SAP Business One

14 Reviews 4/5 ★ ★ ★ ★ ★A cloud-based or on-premise ERP system for small and mid-sized companies.

Product Overview

SAP Business One provides comprehensive business management capabilities for small and medium-sized companies. This system provides integrated departmental support for finance, sales, supply chain management, production, project management, and production processes.

This software can be deployed on-premise or on the cloud, and accessed from any mobile device through iOS and Android apps. The SAP API Business Hub allows for a wide range of partner integrations.

Pros

- Highly customizable

- Improved decision-making capabilities via extensive BI

- Multi-currency/multi-language support

- Native iOS and Android apps

- Supports both SQL Server and SAP HANA database engines

Cons

- Requires phone consult for pricing

- Setup usually requires help from a Value Added Reseller (VAR)

- No payroll module

- Limited chart of accounts

Target Market

Small to midsize enterprises with $1M to $200M in annual revenue seeking a comprehensive ERP solution. It suits businesses aiming to centralize data management and streamline core operations. Companies leaning towards SAP Business One should understand specialized ERP systems.Video Overview

Benefits

- The ability to capture and manage all business information in a single, integrated software platform

- Improved decision-making capabilities via extensive business intelligence capabilities

- Scalability for growing organizations anticipating increased data, transactional, and user demands

- Flexibility to meet changing business requirements through customization and an extensive array of add-on applications

Critical administrative and system-level features that distinguish SAP Business One from other competitors in the SMB ERP market include: multi-currency/multi-language support, notifications and alerts, role-based permissions management, a data transfer workbench for managing the migration of existing business data, an integration framework, and an SDK for rapid deployment of program customizations.

SAP Business One Quick Facts

What Functionality Does SAP Business One Include?

SAP Business One provides a range of ERP-related functionality including:

- Accounting and financial management

- Customer relationship management

- Supply chain and warehouse management

- Manufacturing production management

- Project and resource management

- Purchasing and procurement

- Reporting and analytics

How Much Does SAP Business One Cost?

Pricing on SAP Business One depends on a number of factors including selected modules, user count, user types, deployment preference, support expectations, and implementation and training needs.

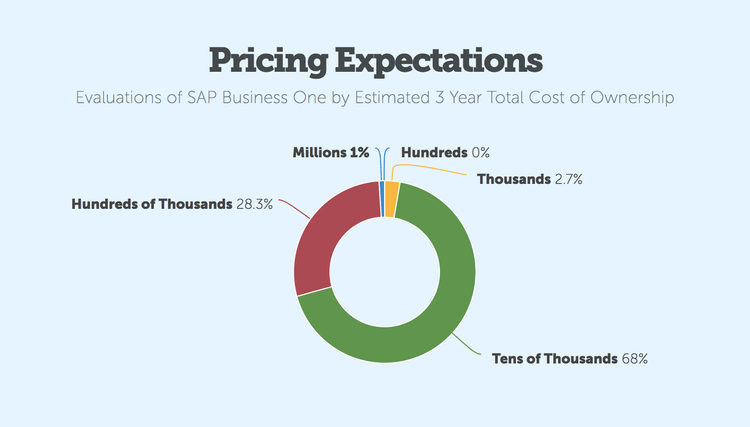

Based on review activity, 68% of buyers who recently considered SAP Business One had spending ranges in the tens of thousands of dollars range (USD) for their estimated total cost of ownership over a 3 year period. The median expected spending range for reviewers of SAP Business One was $51k.

Customized pricing is available upon request, and additional SAP Business One cost info can be found below.

What Are the Licensing Options for SAP Business One?

SAP Business One can be licensed on either a purchase or subscription model.

The SAP Business One OnDemand offering provides managed hosting of the software and makes the software available on a SaaS, subscription basis.

Alternatively, SAP Business One can be purchased via paying a one-time licensing fee. Version updates and tech support for the purchased version of SAP Business One are available via annual maintenance contacts.

Who Sells SAP Business One?

SAP Business One is sold and supported by an extensive network of SAP authorized solution providers.

What Industries Is SAP Business One Appropriate For?

SAP Business One is designed for use in a wide variety of industries. Based on established customer review activity, SAP Business One is most commonly considered by companies in the manufacturing, distribution, retail, and commercial & service industries. Additional data on SAP Business One popularity by industry is available below.

