What is the Procure-to-Pay Process?

Procure-to-Pay Defined

Procure-to-pay refers to how payments are made during the procurement process. Your company determines a number of steps, including creating requisition invoices and authorizing payment amounts for all your business-related goods and services. To make accurate and timely payments, P2P covers more than just transferring funds. It’s involved at the very start of the procurement process, which can lead to insights into your company’s buying habits to optimize cash flow and improve the bottom line. Procure-to-pay software is often used to streamline the process.

Procure-to-Pay Process

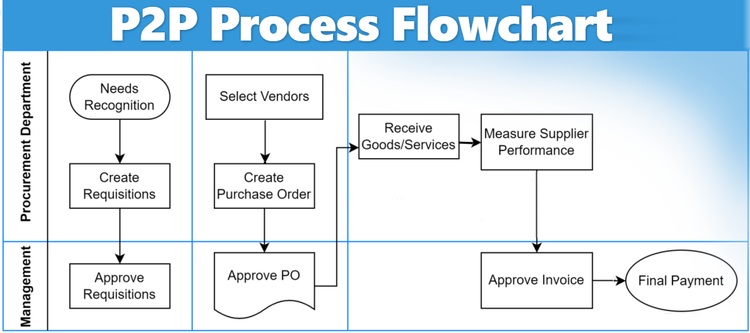

The main three procure-to-pay processes are categorized as being related to either purchase orders, receiving, or invoicing. The individual P2P process flow steps are generally as follows in this flowchart:

Process Steps Explained

The various steps can be further explained as follows:

- Needs recognition to create requisitions

- Approval of requisitions

- Selection of vendors

- Create purchase orders

- Approval of purchase orders

- Generate receipts

- Supplier performance measurement

- Approval of invoices

- Final payment

Needs Recognition and Requisitions Creation

The procure-to-pay cycle begins with needs recognition, the act of identifying what materials and supplies your company needs to operate. Sometimes referred to as sourcing, this covers both direct and indirect procurement, meaning you have to find what you need for production and daily operations. Traditionally, this process would involve a procurement team member reviewing inventory lists and performing on-site audits to determine what is needed for work to begin.

Approve Requisitions and Select Vendors

Once the procurement team has learned what needs to be ordered, the approval process begins. A chief procurement officer (CPO) may be in charge of overseeing final approval on all purchase requisition forms, whether they are one-time expenses or recurring purchases.

With approval, the procurement team can begin looking for the best suppliers for the job. The selected vendor is then contacted to begin the next steps of the purchasing process.

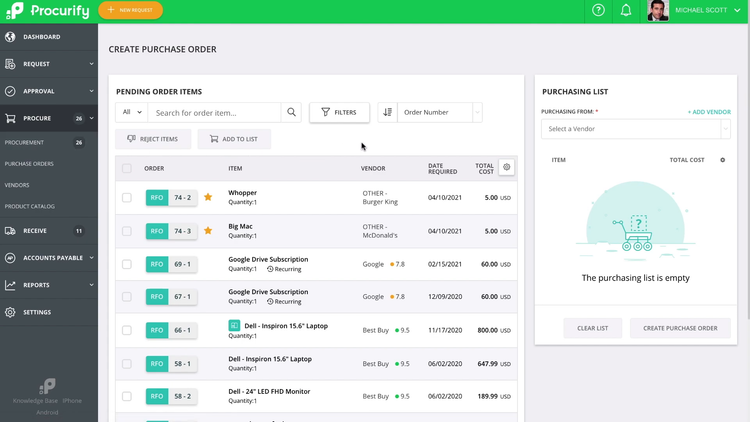

Create and Approve Purchase Orders

First, the purchase order (PO) has to be created with all the exact purchase details. Next, both the company and the vendor must approve the purchase. Like requisitions approval, the CPO or procurement team may be involved in finalizing the purchase.

At this point, any regulations regarding the goods or services must be considered to ensure compliance. For example, certain materials cannot be transported across the country without strict adherence to local and federal standards. Before approving a PO, ensure the vendor is capable of complying with those requirements.

Generate Receipts and Measure Supplier Performance

Referred to as either receipts or receiving, this is when the good or service is actually received by your procurement department. Whoever accepts the order must check it for accuracy and document the process in receipts, invoices, etc. Any irregularities, such as mismatched line items, should be reported.

Once the goods have been received, they should be checked for quality and quantity. If there are any issues with the product or service, a dispute will be made as to whether or not any payment is made. Ideally, dispute terms should be set out clearly during the initial purchase order to expedite closure.

With a good understanding of supplier performance, you can keep detailed records of your preferred vendors to continually get the best products and services at the lowest possible prices. By forging good vendor partnerships early, you can potentially benefit from long-term savings as the mutually beneficial relationship grows over time.

