FastFund Accounting

We recommend FastFund Accounting to nonprofits looking to meet compliance requirements set by government regulations. It’s useful for managing internal and external auditing processes at charitable organizations which want to increase transparency for donors and contributors.

However, FastFund is not an ideal fit for NPOs which focus on the collection and distribution of physical assets rather than financial contributions. Very small organizations which operate on a cash only basis might be best served by FastFund Online LT. It’s also best used by those with some degree of accounting experience.

- Contains general ledger, payroll, and more

- Affordable for small organizations

- Supports wide range of organizations

- Popular replacement for QuickBooks and other non-NPO specific accounting software

- Customizable reporting tools

- Difficult for those without accounting background

- Must log-in separately for different organizations

- No native mobile app

- Initial learning curve with navigating system

- Developer Araize

- Client OS Web

- Deployment Cloud or On-Premises

What is FastFund?

FastFund Accounting is a fully integrated fund accounting system designed by CPAs. Just a few of the fund accounting modules offered by FastFund include general ledger, accounts payable, accounts receivable, cost allocations, payroll, and fundraising. These reporting capabilities produce custom reports to meet all NPO fiscal requirements, including multi-year reports, budgets, and reports that comply with FASB 116 and 117.

This software is made to handle the complex reporting requirements of multi-funded organizations in the nonprofit sector. As such, FastFund is primarily used by nonprofits, government programs, and churches. It has also been used by small municipalities.

Our Ratings

| Usability - 8.2 | Dashboard provides immediate overview of accounts; provides multiple ways to customize reports; the navigation may require a bit of guidance or training to be optimally intuitive. |

| Support - 9.7 | Phone support offered during normal business hours (EDT timezone); support requests can be sent by email; one-on-one training sessions are available; user guides cover more training; pre-recorded webinars and video tutorials available to watch. |

| Features - 9 | Each module offers different features; projects allow users to track revenue and expenses from short-term activities; no mobile app, but still accessible from web browsers on mobile devices. |

| Security - 9.8 | Data is backed up daily and secured on a server protected by encryption techniques and passwords; API integrates with EFT Corporation and National Payment; reports can be generated as HTML, PDF, XLSX, or CSV files. |

| Value - 9.9 | Has Standard and Premium pricing plans; plans start at $45 per month and reach $100 per month; additional modules are an extra monthly subscription of $20-$35 each. |

| Performance - 9.1 | Functionality was quick and responsive; reports were generated in less than a second. |

| Scalability - 8 | Only has two plans available to users; additional features all cost extra; only allows 5 concurrent users for multi-user accounts. |

Features

During our review of FastFund, we focused on a few key fund accounting features:

Overview of Revenue and Expenses

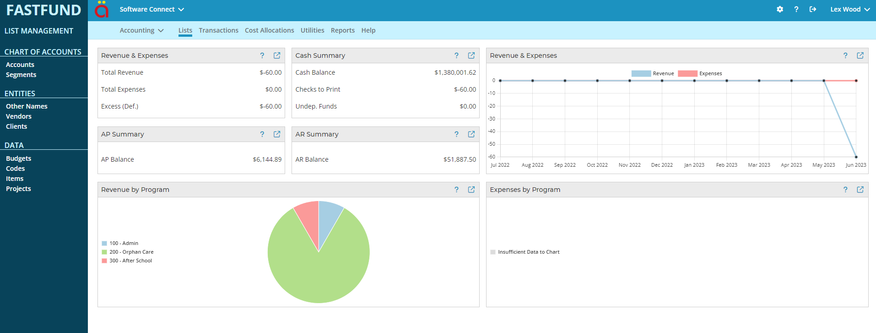

First, the home dashboard provides an immediate overview of revenue, expenses, cash, and more.

Users can click each specific section to go to a more in-depth version of the report.

Customizable Reports

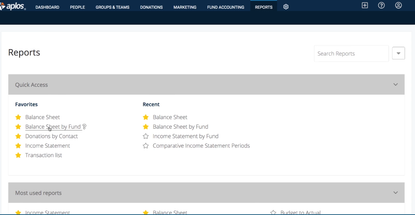

FastFund offers a wide range of different report types so users can fully customize financial data. A few top-level reporting categories include:

- Donors

- Campaigns

- Pledge Subsidiaries

- Transaction History

- Lists

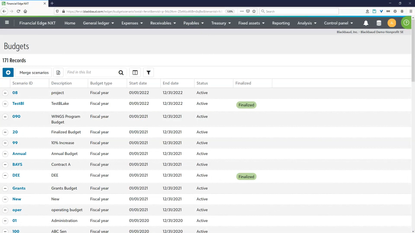

Budget

Make detailed budgets each year to see exactly how your NPO’s finances change on an annual basis.