What Size Companies Use SAP Business One?

While SAP software is often associated with large enterprises, the SAP Business One solution is designed specifically for small and mid-sized businesses, typically between 1 to 200 employees and $1M to $200M in annual revenue. These companies are often outgrowing manual spreadsheets or QuickBooks and are striving to increase sales.

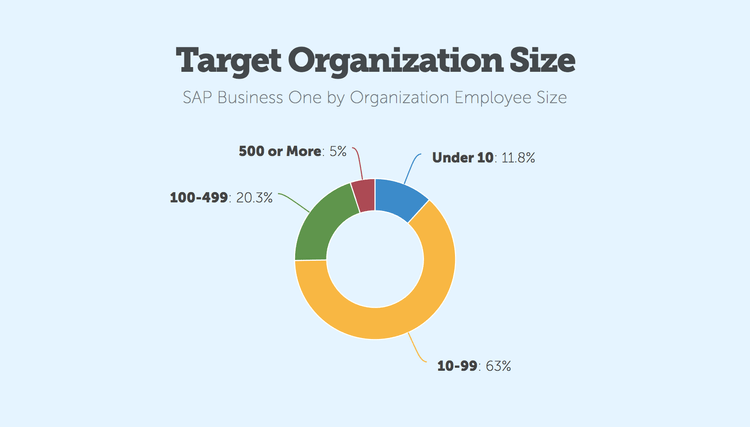

Based on recent customer review activity, 63% of organizations reviewing SAP Business One had employee counts between 10 and 99. Additional data detailing the popularity of SAP Business One as a review option across different organizational sizes is available below.

Is SAP Business One Cloud-Based?

SAP Business One functionality can be accessed via the cloud in both self-hosted or managed-hosted deployments.

Users running SAP Business One via the cloud will require either Citrix XenApp Edition or Windows Terminal Services in order to access the software from Windows-based work stations.

Mobile users can access select SAP Business One functionality via native iOS and Android apps.

What Operating Systems Can the SAP Business One Client Run On?

SAP Business One is designed for users running Microsoft operating systems. Additionally, select functionality is available for iOS and Android users.

Can SAP Business One Be Customized?

SAP Business One offers extensive customizability options. The SAP Business One Software Development Kit (SDK) provides programming interfaces, sample code, documentation, and a variety of utilities enabling customization of program functionality.

Are Additional 3rd Party Software Options Available to Extend SAP Business One?

A large variety of 3rd party software add-ons are available to extend the core functionality of SAP Business One.

Features

The SAP Business One solution provides a broad set of functionality designed to meet the business challenges of small to medium-sized businesses.

The following chart displays data on the feature support found in SAP Business One for a selection of functionality commonly desired by companies seeking an SMB-oriented ERP product.

| Functionality | Support | Note |

|---|---|---|

| Accounts Payable | Yes | AP batch processing; partial payment support; credit & debit memos |

| Accounts Receivable | Yes | Dunning wizard; invoice reversals; recurring transactions; down payments |

| Bank Reconciliation | Yes | Bank statement import; payment method filters; guided reconciliation |

| Benefits Management | No | SAP SuccessFactors recommended |

| Bill of Materials | Yes | Multilevel BOMs for productions orders; BOM revision management; assembly/sales/production BOM options |

| Billing | Yes | Progress billing; down payment invoices; customizable billing cycle definition |

| Budgeting | Yes | Budget authorizations; budget distribution flexibility; budget imports |

| Business Intelligence | Yes | SAP Integrates with SAP Crystal Reports to generate customizable dashboards for all your data. |

| Cash Flow Management | Yes | Cash flow reporting automation |

| Commissions Management | Yes | Definable commission employee groups; automated commission calculation |

| Credit Card Processing | No | Certified 3rd party add-ons available |

| Customer Relationship Management | Yes | Marketing campaign, opportunity, and sales management; interactive dashboard reporting; customer contact management |

| eCommerce | No | Certified 3rd party add-ons available |

| EDI | No | Certified 3rd party add-ons available |

| Employee Records | Yes | Employee contact management; salary/compensation data; attachments & document management |

