The Farmer’s Office

4 Reviews 5/5 ★ ★ ★ ★ ★A farm accounting software focusing on financial management, cost accounting, HR, payroll, and inventory management.

Product Overview

The Farmer’s Office is a farm accounting software that allows detailed tracking and analysis of expenses and income by cost center and crop year. The software also supports customized invoicing, payment tracking, and extensive budgeting capabilities, making it a good tool for financial management in farming.Pros

- Cost accounting system with per acre and per yield analysis

- Customizable invoicing and statements

- Includes budgeting tools

Cons

- Traditional Windows-based interface can seem outdated

- Pricing requires consultation

- Initial learning curve

Target Market

Small to large-scale crop farming operations that require detailed financial tracking and analysis.The Farmer’s Office Key Features

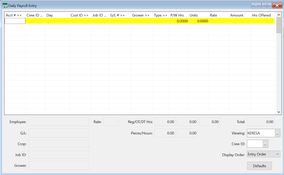

- Ag Payroll: Manages agricultural employee data, ensuring compliance with payroll regulations.

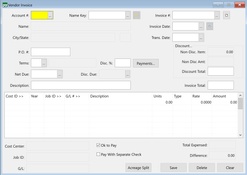

- Accounts Payable and Receivable: Streamlines vendor payments and customer invoicing.

- Farm Management Billing: Facilitates billing for farm-related services and products.

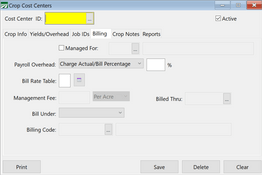

- Cost Accounting: Offers detailed farm expenses and income tracking by various categories.

- Equipment Costing: Tracks farm equipment maintenance and usage costs.

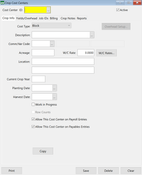

- Crop Budgeting: Enables creation and management of budgets for different crop cost centers.

- General Ledger: Integrates with all modules for real-time financial data updating.

- Pesticide Application Reporting: Manages pesticide use records, ensuring regulatory compliance.

- Chemical Inventory: Keeps track of chemical stocks and usage.

- Data Export/Query Tool, Magnetic Media Reporting: Facilitates data analysis and reporting.

- Multi-user Network Access: Supports multiple users on a network.

- Integration with Data Collection Units: Allows data transfer from field devices.

The Farmer’s Office Support

Users receive customer service through toll-free support, regular software updates, and both in-house and on-site training options, the latter of which is available for an extra fee.

The Farmer’s Office Pricing

Pricing is available directly from The Farmer’s Office and varies based on the company’s size and needs.

Video Overview

Product Overview

Developer Overview

Related Products

User Reviews of The Farmer's Office

Write a ReviewOne feature of Farmer's that I just discovered

One feature of Farmer’s that I just discovered that I love a lot is the Acreage Split. Sometimes we have invoices that have to be broken down through all our ranches, and Farmer’s has the capability where you can input your breakdown and it saves them. Instead of having to manually reenter everything, you right click on acreage split, select the one you want, enter your activity, and it breaks it all down for you, which is a huge time saver.

One of the best business decisions we ever made

We were at a fork in the road where we were beginning to grow and had issues with clashing software and instability. We decided to give Datatech a try and it was one of the best business decisions we ever made.

It really gave us the backbone software-wise to grow and not inhibit ourselves by using inferior software.

It’s a complete solution and well thought out in many areas.

The service makes our lives much easier as well

We started with Datatech in 1984 because they had developed this fabulous customized software for the raisin industry. In addition to that, it had accounts payable accounts receivable general ledger, and it is all working very easily with our company. We utilize all of it.

It’s very user friendly to quote an old quote. The service makes our lives much easier as well. They have excellent customer service.

The Farmer's Office Review

I love it. It does everything. I have the human resources, the payroll,. the accounts payable. The program is easy. The grower reports are essential. The growers are happy and I’m happy because they’re not bothering me.