The CFO’s Guide to Bitcoin, Part 2: Taxes and Accounting

“In this world nothing can be said to be certain, except death and taxes.”

No doubt, many aspects of the bitcoin phenomenon would astound Benjamin Franklin if he were alive today. (Though perhaps not as many as you might expect. He did help architect the new republic’s original alternative cash, Continental Currency.) But the inability of bitcoin to escape tax liability clearly wouldn’t have surprised the founding father a bit!

Anyone inquiring into the prospect of accepting bitcoin payments will also find the taxation issue inescapable. Two questions are inevitable:

- What are the tax ramifications of taking bitcoin payments? And,

- How will that affect accounting?

These questions don’t always seem to have easy answers. But recent government announcements have shed light on bitcoin’s tax status.

And, bitcoin fans aren’t always excited about what they’re seeing.

A single CNN article described the tax rules governing bitcoin as “a headache,” “an accounting nightmare,” and “a shot across the bow.”

But the same article also speculated that a solution could come in the form of “a killer bitcoin app.” “Something that tracks your basis [bitcoin value] and records gains and losses against market value, daily.”

Where are we at now with bitcoin from a financial management perspective? Government regulations are in place. Technologies are emerging from the bitcoin development community that help ease accounting difficulties. And, standardized bitcoin business accounting is starting to take shape.

Let’s take a closer look.

How Are Bitcoins Taxed?

On March 25th, 2014, the IRS ended one of the great mysteries surrounding bitcoin when it released Notice 2014-21. The notice declared:

For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.

The announcement signified that revenues realized from the sale or exchange of bitcoins would count as capital gains. According to the IRS:

A taxpayer generally realizes capital gain or loss on the sale or exchange of virtual currency that is a capital asset in the hands of the taxpayer.

CNBC contributor Gina Sanches observed, “What this says is every time you make a transaction, you basically have to keep track of your capital gains.”

For many bitcoin advocates the hope had been that bitcoin would be treated the same as any foreign currency. The hope wasn’t entirely unfounded, either. A March of 2013 announcement from the Treasury Department’s Financial Crimes Enforcement Network (FinCen) did consider bitcoins to be money, rather than assets. FinCen stated that anyone operating a virtual currency exchange would be considered to be “running a money transmitting business.” (NYTimes.com)

But for daily business purposes, the IRS decision settled the tax status issue. In the eyes of the tax collection agency, Bitcoins are indeed property and capital gains taxes are be due on revenues from their sale or exchange.

How Do I Calculate Capital Gains on Bitcoin?

Bitcoin capital gains use the same formula as any other asset might.

Sale price - purchase price (including fees) = capital gains.

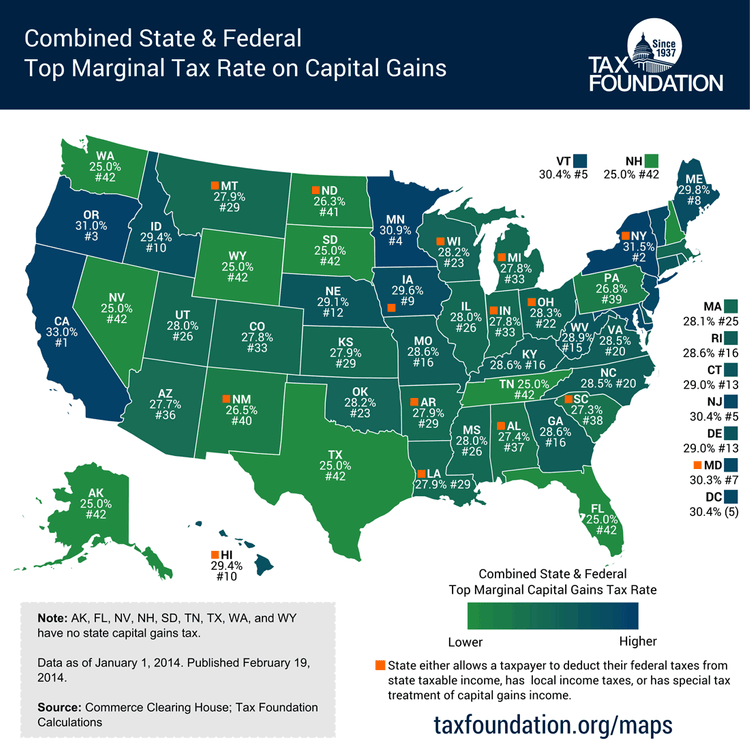

As with other assets, the length of the asset’s holding period determines long term or short term gains status for tax rate assignment purposes. The Turbo Tax website identifies that short-term capital gains rates ranged from “10 percent to 39.6 percent” in 2013, with long-term capital gains rates at “0, 15, and 20 percent for most taxpayers.”

For more on general capital gains calculation, check out the IRS literature governing the “Disposition of Business Property.”

What Are the Unique Challenges of Bitcoin Tax Calculation?

Calculating gains on bitcoin assets is different than with many other assets, though, for a few reasons:

- Bitcoins are virtual.

- Bitcoins are divisible.

- Bitcoins are relatively liquid (at least at SMB volumes).

These differences present a challenge related to establishing initial bitcoin purchase prices. It’s a challenge that’s easy to accommodate when accounting for just a few transactions. But it gets harder when transaction counts rises to the hundreds or thousands.

