Bloomberg Tax Fixed Assets

6 Reviews 3/5 ★ ★ ★ ★ ★A fixed asset management software featuring strong reporting capabilities.

Product Overview

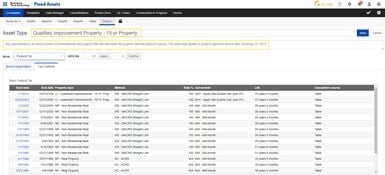

Bloomberg Tax and Accounting Fixed Assets is fixed-asset software that automatically and accurately calculates depreciation, allowing companies to maximize tax savings. It manages the entire lifecycle of fixed assets, from acquisition to retirement. It also simplifies user training by streamlining the process of classifying and handling various asset types.Pros

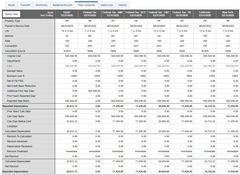

- Consolidation and reporting capabilities

- Asset type method simplifies user training

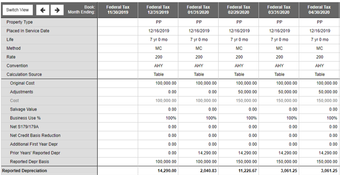

- Granular control over asset depreciation

- Accurate calculations

Cons

- "Switch View" features needs a larger data selection

- Customization limitations in the "Add Asset" window

- Costly for those with many assets but few transactions

Target Market

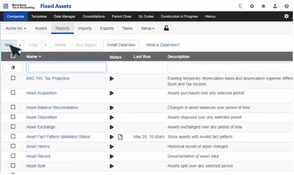

Accommodates businesses ranging from small enterprises to multinational corporations. The software is especially suitable for tax and accounting professionals managing fixed assets and depreciation.Bloomberg Tax & Accounting Fixed Assets software handles data entry, management, and reporting. This software is distinguished by its Open Timeline feature, which provides flexibility and control. It allows users to create reports and access historical information for any asset whenever needed.

Key Features

- Scalability: Handles a wide range of asset quantities, from 5,000 to over a million, with high processing speed.

- Global Accessibility: Asset data can be accessed anywhere with an internet connection, ensuring secure and flexible management.

- Security: Advanced security measures and automatic data backup.

- Compliance: Supports various accounting standards, including GAAP, Federal Tax, AMT, ACE, E&P, and customizable user-defined books.

- User Assistance: Provides wizards for routine or sporadic asset maintenance tasks.

- Strong Reporting: Over 20 predefined reports, including five tax forms, and the ability to create custom reports.

- Added Feature: The new Fixed Assets Report Writer module integrates with Crystal Reports systems for enhanced report control and flexibility.

Video Overview

Product Overview

Developer Overview

Related Products

User Reviews of Bloomberg Tax & Accounting Fixed Assets

Write a ReviewAllows my organization to efficiently complete fixed asset tasks

“Bloomberg Tax Fixed Assets allows my organization to efficiently complete all monthly, quarterly, and annual fixed asset tasks and federal and state tax filings … If my organization’s fixed asset related tasks were outsourced, I would anticipate $50k+ in spend required.”

The most comprehensive and easy-to-use fixed asset software

“We have used this product for decades as it is the most comprehensive and easy-to-use fixed asset software on the market. We can always count on timely product updates and 100% accurate calculations. It is our go-to product to manage our exhaustive list of fixed assets from acquisition to disposal and everything in between.”

Having automatic updates allows us to focus on other things

Having automatic updates allows us to focus on other things. Once we become aware of any changes, we know that it will be updated in the platform, and we will not have to worry about making any adjustments immediately. The platform does the calculation, and makes all future changes.

- Professional Services

- 51-250 employees

- Annual revenue $10M-$50M

Price is ridiculous

The price break of the software simply makes it unaffordable. They took the software to a online version and increased the price 20X. That is not reasonable. We will be looking elsewhere.

Pros

Previously it had easy to use reports. Can't say the same for this new garbage

Cons

Price is ridiculous.

A terrible follow up to the desktop version

This product is a terrible follow up to the desktop version. It is difficult to use, counterintuitive in how you want to search and even edit assets. Everything is within multiple menus and does not lend itself well to editing large amounts of data. The company needs to not force its customers onto an “online solution”. We literally don’t want this, please leave as a desktop version.

Pros

The desktop version is great. I don't like anything about the online version.

Cons

How difficult it is to edit assets. How difficult it was to transfer in all the assets from the desktop version. The whole way BNA is not selling desktop versions anymore. It's all one big pay to play cash grab, they charge based on the number of assets a company has. Apparently nobody on the support lines knows anything.

- Insurance

- 51-250 employees

- Annual revenue $10M-$50M

Bloomberg Tax & Accounting Fixed Assets Review

Switch to the web based platform from a local install and the solution has multiple bugs in the depreciation portion.