| Estimating | No | Certified 3rd party add-ons available |

| Field Service Management | Yes | Service call management; customer equipment cards; service contracts; solution knowledge base |

| Fixed Asset Tracking | Yes | Definable depreciation schedules; asset class assignments |

| Fund Accounting | Yes | Restricted and unrestricted fund support |

| Fundraising Management | No | Certified 3rd party add-ons available |

| General Ledger | Yes | Predefined chart of account templates; recurring postings; distribution rules for revenue & expense allocation |

| Human Resources | Partial | Employee records; employee absence reporting |

| Inventory Control | Yes | Item master data management; multiple costing method support; serial & batch numbers |

| Job Costing | Yes | Project budgeting and costing control |

| Manufacturing Execution System | Yes | Production orders |

| Material Requirements Planning | Yes | Material requirements planning based on inventory and demand forecasting |

| Payroll | Yes | SAP SuccessFactors or certified 3rd party add-ons recommended |

| Point of Sale | No | Certified 3rd party add-ons available |

| Project Management | Yes | Planning, task management, and project budgeting; stage dependencies; document management |

| Purchasing | Yes | Goods receipt PO updates; quotation requests; approvals; split purchase orders |

| Quotes | Yes | Quote to order conversions; “valid until” management; sales employee assignment; rounding management |

| Recruitment and Talent Management | No | SAP SuccessFactors or certified 3rd party add-ons recommended |

| Sales Forecasting | Yes | Forecasts based on historical records; forecast window customization |

| Sales Order Management | Yes | Quote to order conversion; delivery tracking; backorder management; multiple sales order to production order consolidation |

| Time Tracking | No | Certified 3rd party add-ons available |

| Warehouse Management (Advanced) | Yes | Stock transfer management; bin location tracking; pick and pack management |

| Work Order Management | Yes | Service call management; customer equipment cards; service contracts; solution knowledge base |

Pricing

Pricing on SAP Business One depends on a variety of factors, including required functionality, support expectations, implementation and training needs, deployment preference, active promotions, and user count. Consequently, pricing on SAP Business One can vary significantly.

The following chart provides an overview of the estimated maximum acceptable spending range over a 3 year period of total ownership reported by reviewers of SAP Business One.

Target Organization Size

SAP Business One is intended for use by small and medium-sized organizations. The median size of organizations who consider SAP Business One based on recent review activity is 30 employees.

Cannabis ERP Software

Cannabis and CBD product producers require a system that can handle the complexities of their entire operation. The SAP Business One platform has all functionality built into one system, with a shared centralized database to increase efficiency throughout the organization. State-of-the-art analytics and dashboards will help you make better business decisions.

Core Business Functionality

SAP Business One comes standard with core functionality all cannabis businesses need to operate:

- Best practices financials and accounting

- Materials resource planning and forecasting

- Advanced purchasing functionality

- Sales, order processing and delivery

- CRM and customer service

- Inventory management

And SAP Business One functionality meets the specific requirements unique to the cannabis and CBC industry:

- Seed-to-Sale tracking

- Integration to METRC

- Multi-State Operations (MSO)

- Lot and batch numbering

- Advanced bill of materials (BOM)

- Availability to promise

- Raw material traceability

- Certificate of analysis templates

- Advanced planning and scheduling

- Recall traceability

- Materials Resource Planning (MRP)

SAP Business One easily integrates with other platforms with industry-standard APIs.

- Website and eCommerce

- Customer and vendor portal

- Warehouse management systems

- Shipping and logistics

- Third-Party Logistics (3PL)

- Point-Of-Sale (POS)

Modules

Accounts Payable

SAP Business One includes a comprehensive solution to improve vendor management and control accounts payable operations.

Accounts Payable vendor account records integrate directly with inventory items and purchase orders so that you can optimize the purchasing and purchase payment operation in your business. That integration provides you with great features such as:

- Issue purchase orders to define purchase terms such as price, quantities, delivery dates, etc.

- Record goods when received and match vendor invoices to purchase order detail

- Once invoices are recorded and matched with receipts and purchase order terms it’s a simple matter to process vendor payments

- Record credit memos for vendor returns and assure proper credit is received

SAP Business One’s vendor and accounts payable functions make this critical and time-consuming task simple to perform

Accounts Receivable

Keeping on top of customer Receivables is critical. With SAP Business One makes this crucial task easy to do.

