The Best ERP Systems for Professional Services

Professional Service ERP helps you manage projects, record job costs, and track time on one platform. We’ve reviewed the top options for various industries, from IT services to consulting and advertising firms.

- Sleek, modern user interface

- Native Salesforce integration

- Modular implementation for service-based businesses

- Offers detailed project view and financial analysis

- Supports complex and diverse billing requirements

- Provides multi-currency support

- Open architecture for rapid integrations

- Multi-entity support

- Mobile accessibility

In this guide, we’ve ranked the top ERPs for professional services based on their support for different industries, such as IT services and consulting. We’ve also evaluated their industry-specific features, like project accounting and resource management, so you can find the best fit for your business.

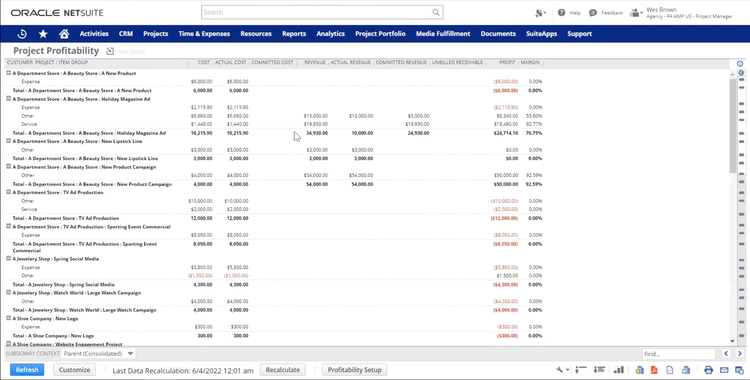

- Certinia ERP: Best for IT Services

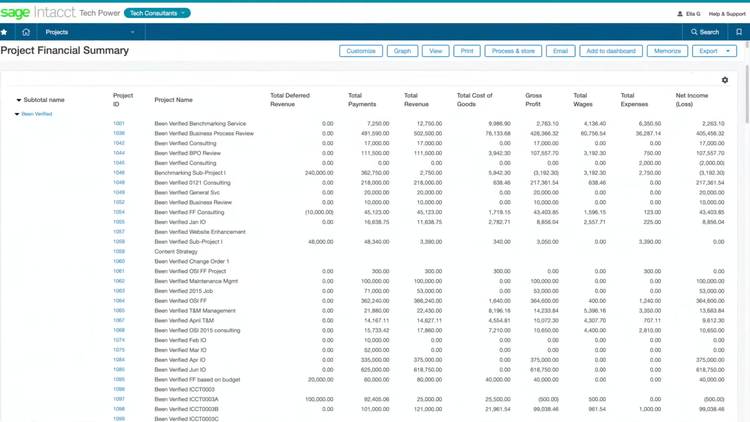

- Deltek Vantagepoint: Best for A/E Firms

- Acumatica: Best for Consulting Firms

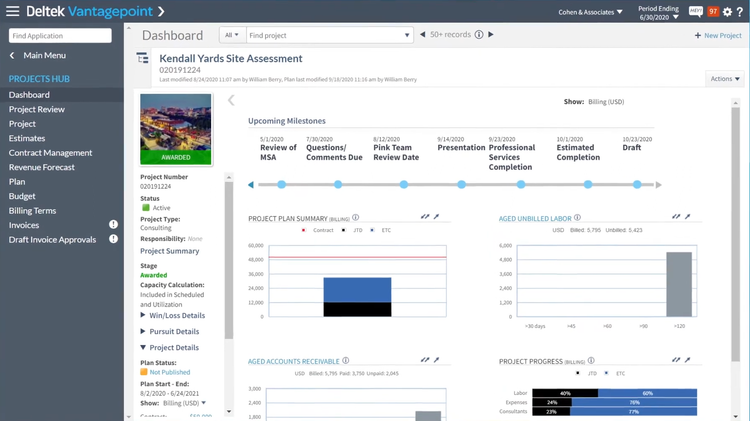

- NetSuite: Best for Marketing & Advertising Agencies

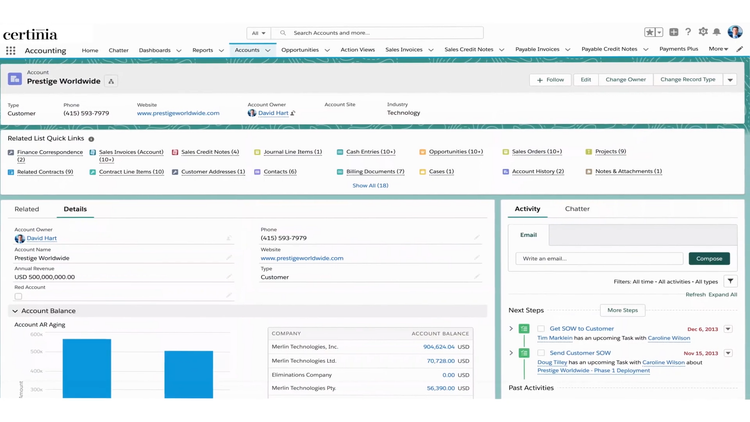

- Sage Intacct: Best for Financial Services

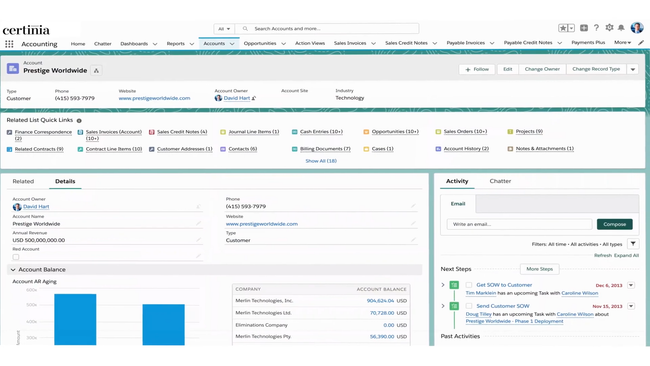

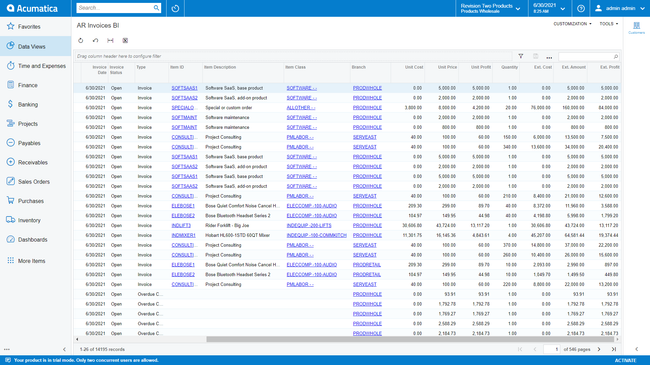

Certinia ERP - Best for IT Services

Certinia ERP, formerly FinancialForce, offers strong resource planning tools, which are essential in IT service and systems integration environments. It helps make the sales-to-service handoff smoother with built-in planning. You can start mapping out roles, responsibilities, and requested hours as early as the estimating phase. This can help improve department alignment and ensure your team can handle the increased workload.

The tool also lets you track skills and certifications for your entire team. You can filter your staff by specific credentials, so you can assign people to tasks they can handle. It’s a win-win for your staff and the client. And if some employees lack the required experience, Certinia has built-in skill management and reminders to promote career development.

Once projects are accepted, you can see real-time utilization of employees, so you know who is over- or under-worked. Use other data, like capacity by region or department, for headcount planning and revenue forecasting. The unified scheduling calendar even allows you to see everyone’s daily capacity, ensuring everyone receives their requested or required hours.

Certinia ERP also offers native Salesforce integration, combining sales, services, and CRM under one roof. Pricing starts at $175/user/month for core access to all features. That said, you’ll need a custom quote, as there is a minimum user count, different module packages, and discounts.

Visit our full Certinia ERP product profile to learn more.