What Features Are Missing?

Using FastFund might have been improved with a few additional features:

- Intuitive navigation: FastFund is not particularly intuitive for new users. The options available do not always lead where I expected, such as Data Management tools being hidden under the Utilities tab. However, one-on-one training and the many recorded demos make it possible to learn.

- More integrations: FastFund currently offers integration with email platforms for sharing reports, yet it does not yet have the ability to share data with third parties like Salesforce. This won’t be an issue for some organizations, but it could be a deal-breaker for others.

Pricing Plans

| Plan | Pricing | Features |

| Standard | $50 per month | Designed for smaller organizations.

|

| Premium | $110 per month | Designed for larger organizations. Includes all Standard features, plus:

|

| Additional features | $22-$40 per feature | These features are available for both Standard and Premium as add-ons:

|

Users can pay annually or monthly. All features are available for both plans at an additional monthly fee. Araize offers an unconditional 90 day money back guarantee and one-year of free phone support. Additional services include training, consulting, online support, which are available for a price.

FAQ

Here are a few top questions frequently asked about FastFund software:

Does FastFund have an app?

FastFund is a fully integrated, cloud-based software accessible on any web browser or device. However, there is not a native mobile app for iOS or Android devices.

How much does FastFund cost?

The two subscription plans offered by FastFund start at $50 and $110 per month. Adding all possible features can raise the price by $20 to $25 per module per month. Most customers average only $105 per month.

Alternatives

Summary

Based on our experience using FastFund, we’d recommend this software product for growing NPOs that need a fund accounting software to do what generic accounting programs like QuickBooks can’t. Any nonprofit in need of a segmented chart of accounts or audit trails for 990s can use FastFund. This solution’s pricing makes it suitable for organizations with budgets in the $1-$2 million range, though it can fit the budget of smaller and larger organizations.

For smaller orgs, this software might be too much. However, the FastFund LT version is available for the low cost of $275 per year. Users can upgrade to the Standard or Premium version as they grow. Otherwise, FastFund is not suitable for very small organizations. It’s also not ideal for orgs which need integrations with third-parties like Salesforce.

User Reviews of FastFund Accounting

Write a ReviewPerfect for our organizations needs!

The Fast Fund Nonprofit Online has been perfect for our newly formed organization’s needs. It provided a very affordable and user-friendly platform for both donor tracking and reporting and for our accounting needs. We were also able to integrate our bank and our donation processor directly to the platform, which is a big plus. Their support team is very responsive and very helpful with the initial setup. Not being an accountant, the training videos and user guides have been very useful tools, and generating reports is a very simple process. I trust their experience and am confident the platform is updated as needed to meet current reporting guidelines.

Pros

Affordable / offers modular licensing and pricing is constituent based so license pricing is based on your size and can grow with you / experienced support team with quick response time / generating reports is relatively simple / offers variety of training - prerecorded tutorials, webinars, and user guide / provided a single platform for both donor tracking and accounting/user friendly

Cons

Don't really have any at this point

- Public Administration

- 1-10 employees

Great support and very affordable!

It was very affordable and useful for the purpose I needed it for. It was great to get the hands-on support to implement it!

FastFund was able to support the needs of the animal shelter

We, alongside FastFund, Looked at Aplos and CDM + Church and Non-Profit Management. The client we were researching software for was an animal shelter. We found Aplos and CDM aimed more specifically for churches. FastFund was able to support the needs of the animal shelter (donor database, fundrasing, automated email marketing/follow-up) and we ended up signing up with them.

We moved onto FastFund and have been very happy

We were on Quickbooks Desktop and in having to switch to Quickbooks Online we found our reporting capabilites limited. Our chart of accounts is separated by Class and we were no longer able to differentiate our accounts by that factor. We moved onto FastFund and have been very happy with the overall system and the support. Our contact with FastFund has been great throughout the entire the process.

My accountant loved it

Liked it a lot. My accountant loved it. The way I input the information, the accountant could run whatever reports he wanted. I only worked in the receivables personally, but I loved the system and I’d recommend it.

