to memorize account distributions, up to 999 details per allocation, in all A/P transaction journals.

- Automatic pop-up of open purchase orders by line number, upon selecting the vendor.

- Schedule pending A/P computer checks by selecting individual invoices or by group.

- Perform cash requirement procedures and print either pre-printed or MICR computer checks.

- Void checks and adjust invoices with automatic credit/debit memos.

- Auto-create, edit, and print 1099 and 1096 IRS approved forms.

- Print all vendor listings, invoice and check register reports, balance due reports, aging reports, cash transfer reports and cash basis expense reports.

- Fully integrated to the general ledger and purchase order modules.

Accounts Receivable

- Manage clients, add/edit accounts receivable bills to record revenue, to an unlimited number of funds or control accounts.

- Utilize direct allocations to memorize account distributions, up to 999 details per allocation, in all A/R transaction journals.

- Subdivide clients into agency groups for segregation on balance due reports.

- Open bills pick list automatically pops up in cash receipts when a client code is selected.

- Auto-create cash receipts function can create payments for open bills by any combination of batch #, bill date, fund, A/R account or agency.

- Adjust accounts receivable bills with automatic credit/debit memos.

- Print all client reports including listings, bill and cash receipt registers, balance due reports, aging and history reports.

- Fully integrated into general ledger, client billing, and HIPAA billing modules.

Allocations

- Allocate transactions using direct allocations at ‘point of entry.’

- Direct allocations work in all transaction screens across all accounting modules.

- Utilize fixed percentage, units of measure, direct amounts, or a combination of methods.

- Allocate admin or overhead expenses at period-end with indirect allocations.

- Select one or more chart of accounts levels to be used in the allocation, and disable irrelevant levels to simplify allocation instructions.

- Supports up to 999 ‘from/to’ transfers within each indirect allocation group.

- Allocate using fixed percentage, units of measure, weighted average of direct costs, weighted average of selected accounts or its inverse (ratio value method).

- Allocation targets can differ from source accounts to maintain pre-allocated amounts.

- Use up to 12 different allocation groups within one allocation - one for each month of the year.

- Allocate to new department levels not used in transaction entry to create a ‘new view’ of the organization.

- Allocate budgets along with actual dollars and print allocated budget comparisons with an option to include budget revisions.

- Print allocated financial statements and allocation distribution reports that display generated percentages to 10 decimal places.

Client Billing

- Enter billing orders and print billing invoices with varying ship-to addresses and up to 999 billing code lines per order.

- Unlimited length memos for each billing code allow detailed explanations of products or services sold.

- Set billing codes for goods or services sold with variable, fixed, or sliding scale pricing.

- Cost per unit can be calculated to three decimal places and fractional unit amounts and descriptions (e.g. dozen) are available.

- Assign default chart of accounts data to a billing code for the posting to the credit side (usually revenue) on A/R bills.

- Adjust billed invoices automatically by adjusting the quantity sold or adding new billing codes to existing invoices.

- Creates accounts receivable credit/debit memos for billing adjustments and appends details to original invoice for reprinting.

- Create recurring billings for groups of clients with user-defined billing details and frequency control.

- Print order, invoice and sales reports as well as statements of accounts and statements of client activity.

- Fully integrated to the FUND E-Z accounts receivable module.

Fund Raising

- Track donors and their attributes.

- Track donations and other donor activities.

- Track pledges and pledge receivable balances.

- Integrate donation, pledge and adjustment activity with FUND E-Z accounting.

- Import donor, donation and pledge information from external files.

- Use the built-in word processor to send mail-merge acknowledgements to donors.

- Report on fundraising information using variable search and sort criteria.

- Integrate into the data access component for custom reports, exports, and data analysis.

General Ledger

- Record bank deposits and manual checks and adjust journal entries.

- Utilize direct allocations to memorize account distributions, up to 999 details per allocation, across all transaction journals. Budget management: auto-create budgets, mass update budgets, edit budgets, add and post budget revisions, and print budget analysis reports.

- Perform unlimited automatic bank reconciliations, reconcile one cash account across funds, auto-clear cash items, and print reconciliation reports.

- Print GL source journals, trial balances, account detail and general ledger reports with running balances, print financial statements and budget reports.

- Create custom column and row codes for financial statement formatting.

- Create filter and sequence codes for unlimited filtering and sorting of report information.

- Set up and print FASB 117 financial statements.

- Fully integrated to all other FUND E-Z accounting modules.

Purchase Orders

- Enter and print purchase orders with unlimited ship-to addresses with up to 999 products per PO.

- Update quantity of goods received, auto or manually close POs, either one PO line at a time or entire PO with one click. Product codes can apply to all vendors or be restricted to one vendor, and pricing can be variable or fixed.

- Assign default chart of accounts data to a product code or use a direct allocation to assign split distributions.

- Encumbrance ledger account distributions can be edited directly from the PO with a pop-up.

- Enable the auto-close PO feature to ensure that postings to the encumbrance ledger do not exceed earmarked monies.

- Print purchase orders, PO registers, PO history, goods received and encumbrance ledger reports.

- Encumbered columns on budget comparison reports are used to display ‘worse-case scenario’ variances.

- Fully integrated to the FUND E-Z accounts payable module.

Utilities

- Backup utility creates a compressed *.fbk file that can be saved to any drive, folder and file name at any time.

- Restore utility warns against overwriting data and requires supervisor password rights to execute and access rights to view restored data.

- Import fixed width data or comma delimited data, which utilizes a flexible user-defined import spec to map fields.

- Import general journal entries, cash receipts, cash disbursements, invoices, bills, clients, vendors, donors, budgets, and billing claims with full data validation, error reports, and success reports.

- Export capabilities for all reports to numerous formats and applications including MS Word, Excel, Lotus, Adobe Acrobat, CSV files, and more.

- A full suite of security tools is included, including data integrity checkers, recreation of system indexes, recreation of GL net activity files, data cleaners, and data editing tools.

- The remove obsolete data function deletes old fiscal years and properly maintains bank reconciliations, accounts payable and accounts receivable transactions that straddle the remove date.

Price Range

Learn More

$ $ $ $ $

$ $ $ $ $

Product Overview

Developer Overview

Related Products

User Reviews of Fund EZ

No reviews have been submitted. Do you use Fund EZ? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!