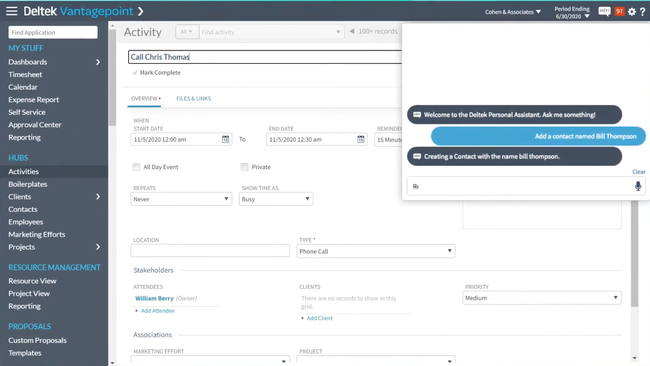

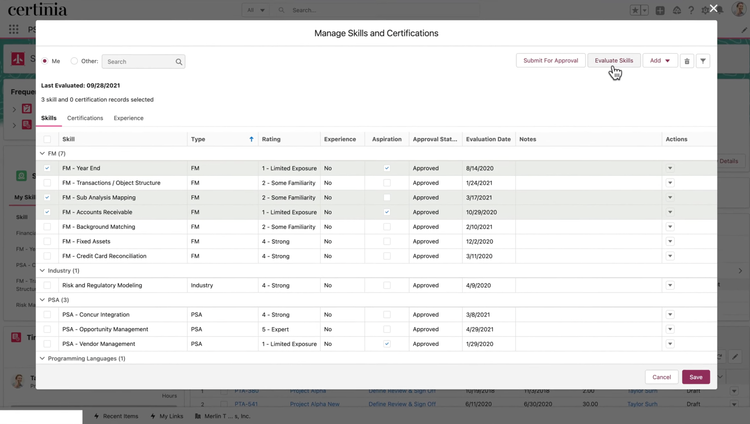

Deltek Vantagepoint - Best for A/E Firms

Deltek Vantagepoint allows architecture and engineering firms to track the profitability of every project. Timesheets and cost rates allow you to allocate labor, overhead, and expenses to jobs, helping create more accurate budgets. You can also change the job cost frequency to match the payroll cycle. That way, costs are allocated correctly for projects that take several months to execute.

Additionally, the system has flexible progress billing options. You can base this on percentage complete, fixed amounts, unit-based fees, and other billing methods. It also allows you to update progress and your percentage complete at various phases. This enables you to draft invoices with milestone billing, creating more WIP control. Plus, you’ll get paid faster, increasing your cash flow during multi-phase projects.

Deltek Vantagepoint is best for mid to large-sized A&E companies that need an all-in-one project-based ERP. Other features include CRM, document management, payroll, and reporting dashboards. You’ll need a custom quote for pricing information, as your final cost depends on the size of your firm, required modules, and number of users.

Read more about Deltek Vantagepoint.

