Amortization vs. Depreciation: Key Differences

Amortization writes off the cost of an intangible asset over its useful life, while depreciation tracks loss in value for tangible assets.

Depreciation and amortization are methods by which you can spread out the cost of an asset over time. These expenses can then be utilized as tax deductions to lessen your company’s tax liability.

Amortization Meaning

Amortization describes the annual depreciation of an intangible asset over the span of its useful life. Examples of intangible assets include:

- Costs of issuing bonds to raise capital

- Customer lists

- Franchise agreements

- Human capital

- Lease rental agreements

- Organizational costs

- Patents

- Trademarks

- Trade names

You can calculate amortization using the straight-line depreciation method. This means that the annual amortization expense you write off each year remains fixed throughout the life of the asset.

The term “amortization” can also apply to concepts outside of accounting, for example utilizing an “amortization schedule” to calculate the principal and interest in a sequence of loan payments. Though these terms refer to two separate ideas, the process is essentially the same. A mortgage loan, for example, will diminish in carrying value as you pay off the balance.

Depreciation Meaning

Depreciation describes expensing a fixed asset over the span of its useful life. Physical assets include:

- Buildings

- Computers

- Equipment

- Machinery

- Manufacturing Facilities

- Office Furniture

- Vehicles

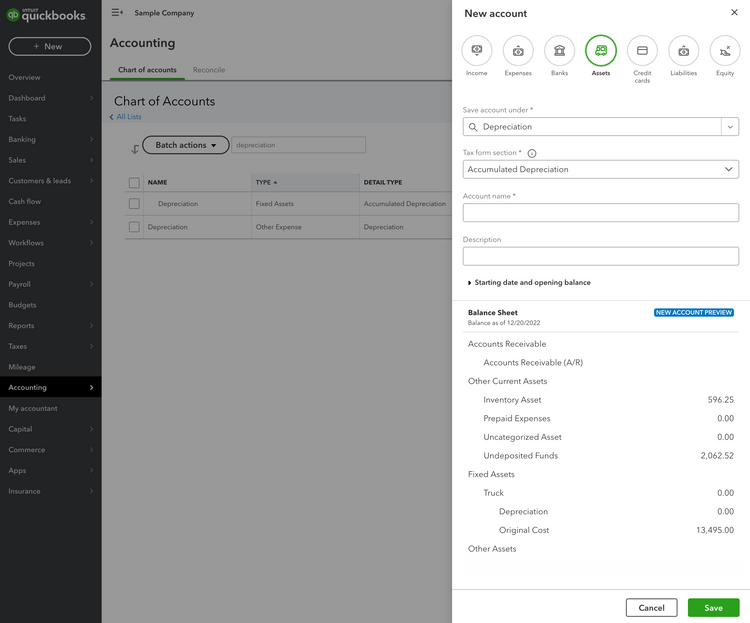

As these assets operate and deteriorate over time, they experience a decline in value. It is often calculated using fixed asset management software. Accordingly, depreciation expenses are recognized as deductions for tax purposes.

The annual depreciation expense you write off each year covers the majority of this loss, with salvage value (or resale value) comprising the remainder. This residual value is not factored into the loss since you can recoup these costs by reselling the resource or property.

Depreciation Methods

Amortization is always calculated using the straight-line method of depreciation. Depreciation, however, can be calculated using straight-line or accelerated methods. For tax purposes, your company can report higher expenses in the early years of an asset’s useful life.

The IRS outlines best practices on recovering the cost of business or income-producing property through deductions.

- Straight-line depreciation

The loss in value is distributed evenly through the asset’s useful lifespan. - Units of production

Rather than calculating the value of the asset, you determine the number of units it will produce over its lifespan. - Declining balance

Loss in value is distributed more aggressively early in the asset’s useful life; to calculate this, multiply the asset’s current book value by a fixed depreciation rate. - Double-declining balance

In this accelerated method, the loss in value is distributed more heavily in the first year of ownership at twice the straight-line depreciation rate; this decelerates over time. - Sum of years digits

An accelerated declining balance method that factors in the economic usefulness of an asset rather than the period for which it is used:

Depreciation Expense =

(cost - salvage value) x # of years left in asset life /

sum of years in asset life

Key Differences

Although both amortization and depreciation calculate the expenses associated with assets over time, there are some key differences between these accounting approaches:

| Method | Depreciation | Amortization |

|---|---|---|

| Type of Asset | Tangible | Intangible |

| Residual Value | Residual salvage value | No salvage value |

| Formula | (Tangible Asset - Salvage Value) / Useful Life | (Cost of Intangible Asset) / Useful Life |

| Purpose | Tracks diminishing value over time | Allocates costs over time |

Value

Amortization uses the straight-line method to determine the decreasing value of intangible assets. Factors that determine these values include market competition or legal expiration. Depreciation, also known as salvage value, considers the value of tangible items after their use. This is affected by their physical condition and use over their lifecycle.

Application

Amortization is applied to determine the cost of intangible assets compared to the revenue they help generate for the business. It’s primarily used when acquiring an existing business. Depreciation only applies to physical assets and is used to help allocate costs over an asset’s useful life compared to the revenue it will generate.

Similarities

Amortization and depreciation both track business assets but also share some other characteristics:

- Recorded as non-cash expenditures on a statement of cash flow (i.e., there are no actual cash expenses made throughout the asset’s useful life)

- Used to calculate the book value of an asset — or the original cost of an item minus accumulated depreciation/amortization

- Documented as reductions in your company’s balance sheet under assets

- Logged as expenses in your company’s income statement

- Recorded as debits in journal entries (Note: Accumulated depreciation and amortization are logged as credits)

Examples

Depreciation Sample - Declining Balance Method

Your manufacturing facility makes a $50,000 purchase for a piece of equipment with a useful life of ten years. The salvage value at the end of its useful life is $5,000, with a depreciation rate of 20%.

Your yearly depreciation amount will be highest in the early years of your asset’s life. This method is ideal for assets like computers, cell phones, and vehicles that are quickly made obsolete by newer models.

| Year | Depreciation Equation | Yearly Depreciation Amount | End-of-Year Value |

|---|---|---|---|

| 1 | 20% x $50,000 | $10,000 | $40,000 |

| 2 | 20% x $40,000 | $8,000 | $32,000 |

| 3 | 20% x $32,000 | $6,400 | $25,600 |

| 4 | 20% x $25,600 | $5,120 | $20,480 |

| 5 | 20% x $20,480 | $4,096 | $16,384 |

| 6 | 20% x $16,384 | $3,277 | $13,108 |

| 7 | 20% x $13,108 | $2,621 | $10,487 |

| 8 | 20% x $10,487 | $2,097 | $8,390 |

| 9 | 20% x $8,390 | $1,678 | $6,712 |

| 10 | 20% x $6,712 | $1,342 | $5,370 |

Amortization Sample - Straight-Line Depreciation Method

Your manufacturing facility secures a patent for $15,000, set to expire in five years. To calculate amortization, use the following formula:

Amortization formula:

Purchase value / useful life

$15,000 / 5 = $3,000 annual amortization expense

Over the next five years, you will write off $3,000 each year to cover the cost of this patent.

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Opening Amortization | $0 | $3,000 | $6,000 | $9,000 | $12,000 |

| Addition | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Cumulative Amortization | $3,000 | $6,000 | $9,000 | $12,000 | $15,000 |