Features Include:

- Customer receivable collection - Collection wizard provides the ability to manage multiple collection letters per customer along with a complete collection history.

- Interest, collection and late fees can be easily added using different calculation methods that best fit your business needs.

- Track outstanding receivables by client or invoice… your choice.

- Create an invoice AND receipt in one step by using information on the same document

- Easily create credit memos by importing data from the original invoice when products are returned

Bank Transactions

Features and Functions of Bank Transactions

- Receipt - Records any payment term given to you by a customer, such as checks, credit cards, cash, or bank transfers

- Payment to supplier - Issues a payment to suppliers, allocates payments to open purchase invoices, and automatically prints the check

- Deposits - Enables you to deposit cash, credit cards, or checks to the bank

- Deferred checks - Automatically displays the deferred checks that should be deposited that day

- Checks for payment - Issues checks for vendors, employees, or other creditors – and can write and print a check and update the creditor balance accordingly

- Reconciliation - Gives you fully automatic bank reconciliation, so you can reconcile debit versus credit transactions or reconcile your data with your bank’s records

Banking and Reconciliation

With the banking and reconciliation functionality in SAP Business One, you can automate and accelerate incoming and outgoing payments. The payment wizard allows you to clear multiple accounts receivable and accounts payable invoices in batch mode for checks and bank transfers. The payments are executed according to your selection criteria and payment methods (such as check, bank transfer, credit card, or cash), and then the journal entry transactions are automatically posted once the process is completed. With the bank statement processing feature of SAP Business One, you can also readily process external bank statements to generate incoming and outgoing payments and to reconcile your balance sheet accounts.

SAP Business One enables you to match payments that are not automatically reconciled, such as payments made “on account,” to open items either automatically or manually through its reconciliation engine. You can filter this engine by using a general ledger account or by a business partner.

Cost Accounting

SAP Business One enables you to define profit centers so that you can monitor and regulate the costs of your business processes effectively. The profit center reports give you important information about the costs and revenues that have arisen, sorted by area and department.

First of all, you define the various cost centers or departments in your company as profit centers. You then assign revenue and expense accounts to the profit centers so that any data relevant to a profit center can be updated automatically for all transactions entered in the system. Costs are allocated to the profit centers using information that you define in a distribution rule. This means that any costs incurred will be allocated to the profit centers on the basis of a specific key. If you decide that the way in which costs are allocated no longer reflects the way in which your company works, you simply change the distribution rule as required. You can use the Profit Center Report to generate a profit and loss statement for any profit center and period.

In addition to conventional financial accounting (where the values of all business transactions are recorded), many companies also perform cost accounting. The aim of cost accounting is to determine how profitable a company’s business activities are.

Cost accounting allows you to analyze the expenses and revenue of a specific business area in detail. Some expenses can be assigned to one specific business area. Expenses and revenues that can be assigned to one specific business activity are called direct costs and direct revenues.

In every company, there will always be expenses (and sometimes even revenues) that cannot be assigned to one specific business activity. These include administration costs, advertising costs, and financing costs. In Cost Accounting, these indirect costs (and indirect revenues) are allocated to business activities by means of distribution keys. In addition to the data that you enter for for-profit centers and distribution rules in the standard fields of SAP Business One, you can also define as many user fields as you want for these objects. This is a convenient way of storing a large quantity of additional data required in your company. If you have created user-defined fields for-profit centers and distribution rules, you will find these in the menus for processing these objects in the menu bar.

Customer Relationship Management CRM

SAP Business One provides comprehensive, integrated sales and service features to ensure total control of customer acquisition, retention, and profitability for your business.

SAP Business One helps you record and track each sales opportunity, from lead identification, to qualification, proposal, sale close and after sales service and support. Managing sales campaigns and prospects means you’ll close more sales for less cost. Create prospect lists for telemarketing, direct mail or e-mail campaigns. Off-site access also available via Web-based access to SAP Business One data.

CRM Provides Integration With:

- Sales and Accounts Receivable activity

- Purchasing and Vendor transactions

- All customer and vendor contact information, including things like e-mail addresses, sales and purchasing reports, etc.