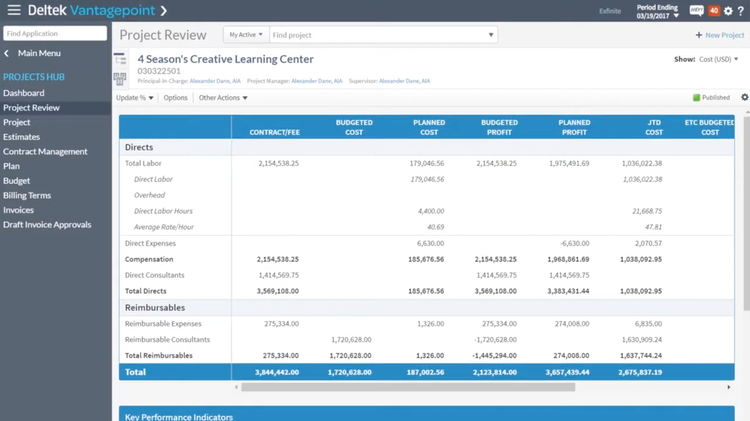

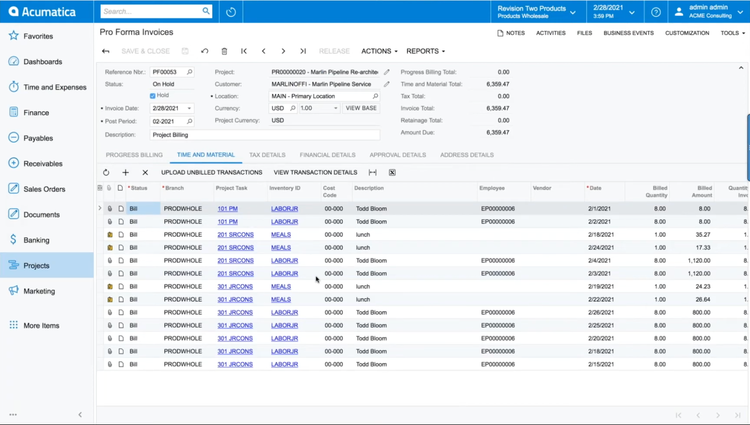

Acumatica - Best for Consulting Firms

Acumatica’s professional services edition includes a strong time management feature that’s a great fit for consulting firms. It connects to all areas of the ERP, from project accounting to payroll, so you can have consistent and accurate timesheets. This helps your accounting department during client billing, as the system handles both billable and non-billable hours tracking.

Consultants can create new timecards through the mobile app, which is crucial when they’re on the go. You can associate time with projects and tasks, and add notes for each entry, assigning billable hours accurately. Once submitted, supervisors are notified to approve or reject, adding an extra layer of security.

Acumatica then posts all approved consultant timesheets to the project accounting module for costing, billing, and WIP recognition. This allows for total cost visibility even before you process payroll. And because everything is integrated, this is done automatically with configurable rules for earning types, rates, and posting. It’s a great way to keep real-time data for your client billing while increasing automation.

Acumatica’s pricing starts at $1,800/month, though exact costs are based on your resource usage and required functionality. It’s a modular system, so you can add features anytime as you grow, making it ideal for midmarket businesses that need flexibility. It also features a cloud-native architecture with REST APIs if you need any non-native integrations.

Learn more on our full Acumatica review page.

NetSuite - Best for Marketing & Advertising Agencies

NetSuite offers a comprehensive package for advertising agencies, including a strong project management tool for better campaign execution. The project portfolio dashboard gives your PM a clear overview of overdue or on-time tasks. Drill down into each to see individual tasks and milestones that are running behind, along with their original due dates. It’s a quick and easy way to investigate and resolve potential roadblocks or bottlenecks, helping to complete those late tasks as soon as possible.

On the portfolio, you can add tiles to drill down into project details quickly. For example, the project profitability tile lets you see the projected versus actual cost of each ad item for a client. It also displays projected versus actual revenue, with total profit and your margin. This is helpful for seeing the current status of specific campaigns, so you can identify areas of overspend or which types of campaigns were financially successful for different projects.

NetSuite is ideal for mid to large-sized agencies with over 50 employees. And if you need to integrate third-party apps for processes, it has its SuiteApp marketplace with hundreds of built-in integrations. That said, pricing can get steep. The bare minimum starter pack begins at $1,299/month, plus $129/user/month. However, the advertising agencies edition will be more expensive and requires a custom quote based on your business size, number of users, and desired modules.

Read our full NetSuite ERP Review to learn more about its features.

Sage Intacct - Best for Financial Services

Sage Intacct’s core financials module is GAAP-compliant and can support multiple entities, currencies, and consolidations. Specifically, its multi-dimensional chart of accounts handles hundreds of subsidiaries and funds, instead of creating a separate GL account for each. This makes consolidation and intercompany eliminations much simpler while reducing chart bloat. And after you create a dimension, you can use it for any transaction to ensure accurate tracking.

This flexibility also extends to its financial reporting, which is one of the strongest on the market. It includes over 150 standard reports out of the box, with easy configurations to tailor them to your needs. You can split dimensions, create conditional formatting, and access audit trails. It also has industry-specific ones for financial service firms and accountants, like fund and investment, client and engagement profitability, and IFRS financials. It can be a game-changer for companies needing granular insights to make better data-driven decisions department-wide.

In addition to the core Intacct platform, you can also integrate Sage Timeslips to track time and client expenses from your computer or mobile phone. The PSA edition also includes project financials, resource management, and capacity planning. But for just the core financials, the price starts at $8,580/year, though you’ll need a custom quote based on your modules and user count.

