ACS Technologies Software

ACS Technologies provides software for churches to manage memberships, donations, events, groups, volunteering, and check-ins.

Product Overview

ACS Technologies’ software is a church management solution that assists staff in managing member records, contributions, events, small groups, volunteering, and check-ins. It features tools for calendaring, scheduling, registration, attendance tracking, and bulk email communication. Additionally, it provides accounting tools for finance management and contribution tracking, supporting various types of donations and generating automated tax statements.Pros

- Member database management with child registration and donation tracking

- Separate 'people' and 'accounting' side of software

Cons

- Extensive training required

- Users report large donor files can cause slow speeds

- Limited customization options

Target Market

Churches of any size looking to manage a wide range of activities - from member information and group activities to financial management and event organization. It is especially beneficial for churches seeking a comprehensive system that can handle multiple facets of church management in one platform.Not Recommended For

Churches with limited resources or those unable to afford the subscription and setup fees. It might also be less suitable for churches with volunteers or members who are not tech-savvy or reluctant to use computer-based systems. Smaller churches with predominantly senior adult members or very busy or bi-vocational pastors might find the software’s complexity and time demands challenging.Features

- Comprehensive financial management for faith-based nonprofits.

- Manages finances, bank accounts, funds, invoices, equipment, direct deposits, and fee-based services.

- Customizable with extensive reporting options.

ACS Accounts Payable

Check writing and vendor management.

- Increases accounting accuracy.

- Streamlines payment processing.

- Automates bill payments with memorized invoices.

- Detailed reports on payables and checks.

- Manages 1099 forms.

- Flexible check printing and payment suspension options.

- Interchangeable checks from ACS.

ACS Accounts Receivable

Manages outgoing bills and incoming payments.

- Instant receipting for payments.

- Customizable billing codes for accurate billing.

- Batch invoice processing.

- Links with ACS School Suite for tuition billing.

- User-defined revenue centers and billing frequencies.

- Customizable aging periods for invoices.

- Comprehensive reporting options.

- Suitable for both cash and accrual basis accounting.

ACS Fixed Assets

Inventory management for equipment and assets.

- Tracks asset values and depreciation.

- Compatible with scanners and barcode labels.

- Detailed inventory records (e.g., item number, location, cost).

- Various inventory reports (e.g., Additions Report, Depreciation Journal).

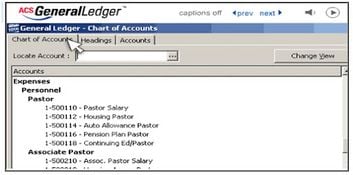

ACS General Ledger

Core financial management tool with nonprofit accounting standards.

- Integration with Microsoft Excel.

- Check reconciliation and standard bookkeeping practices.

- Customizable chart of accounts.

- Extensive budgeting capabilities.

- Cross-referencing for departments or projects.

- Multiple checking account management.

- Visual transaction entry and customizable reports.

- FASB 116 and 117 compliant.

ACS Payroll

Comprehensive payroll management.

- Tracks employee information and different pay types.

- Offers printed checks and direct deposit.

- Generates necessary payroll reports (e.g., W-2s, 941s).

- Customizable additions, deductions, and contributions.

- Automatic posting to General Ledger.

- Annual updates for tax schedules.

ACS Purchase Orders

Cash-flow planning and purchasing management.

- Controls expenses and prevents overspending.

- Keeps detailed records of PO numbers and payee information.

- Integrates with Accounts Payable and General Ledger.

- Posts encumbered amounts for account planning.

- Allows printing of purchase orders.

Product Overview

Developer Overview

Related Products

User Reviews of ACS

No reviews have been submitted. Do you use ACS? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!