Cloud vs. On-Premise: Key Differences, Pros, and Cons

When you’re searching for software, you’ve probably encountered terms like “SaaS,” “cloud-based,” “hybrid,” and “on-prem” before. Wondering what makes them different? And, more importantly, are you trying to figure out which one would benefit your company?

In short, the main difference between cloud and on-premise software is where it’s installed and located. Learn more about how either option can benefit your business:

What is On-Premise Software?

On-premise software, also known as “on-prem software” or “traditional ERP,” generally means any software solution installed on-site on local hardware systems or managed from a dedicated data center. This means any computer program that can only be accessed from on-site or in-office computers or “on the premises.”

If an on-premises software cannot be customized, it’s called shrinkwrap. However, many on-premise solutions include custom modules for personalized performance. On-prem systems tend to have a one-time implementation fee. Some pros and cons include:

Pros

- Customization: On-prem ERP solutions are also a little easier to customize to address specific industry-related business processes. Vendors can consider your exact needs when developing your ERP software package.

- Ease of Use: User training is often included in the implementation costs for on-premises ERP solutions.

- Security: On-premises software systems are highly secure since they are hosted on-site through local servers.

Cons

- Accessibility: The biggest con of on-premises software is the inability to work remotely. Compared to cloud software, an on-premises solution has limited accessibility. Yet there are situations where on-prem ERP is better suited for a business.

- Cost: On-premises solutions are also more expensive, at least initially. Implementation can be costly, requiring employee training. However, these costs may include coverage for long-term support and performance updates.

- Security: While on-prem solutions are easy to secure, it is up to the individual business to protect their servers.

- Support: A perpetual license agreement for on-premises software means you may not be eligible to receive upgrades, even if they improve service. And you’ll need your own IT team to handle maintenance that is not covered by warranty.

What is Cloud-Based Software?

Cloud-based software, also known as software as a service (SaaS) or cloud-based ERP, is hosted remotely on a third-party data center. Some browsers may be better suited for the software than others. Open-source options allow the user to customize the program themselves.

Cloud-based software is often used by companies with multiple locations that need to coordinate in real time. Since SaaS is continuous, users pay for service on a monthly or annual basis. Other pros and cons include:

Pros

- Accessibility: Cloud-based systems allow employees to access services from anywhere, at any time. With an internet connection, work can be done anywhere, allowing businesses to employ remote workers regardless of their real-world location.

- Costs: Cloud-hosted vendors charge on a subscription basis, meaning you only pay for what you want when you use it.

- Customization: While many cloud-based solutions are shrinkwrap, add-on modules add more ideal functionality.

Cons

- Costs: Cloud ERP solutions operating costs can add up over time. 10 years of service can eventually cost as much or more than a one-time perpetual license fee for an on-premise ERP, especially if any add-ons are necessary for desired functionality.

- Customization: As discussed above, add-on modules with additional features can add to total costs.

- Security: While cloud-based systems are highly secure, they are more vulnerable to human error. Data security depends on the vendor—if they are threatened, your data is threatened.

- Support: Updates and improvements can lead to downtime, though SaaS providers will usually send out warnings to their customers with estimates for when the system will be working again.

Key Differences

Cloud-based software has exploded in popularity over the last few years. Yet, there are still benefits to using an on-prem solution. Here are some of the key differences in each deployment method:

| Considerations | On-Premises | Cloud |

|---|---|---|

| Accessibility | Only accessible on-site or on a specific device | Accessible anywhere with internet access |

| Cost | Usually a one-time perpetual license fee | Monthly or annual subscription payments |

| Customization | Solutions may be fully customizable depending on vendor | Add-on modules may be available for an additional fee |

| Deployment Speed | 6–18 months typical; can extend to 24+ months for large, complex implementations | 3–9 months typical; up to 12–24 months for global or highly customized rollouts |

| Ease of Use | May include user training (in-person) | May include user training (remote) |

| Security | Data protection is the responsibility of the business | Data is hosted and protected by the developer |

| Support | Support may be limited to a warranty period | Support is usually included with the subscription |

