Tipalti

4 Reviews 5/5 ★ ★ ★ ★ ★A cloud-based software for AP automation, procurement, expenses, and mass payments.

Product Overview

Tipalti is a global payables automation software designed to manage the entire accounts payable process for businesses. It automates tasks such as invoice processing, global payments, supplier management, tax compliance, and financial reporting. Key features include multi-currency support, advanced payment reconciliation, fraud detection, and regulatory compliance. Tipalti also offers integration with various ERP and accounting systems, providing businesses with a unified solution to improve efficiency, reduce errors, and ensure timely payments.

In 2021 Tipalti acquired Approve.com to expand the Tipalti features to include procurement and expense management.

Pros

- Handles multi-entity

- Integrations with popular accounting software

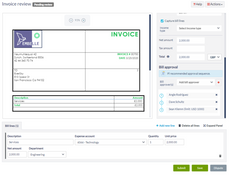

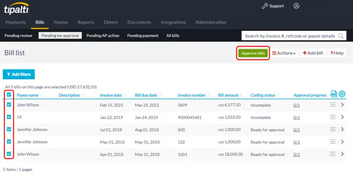

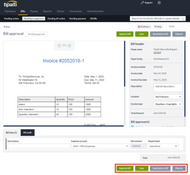

- Invoice-based and performance-based workflows

Cons

- Can't add bills to scheduled payment order

- Lengthy setup

- No VAT or GST functionality between all available integrations

Target Market

Mid-sized to large businesses that deal with global payment operations and high transactions.Tipalti is a software designed for handling accounts payable automation, procurement, expense management and mass payments. This system simplifies recording invoices, streamlining approval processes, and facilitates the execution of global payments.

Tipalti Key Features

AP Automation

- Global payments: Multi-currency support with country-specific banking details

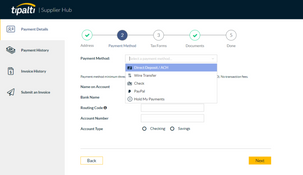

- Diverse payment options: Offers over seven payment methods with a self-serve dashboard for payees

- Automated payment processing: Automates collection and validation of bank details and tax forms, reduces AP workload by up to 80%

- Tax and regulatory compliance: Collects tax documents (W9, W8, etc) and provides 1099 services. Scans payees against global blacklists for compliance

- Cost reduction: Reduces direct payment costs by over 20% and includes fraud detection for secure transactions

Procurement

- Automated purchase orders (PO): Create, approve, and send POs automatically

- PO matching: 2-way and 3-way matching of POs with invoices and receipts to prevent overspending

- Supplier management: Onboard and manage suppliers with multilingual, self-service portals that allow real-time tracking of payment and invoice status

- Budget management: Budget and spending tracking for informed procurement decisions

- Amazon PunchOut integration: Allow employees to order directly from Amazon while generating purchase requests within Tipalti

- Multi-entity and multi-currency support: Procurement across all company entities and currencies with company-specific spend policies

- Approval workflow: Customize workflows and approval processes to reduce bottlenecks and speed up procurement cycles

Expense Management

- Expense reporting automation: Track, submit, approve, and reimburse business expenses

- Spend analytics: Spend dashboards and reporting to track expenditures and identify cost-saving opportunities

- Corporate card integration: Control card spending and automatic reconciliation

- Mobile access: Employees can submit expense reports and purchase requests on the go

- Fraud detection: Uses AI to detect and prevent fraudulent activities proactively

Tipalti ERP Integrations

Oracle NetSuite QuickBooks Sage Intacct Sage 100 Sage 50 Xero Acumatica Microsoft Dynamics 365 SAP Infor Odoo

Other Tipalti Integrations

- 3rd party credit cards (Visa, MasterCard, American Express)

- Slack

- BamboorHR

- bob

- Performance marketing systems

- Ticketing systems

Tipalti Video Overview

Product Overview

Developer Overview

Related Products

User Reviews of Tipalti

Write a Review- Internet Software & Services

- 251-1K employees

- Annual revenue $250M-$500M

A simple and efficient tool for capturing all of our purchasing processes

A simple and efficient tool for capturing all of our purchasing processes and generating better POs

Pros

The UI is by FAR better than any other financial system we've used

Cons

The price of the solution could be lower given they're new to market

Tipalti Review

With Approve.com we can maintain a valid procurement process while keeping it simple and straightforward.

Approve.com must have saved us hundreds of email threads

My pain was mid-management were buying products without an organized approval workflow, and without them having transparency as to how much of their budget is left on a monthly basis. I was afraid of implementing a process using our ERP as it’s not friendly enough and I want to be an enabler of my peers - Approve.com definitely hit my sweet spot with their offering. Approve.com must have saved us hundreds of email threads a month.

Approve is the game-changer we were looking for

Approve is the game-changer we were looking for in our quest to relieve several pain points - we didn’t have a clear requisition flow and as the company grew it became an issue. Approvals by email, lack of visibility into available budgets and not being able to know your Budget status on the spot created a lot of problems. Our previous attempts to implement requisition/procurement solutions failed either due to the over-complexity of the widely familiar tools or due to lack of features in “lighter” products. Approve is just the right solution for us - it’s SaaS, it’s easy to use, it’s intuitive. Their start-up,“can do” approach made them a great partner for us.