MRI Software Asset4000

A fixed asset management software for mid-sized to large organizations needing detailed, customizable reporting.

Product Overview

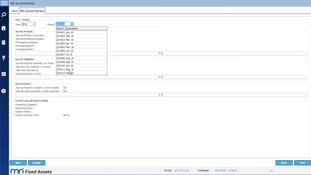

Asset4000 is a fixed asset management software. Key features include customizable depreciation methods, depreciation forecasting and modeling, asset hierarchies, and document management. Asset4000 delivers customizable reports for audits and regular asset tracking. The software’s integration with existing ERP systems, notably Sage Intacct, enhances its functionality.Pros

- Supports multi-book and multi-currency functionality

- Depreciation methods user-definable by asset, group, etc.

- Highly customizable reporting

Cons

- Traditional user interface

- Some users report long processing times for reports

Target Market

Mid-sized to large organizations in commercial real estate, education, hospitals and healthcare, government administration, and transportation.MRI Software’s Asset4000 is a fixed asset management software offering customizable depreciation methods, user-definable reporting facilities, and the ability to import new assets from external files.

Formerly from Real Asset Management, Asset4000 includes asset imaging, parent/child relationship views, and the ability to import new assets from external files.

MRI Software Asset4000 Key Features

- Provides complete information on asset status, history, and location for audit trail purposes.

- Offers asset hierarchies, identifying parent/child relations and dependencies.

- Transaction types include full and partial disposals, transfers, enhancements, cost adjustments, relifes, revaluations, and splits.

- Standard and user-definable depreciation methods can be applied by asset, asset group, and accounting period. Costs are retained for historical periods and automatically calculated as required for current and future periods.

- The audit file holds a history of all user actions, identifying which records were affected and the before/after detail.

- Electronic document management for the fast retrieval of associated files.

MRI Software Asset4000 Benefits

- Assets can be arranged in hierarchies, identifying parent/child relationships and dependencies.

- Depreciation methods are completely user-definable by asset, asset group and period of account. Costs are produced for past, current and future periods and years, including capital expenditure and disposals.

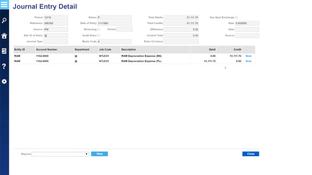

- Data links are provided to spreadsheet packages, general ledgers and management reporting tools. The register also utilizes asset tracking facilities, incorporating the leading bar-code scanning technology.

Multi-Book

- Allows multiple sets of figures to be stored against each asset.

- Each asset record contains a unique identifier and provides the facility to incorporate: existing analysis codes (e.g. category, cost center, department, company), multiple description lines, acquisition and capitalization dates, and book-dependent information such as purchase cost, asset life, depreciation rules, quantity, residual values, and grant values.

- Transactions can be applied across all books, including full and partial disposals, transfers, reliefs, revaluations and splits

- Period cost details for each asset are viewed on one screen as a list or graph. Note tabs provide quick access to costs for each book.

Multi-Currency

- Each accounting book is independently configurable to meet international accounting rules, including different currency settings.

- Complies with U.S. Federal Tax Regulations, including acquisition conventions and MACRS (Modified Accelerated Cost Recovery System) declining balance methods of depreciation.

- European depreciation rules can be applied to individual books, for example, considering the differences in the double straight line depreciation rule between Germany and Belgium.

Multi-Lingual

- Entire system in the required language, from menu options to information messages. Professionally translated on-line help file.

Video Overview

Product Overview

Developer Overview

Related Products

User Reviews of MRI Software Asset4000

No reviews have been submitted. Do you use MRI Software Asset4000? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!