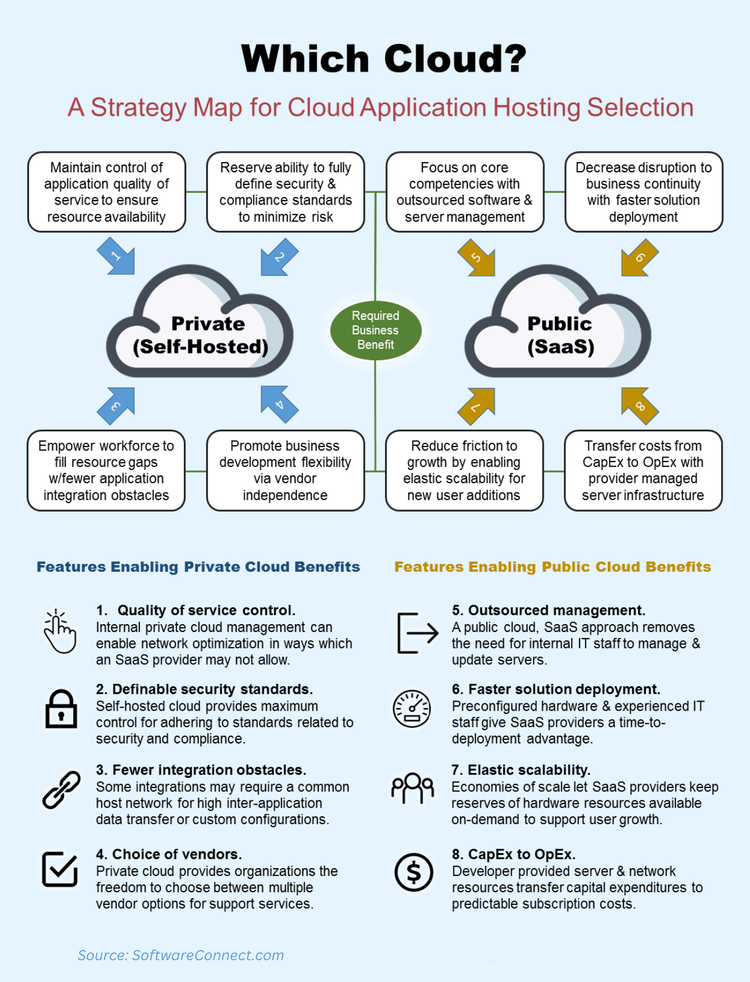

Public vs. Private Cloud

When considering a cloud-based solution, it’s important to distinguish between a self-hosted (private) cloud and a provider-hosted (public) cloud. While both offer end-users access to network accounting application resources, private and public cloud approaches offer very different value propositions.

- Self-hosted (private) cloud: Enables anywhere, anytime access to software capability while maximizing organizational control to meet definable standards for quality of service, security, and integration standards by preserving the hosting of applications on internal servers.

- Provider-hosted (public) cloud: Provides cloud capability while outsourcing server hardware and application support responsibilities in order to minimize capital expense and allow for increased focus on organizational core competencies.

A Third Option: Hybrid Deployment

Hybrid software systems are a mixture of on-premise and cloud-hosted software applications. Secure data may be stored on-premises, while specific applications are only available through cloud-based tools.

Hybrid solutions are used to cut down on the amount of physical software implemented on on-site computers in order to increase computational efficiency. They can be customized or implemented as shrinkwrap.

