The Best Real Estate Accounting Software

- Navigable, user-friendly interface

- Basic inventory management capabilities

- Integrates with Shopify, Square, etc

- Intuitive user interface

- Powerful integrations

- Extensive reporting

- Real estate-specific key metric tracking

- Bank feeds to import transactions

- More affordable than competitor products

The best Real estate accounting software should offer income and expense tracking, automatic transaction uploads through bank integrations, and tax report generation. It should also integrate with industry-specific systems like CRM and property management tools, and provide robust financial reporting capabilities.

To help you find the best real estate accounting solution, we’ve conducted research on a wide range of products to put together a collection of our Best Real Estate Accounting Software.

- Xero: Best Overall

- QuickBooks Online: Best for Small Businesses

- Realtyzam: Best Specifically Designed For Real Estate

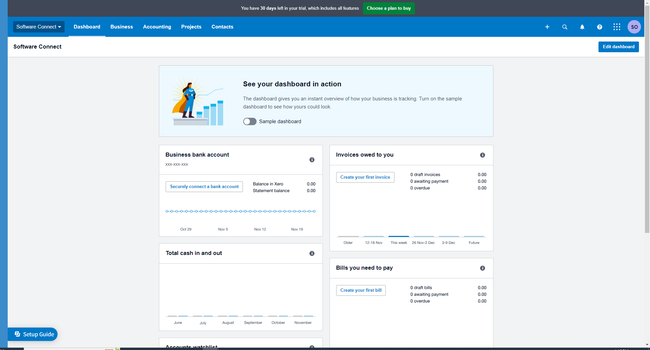

1 Xero - Best Overall

Xero is a comprehensive cloud-based accounting platform. Its features include automated bank feeds, invoicing, bills, expense tracking, project tracking, and financial reporting, all of which can be essential for managing a real estate business effectively.

For real estate businesses, it helps streamline management of rental income, property expenses, and financial reporting. It can also integrate with a variety of other software tools commonly used in the real estate industry, such as property management and CRM systems.

Furthermore, Xero’s cloud-based nature means it can be accessed on any device with an internet connection, which is particularly useful for real estate professionals who are often on the go.

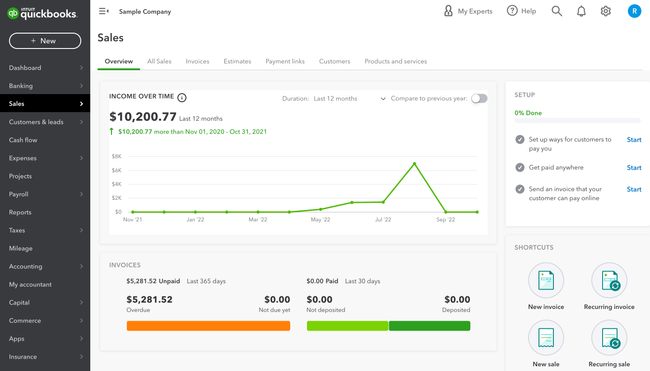

2 QuickBooks Online - Best for Small Businesses

QuickBooks Online is a popular solution for many small businesses. QuickBooks can be used by property managers with few tenants or properties, house flippers, and independent real estate agents to record income from rentals or commission, as well as track expenses from equipment and materials purchased to fix a property or other business expenses.

Real estate agents can even track vehicle mileage from driving between properties to showings for their tax returns. As your business grows, you’ll likely need an industry-specific option to calculate commission percentages and manage real estate contracts.