- Dynamic reports detailing sales, leads, purchasing, inventory data, and more

- Prospect and lead management

- Accessible via the Internet, allowing sales and service employees data access while out of the office

Customer Service and Support CRM

SAP Business One provides the tools to enable you to excel in customer service and support.

Service and Support Related Features Include:

- Create support and warranty contract items for services sold to a customer. Maintain start and end dates for specific contract items, including guaranteed response times if applicable.

- Maintain detailed information about items purchased by customer including manufacturer’s serial number, replacement serial number, service call history, etc.

- View reports on all equipment and corresponding serial numbers sold to a customer or range of customers

- Review info on all service calls. Sort report by technician, problem type, priority, item, call status, etc.

- Realtime monitoring of call status in order to manage team service call queues

SAP Business One’s customer service and support functions are easy to use and quickly help manage this important business function

General Ledger and Financial Accounting

SAP Business One provides you with excellent financial management features to help your enterprise become more efficient, productive and profitable.

Accounting Features Include

- Real-time accounting means financial reports immediately reflect all completed transactions.

- Drill down from financial summary numbers to specific transaction details.

- Easily allocate costs and transactions between multiple departments with predefined posting templates.

- Quickly integrate business, accounting, warehouse, and financial reports with Microsoft Excel and Word.

- Recurring posting feature allows you to define entries that occur on a regular basis.

- Allocate revenue and costs as needed based on predefined distribution rules

Standard Reports Include:

- Balance sheet

- Budget reports

- Aging reports

- Profit and loss statement

- Trial balance

- Company dashboards to instantly view and graph critical company performance metrics such as sales, inventory movement, etc.

- Reports also allow comparison between periods.

- Multiple financial reports are predefined for immediate use. In addition, you can design additional reports and export to Microsoft Excel for even more flexibility

- Very flexible chart of accounts with department and cost center segments available

Business Intelligence

SAP Business One comes standard with business intelligence, with built in Crystal Reports for in-depth analysis. Functionalities include:

- Report creation: Pull financial or sales data from multiple sources to create new reports and analyze data.

- KPIs: Use the predefined KPIs to view crucial metrics at a glance. Customize the display of data, whether it’s charts, graphs, or tables.

- Drill down: Drill into your data to see specific insights or causes to better understand outcomes and performance drivers.

Human Resources Management

The SAP Business One HR functionality supports staff management, including employee details and contact information. It allows the user to capture pertinent information about each employee so you have one place to maintain and manage your employee records and data.

Information you can capture includes:

- Employee contact details

- Skills matrix & previous employment

- Review date and outcomes

- Repository for supporting documents such as references and CV

- Management of candidates

- Issue down payment requests to cash customers.

- Salary information

- Charge interest on overdue receivables.

- Alerts for key notifications i.e. re-certifications

Inventory Control

Inventory, for many businesses, is a large asset that demands constant attention to maximize profits. SAP Business One’s Inventory function helps you keep on top of this important business asset.

Some of the features included in SAP Business One’s inventory include:

- Track serial numbers for inventory items

- Assign and track inventory lots

- Create lists of substitute or alternate inventory items to improve sell-through

- Maintain vendor part numbers to eliminate purchase order errors

- Transfer inventory between multiple warehouses as needed

- Separate posting to record opening inventory balances and/or update warehouse data

- Streamline inventory counting by assigning when inventory items are to be recounted

- Define various price lists and link the lists to customers or vendors.

- Define special prices for individual customers or suppliers OR peg quantity-specific prices based on order volume

- Improved management of the picking and packing process.

- Supports various inventory valuation methods, including standard cost, weighted moving average, and FIFO

- Define optimal order size based on minimum order quantities and average order lead time

- Links directly with MRP functionality to further improve operations

- Maintains vendor order history for review as needed

- Maintain multiple alternate vendors for each inventory product carried

Material Requirements Planning (MRP)

SAP Business One provides an MRP simple planning function to help you schedule and manage items that are to be produced or purchased.

Forecasts help you predict demand based on forecasting metrics and not solely on history or received orders. This helps you better anticipate product demand so you can adjust your material planning to more accurately reflect that demand.