So how do you determine cost basis (purchase price) on bitcoin transactions for capital gains calculation? A recent Investopedia article discussed the topic:

Since Bitcoin is now taxed as personal property, like shares of stock, investors theoretically have the option to sell their assets on a first-in-first-out (FIFO) basis, a last-in-first-out (LIFO) basis, or to sell those specific tax lots that are most efficient under the “specific share identification” method used for stocks. [However…] In real life, “specific identification” sub-accounting may be out of [your] hands or outright impossible. Even the industry’s leading exchanges and hosted wallets currently lack the accounting software needed to ensure trades are executed in a tax-optimizing fashion.

| Method | FIFO | LIFO | Specific ID |

|---|---|---|---|

| Lots sold | 10/2013: Sell 60 BTC | 11/2013: Sell 20 BTC; 09/2013: Sell 40 BTC | 11/2013: Sell 20 BTC; 10/2013: Sell 40 BTC |

| Tax Result | 10/2013: Long term gain (60% × $74,000 × 15%) | 09/2013: Short term gain; 11/2013: Short term gain ($30,000 × 25% - $1,500 × 25%) | 10/2012: Long term gain; 11/2013: Short term gain (50% × $74,000 × 15% - $1,500 × 25%) |

| Taxes Due | $6,660 | $5,250 | $3,690 |

A sample capital gains tax calculation from Investopedia shows how the tax burden can vary based on the timing of the sale and the selected valuation method. (All examples assume the same purchase date and acquisition price.)

Not everyone shares the conclusion that LIFO, FIFO, and specific share identification are all permissible asset valuation methods, though. A tax attorney posting on the bitcoin subreddit warned against using methods other than FIFO:

Once a bitcoin is purchased, it becomes indistinguishable from the other bitcoins stored in the same wallet or account. In a subsequent sale or exchange, there is no way to trace the cost or acquisition date of the bitcoin being transferred out. There are some other methods available, such as LIFO (“Last In, First Out”) and Average Cost Basis, but it’s not clear if bitcoins are eligible for these alternatives. So, I would caution against using any system other than FIFO without guidance from a tax advisor or instructions from the IRS.

At this point, the IRS has not officially stated which asset valuation methods are permissible. However, financial executives should know that the IRS has already shown that it is willing to rule retroactively. IRS Notice 2014-21 did more than simply declare digital currency to be assets. It also said taxpayers who treated virtual currency “in a manner that is inconsistent with this notice prior to March 25, 2014” could be “subject to penalties for failure to comply with tax laws.”

The capital gains calculation issue is significant. It threatens the very practicality of accepting bitcoin payments. In fact, that’s a main reason why the IRS decision to consider bitcoins as property disappointed many bitcoin advocates. Andreas Antonopolous, Chief Security Officer at Blockchain.info, described it as “an untenable burden.”

Andreas Antonopolous comments on the taxation rules related to bitcoin.

But the bitcoin development community is already offering some solutions to the capital gains calculation dilemma.

Libratax.com provide online tools to calculate capital gains tax. Each service integrates with various bitcoin exchanges and digital wallets. Users also can select between FIFO, LIFO, and average costing methods. And, for the moment at least, both services are free. (Though each offers premium tax preparation related services for a fee.)

Is There a Way to Avoid the Whole Capital Gains Tax Issue?

It’s not hard to imagine that accounting departments might prefer to avoid the bitcoin capital gains headaches.

But it’s not necessary to give up bitcoin to do so.

By leveraging bitcoin merchant payment processing services, bitcoin can be kept as a supported payment method without incurring capital gains (or losses).

Many bitcoin payment processors will accept bitcoin payment on your behalf and pay you in cash. Since you never have possession of the bitcoins, you bear none of the responsibility related the risk of fluctuations in the bitcoin value. This prevents the possibility for capital gains (and losses).

The typical bitcoin payment processing services arrangement allows you to maintain an account with the merchant processing provider, from which you can withdraw funds. The subscription model for most services often involves a small fee to be paid when you “cash out.”

Popular bitcoin payment processors include:

How Are Bitcoins Handled From an Accounting Perspective?

For better or worse, IRS Notice 2014-21 did clarify how to manage bitcoin accounting.

Since the IRS considers bitcoins to be property, they need to be treated as such for accounting purposes. Consequently, company owned bitcoin holdings should be recorded to non-cash asset accounts in the general ledger.

Like other non-cash asset accounts, valuation changes in bitcoin accounts can be tracked as appreciation/depreciation. Bitcoins do not require the complex depreciation scheduling that fixed assets do, though. Fair market value can be more easily ascertained from active bitcoin exchanges.

Tracking bitcoin accounts as foreign currency accounts would seem to present another possibility. Aside from the IRS declaration that bitcoin is not a currency (despite behaving like on in many ways), there’s a more mundane reason this often isn’t feasible. Bitcoins are divisible up to 8 decimal points. Most accounting software solutions stop at the traditional 2. So natively tracking bitcoin balances within most accounting solutions doesn’t work. Tracking the converted cash value of bitcoin asset accounts avoids this issue. It also conforms with the IRS guidance on the topic.

What’s leftover from an accounting perspective is mainly the issue of transactional reporting. For instance, what happens when an accounts receivable entry is paid via bitcoin?

The Bitcoin Wiki answered the question this way:

In practice, Bitcoin is likely no different than accepting payment in other forms, such as cash, or gold, or scrip, or gift cards or foreign currency. What would you ask your accountant if you decided that you wanted to accept Berkshire Bucks or 1-ounce gold coins as payment?

As noted in a recent Bitcoin Magazine article titled “Using Bitcoin with QuickBooks,” there are “several possible ways to record Bitcoin sales.” But the method outlined specifically by the author provides a practical approach. It both satisfies the accounting matching principle and allows for the creation of an account dedicated to tracking capital gains for tax purposes.

For more on bitcoin issues relating to the accounting department, check out “The CFO’s Guide to Bitcoin, Part 1: The Basics.” Part 3 of the series will follow and focus on business issues related to bitcoin invoicing and payment acceptance.