AgilLink

7 Reviews 2.5/5 ★ ★ ★ ★ ★A specialized cloud accounting software and secure bill pay formerly known as Datafaction.

Product Overview

AgilLink, formerly Datafaction, provides scale, control and security to family offices, business managers and sport management firms. This software offers bill pay and accounting services. The specialized multi-entity accounting and secure bill payment solution incorporates approval workflow, document management and investment data integration.

A secure API allows AgilLink to integrate with PaymentHub and City National Bank. This cloud-based solution includes a client mobile app to work from anywhere.

The software was acquired in 2010 by City National Bank and is now a Royal Bank of Canada company.

Pros

- Can approve payments on your phone

- Streamlined bill payment process

- Multi-entity accounting

Cons

- Only integrates with City National Bank

- Steep learning curve

- Can take several steps to complete tasks

Target Market

Family offices, business managers, and sports management firms that need bill pay and accounting services. It’s also used by CPAs managing high net worth clients.Video Overview

AgilLink Features

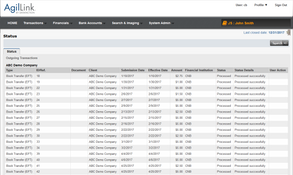

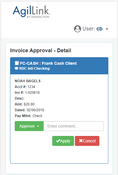

Bill Payment

- Integrated imaging

- Approval workflows

- Mobile approvals

- Treasury management through City National Bank integration

Client Accounting

- General ledger

- Accounts payable

- Accounts receivable

- Investment data integration

- Consolidated reporting

- 1099 contractor management

- Cash flow management

- API integrations

Product Overview

Developer Overview

Related Products

User Reviews of AgilLink

Write a ReviewRunning into constant issues

Negative

Pros

You can approve payments on your phone, if your company give you access. Can recode invoices while in the approval process.

Cons

Running into constant issues because they sent out an unfinished product. My company is responsible for helping them beta test this program while working on real life clients who need reliability. Datafaction was superior, never ran into a crash. Can use the keyboard to navigate in an instant. AgilLink is web based and I need to use the mouse for most actions. AgilLink cannot keep up with the speed that my colleagues and I are able to use an accounting system. Sits there and thinks while you could already have a the report you are trying to run. Each JE takes about double the time it would with the previous system.

- Diversified Financial Services

- 51-250 employees

- Annual revenue $10M-$50M

AgilLink Review

Workflow based accounting solution combined with banking integration and imaging system.

Pros

Allows for single entry accounting while featuring great security protocols.

Cons

Only integrates with City National Bank currently.

AgilLink Review

takes way too many steps to do anything

Pros

nothing

Cons

not user friendly at all, too many steps to do anything

AgilLink Review

Its not user friendly, takes several steps to do any kind of entries, monthly fees adds up which doesn’t seem cost efficient compared to sage or quick book.

Pros

nothing

Cons

too many steps to make any kind of entries.

- Diversified Financial Services

- 51-250 employees

- Annual revenue $10M-$50M

AgilLink by Datafaction has a number of strengths

Datafaction has gone through a complete overhaul. The product is now SaaS based with an easy to use web based interface that be be accessed from any where

Pros

AgilLink by Datafaction has a number of strengths. We are a multi-user, multi-entity G\L with a strong accounts payable module. Because of our tight integration with City National Bank we offer secure bill payment and data flows seamlessly between the bank and our General Ledger reducing manual data entry.

Cons

Systems is designed to meet the needs of financial service firms such as business managers, CPAs and family offices. As such we do not have many of the functions you would expect for other small\mid size businesses usch as inventory tracking and job costing.

One of the worst programs I've worked with

One of the worst programs I’ve worked with. DOS interface that relies on a command prompt, with no help function or instruction manual. There are many functions the user simply cannot access, and you must call support and have them do it for you- which you are charged for. Very limited capabilities as far as compiling or printing reports. Using this program feels like going back in time to 1992.

Pros

Honestly, nothing. Once you've worked with it a few years you can memorize how to get around in it (how to find functions or reports you're looking for, the ridiculous number of steps you have to go through for something simple like a bank reconciliation- none of it is intuitive) and once you've memorized it it's bearable, but not even close to good.

Cons

The interface is completely out-dated, even the simplest tasks have an overwhelming number of steps, many of the reports you look for aren't even possible to print or export to excel, it's compatibility with excel is laughable, nothing is intuitive, you *will* need to call support for certain tasks and will be charged for it- there's no reason to use this software.

AgilLink Review

very intimidating software. it is very difficult to exit.

Pros

not much....will not recommend.

Cons

make it easier for the user to exit.