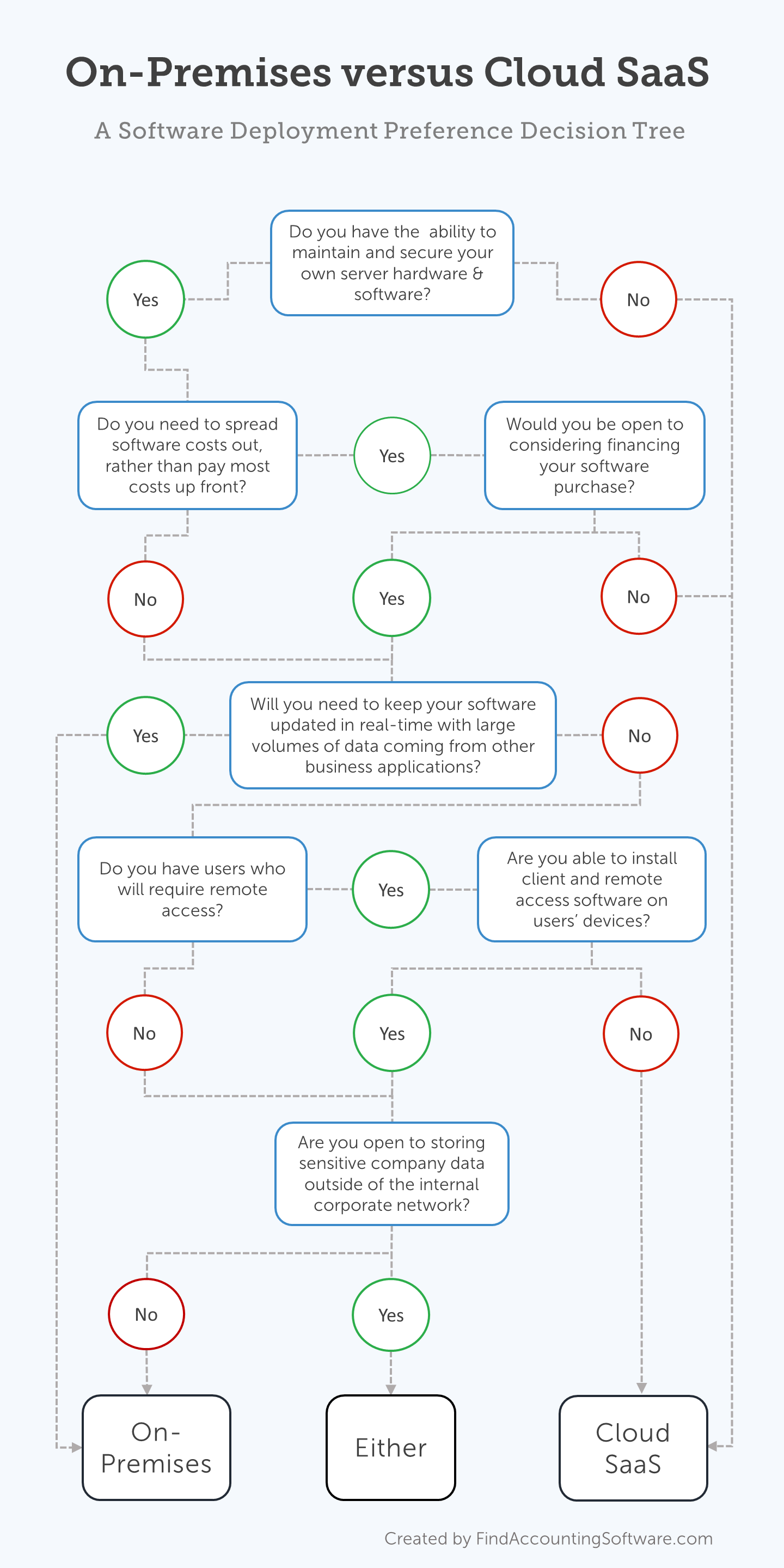

Finding the Software Deployment Model Best for Your Business

There are several factors which will determine which style of deployment is best suited for your company:

Updates and Improvements

One big difference between on-prem and cloud-based systems is how changes to hardware and software are managed. A perpetual license agreement for on-premise software means you may not be eligible to receive updates, even if they improve service. Updates and improvements can lead to downtime, though SaaS providers will usually send out warnings to their customers with estimates for when the system will be working again.

Cost of Services

You need to know your budget before seeking software. Cloud-based software is often SaaS. Charges for continued use may be monthly or weekly. On-premise software usually involves a one-time perpetual license charge and implementation costs. 5 years of an SaaS may cost the same as one-time on-prem deployment.

You may want to make one big-time payment upfront or continue to make small payments over the years. And if you have to buy new hardware for your software, your overall implementation costs will go up no matter what.

Number of Facilities

Do you operate from a single office with a dozen employees or are you part of a worldwide corporation? That matters when picking software. Cloud-based software is ideal for global companies with multiple locations across time zones and in different countries. If you work in one store and just need a POS system to record transactions, you’re better suited going with an on-premise deployment.

Reliance on Hardware

If you regularly work with hardware, like barcode scanners, medical equipment, or POS cash registers, you’ll need a software system which can be deployed on each device. There are many cloud-based solutions for handheld devices while larger machinery often requires on-premise software. Several hybrid systems allow you to integrate on-prem device hardware with cloud-based software used in your offices.

Reliable, Real-time Support

Unfortunately, software doesn’t always work exactly as planned. Changes to an operating system or a disruption to Internet services can lead to delays or outright failures. While most software companies offer some level of IT support during implementation, additional help may not be available for free if you have a perpetual license on-premise software. Some cloud-based providers offer free 24/7 support, though this is not always the case.

Cloud vs. On-Premise ERP Systems

Imagine your company needs to select an enterprise resource planning (ERP) systems. These software suites contain comprehensive tools useful for streamlining business operations across every industry, from basic accounting to inventory control. Reviewing the differences mentioned above, you might decide on an on-premise ERP software in order to protect your data. Or you may choose an entirely cloud-based ERP solution to facilitate remote access to various applications. Or you might determine hybrid ERP systems have the most benefits for your company.

Not sure what’s best for your business? Contact the experts at Software Connect for a free software recommendation.