SAP Business One’s MRP Wizard optimizes future material requirements and helps manage and execute purchasing and manufacturing recommendations and exceptions. Also, take advantage of purchasing price breaks and standard product lot sizes in order to further reduce your costs

Automatically create product and purchase orders based on the order recommendation report. Items can be easily outsourced if needed by converting a production order to a purchase order. In addition, it’s simple to consolidate individual vendor POs into a single order to further streamline the purchasing process

Mobile Application for iPhone

With today’s technological advances, there is a growing need for connectivity and information accessibility as your customers expect you always to have up-to-date information at your fingertips. They would like to know what’s available, how much it costs, and when you can deliver it. To stay on top of things, people and businesses are increasingly turning to smart phones. With the SAP Business One mobile application for iPhone, SAP empowers you by providing immediate access to the most relevant information to enable you to run your business from any location at any time. You can manage customer and partner data, process pending approval requests, view reports, and much more.

Key Features

- Manage tasks and activities - View your upcoming tasks and scheduled activities at a glance, with the flexibility to drill into details and update information if needed. Display all activities pertaining to a specific customer or partner, update activities, or add new ones

- View and interact with alerts and approval tasks - Get alerts on specific events such as deviations from approved discounts, prices, credit limits, or targeted gross profits – using an intuitive interface that allows you to sort various alerts by date, type, or priority. View and complete approval requests, and drill into the relevant data or metric before making your decision – with just a few taps. Ask for additional information or provide comments to requesters in the approval and rejection process.

- Access real-time reports - Access built-in reports from SAP® Crystal Reports® software. Add your own customized reports to the application, and share them via e-mail.

- Manage customer and partner data - Access and manage your customer and partner information, including addresses, phone numbers, and contact details; view historical activities and special prices. Create new customer and partner data, and add new activities as new opportunities arise. Have all changes automatically synchronized with the SAP Business One application on the back end.

- Check on-hand inventory and item data - Monitor inventory levels, and access detailed information about your products, including purchasing and sales price, available quantity, manufacturer, shipping type, product specifications, and pictures

- Customize by adding new features - Add custom features to the application by working with your SAP partner to meet your exact needs.

Purchasing

SAP Business One helps you better manage your supplier relationships.

Some of the Features and Functions of Purchasing Include:

- Issue purchase orders to vendors for materials or services, update the available amount for the items ordered, and notify the warehouse manager of the expected delivery date

- Split order delivery to one or multiple warehouses.

- Goods receipts may be linked to a purchase order, which means that the purchase order quantity can change if the quantity received does not match the original purchase order amount

- Record and track goods returned to suppliers to ensure proper credit

- When recording a supplier invoice, the system simultaneously records a stock entry to update new stock available

- Landed costs calculate the purchase price of merchandise by allocating various landed-cost elements (such as freight, insurance, etc) to the FOB cost of each item. Actual merchandise warehouse value updates automatically as well

Report Writer

SAP Business One makes it easy for you to pull together reports on any and all your business data. Many standard reports are immediately available for your use but with SAP Business One you have the ultimate ability to quickly pull together reports when you need them.

Here Are Some of the Features You’ll Find in SAP Business One

- Easily integrates with Microsoft Excel, Word, and Outlook

- Microsoft Outlook integration means it’s simple to email quotes and invoices to customers and prospects.

- Data synchronization between SAP Business One information and your Microsoft Outlook -calendar, contacts, tasks, etc

- Report creation wizard means you’ll quickly create unique reports to better understand your business activity

- Company dashboards allow you a top-level look at your business with custom views and graphs

- Custom reports work with Microsoft Excel functions and interfaces to extend your ability to compose reports with advanced report design options. It’s easy to create custom parameters, formulas, and layouts from scratch

Sales Orders, Invoices & Quotes

SAP Business One provides a comprehensive, simplified method to enter and record customer orders and issue invoices.

- Access complete inventory views across multiple warehouses during order entry

- Out of stock for a hot-selling item? No problem, simply offer a list of alternative items and make the sale!

- Need to schedule order delivery dates? Check! With SAP Business One you can schedule different delivery dates AND different ship-to-addresses for each item on the order! That’s flexibility.

