MIP Accounting

9 Reviews 4/5 ★ ★ ★ ★ ★Fund accounting software designed for nonprofit organizations and government agencies. Formerly Abila MIP.

Product Overview

MIP Accounting is a software supporting a wide range of transaction types through up to 25 different modules. It offers a suite of functionalities including fund accounting, procurement, budgeting, payroll, HR, timekeeping, fixed asset management, and grant management.Pros

- Collect donations from desktops, tablets, and mobile devices

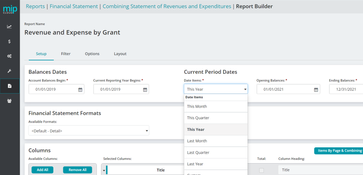

- Customizable Reports

- Integrates well with other software

- On-Premises or Cloud Deployment

- Track real-time donation, registration, and RSVP metrics

Cons

- Clunky design

- Not very user-friendly

Target Market

Small to medium-sized NPOs with 10 to 500 employees and annual revenues ranging from $1 million to $50 million.MIP Accounting, previously known as Abila MIP or Sage 100 MIP Fund Accounting, is known for its configurability, allowing users to tailor it to their specific reporting and tracking needs.

Key features include fund accounting, human capital management, payroll, procurement, and budgeting. MIP offers a variety of deployment options, including on-premise, cloud-based, or self-hosted systems, with flexible purchasing or renting terms.

The developer of MIP Accounting, Community Brands, rebranded to Momentive in 2024. They have also changed the name of “MIP Fund Accounting” to “MIP Accounting.”

MIP Accounting Editions

-

Single User Edition: The Single User Edition of MIP Accounting is designed for smaller organizations with limited staff and budgets, offering access to essential fund accounting software. This edition includes a single-user license and encompasses seven core modules: system manager, general ledger, accounts payable, accounts receivable reporting, budget, bank reconciliation, data import/export, and forms designer. Users have the option to upgrade to the full MIP Accounting system to accommodate additional users.

-

Executive View Licensing: The Executive View License provides access to MIP Accounting’s financial reports, including operating results and budget positions, without transaction access. This feature enables executive users to view, add, and create their own financial reports for analysis. The embedded report writer within the system allows for the creation of customizable reports across various cost centers and periods. Additionally, it supports the building, maintenance, and reporting of unlimited budgets, projections, and forecasts directly within the system.

MIP Accounting Modules

- Accounts Payable: This module simplifies the management of accounts payable, enabling the tracking of unlimited accounts and updating the general ledger and vendor accounts automatically. It supports processing invoices, checks, and payments, with robust security controls and extensive reporting capabilities.

- Accounts Receivable: Offered in two modules, AR Reporting and AR Billing, it provides functionalities for tracking accounts receivable without billing functions, and automates billing with recurring transactions for different customer groups.

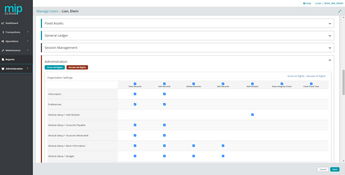

- Advanced Security: Ensures data security while allowing key employees access to necessary system areas. It includes features for setting permissions, limiting access to designated accounts, and allowing budget monitoring by program managers or department heads.

- Allocations Management: Facilitates complex allocations of indirect costs and investments, with features for flexible allocation options, time-saving tools, advanced calculation options, and compliance with OMB Cost Principles.

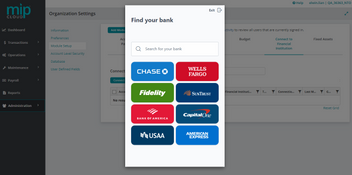

- Bank Reconciliation: Streamlines bank reconciliation processes, providing control over cash management, monitoring bank balances, tracking transactions, and automatically updating clearing details.

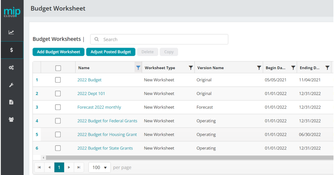

- Budget: Enables creation and tracking of budgets for grants, programs, and departments. It allows for instant budget creation, maintenance of multiple budgets, and advanced reporting for budget inquiries and financial analysis.

- Data Consolidation: Facilitates the generation of consolidated reports from different locations using any Sage 100 Fund Accounting product. It includes features for easy data consolidation, customized reporting, and balance adjustments.

- Data Import/Export: Simplifies data transfer between systems, supporting a wide range of data types including Excel and timesheets, with features for data validation and report exporting.

- Direct Deposit: Enhances payroll processing by allowing electronic deposit of pay and integrates with the General Ledger.

- Electronic Funds Transfer: Offers a method for electronic vendor payments, integrating with Accounts Payable and the General Ledger for streamlined cash flow management.

- Electronic Requisitions: Provides a system for electronic purchase requisitions with budget checking, integration with other modules, and comprehensive reporting options.