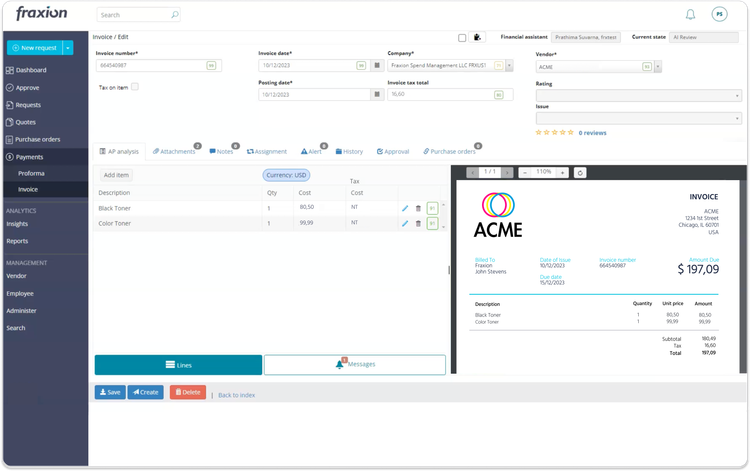

Approve Invoices and Submit Final Payment

The final step of the P2P process is where the name comes from: payment. Careful payment processing can help balance your accounts payable (AP) after each purchase without the risk of human error causing costly mistakes.

With procure-to-pay software, payment can be made automatically once the final invoice is approved by whoever is in charge of authorization, thanks to three-way matching features. No more inefficient from running back and forth trying to get signatures for traditional invoice matching, just money instantly moved to where it needs to be through an advanced pay solution.

Example of the P2P Cycle

To get the full picture of the procure-to-pay cycle, let’s take a look at an example:

Imagine a clothing manufacturer decides to expand into selling pants after previously only making shirts. During the initial needs recognition step, the procurement department will research what the company needs to make pants: new machinery, different fabrics, and efficient design patterns. Then, they will fill out purchase requests for each.

With the needs identified, work can begin to find the right vendors. The procurement department can check their existing supplier relationships to see if anyone would offer discounts or deals on new goods and services. This can potentially lead to valuable cost savings and cut down on the time-consuming task of finding brand-new suppliers.

Each item will need requisition approval. At this stage, the CPO in charge of decision-making may determine whether the current machines can be adapted to make both shirts and pants and turn down the request. Or they may decide whether the new machinery is necessary and approve the one-time purchase after consulting the budget. The various fabrics and threads will likely need to be a recurring purchase to meet the production volume and keep the supply chain moving. And an expert third-party fashion consultant might be brought in to develop new designs.

After finding the best vendors for each, purchase orders can be officially made to document the rest of the process. Through P2P systems, all three payments can be prepared in a single system, cutting down on potential miscommunication, discrepancies, and delays. Detailed POs, goods receipts, and invoices can show where each purchase is in the cycle. Accurate vendor payment for each need can then be made as soon as the final product is received.

P2P Software

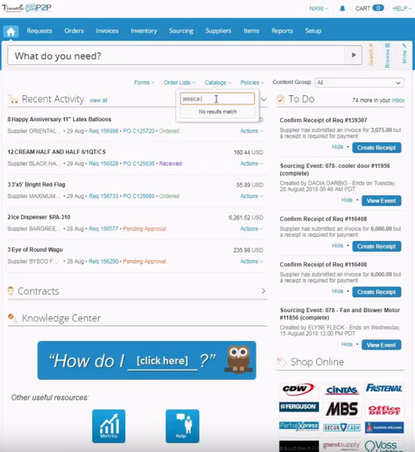

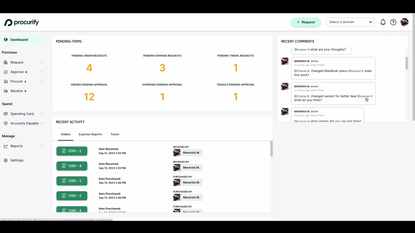

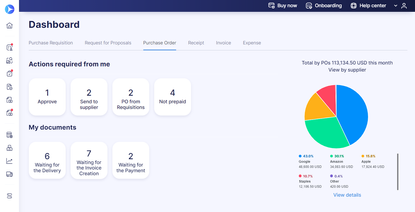

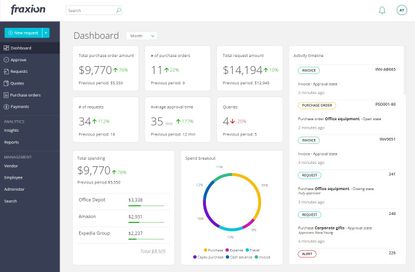

There are several procure-to-pay systems on the market that can help you streamline the entire P2P process. Commonly, ERP systems will integrate these with their existing core accounting modules for advanced functionality. Some leading systems include:

Read our full procure-to-pay roundup for more info.