Pros

Their customer service is fantastic.

Cons

They advertise that you don't have to have an accounting background to make good use of the product... but really if you do not, it makes it pretty tough. It really helps to have some level of background.

- Professional Services

- 11-50 employees

- Annual revenue $1M-$10M

It is very easy to learn and use

It is very easy to learn and use

Pros

It is easy to use and learn

Cons

We use it for multiple companies and we have to log out and login for each company. It would be nice if I could just change between companies without having to log in and out.

- Diversified Financial Services

- 51-250 employees

- Annual revenue $10M-$50M

It's a better accounting system than what we had

It’s a better accounting system than what we had, It does lack things for people to use on the fly… if I have a payroll item code, I have it up and I don’t have to back out of everything set up a payroll code and go back in. I can do that on the fly.

Pros

I love the fundraising. It gives me what I want when I need it and I can give a list of donors by amount. It's their best feature by far but I'm disappointed in the accounting.

Cons

I can't use SQL tables to write reports outside the system even though it's a SQL-based software... the report writer in the system itself is not user-friendly.

- Internet Software & Services

- 11-50 employees

- Annual revenue $1M-$10M

FastFund Accounting Review

We only used FastFund for a couple of months, because they had over sold what the software did at that time. However, it has been 2 years, and I would hope they have improved the software.

- Diversified Telecommunication Services

- 51-250 employees

- Annual revenue $10M-$50M

Fits our budget

Works for us. Fits our budget. It’s not quite as user friendly as I would like to have, but that may not be possible based on what we are looking for. I would only recommend it to someone who is computer savvy.

Pros

I like the way that it keep tracks of the restricted donations.

Cons

The report writing could be a bit easier.

They got me started in a hurry

I like it a lot. Excellent support. I went into this not knowing much about the software (it’s been a long time since I was involved in accounting) and they got me started in a hurry. They are just minutes away. The reporting is easy and it’s very intuitive once you get things put together.

Pros

The help screen is useful but it's pretty straight-forward. The cost is very reasonable as well. They have since added payroll functionality.

Cons

I think they are improving what is needed, with adding the payroll module to the program and better tax reporting.

Designed for nonprofits, very easy to use

Designed for nonprofits, very easy to use.

Pros

Easy to use, easy to log into it. From wherever or whenever. Very user-friendly. Owner of company was more than helpful anytime there was an issue. I helped recommend a few other people to use this software.

Cons

N/A

- Diversified Consumer Services

- 1-10 employees

- Annual revenue $0-$1M

Customer support is first rate

A good package for a smaller non-profit. Has functionality for payroll, and billing, along with extensive donation/fund raising record keeping. Customer support is first rate.

Pros

Customer service. I can't rave enough about how Joe and the rest of the team are there for me to answer questions and help me figure out things that I just am not understanding.

Cons

Some things are not intuitive, but the support team is there to show you the way.

- Diversified Telecommunication Services

- 51-250 employees

- Annual revenue $10M-$50M

We are extremely pleased with the integration of the 3 modules

This software for small non-profits is easy to use and allows you to get reports usually only available in bigger software programs. The customer support is excellent. I use the accounting, payroll and fund raising modules for my organization. We are extremely pleased with the integration of the 3 modules.

Pros

Ease of use. The User Guide is spare, but there are webinars available as tutorials that are excellent. The report function is also excellent. I had to get a payroll report across fiscal years for a grant report and was able to do so with ease.

Cons

Having to move from accounting module to fund raising module when entering a cash receipt gift. We understand completely why this must be, but it is the only thing I can think of that I don't care for with the program

the transfer was truly seamless

We are a 40 plus year old non-profit,having used FastFund since 1999. We shifted to the cloud version in recent years; the transfer was truly seamless. Araize is one of the most customer oriented firms in the country, constantly making refinements and improvements!

Pros

High customer support and appreciation.

Cons

N/A

- Specialized Consumer Services

- 51-250 employees

- Annual revenue $10M-$50M

FastFund facilitates the tracking of restricted funds

FastFund is an affordable SAAS solution for not-for-profit fund accounting. It is easy to use and processing steps are very intuitive.

Pros

FastFund facilitates the tracking of restricted funds. For interfund transactions, it automatically records the off-setting transactions; there is no need to do 2 entries every time there is a transaction between funds. FastFund also allows the creation of a variety of reports, all of which can be exported to other formats, such as PDF or Excel workbooks. I implemented FastFund at my former employer, and I hope to implement it at my new organization.

