ERP ROI Analysis: Pros, Cons, How to Calculate

ERP software ROI analysis can help businesses justify implementing or upgrading a new system. This analysis measures a business’s financial gains relative to its initial investment.

What is ERP ROI Analysis?

ERP ROI analysis is a process that helps organizations evaluate the financial benefits and drawbacks of implementing an ERP system. The goal is to determine whether the investment will deliver a positive return on investment over time.

Analysis involves estimating costs and benefits and calculating the net financial gain or loss over a defined period, often several years. It ensures that the implementation of an ERP system aligns with business objectives, justifies the associated costs, and provides a framework for ongoing assessment and improvement.

How to Calculate ERP ROI

Consider both tangible and intangible benefits when determining the potential return on your ERP investment. Here’s how:

Identify Tangible Benefits: Quantifiable advantages such as reduced operational costs or increased revenues, such as savings from decreasing labor hours for data entry.

Assess Intangible Benefits: Factors like streamlined processes or improved customer experience aren’t directly measurable, but they’re crucial for business growth.

Contrast Against Projected Costs: Factor in all expenses related to the ERP, including software, hardware, training, and maintenance.

Calculate ROI Use this formula:

ROI = (total value of investment - total cost of investment) / total cost of investment x 100.

Given an example where the ERP’s 5-year benefit is $1,000,000 against a 5-year cost of $500,000:

ROI = ($1,000,000 - $500,000) / $500,000 x 100 = 100%.

This suggests a 100% ROI from the new system.

How to Boost ERP ROI

To maximize the return on your ERP investment:

-

Continuous Training: Equip users with regular training sessions to ensure they leverage the ERP system fully. Well-trained users can increase efficiency, productivity, and data consistency while reducing system resistance.

-

Regular Updates: Stay current with regular system updates. These enhance features, streamline processes, and ensure compliance with evolving industry regulations, minimizing potential legal risks.

-

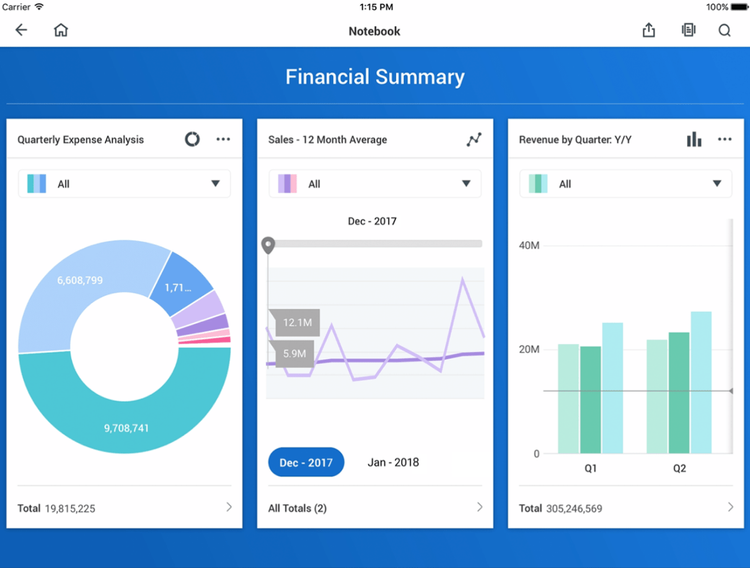

Data-Driven Decisions: Leverage the system’s analytical capabilities to derive actionable insights. With improved analytics, businesses can make precise forecasts, optimize operations, and minimize waste.

Pros

Viewing ERP as a strategic investment rather than a one-time expense can offer valuable insights. Conducting an ERP ROI analysis brings several advantages:

- Objective Metrics: Focusing on tangible financial benchmarks offers a transparent view of the expected returns. Key indicators include operational savings, revenue growth, inventory reduction, and enhanced cash flow.

- Strategic Planning With quantifiable ROI data, leaders can strategize budgets and prioritize business goals. For example, if inventory management yields high ROI, investing further in related modules or features might be beneficial.

