Product Overview

AptaFund is school accounting software that helps educational institutions manage financial operations. Key features include accounts payable, billing, budgeting, payroll, purchasing, requisition, and approval processes. It also offers an employee self-service portal for service requests and documents. Administrators can use built-in templates for custom reports and configure auditor access. The software ensures compliance with GAAP and USFR standards.Pros

- Has customizable report templates

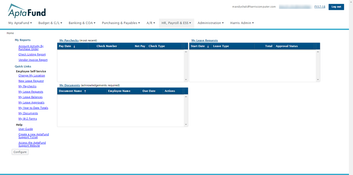

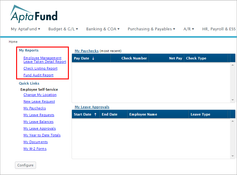

- Offers an employee self-service portal

- GAAP and USFR compliant

Cons

- Pricing details not provided by the developer

- Limited platform accessibility

Target Market

Medium to large-sized K-12 educational institutions.Features

- Accounts Payable: This module streamlines vendor invoice management, including credits, direct payments, and automatic calculations for shipping and taxes. The payment management feature allows for easy invoice selection for payment vouchers and secure on-demand warrant printing. The integration with the capital assets module helps track post-payment assets.

- Accounts Receivable: The customer management and cash receipts modules facilitate the management of incoming cash and revenue, with seamless integration with the general and banking modules for real-time data synchronization.

- Banking: Integrated with several other modules, the Banking module offers comprehensive bank account management and transaction tracing through AptaTrace, aiding in detailed financial tracking and reconciliation.

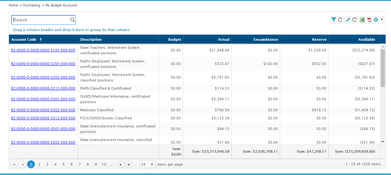

- Budget Management: This module allows for efficient budget control and adjustment, integrated with other modules for encumbrance and transaction monitoring, supporting budget checking functionalities.

- Capital Assets: Manage and track capital assets compliant with GASB 34 standards. This module supports detailed asset management, including depreciation, inventory tracking, and reporting, with full historical data maintenance.

- Chart of Accounts Administration: Define and maintain account structures and codes, fiscal years, and accounting periods. This module supports multi-dimensional account code hierarchies and facilitates smooth fiscal year transitions with account mapping features.

- General Ledger: As the core of AptaFund, the general ledger integrates with other modules, providing detailed financial records, transaction tracking, and advanced reporting capabilities.

- Payroll: This module simplifies payroll management, supporting various pay plans, state-specific deductions, and direct deposits. It includes functionalities like preview net pay and integrates with the general ledger for real-time data updates.

- Purchasing: Streamlines the creation and submission of purchase requisitions and orders, with budget checking and authority-level management for purchase approvals.

- Receiving: The receiving module ensures accurate item verification against purchase orders and supports blind receiving for error reduction and secure processing.

- Vendor Management: Manage vendor information and balances, customize vendor number assignments, and handle 1099 form generation and IRS filing with this module.

Product Overview

Developer Overview

Related Products

User Reviews of AptaFund

No reviews have been submitted. Do you use AptaFund? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!