ProSeries Fixed Asset Manager

A fixed asset management software by Intuit that handles unlimited asset tracking and automatic depreciation calculation. Can be deployed on-premise or cloud-hosted.

Product Overview

ProSeries Fixed Asset Manager handles unlimited asset tracking and automatic depreciation calculation across different bases, making it a good tool for professionals managing various asset types and depreciation scenarios. The integration with ProSeries tax programs and the ability to import clients directly into the Fixed Asset Manager streamline the workflow for tax professionals, enhancing efficiency during peak tax seasons.Pros

- Comprehensive depreciation calculations including multiple bases

- Integration with ProSeries tax programs

- Over 35 predefined reports

Cons

- Annual renewal required

- Limited to on-premises deployment

- Designed primarily for Windows

Target Market

Accounting professionals and firms that manage a significant volume of fixed assets for their clients.ProSeries Fixed Asset Manager is a fixed asset management and depreciation tracking software designed to help track assets and calculate clients’ depreciation automatically.

ProSeries Fixed Asset Manager is available as an add-on to the Professional edition of Intuit ProSeries Tax or as a stand-alone software. It can be downloaded on your desktop or can be hosted using cloud hosting to access your software from anywhere.

ProSeries Fixed Asset Manager Features

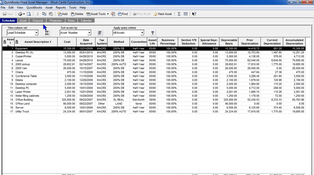

- Unlimited asset tracking

- Automatic depreciation calculation

- Separate values for book and tax depreciation

- Ability to track asset purchases and sales throughout the year

- Different Modified Accelerated Cost Recovery System (MACRS) depreciation methods

- Reporting for client property tax return

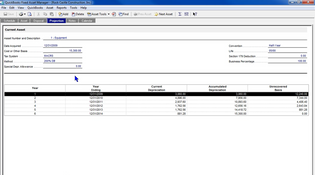

- Depreciation schedule (including categories) along with tax returns

- Asset splitting into two or more new assets

- Monthly depreciation reports

- Information changes to multiple assets at one time

- Transfer of asset data to any ProSeries federal tax program

- Automatic creation of clients in Fixed Asset Manager, imported from ProSeries

- Asset grouping by common categories you define

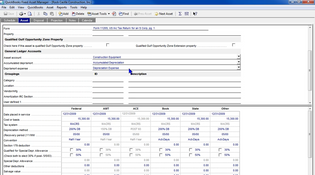

- Depreciation calculation on up to six different asset bases: book, federal, state, Alternative Minimum Tax (AMT), Adjusted Current Earnings (ACE), and custom

- Over 35 predefined reports

- Client template setup

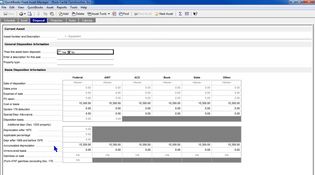

- Printing tax worksheets for Forms 4562, 4626 and 4797

- Section 179 expense tests and mid-quarter determinations and calculations

- Automatic calculation of tax preference amounts, prior-year depreciation, and gains and losses on asset sales

- Project depreciation through the life of an asset

- Copying assets from within a company or from one company to another

- Interim depreciation calculation

Integrations

- Intuit Tax Advisor to access a library of tax strategies

- Hosting options to enable work-from-anywhere capabilities

- eSignature for digital signing

ProSeries Fixed Asset Manager Pricing

The cost of ProSeries Fixed Asset Manager starts at $463/year. The software must be renewed yearly, as each purchase is only for the current tax year.

Video Overview

Product Overview

Developer Overview

Related Products

User Reviews of ProSeries Fixed Asset Manager

No reviews have been submitted. Do you use ProSeries Fixed Asset Manager? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!