BlackLine Systems

1 Review 5/5 ★ ★ ★ ★ ★A cloud-based financial automation platform for processes like reconciliations, journal entries, and financial close.

Product Overview

BlackLine is a cloud-based financial platform designed to automate financal close processes, account reconciliations, and journal entry workflows. It aims to reduce manual tasks and improve control over financial data.

It integrates with major ERP platforms like Oracle, SAP, and Microsoft Dynamics 365 to enable two-way data sync between them. The platform also helps manage intercompany accounting and invoice-to-cash workflows through dashboards, audit trails, and AI-based tools.

Pros

- Exception management

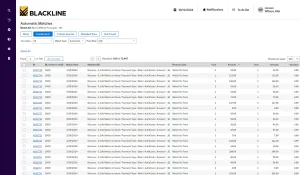

- Match transactions across multiple sources

- Real-time visibility into financial data

Cons

- High implementation complexity and steep learning curve

- Too expensive for small organizations

Target Market

Mid-to-large enterprises with complex accounting and financial needs, like multiple subsidiaries and heavy reconciliations.Not Recommended For

Small businesses or simple accounting operations that don’t need a full reconciliation suite.Video Overview

Key Features

- Balance Sheet Integrity: Standardizes and automates reconciliations from the general ledger, balance sheet accounts, bank accounts, credit cards, cash, and inventory.

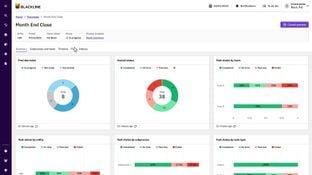

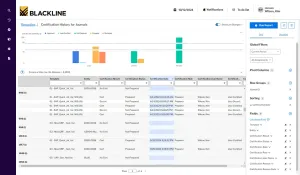

- Close Process Management: Includes account reconciliations and task management tools that help standardize reconciliation and period-end close processes.

- Accounting Process Automation: Improves the speed, accuracy, and reliability of the reconciliation to adjustment process through account reconciliations, journal entries, and transaction matching.

- Intercompany Hub: Helps approve, review, and reconcile intercompany transfers and balances across currencies and geographies.

- Smart Close: A financial close tool directly integrated into SAP products.

- Compliance: Helps teams stay proactive in identifying and monitoring risk. Handles audit and control management.

Verity AI

BlackLine uses Verity AI throughout its platform. Its main functions include:

- Verity Prepare: Helps prepare for financial close by analyzing new accounts for high-risk items and drafting explanations for discrepancies.

- Verity Collect: Identifies action items, transcribes calls for outstanding invoices, and autonomously manages customer outreach for AR efficiency.

- Verity Insights: Perform on-demand analysis without sifting through data.

- Verity Flux: Speeds up variance analysis by generating explanations of balance changes.

Product Overview

Developer Overview

Related Products

User Reviews of BlackLine

Write a ReviewBlackLine Review

We’re an insurance company in the UK. I look over all the regulatory reporting. We used to have our own in-house software that we used for many years. It was no longer capable of holding the amount of data we needed any more. Blackline was our preferred option. The whole implementation was 4-5 weeks from signing the contract to going live.

Blackline had a big advantage as we could attach documents, store them, have different people check in on the reconciliations, roll the period and check in on other reconciliations if needed, identify errors, and make sure people worked them properly. It also gave a control framework to avoid issues during the reconciliation process.

From a manager’s point of view, they’ve seen a huge improvement. They used to have to work at home due to how involved the reconciliation was. Now, most work is done in the office in the day time. They are pleased to have their evenings back.