Fixed Assets CS

1 Review 2/5 ★ ★ ★ ★ ★A fixed asset management and depreciation software designed for accounting professionals and businesses.

Product Overview

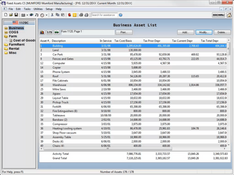

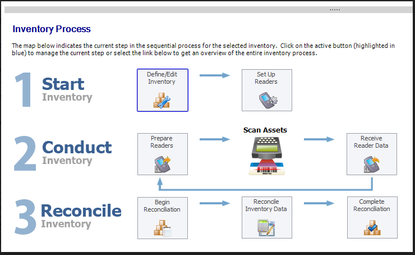

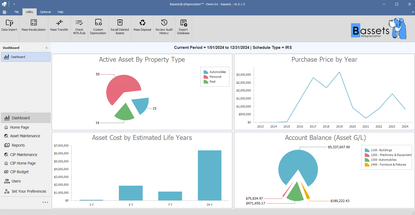

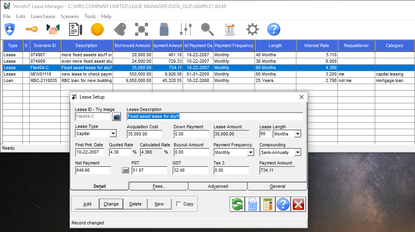

Fixed Assets CS is a depreciation and asset management software designed for accounting professionals. It offers a range of features for tracking and managing fixed assets, including various depreciation methods, detailed reporting capabilities, and integration with UltraTax and other CS Professional Suite products.

The system also allows users to create custom reports, set up business activities, assign images to assets, and work with short-year clients.

Pros

- Integrates with UltraTax

- Supports multple depreciation methods, including straight-line, MACRS, ACRS, and more

- Automates calculating federal and state depreciation differences

Cons

- Unable to import assets with specific depreciation methods

- Lengthy setup and customization process

- Lacks an audit trail feature

Target Market

Accounting firms and businesses that need to manage fixed assets and depreciation for multiple clients or entities.Features

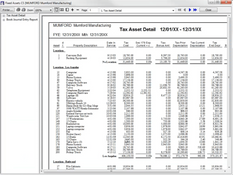

- Depreciation Methods: Supports various depreciation methods, including Straight-Line, MACRS, ACRS, Units of Production, Sum-of-the-Years Digits, and multiple declining methods.

- Automatic Calculations: Automatically calculates depreciation based on the asset’s method, life, and the date it was placed in service. It can handle monthly, quarterly, or annual calculations.

- Asset Lifecycle Management: Includes tools for mass dispositions, transfers, disposals, asset acquisition, splits, consolidations, and sales.

- Customizable Reporting: Users can generate predefined or custom reports, including forms 4255, 4562, 4797, ns FASB 109. Reports can be saved in Excel or PDF.

- Integrations: Integrates with other CS Professional Suite products, including UltraTax GS, and GoSystem Tax RS.

- Customizable Data Entry: Offers customization options for asset data entry, including user preferences, client-specific options, and field navigation.

Deployment Options

Fixed Assets CS is natively an on-premise solution that can be downloaded on your internal computers or servers. You can also remote host the solution using Thomson Reuters Virtual Office CS platform that allows your teams to work from remote offices and access all their accounting software virtually.

Pricing

Thomson Reuters does not list pricing publically for the Fixed Assets CS platform. Its typically sold on as a one-time purchase with additional support contracts. If you plan on cloud hosting the platform, expect ongoing monthly or annual costs for those services.

Alternatives to Consider

Product Overview

Developer Overview

Related Products

User Reviews of Fixed Assets CS

Write a ReviewFixed Assets CS Review

I personally use ATX and it’s fixed asset program is 100% better than UT that I use at work

Pros

When you first open the product, it looks impressive and like it will help you choose an asset life for your asset. However, it does not.

Cons

It will let you do anything you want and will not give you an error when choosing an impermissible method. It is hard to find where to elect out of bonus. I have a hard time getting the maximum depreciation on autos/SUV's to work