See our full Sage Intacct review for more info.

What is a Professional Services ERP?

ERPs for the professional service industry are all-in-one platforms designed for businesses whose primary value comes from people and projects–such as consulting, IT services, architecture, engineering, and accounting. These systems focus on industry-specific functionality, integrating financial management, project accounting, time and expense tracking, and CRM in one place.

The goal is to give firms real time visibility into project and client-specific data like billing, utilization rates, and budget vs. actuals. By centralizing data, it can reduce manual workflows and strengthen client relationships.

Common Challenges

These are the most common challenges professional service ERPs help your company overcome:

- Disconnected Systems & Data Silos: Many firms have time tracking on one platform, project management on another, and accounting on a third. This isolates your departments and causes slow manual data entry between them.

- Project Profitability Visibility: In this scenario, agencies can’t tell which projects are profitable until they’re complete. This results in frequent budget overruns and guessing at pricing instead of using historical data.

- Manual Time Tracking: Paper timesheets or disconnected tools have employees report time weekly or bi-weekly, leading to billable hours errors. This also causes a long cycle time from work completion to invoice, reducing cash flow.

- Scaling Bottlenecks: Disconnected systems can’t handle business growth, and adding new teams or offices requires complex workarounds.

Key Features and Benefits

The most common ERP features used by professional service firms include:

- Project Accounting & Job Costing: Track budgets, costs, and profitability of every project, down to the phase or task level. Ensure jobs are on budget, identify the most profitable ones, and pinpoint where overruns occur.

- Time & Expense Management: Allow team members to log hours and expenses directly into the ERP, oftentimes through the mobile app. This helps with faster timesheet approvals, more accurate entries, and efficient billing.

- Billing and Revenue Recognition: Use flexible billing models, like time & materials, fixed fee, retainer, or milestone-based. Automate revenue recognition to keep billable hours accurate for client contracts.

- Resource Management & Utilization Tracking: Optimize the allocation of your staff across projects based on skills and availability, driven by demand forecasts. This reduces bench time and maximizes billable utilization to drive profitability.

- Integrate Financial Management: Access core accounting features like GL, AR/AP, and consolidated reporting across entities or funds. This connects your finances directly with your projects for better visibility and control.

- CRM: Centralize client and prospect data and integrate it with proposals and projects. Track your sales pipeline and opportunities through the final invoice to grow accounts, manage renewals, and maintain client satisfaction.

ERP vs. PSA Software

Professional service ERP shares some common features with Professional Services Automation (PSA) software, like project management and service billing, but has key differences that set it apart. These include:

- Financial Management: ERPs have core accounting and financial management as their backbone. PSA systems require a third-party integration, like QuickBooks Online.

- Scope: ERPs are much broader in scope, integrating modules like HR, finance, CRM, and projects onto one platform for better scalability. PSA systems focus solely on project delivery, like time, resource, and job management.

- Use Cases: ERPs are best for mid-size to large professional service firms with multiple locations–nationally or globally. PSA is better for small companies that need the essentials on a smaller budget and scale. Organizations often start with a PSA and an accounting tech stack, then upgrade to an ERP when that can no longer meet their needs.

Pricing Guide

ERP subscriptions vary heavily based on your company size, desired modules, user count, and whether you need on-premise or cloud deployment. Generally, monthly subscriptions for small to midsize businesses can range from $400 to $12,500. Also, remember that implementation costs will increase your total cost in the first year, often being a one-time fee that’s double your annual subscription.

- Low-Tier ERP: For small operations with 1-50 employees, costs can range from $5,000 to $30,000 per year for products like Odoo, BQE CORE, or Deltek Vantagepoint.

- Mid-Tier ERP: For midsize companies with 50-250 employees, pricing ranges from $30,000 - $150,000 per year. These are where most firms invest in ERP, with products like Acumatica, NetSuite, or Sage Intacct.

- High-Tier ERP: For large businesses with 250+ employees, pricing ranges from $150,000 to $500,000 per year. Products include Deltek Vantagepoint, Unit4, or higher-end NetSuite packages.

Read more about specific pricing factors on our How Much Does ERP Cost? page.