- Automatically create PO’s from a sales order to eliminate data entry and speed your time processing orders.

- Drop-ship ordered items directly to customers site as needed

- Generate packing documents for all goods shipped.

- Store delivery tracking numbers with each order shipped

- Built-in packaging function facilitates virtual input of items into different parcels to optimize shipping

- Insert free-form text anywhere within the body of the document

- Store and reuse standard comments, headers and footer text for documents

SAP Business One helps you quickly create customer quotes as well. Calculate sales price and gross profit for each quote and seamlessly export to Microsoft Word when done

Warehouse Management

The warehouse and inventory management tools in the SAP® Business One application allow you to manage your supply chain and enhance customer satisfaction by providing reliable information about inbound and outbound shipments as well as current inventory levels. You can keep track of product inventory, quantity at each warehouse, movement history, and stocking status. Inventory data is updated in real-time so that you can extract insights to meet customer demand and expectations.

SAP Business One gives you integrated accounting functionality, so you can be assured that your warehouse management and your financial accounting data are consistently synchronized. The software automatically values every goods movement and cost and price change, thereby eliminating manual interaction and the associated errors and costs.

Using integrated production functionality, you can manage various types of bills of materials and link your warehouse with your order processing and production operations. Additionally, the material requirements planning feature in the application allows you to effectively plan material requirements for complex, multilevel production processes and maintain an optimum level of inventory.

SAP Business One also has a comprehensive set of reports to meet any of your warehouse and inventory reporting needs. Detailed reports on stock transactions and inventory valuations, inventory counts, production planning, and material requirements provide the information necessary to make quick and effective management decisions.

Product Overview

Developer Overview

Related Products

User Reviews of SAP Business One

Write a Review- Manufacturing

SAP Business One Review

The interface is very complicated and not easy to learn. If your staff has the time to invest in the training, it is a powerful ERP but does not offer an easy learning curve. It is also not the best choice for a job shop. It can manage cost accounting, which is vital in manufacturing, but only after a great deal of programming. It is not a native feature of the system.

- Pharma Manufacturer

- 11-50 employees

- Annual revenue $10M-$50M

SAP Business One Review

We implemented SAP with the hopes of remaining on the software through the various growth phases of the business. However, as a pharamaceutical manufacturer, we began to see fractures in the system, having to create work arounds to assure we were in compliance across different reporting venues. With our business continuing to grow we could not confidently stay oin the system and be assured we would meet all standards across the FDA and GMP.

- Construction & Engineering

- 1-10 employees

- Annual revenue $1M-$10M

The system is robust and intuitive when implemented

I have implemented Business One across several manufacturing companies and the system is robust and intuitive when implenented into the right environement. We recently explored the software for a more complex manufacturer, made-to-order, and the system fell short in several areas. First the pricing was not a great fit for a small to medium-sized company trying to expand with the right system. It also was not able to support sub-assemblies and phantom BOMs. Without these features our client ran the risk of duplicates in production. The reporting was also more basic. They were having to export data onto Excel to achieve the desired reports.

- Tobacco

- 1-10 employees

- Annual revenue $0-$1M

Everything we need in one program

We were looking into a Cannabis ERP program for our grow and dispensary operations. After looking at SAP Business one, we really liked how it was able to tie everything we needed into one.

However, with the high price tag and not being able to test the system out first in our business before putting money down, we will stick with smaller programs and using APIs to make everything communicate.

Pros

Everything we need in one program

Cons

Too high of an investment to just try out and hope it works.

- Construction & Engineering

- 1-10 employees

- Annual revenue $0-$1M

SAP Business One Review

Simple and fast. Not the cheapest but definitely worth it

Pros

Everything

Cons

Not so much

- Industrial Conglomerates

- 11-50 employees

- Annual revenue $1M-$10M

Buyer be ware! This software is really bad

Buyer be ware! This software is really bad. I have used several ERP platforms and this is by far the worst. SAP is a very large company, in fact they are most likely the largest ERP company on the planet. However, they focus their efforts on the large scale version of SAP which has nothing to do with SAP B1. In an effort to have a foothold in the small business market, they purchased another product many years ago, this is where SAP B1 comes from. SAP Partners are happy to use the SAP name to sell this smaller product to unsuspecting small businesses. However, the software is CRAZY buggy! It crashes all the time, it’s very slow (even the HANA version which is supposed to be fast). When we report bugs to our partner they are powerless to do anything about it. They pass it on to SAP and this is where it dies. SAP simply doesn’t care about the end user. I could go on all day…just don’t do it!!

