Guide To Calculating Fixed Asset Depreciation

What is Depreciation?

Depreciation is an accounting practice of allocating the cost of an asset over its useful life. It helps companies maximize profits by:

- Spreading costs over time to increase profits and reduce tax liabilities

- Providing accurate asset valuations to determine the overall value of a business

You calculate depreciation based on how you want to view or evaluate the costs of your assets. This post explains how depreciation works and four methods—along with formulas, use cases, and examples—to help you calculate it.

5 Depreciation Calculation Methods

Depending on the assets you need to evaluate for depreciation, you can choose from five calculation methods.

1 Straight-line Depreciation Method

Straight-line depreciation spreads an asset’s value evenly over its useful life. This method gradually deducts an asset’s cost minus its salvage value (or book value). In some cases, the salvage value can fluctuate, and companies might need to readjust depreciation.

Formula: (asset cost - expected salvage value) / useful life (years)

Best use cases: Furniture, rental properties, and warehouses are fixed assets that lose value consistently.

Example: Your office purchases a $3,500 desk with a salvage value of $500 and a useful life of five years. Over the next five years, you will write off $600 annually to cover the cost of this furniture.

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Opening Depreciation | $0 | $600 | $1,200 | $1,800 | $2,400 |

| Addition | $600 | $600 | $600 | $600 | $600 |

| Accumulated Depreciation | $600 | $1,200 | $1,800 | $2,400 | $3,000 |

2 Declining Balance Method

Declining balance depreciation distributes the loss in value more aggressively in the early years of an asset’s useful life. To calculate the value, multiply the asset’s current book value (minus salvage value) by a fixed depreciation rate.

Formula: (Current book value - salvage value) x depreciation rate %

Best use cases: Computers, cell phones, vehicles, and equipment quickly become obsolete by newer models.

Example: A manufacturing plant purchases machinery valued at $25,000 with a useful life of five years. The salvage value at the end of its useful life is $8,192, with an annual depreciation rate of 20%.

The yearly depreciation amount is highest in the early years of the asset’s life, as shown in the following table.

| Year | Depreciation Equation | Yearly Depreciation Amount | End-of-Year Value |

|---|---|---|---|

| 1 | 20% x $25,000 | $5,000 | $20,000 |

| 2 | 20% x $20,000 | $4,000 | $16,000 |

| 3 | 20% x $16,000 | $3,200 | $12,800 |

| 4 | 20% x $12,800 | $2,560 | $10,240 |

| 5 | 20% x $10,240 | $2,048 | $8,192 |

3 Sum-of-the-Years’ Digits Method

Sum-of-the-years’-digits (SYD) depreciation is accelerated fixed asset depreciation that factors in the economic usefulness rather than the ownership period. This method is commonly used for manufacturing equipment depreciation. As years of wear-and-tear decrease performance, maintenance and repair costs simultaneously increase. By using the SYD method, businesses can take on more considerable depreciation expenses early in the asset’s useful life, offsetting the gradual decrease in usefulness.

Formula: (remaining lifespan / SYD)

Best use cases: Computers, machinery, and equipment have the best economic usefulness early in ownership.

Example: A manufacturing plant purchases a piece of equipment valued at $20,000 with a useful life of five years and a salvage value of $5,000. First, you add the sum-of-the-years’ digits together (5+4+3+2+1) for a total of 15. Then, you divide each digit by 15 to determine the depreciation rate:

Year 1: 5/15 = 33%

Year 2: 4/15 = 27%

Year 3: 3/15 = 20%

Year 4: 2/15 = 13%

Year 5: 1/15 = 7%

| Year | Opening Value | SYD Equation | Depreciation Value |

|---|---|---|---|

| 1 | $20,000 | 33% x $15,000 | $4,950 |

| 2 | $15,050 | 27% x $15,000 | $4,050 |

| 3 | $11,000 | 20% x $15,000 | $3,000 |

| 4 | $8,000 | 13% x $15,000 | $1,950 |

| 5 | 6,050 | 7% x $15,000 | $1,050 |

At the end of year five, the equipment depreciates to its salvage value of $5,000.

4 Units-of-Production Method

Rather than calculating the asset’s value, the units-of-production method determines the number of units produced or hours of service performed throughout a tangible asset’s lifespan. As with declining balance and SYD depreciation schedules, you can expect to see the highest depreciation in the first year and then diminishing depreciable costs over the asset’s useful life.

Formula: (asset cost - salvage value) / units produced OR hours of service over useful life

Best use cases: Tangible assets best suited to the units-of-production framework include high-value equipment, computers, or machinery with a measurable output.

Example: A manufacturing facility invests in equipment with a purchase price of $50,000. The equipment should provide 100,000 total units over five years, and the salvage value is $10,000.

To calculate the amount of depreciation, you subtract the salvage value from the asset cost to calculate the book value. Then, you divide the asset’s book value by the estimated number of units produced.

Book value = ($50,000 - $10,000)

40,000 / 100,000 = 0.4

This value represents an hourly depreciation of $0.40. The equipment will produce 24,000 units in its first year of use.

