Kashoo Software

2 Reviews 4.5/5 ★ ★ ★ ★ ★An invoice and accounting software for small businesses.

Product Overview

Kashoo is an invoice and accounting software built for small businesses. It enables users to send invoices, set up credit card payments, and view digestible reports. It also offers straightforward bank reconciliation and efficient tax filing reports. The platform is online and is designed for use by average business owners, not certified accountants.Pros

- 5000 bank feeds supported

- Multiple branded design templates

- Unlimited invoices

- Has a "lite" version for a lower cost

Cons

- Limited integrations

- No Android app

- No estimating or time tracking

Target Market

Small business owners or freelancers who are not accounting experts and need a simple accounting solution without advanced features.Features

The top features of Kashoo include:

Expense Tracking

- Upload receipts from your mobile phone

- Set up recurring expenses

- Handle unpaid bills

- Supplier statements

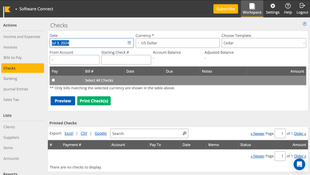

- Print checks

Invoices

- Customized invoices

- Customized payment instructions

- Templates

- Email integration

- Recurring invoices

Reporting

- Income statements

- Balance sheets

- Project Tracking

- Sales Tax

- Export to other formats

Credit Card Processing

- Kashoo Payments for credit card acceptance

- Automatic deposits to users bank accounts

- Integration with Stripe and BluePay

Bank Feeds

- Automatic bank reconciliation

- Multiple account setup

- Data encryption for security

Pricing

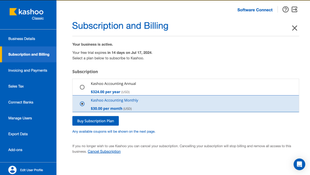

Kashoo pricing starts at $324 per year. A “lite” version, trulySmall Accounting, is available for $216 per year.

Product Overview

Developer Overview

Related Products

User Reviews of Kashoo

Write a ReviewThe first thing that struck me when reviewing Kashoo was the dashboard

I started investigating Kashoo back in 2012. I was impressed because it was simple but had the essentials that accountants and bookkeepers needed.

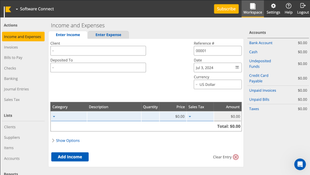

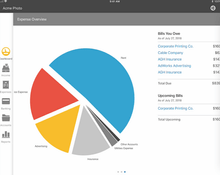

The first thing that struck me when reviewing Kashoo was the dashboard. Unlike other software, the dashboard was designed to quickly enter income and expense transactions. There are some key metrics found on the right-hand side, but it’s mainly a form for entering income and expenses.

There is no big distinction between sales receipts and invoices, and bills and expenses. One just lets you enter in more details than the others.

Receipts are things paid for at the time of purchase, while invoicing is for paid at a later date. However, in Kashoo, you either pay something with a Paid account, like Cash, or an unpaid accounts receivable. This can be confusing at first but you get the hang of it.

As a data entry tool, it’s probably my favorite web app. The navigation is simple, the forms are simple, and everything can be accessed in just a click or two. The way it’s structured by allowing the use of any account type in account fields and having strong sales tax options makes it flexible for a variety of uses.The fact that it doesn’t have 100 different forms for income and expenses is a big plus. Out of all the software I’ve reviewed, I think it’s the easiest to learn.

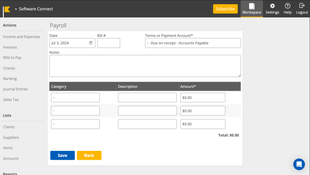

On the downside, the simplicity, is what can be negative about it. Kashoo doesn’t have much in terms of automation, and it doesn’t have online payment capability. There’s also no inventory, no ability to attach items to invoices, and no add-ons beyond Payroll. There’s a trade-off with Kashoo that comes down to transactions. Once you get above 50 transactions a month, other automated options become more attractive.

always on the go

I use Kashoo because I’m always on the go. I take my iPad with me and I can work on financial stuff in my studio or a cafe. It makes it easy to keep track of expenses, take pictures of receipts, send invoices. Kashoo makes it easy for me to do my job.