3 Realtyzam - Best Specifically Designed For Real Estate

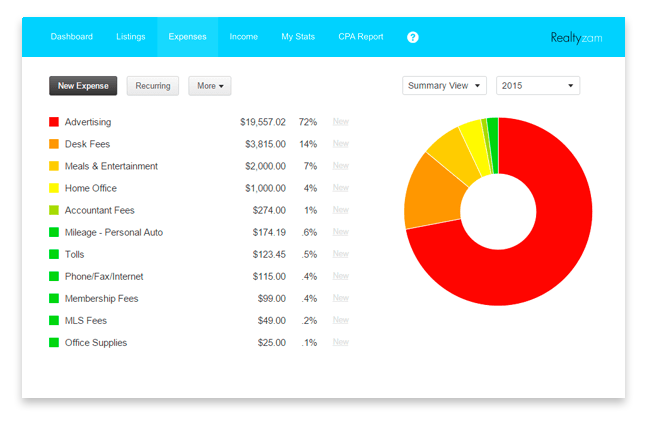

Realtyzam is a specialized accounting software designed specifically for real estate agents, providing a range of features to streamline financial management. It allows agents to track income and expenses, link to bank accounts and credit cards for automatic transaction uploads, and generate tax reports.

Realtyzam also has a receipt upload function, aiding in expense tracking and proper categorization of business costs. Additionally, it provides the capability to generate detailed financial reports, offering insights into financial performance and profitability trends.

The software is cloud-based, enhancing accessibility and collaboration, and it also offers a mobile app for Android and iOS devices, providing convenience for on-the-go access.

What is Real Estate Accounting Software?

Real estate accounting software tracks income and expenses from real estate transactions. This includes commission management, contract management, and financial reporting to brokerages, realtors, real estate investors, property managers, and other real estate professionals.

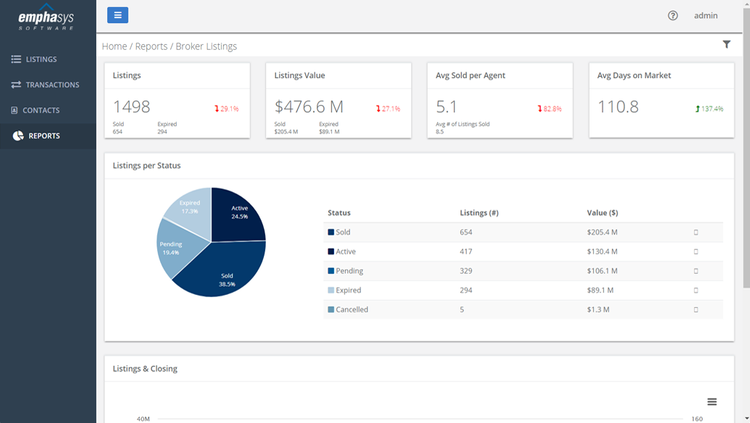

Real estate accounting systems will track income from real estate transactions and rental income. Broker and agent commissions can be managed from the software–set commission percentages and caps as you see fit. The system also tracks business expenses like office space rentals, advertising costs, utility bills, and more. Run reports on income and expenses, the values of active and expired listings, and other key performance indicators.

Real estate accounting software can also assist with contract management. Some contracts you can manage with the software include purchase agreements, assignment contracts, and lease agreements. The system will ensure you’re using the right forms and filling in all required information to manage your real estate transactions.

Real Estate Accounting Software Features

| Feature | Description |

|---|---|

| Core Accounting Features | Track revenue and business expenses in real-time. Modules include accounts payable, accounts receivable, and a general ledger. |

| Commission Management | Calculate commission rates for real estate agents and assign commission caps as needed. |

| Financial Reports | Create reports on real estate transaction values, listing values, overall income and expenses, and more. |

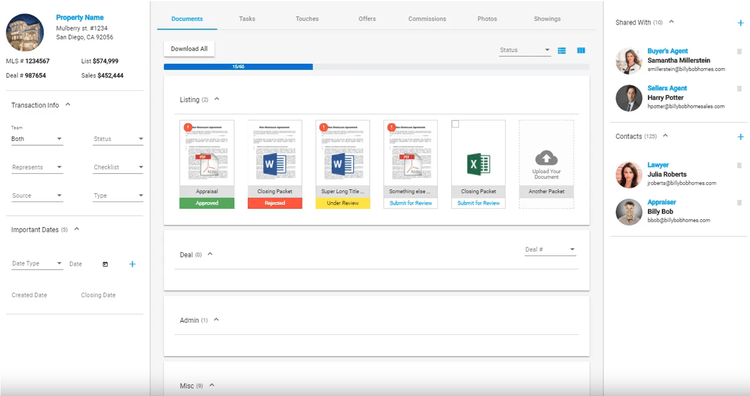

| Contract Management | Upload, edit, and store real estate contracts including purchase agreements, lease agreements, and assignment contracts. |

