BILL Accounts Payable & Receivable

A billing and invoicing software with customizable invoicing, AR/AP management, and mobile app functionality. Formerly Bill.com

Product Overview

BILL Accounts Payable & Receivable is a billing and invoicing software with customizable invoicing, AR/AP management, and mobile app functionality. The platform simplifies managing vendor payments and invoice tracking. Bill.com supports electronic payments via various methods, including ACH, credit card, and international wire transfers. The mobile app allows for easy payment approvals and invoice management.Pros

- Automated invoice creation with customizable templates

- American Express partnership for Vendor Pay

- Mobile app for on-the-go management of payments & invoices

Cons

- Limitations in customizing reports

- Users cite slow response times from customer service

- Cost-prohibitive for smaller businesses with multiple users

Target Market

Small to medium-sized businesses handling a mix of domestic and international payments.BILL is a bill payment platform offering various financial management features:

- Accounts Payable: Approve, pay, and synchronize bill payments.

- Accounts Receivable: Send invoices and expedite payment receipt.

- Credit and Expense Management: Acquire credit, oversee budgets, and control expenses with BILL Spend & Expense, formerly Divvy.

Video Overview

BILL Benefits

- Management of due dates to prevent late payments and leverage discounts.

- Storage of all invoices and documents on BILL servers for easy retrieval.

- Real-time visibility of spending and cash flow for improved financial planning.

BILL Key Features

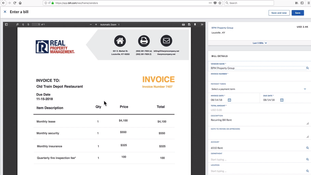

Invoice & Receive

- Create, send, and manage invoices from a computer or mobile phone

- Automate invoice creation to save time

- ACH and credit card payments are deposited directly into a bank account

- Customizable invoices with company branding

Pay

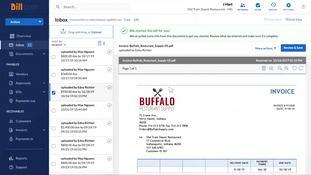

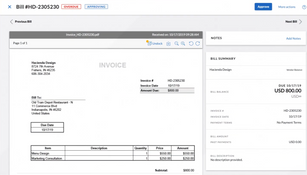

- Uploading, emailing, or faxing bills to BILL

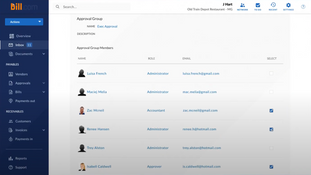

- Assigning bill approvers and allocating departmental expenses

- Scheduling bill payments or using alerts for upcoming dues

- Manage business cash flow

- Integrate with accounting software for data sync

Store & Access

- Central repository for bills, invoices, receipts, contracts, and other company documents.

- Efficient document access and management.

- A real-time calendar displaying daily cash position for better financial planning.

Track & Report

Reporting features in HTML, PDF, or CSV formats include:

- Payables: Overview of past and unpaid bills, vendor-specific amounts due, and upcoming bills.

- Receivables: Detailed insights into amounts owed, customer-specific debts, and aging reports for collections.

- Cash Flow: Monitoring of money movement on specific dates or over selected periods.

BILL AR/AP Pricing

- Essentials - $45/user/month

- Team - $55/user/month

- Corporate - $79/user/month

- Enterprise - Custom Pricing

Starting Price

$45

/user/month

Price Range

Learn More

$ $ $ $ $

$ $ $ $ $

Product Overview

Developer Overview

User Reviews of BILL Accounts Payable & Receivable

No reviews have been submitted. Do you use BILL Accounts Payable & Receivable? Have you considered it as part of your software evaluation process? Share your perspective by writing a review, and help other organizations like yours make smarter, more informed software selection decisions!