AutoRek

3 Reviews 5/5 ★ ★ ★ ★ ★A cloud-based financial data management and reconciliation software for financial institutions and large enterprises.

Product Overview

AutoRek is a financial data management and reconciliation software. Its ability to handle vast and complex data sets efficiently makes it a viable tool for financial institutions and large enterprises. The platform’s automated reconciliation processes reduce the manual workload and mitigate the risk of errors. AutoRek’s reporting tools ensure compliance with various regulatory standards.Pros

- Real-time, reliable MI and comprehensive audit trails

- Supports CASS, EMIR, MiFID II, IFRS 17, ISO 20022

- Data templates to load complex files from multiple sources

Cons

- Steep learning curve

- May be cost-prohibitive for smaller organizations

- Complicated integrations

Target Market

Medium to large enterprises with a significant volume of transactions and requiring advanced financial reporting and reconciliation.AutoRek is an automated reconciliation software that helps firms simplify the collection, validation, and reconciliation of data. It mainly operates within the FS sector, servicing many large banks, asset managers, and insurance firms. The largest reconciliation deployment managed up to 2.4 billion transactions per hour.

Video Overview

AutoRek Key Features

- Cost reduction: AutoRek’s cloud-based solution reduces IT costs.

- Automation: Incoming data is automatically aggregated, validated, and enriched so users can focus on resolving exceptions.

- Data templates: Available to load complex files from multiple sources.

- Intelligent workflows: To enrich, categorize, prioritize, re-assign, and escalate high-risk transactions to multiple teams.

- Self-sufficiency: Users can create and manage data feeds, match rules, and set up accounts for existing and new reconciliations.

- Regulations: Single solution to support multiple regulations i.e. CASS, EMIR, MiFID II, IFRS 17, ISO 20022.

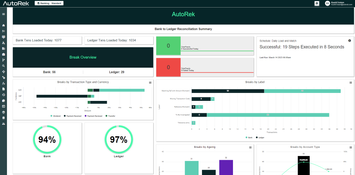

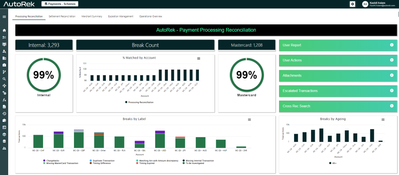

- Reporting, Dashboarding, and Auditing: Use dashboards with drill-down functions to visualize company-wide or departmental data. Businesses can also automatically schedule reports to run.

AutoRek Target Market

The AutoRek platform services many clients worldwide, including leading asset managers, banks, payments and insurance companies. They work with employees across the business in the finance, operations, compliance, and IT departments.

Product Overview

Developer Overview

User Reviews of AutoRek

Write a ReviewAutoRek Review

As a firm with a huge volume of transactions, AutoRek has freed up our time so that we can focus on the errors and breaks, rather than the manual tasks. Since implementing the product, we are already seeing an ROI.

Our client money reconciliation process has been reduced

Our client money reconciliation process has been reduced from two full-time equivalents daily, to around 15 minutes per day. This has freed up our team’s time to spend on other critical processes, including investigation and resolution of breaks, innovation and automation and ultimately supporting the wider growth goals of the business. We are already seeing significant ROI from our investment and are very excited for the future

- Internet Software & Services

- 11-50 employees

- Annual revenue $1M-$10M

AutoRek is very flexible and it is not limited in what it can do

iSoftware4Banks, Inc was looking to resell a reconciliation tool to sell to Banks and Credit Unions. We reached out to several providers and the senior team who are all former banks who held senior positions decided to go to market to serve our clients and new clients with AutoRek.

Pros

AutoRek is very flexible and it is not limited in what it can do. It covers all areas of finance, reporting, bank to bank, budgets etc. It is not limited in its ability at all. Many areas within an organization can use this software. To understand and see it in action you need to have a demonstration and you will be surprised of all its enhanced capabilities.

Cons

Honestly, there is nothing I can honestly state other than I wish I had it in banking career.