- Performance Tracking: Regular analysis allows businesses to measure their ERP’s real-world performance against initial expectations. Significant discrepancies between expected and actual ROI can prompt adjustments, such as enhancing user adoption or refining change management approaches.

Cons

Calculating the ROI of an ERP system provides essential insights. Still, it’s important to recognize that not all benefits are readily quantifiable. Biases or assumptions in the analysis can inadvertently miss long-term advantages.

- Intangible benefits: Advantages like enhanced team collaboration, organizational agility, or employee morale significantly affect the system’s overall value. When such benefits aren’t quantified, decision-makers might undervalue the ERP system’s full potential, potentially leading to under-investment in crucial areas like training or complementary modules.

- Overemphasis on Short-Term: ROI calculations can prioritize short-term gains, overlooking long-term benefits such as cost savings. An ERP system could foster a data-driven decision-making culture, a transformative advantage evident only years later. Relying solely on immediate financial returns can miss these more profound impacts.

- Potential for Bias: Projecting ERP ROI, like other forecasting tasks, can be influenced by biases and unfounded assumptions. For example, a projection might optimistically assume swift user adoption without accounting for potential resistance or training hurdles.

| Pros | Cons |

|---|---|

| Enables strategic budgeting and goal prioritization. | Risks prioritizing short-term gains over long-term benefits. |

| Measures ERP performance against expectations. | May undervalue unquantified benefits, risking under-investment in training or modules. |

| Identifies and mitigates ERP implementation risks. | Susceptible to biases and assumptions. |

| Prioritizes ERP functionalities for implementation. | ROI realization takes about 2.5 years. |

Business Processes with the Highest ROI Potential

ERP systems often yield significant ROI in the following areas:

- Inventory Management: Lower stock levels reduce space needs, offering savings in warehouse rent, utilities, and maintenance. With decreased holding costs, funds previously tied to inventory can be reallocated, enabling investments in other growth areas.

- Order Processing: A streamlined order-to-cash process accelerates cash collection, reducing the day’s sales outstanding (DSO) and enhancing the company’s working capital. More efficient order processing results in fewer errors, saving costs from returns, corrections, and customer service inquiries.

- Human Resources: Effective talent management fosters engaged and well-trained employees aligned with organizational goals. A productive workforce enhances ROI, while increased employee satisfaction and retention reduce costs tied to recruitment, training, and vacancies.

- Financial Management: Faster financial closing provides timely insights into fiscal performance, aiding quick and informed strategic decisions. Enhanced compliance tracking can prevent regulatory fines. Effective cash flow management ensures timely fulfillment of obligations, such as debt or vendor payments, avoiding late fees or penalties.

How long does it typically take to see a return on an ERP investment?

On average, companies realize the return on investment for an ERP in 2.5 years. Larger organizations may sometimes face lengthy implementation or initial user resistance and a learning curve. After implementation, there’s typically a phase of optimization based on actual usage. Moreover, significant financial benefits, like increased revenue, often emerge over extended business cycles, sometimes spanning multiple financial years or sales cycles.

What’s the average rate of ERP implementation failure?

First-time ERP buyers encounter an implementation failure rate of 55% to 75%. Despite thorough planning, many companies find ERP implementations taking 30% longer than expected. Moreover, 45% of ERP projects exceed their original budgets.

Do many users initially resist adopting a new ERP system?

Yes, resistance to a new ERP system is typical, with 82% of employees potentially opposing it. While only 8% of businesses struggle with technical aspects of ERP implementation, 75% identify organizational change as their main challenge.

How do I calculate the ROI of an ERP system?

Use the formula: ROI = (total value of investment - total cost of investment) / total cost of investment x 100. To explore justifying ERP investments further, check out our article on building an ERP business case.

An ERP ROI analysis offers a clear financial picture of the software investment. While benefits are evident, tangible and intangible factors are crucial for a well-rounded view. Diligent research, setting realistic expectations, and ongoing optimization ensure a successful investment outcome.