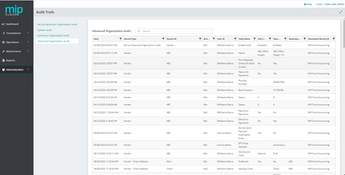

- Encumbrances: Supports budget reservation for planned expenditures, offering tools for encumbrance entry, audit trails, financial statement integration, and budget verification.

- Executive View Licensing Options: Offers report-only access, allowing budget monitoring and report generation without transactional access, at a reduced cost compared to full licenses.

- Fixed Assets: Tracks assets, calculates depreciation, and integrates these entries into the general ledger.

- Forms Designer: Customizes accounting forms, including logos, auto-signatures, and personalized layouts.

- GASB 34: Facilitates creation of GASB-34 required reports and manages complex government financial reporting and accounting standards.

- General Ledger: Serves as a comprehensive accounting foundation with features for fund tracking, financial reporting, and transaction management.

- Grant Administration: Integrates grant management within the accounting system, allowing for efficient tracking, managing, and reporting on grants.

- Inventory Control: Manages perpetual inventory, complying with GAAP and streamlining inventory-related operations and reporting.

- Multicurrency: Processes transactions in multiple currencies, complying with FAS 52 regulations, and integrates with various modules for comprehensive multicurrency management.

- NightShift Scheduler: Automates report generation and transaction processing during off-peak hours.

- Payroll: Manages nonprofit payroll with comprehensive features for employee tracking, tax processing, and payroll reporting, fully integrated with other modules.

- Purchase Orders: Combines purchase order management with strong reporting capabilities, integrated with other accounting modules.

- Sales Order Entry: Manages the sales process, from quote generation to order fulfillment and reporting, integrated with inventory and accounts receivable modules.

- Visual Analyzer: Provides a business intelligence tool for financial data analysis, offering visual dashboards to monitor trends, budgets, and spending.

Product Overview

Developer Overview

Related Products

User Reviews of MIP Accounting

Write a Review- 11-50 employees

- Annual revenue $1M-$10M

Best "bang for our buck"

After reviewing several options, we found MIP Fund Accounting offered the best “bang for our buck”. They not only offered the accounting and budgeting but also had added functionality such as purchasing/requistion and payroll that were terrific. The cost benefit analysis we did, had them as the stand out choice.

It's extremely antiquated

It’s extremely antiquated. If you need this for multiple entities and funds, forget it. No clarity. There’s not ability to consolidate and run elimination entries. Reporting is very difficult. The ability to drill down on a balance from your financial statements is almost nonexistent. Weak audit logs. We’re leaving MIP for good.

Pros

Nothing.

Cons

No multi-entity reporting capabilities. No auto eliminations.

MIP Accounting Review

The program is clunky, confusing and not user friendly whatsoever.

- Capital Markets

- 51-250 employees

- Annual revenue $10M-$50M

The reporting capabilities are on the weak side

After using this program for quite some time, the reporting capabilities are on the weak side as they are unable to calculate cost of customer acquisition and the deployment is outdated as our IT staff has a very difficult time integrating it with other industry specific solutions that we use.

- Diversified Consumer Services

- 11-50 employees

- Annual revenue $1M-$10M

MIP Accounting Review

It’s my favorite fund accounting software package.

Pros

A person can run reports by any segment or combination of segments, which is VERY helpful!

Cons

Changing PO amounts once the PO is printed.

- Health Care Providers & Services

- 51-250 employees

- Annual revenue $10M-$50M

MIP Accounting Review

Just now setting it up. So far I like it. When we had a question, they got back to us right away.

- Hotels, Restaurants & Leisure

- 1-10 employees

- Annual revenue $1M-$10M

MIP Accounting Review

Fund Accounting Software including; Accounts Payable, Accounts Receivable, Payroll/HR, Budgeting, and Inventory Modules

Pros

User friendly system; able to accomodate all levels of users from basic accounting clerks to payroll specialists.

Cons

Printed Tech Support Guides difficult to understand; instructions not clear and icons are not intuitive. Tech support and training online is excellent.

- Diversified Consumer Services

- 11-50 employees

- Annual revenue $1M-$10M

MIP Accounting Review

This software has all of the features we were looking for - payroll, fixed assets, general ledger etc. It has the ability to automatically post benefit expenses as it posts payroll. Will definitely cut down on tracking through individual spreadsheets. Streamlined over our current software

Pros

We are still implementing the software, working with a CPA firm. We have found that going through a CPA firm is much easier as they understand your questions from an accountants perspective. The software can be customized in many ways to make it tailored to our needs.

Cons

We haven't worked in it enough to know its quirks.

- Family Services

- 11-50 employees

- Annual revenue $1M-$10M

MIP Accounting Review

Our vendor was very professional and accommodating to our search. They were very helpful at demonstrating the product functionality with our specific examples and came across from knowledge and confident in their solution for us.

Pros

It appears very user friendly and during our due diligence we discovered many satisfied users.