24,000 x 0.40 = $9,600

Write off $9,600 of depreciation in the first year, $11,200 in the second year, and so on.

| Year | Total Operating Hours | Depreciation Expense | End-of-Year Value |

|---|---|---|---|

| - | - | - | $50,000 |

| 1 | 24,000 | $9,600 | $40,400 |

| 2 | 28,000 | $11,200 | $29,200 |

| 3 | 30,000 | $12,000 | $17,200 |

| 4 | 10,000 | $4,000 | $13,200 |

| 5 | 8,000 | $3,200 | $10,000 |

5 Revaluation Method

The revaluation method assesses the fixed assets’ value at the beginning and end of the year. The difference between these values is the depreciation. Additions or sales of these assets will result in adjustments made to the depreciation figure.

Formula: beginning value + additional purchases - assets sold - ending value

Best use cases: Loose tools, books, and small office machinery are examples of low-value, damage-prone assets. These assets are grouped into one fixed asset account.

Example: Your office purchases a $3,000 printer on January 1, 2022. On December 31, 2022, you determined the value was $2,500. That same year, your office purchased a second, smaller printer for $750. You calculate depreciation in the following way:

| Value on January 1, 2022 | + | Additional 2022 purchases | - | Value on December 31, 2022 | = | Depreciation |

|---|---|---|---|---|---|---|

| $3,000 | + | $750 | - | $2,500 | = | $1,250 |

Can You Defer Depreciation?

Sometimes, companies can skip depreciation for a year. For example, consider a business that exceeds revenue expectations one year and then experiences a drop in revenue the next year. The company can skip depreciation during the more profitable year, deducting the full cost of the assets to reduce tax liability.

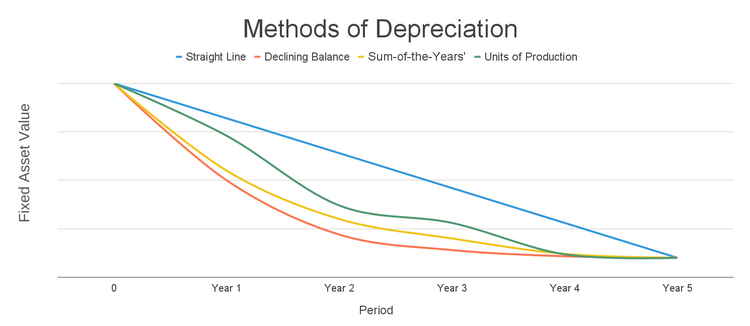

Choosing the Correct Method

Calculating total depreciation for your tangible assets ensures accuracy on your tax returns, shows your business’s capital asset value, and maximizes asset utilization periods. Choosing a suitable method of depreciation for your assets is critical to your company’s longevity:

- Straight line: Consistent depreciation each year.

- Declining balance: Aggressive depreciation in the early years of an asset’s lifespan.

- Sum-of-the-years’ digits: Aggressive depreciation in the early years of the asset’s lifespan.

- Units-of-production: Significantly varied depreciation based on asset’s productivity.

- Revaluation: Depreciation based on the difference between the asset value assessed at the start and end of the year.

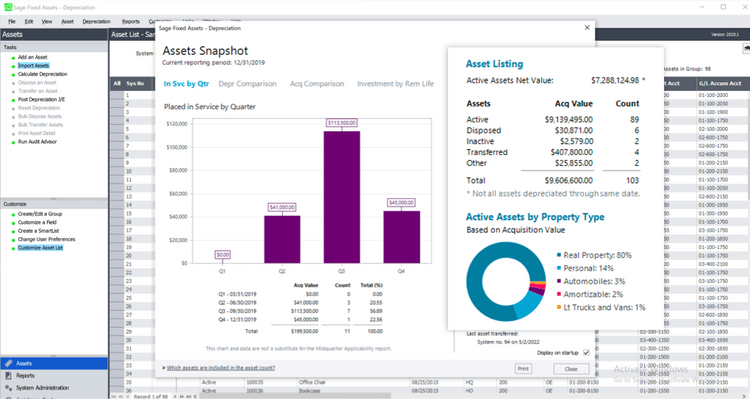

Though complex and time-consuming, these calculations are essential to your business’s financial health. In addition, you can automate fixed asset depreciation with software that tracks purchase costs, valuations, and asset gains and losses.

Frequently Asked Questions

Can I claim depreciation costs on my tax return?

The Internal Revenue Service (IRS) defines depreciation as an annual income tax deduction that allows a business to recoup fixed assets’ costs over time. Use IRS Form 4562 to claim depreciation deductions on your business tax return.

While certified public accountants (CPAs) and attorneys can expedite the tax return process, you are primarily responsible for the overall substantive accuracy of your return.

What is the modified accelerated cost recovery system (MACRS)?

Where can I find depreciation on a balance sheet and an income statement?

Your business logs depreciation as an expense or debit reducing income in the assets section of your balance sheet as in the following example:

Original asset price: $10,000

Less accumulated depreciation: ($4,000)

Book value: $6,000

Your income statement reports depreciation as a normal business expense, or an operating expense if the asset is used in production.

How is depreciation different from amortization?

Amortization writes off the cost of an intangible asset over its useful life, while depreciation tracks loss in value for tangible assets.

Read more: Amortization vs. Depreciation