Cons

A statement of cash flows would be helpful.

- Specialized Consumer Services

- 1-10 employees

- Annual revenue $0-$1M

FastFund Accounting Review

From Clinton Hill Day Care likes the outstanding navigation of the system. The chart of accounts is superb

Pros

The navigation and report(s) formatting

Cons

How to enter the cash receipt(s) in the system for multi fund(s)

- Media

- 11-50 employees

- Annual revenue $1M-$10M

Fast transaction processing, dependable, secure, portable

A modular, integrated, robust and capable accounting software application. Very user friendly and easy to learn, especially if you have prior accounting software experience.

Pros

Fast transaction processing, dependable, secure, portable, great pricing, great support, training videos & webinars, embedded user guide, and more.

Cons

This is not really a bad feature, but similar to many ERP Solutions, the reporting functionality has it's own separate learning curve.

FastFund Accounting Review

Pretty intuitive and easy to use

Pros

simplicity

Cons

simple

- Diversified Consumer Services

The best feature is how easy it is to use

Fast Fund Nonprofit Software gives users the ability to track multiple funds, budgets and allocations in an easy to use format. It has different integrated modules available, such as accounting, payroll, and fund raising software. Fast Fund Nonprofit Software also has a custom reports feature, so you can get the information you need in the presentation you want.

Pros

The best feature is how easy it is to use! And, the more you learn about everything Fast Fund Nonprofit Software has, the better! You can eliminate a lot of manual processes with this software, because it has the capabilities to do the work for you.

Cons

Specifically, I wish the general ledger detail report could be totaled at the bottom. I have to manually total this report on several occasions. I cannot think of anything else. The software and the support is excellent!

FastFund Accounting Review

The accounting system works well for us as a non-profit organization that needs to track different funds, programs, grants (funding sources) and projects. It also has a great donor management system. It is all online, convenient and economical.

Pros

It is easy to use and the customer service is great. They also continually have online webinars for training.

Cons

There are some modules of the system that are still in development, like cost allocations and payroll, but they are working on it. The server- based system has been in place for years (so you know it is a reputable company). But the online cloud-based system we use is still being worked on. They are adding and improving all the time.

- Diversified Telecommunication Services

- 51-250 employees

- Annual revenue $10M-$50M

FastFund Accounting Review

The product integrates accounting, donor management and payroll. It meets our needs very well.

Pros

Support is excellent.

Cons

Would like more ease and flexibility with searches of the data base.

- Education Services

- 5K-10K employees

- Annual revenue $1B-$10B

FastFund Accounting Review

It’s an accounting package that is modular. It can do AP and AR and is auditable. It has Crystal Reporting, which allows for some customized reporting. It is fully online, so nothing has to be installed locally.

Pros

The software was fairly cheap to buy and maintain. We used it for a year, and the cost was so low compared to other options, we felt it was a no-brainer to try it out. The customer service was also good and responsive. We did some training with the company and they were offering help regularly.

Cons

The training and software assumed a basic understanding of accounting, especially when it came to setting up a chart of accounts and then entering transactions. We have zero accounting background, so this was hard for us. The software could not be 100% customizable to help us understand menus and labels better. Lastly, the reports could not be fully customized to let us see only the exact data we wanted to see; the problem was that our requirements were ultra basic, and the software produced its most basic reports with more information on the page than we wanted/needed.

FastFund Accounting Review

It is very good for non-profit organizations who receive donations as their primary source of income (Fund-Raising module). This is combined with the Accounting module which enables non-profits to show how funds contributed for specific purposes were spent for the purposes for which the funds were given. It is the combination of these two modules that provides a service that other accounting programs do not provide.

Pros

The ability to track donations (given for specific purposes) and to keep those funds separated for reporting purposes.

Cons

The reports function needs work (as there is a limited ability in producing reports). I find it difficult to produce the detailed reports that I need to produce for my board.

FastFund Accounting Review

Online software (software as a service); different modules available. We have the contact management module and the accounting one. Good integration, as both work off the same database. Other modules are available, such as payroll.

Pros

Good integration, excellent support.

Cons

Some of the design limitations are a bit frustrating for our staff. It won't always do what we wish it would. i.e. list all our child sponsors who pay annually by cheque;