Pros

I'll have to think for a LONG time to come up with something I like....

Cons

It is very slow and crashes all the time.

- Automotive

- 1-10 employees

- Annual revenue $1M-$10M

SAP Business One Review

Too cumbersome and expensive and doesn’t meet a lot of our reporting needs and is only customizeable at a price and everything we need to change comes with cost.

- Household Durables

The program works wonderfully in this regard

We are basically doing order-processing. And we have about 15,000 items with multiple product categories and pricing levels. Fairly big customer database, over 10,000 and growing. The program works wonderfully in this regard. I know there is a lot of manufacturing capabilities and putting items together with multiple parts, but we do not use that functionality so I can not comment.

Pros

The CRM capabilities are sufficient for what we do. Our accounting is obviously standard accounting and our accountant seems to have an easy time to evolve the books.

Cons

Nothing negative to say!

SAP Business One Review

Easy to implement, end user computing design concept. Flexibility and reliability.

Pros

System architecture.

Cons

OEM solution for MRP. MRP should can run by SO not only by items.

- Insurance

- 11-50 employees

- Annual revenue $1B-$10B

SAP Business One Review

The thing that ultimately sold me on the product and has turned out to be very true as I have gotten into it is how customizable it is. I needed it for a very specific application which was premium accounting which is its own kind of world and I have been able to manhandle it into a nice little premium accounting system which you cant do with all software. It was highly customizable especially with an add in that is integrated in the system called B1 and also the fact that it is set up to work with crystal reports which I’m very facile with.

Pros

The ability to highly customizable and that it works with crystal reports. For an organization or size who only has two people utilizing the software, it was amazingly cost competitive. I don't know what it would be for a large accounting shop but for a two person accounting shop it turned out to be very rich software for the money.

Cons

They have strange names for things so it can be hard to search for things or find what I am looking for.

- Textiles, Apparel & Luxury Goods

- 11-50 employees

- Annual revenue $1M-$10M

SAP Business One Review

SAP Business One is an affordable, easy-to-implement business management solution designed specifically to meet the needs of emerging and dynamically growing small companies. A solution that gives managers on-demand access to critical real-time information through one single system containing financial, customer relationship management, manufacturing, and management control capabilities. The solution that enables rapid employee productivity, while empowering managers to make better business decisions and stay ahead of the competition.

Pros

SAP Business One does absolutely everything it advertises. It's easy to use and the basic and custom reports can give you any data in any combination you could possibly want it. If you can specify what you want, SAP Business One can generate the report.

Cons

The couple of issues I had with the product have all since been resolved with new releases. SAP is continually investing in the Business One solution for small to mid-size businesses and as soon as you think of something that you may want it to do that it's not doing.... it becomes available in a new release. This is not a stagnant software that's been added onto from something antiquated that no longer applies to the way business is done. This is new, fresh, dynamic and constantly improving.

- Industrial Conglomerates

- 11-50 employees

- Annual revenue $1M-$10M

SAP Business One Review

Well designed ERP program that didn’t include things I thought it should, like a good report writer and the ability to talk to UPS.

Pros

Clean. That was our number one criteria.

Cons

Didn't connect to UPS and a very poor report writer.

- 1-10 employees

- Annual revenue $0-$1M

SAP Business One Review

(NOTE: This review is not certified as having purchased SAP Business One).

The product easily handles inventory control (for over 80,000 separate products) order entry, accounts receivable, and customer contact records.

Pros

The software adapted to our business rather than expecting us to change our methods to fit the software. You are able to search and sort our product information in unlimited ways.

Cons

We can't link our database, etc to our website yet through this program.

- Road & Rail

- 251-1K employees

- Annual revenue $50M-$100M

SAP Business One Review

Very flexible and extensible. Complex and rich but not to the point of being daunting to implement.

Pros

The ability to quickly develop and present data queries for users.

Cons

I would have preferred it be web based.