Commission Management with Real Estate Accounting Software

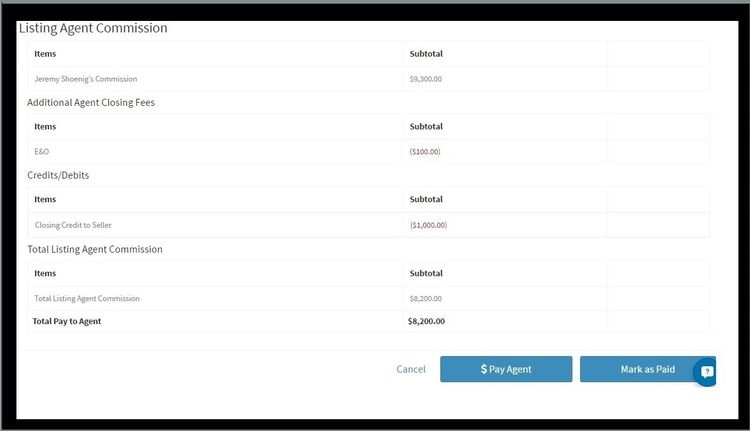

Real estate accounting systems automatically calculate the commission amounts based on the commission rate and the final sale price of the property. The real estate brokers–both the listing broker and buyer’s agent broker–get a percentage of the property’s sale price as commission. The listing broker splits their commission with the listing agent and the buyer’s agent broker splits their commission with the buyer’s agent.

The real estate brokerage typically determines the commission percentage and split rate between the broker and agent. The real estate accounting software allows you to set this percentage for commission calculation. You can also set commission caps for agents.

Accounting solutions will also take into account any taxes or fees that need to be subtracted from the commission total. For example, any self-employment taxes, state and federal income taxes, and fees including dues, MLS fees, advertising costs, and more. The software makes it easy to track income withholding come tax time. This information can also be used to file tax returns.

Financial Reports with Real Estate Accounting Software

Real estate accounting software gives you a better sense of overall ROI and cash flow via reporting tools. Real estate agents and brokerages can monitor the value of any current or expired property listings, as well as a breakdown of property sales values from each agent. Reports can also be run on how long properties have been listed on the market–this is helpful to know if a property isn’t selling well, the value may need to be adjusted.

Property management companies can also use real estate accounting software to run financial reports on income and expenses from rental properties. The reports can give you an overview of rental income, vacant units, and expenses on advertising, repairs and maintenance, and more.

Contract Management with Real Estate Accounting Software

Real estate accounting systems allow you to store, upload and update various types of real estate contracts including:

Purchase Agreements

Purchase agreements define the sale terms between the buyer and seller. The system will ensure all information required by your state is included in the State/Association Purchase Agreement forms. Typically the purchase agreement includes the property’s address, final agreed-upon price, the names and signatures of the buyer and seller, and the closing date.

Lease Agreements

The lease agreement is a contract between a renter and property manager or building owner. The lease agreement will contain the name and contact information of the landlord and tenants, the property address, rental term lengths, rental payment amounts and due dates, security deposit amounts and terms, and dated signatures by the landlord and tenant. The software will also ensure the tenant rights and responsibilities are outlined on the form in accordance with the appropriate state regulations.

Assignment Contracts

Assignment contracts are primarily used by real estate investors. The contract allows the property owner to give the investor the right to buy the property. The investor can sell the right to purchase to another party (the end buyer) for an assignment fee. The end buyer will complete the purchase and acquisition of the property.