Denali Fund

2 Reviews 4.5/5 ★ ★ ★ ★ ★A fund accounting software offering fraud prevention features and a full suite of accounting modules.

Product Overview

Denali Fund software, developed by Cougar Mountain Software, is a specialized fund accounting solution tailored for non-profit organizations. It emphasizes GAAP and FASB compliance with the ability to generate audit trails to deter fraud. The software is designed to handle complex accounting needs such as managing federal grants, private grants, and corporate sponsorships. It stands out for its focus on transparency, reliability in fund management, and its user-friendly interface.Pros

- Provides audit trails for fraud prevention

- Has in-depth reporting capabilities

- Scalable multi-module system

Cons

- Limited customization of batch numbering

- Difficulties in data export

- Exact pricing requires a developer consultation

Target Market

Small to mid-sized NPOs with 1-200 employees and annual revenues up to $5 million.Features

- Budget management

- Donor tracking

- Fixed assets

- Integrated eCommerce

- Inventory control

- Job cost

- Tax updates

Track Vendors

- Search a vendor’s history by reference number, transaction date, or due date.

- Set up default general ledger expense accounts for each vendor.

- Print a vendor master list for a complete detail of vendor accounts.

- Merge two vendors while maintaining their full histories.

- Easily renumber vendors while maintaining and transferring all history from previous records.

- Vendor search and sort can be performed by the vendor’stelephone number.

Generate Checks and Reports

- Use the drill-down feature to save time and paper when you print an accounts payable history report, payment to invoice report, or invoice to payment report specified in the time period you wish to print.

- Print a dated invoice/payment report showing the amount of open items as of a specified date.

- Write checks at the same time bills are entered; enter bills, and then later select them for payment and write the check; or enter bills and record handwritten checks.

- Print Forms 1099 Misc. and 1099 Magnetic Media for contract labor.

- Prepare a check register of all payment transactions for quick payment auditing.

- Maintain month-end balances of total payments, credits, and debits.

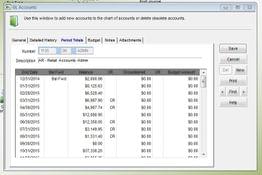

Accounts Receivable

- Track customer purchases over time and retain a history of customer charges and payments

- Set up credit limits and apply discounts.

- Send customer invoices directly to their email, where they can click on a link and immediately make the payment using automated payment collection.

Bank Reconciliation

- Quickly process hundreds of transactions at a time

- Flag missing checks

- Manage multiple bank accounts

- Retrace questionable transactions

- Track expenses by department

- Set up recurring transactions

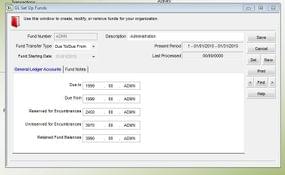

Fund Accounting

- Unlimited funds

- Multiple fiscal calendars

- Budget management tools

- User-defined classifications

- Report filtering by fund

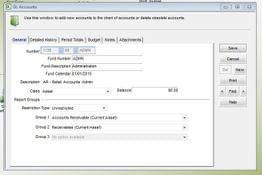

General Ledger

- Unlimited funds

- Multiple fiscal calendars

- Budget management tools

- User-defined classifications

- Report filtering by fund

- GL Report Generator

Payroll

- Any compensation types (i.e., hourly, salary, hourly/salary, per-diem, multi-state, contract or piece work)

- Automatic direct deposit (from company account to employee)

- Paychecks (use Cougar Mountain Forms+Supplies for official checks)

- W-2s, with option for electronic W-2 submissions using Aatrix

- Any standard and user-defined deductions and garnishments

- Built-in and user-defined security for controlled access to payroll and employee records

- Several payroll reports (see screenshots below)

- Because all modules are integrated, there’s no need to enter the same data twice.

Payroll Reports

- Quick Employee List Report: Prints a list of active and/or non-active or both employees.

- W-2 Report: The report is pre-formatted to print out on pre-printed W-2 forms.

- Master Employee Report: Prints information stored in the employee’s master record.

- Employee Earnings Report: Provides a breakdown of all earnings for each employee.

- Account Impact Summary Report: Provides real-time information to see what your balances will be once you post.

- Employee Benefit / Deduction Report: Shows the benefits, deductions, additions, tips, and EIC codes for selected employees.

- Employee Project Report: Shows project hours and costs with respect to employee time and wages.

- Employee History Report: Shows the number of units and dollar amount for each pay type for each employee.

- Employee Leave Report: Reflects the balance of earned leave.

- EFTPS History Report: Provides the payroll tax amounts necessary for preparing EFTPS coupons. Pre-posting EFTPS Report: Lists all FICA and FUTA taxes for the current payroll period.

- Employer’s Quarterly Report [941]: Prints your quarterly 941 report information on a pre-printed government form or on plain paper.

- 941A Report: Provides year-to-date tax history by quarter for selected employees.

- Electronic Media W-2 Report: Allows you to electronically report the quarterly tax information submitted on Form 941.

- Employee Department Report: Provides a breakdown of units and wages earned by each employee, or the total units and wages charged against each department project.

- Taxable Wage Report: Shows the amount of taxable wages for each employee.

Payroll Add-Ons

At-a-Glance Dashboards - One of the most popular features of the DENALI Accounting Software is the sales and financial dashboards, which bring you real-time, graphical reports about the trends, financial health, and sales of your organization. Management will be thrilled to have instant access to key financial information.

Tax Updates - Tax updates provide the latest changes and updates based on current tax requirements. The PR tax update utility contains the latest federal, state, and local withholding codes to keep tax tables current. The utility also has payroll and accounts payable tax reporting forms for the current tax year.

Tax Forms - Cougar Mountain has partnered with Aatrix to offer a solution that allows you to integrate with the payroll application to prepare, print, and eFile payroll forms in all 50 states.

Forms and Supplies - Forms and other print supplies for your Cougar Mountain Software. Blank documents from Cougar Mountain Forms+Supplies are IRS-compatible and guaranteed to work with the accounting software. Most forms also work with other accounting software systems.

ACH Direct Deposit - Add-on for payroll users. Save money every payday and streamline your payment processes with NatPay’s ACH Direct Deposit Distribution services.

- NACHA estimates that employers spend approximately $1.90 per employee in payroll distribution – checks and/or pay stubs

- Companies who do not offer Direct Deposit usually incur additional expenses averaged at $1.20 per employee paycheck, per pay period

- Increase productivity by eliminating the need for employees to leave work to deposit checks

- Eliminate the cost of reissuing lost or stolen checks, and associated stop-payment fees

- Reduce HR headaches with a streamlined payroll process that is completely paperless

Point of Sale

- Single-screen transactions (from start to finish) for quick and error-free sales

- Easy and secure electronic transactions of credit/debit cards, gift cards, checks, and EBTs

- Integrated inventory management with the Inventory module

- Customizable sales entry screens, sales receipts, and invoices

- Perform refunds, special orders, voids, register changes, and authorized override transactions

- Enter account numbers up to 45 digits and 6 segments for nonprofits

- Post multiple registers at once

- Restrict employees to only authorized information

- Control cash and balance books daily

- Retrieve real-time reports on sales by item, salesperson, register, and store

Purchase Order

- Manage orders from initial ordering through receiving and invoicing

- View vendor history, previous item costs, and order/receive dates for all orders

- Automatically generate purchase orders based on demand, quantity on hand, minimum quantity, and order quantity

- Control buyer access to saved purchase orders, vendors, and stock item information

- Permit buyers to edit, view or generate orders or other buyer’s orders

Purchase Order Reports

- Open Purchase Order Report: Shows all orders not marked complete or purged from the system.

- Expected/Late Items Report: Displays items expected to arrive by a certain date or are past due.

- Vendor Performance Report: Shows the variance between the values entered on the purchase order and the actual values after the order arrives.

- History Report: Displays all posted purchase orders or the history of items ordered.

- Recurring Purchase Order Report: Shows recurring orders set up in the software.

- Code Reports: Prints a list of all codes for a specific Code type.

- Pre-Issue Purchase Order Report: Displays a list of pre-issued purchase order numbers.

Product Overview

Developer Overview

Related Products

User Reviews of Denali Fund

Write a Review- 1-10 employees

- Annual revenue $1M-$10M

Denali Fund Review

Its basically fund accounting software and there are several ways that you can do each task so it is pretty intuitive and you can pretty much guess how to do it if you know how to do accounting.

Pros

I like that there are several ways to do each task.

Cons

Nothing yet so far.

- Family Services

- 11-50 employees

- Annual revenue $1M-$10M

Denali Fund Review

It was easily the best value that we found. We needed to evolve into a system that would have fund accounting which is why we selected it. It is newer, it is only a few years old but they work fairly quickly to get bugs out if I come across them.

Pros

It is more robust than most systems

Cons

I think in general fund accounting has more nuts and bolts so there can be more pieces to the software.