Oracle Fusion Cloud ERP

4 Reviews 5/5 ★ ★ ★ ★ ★An ERP software suite designed to automate finance, project management, procurement, and risk management in the cloud.

Product Overview

Oracle Fusion Cloud ERP is a suite offering advanced capabilities like AI automation, real-time analytics, and regular updates. It covers various business functions including financial, project, and supply chain management. This software is designed for businesses looking to streamline operations, enhance efficiency, and reduce IT costs.Pros

- Automated and controlled financial planning and reporting

- Flexible scalability

- No expensive hardware required for deployment

- Pricing starts at $175 per month

Cons

- Additional costs for integrated products

- Basic reporting tools

- High implementation costs

Target Market

Businesses of all sizes, and is known for serving companies with thousands of employees. It’s best for companies seeking a customizable ERP with many integration options.Not Recommended For

Small businesses or startups with limited budgets and simpler operational needs, as the software’s complexity and cost may outweigh its benefits for smaller-scale operations.Oracle Cloud Enterprise Resource Planning (ERP) is an integrated suite of modules assisting with finance, project management, procurement, risk management, and other day-to-day activities. The software can be scaled based on needed applications, user access requirements, transaction volume, and more.

Also known as Oracle Fusion Cloud ERP, this modern cloud ERP suite offers advanced capabilities such as AI to automate manual processes, analytics to respond to market shifts in real time, and automatic updates to maintain a competitive edge.

Video Overview

Main Oracle Cloud ERP Products

- Oracle Financials Cloud: Bundles financials and an accounting engine.

- Oracle Procurement Cloud: Includes sourcing, contracting, procure-to-pay, and supplier management.

- Oracle Risk Management Cloud: Security, audit, and fraud monitoring.

- Oracle EPM Cloud: Enterprise performance management (EPM) including planning and reporting.

- Oracle SCM Cloud: Supply chain planning, procurement, inventory, logistics, and product lifecycle management.

Oracle Cloud ERP Service

Oracle Cloud ERP Service offers an integrated financial management suite designed to automate and control financial processes without the overhead costs of expensive hardware and system management.

The suite provides self-service business applications on an integrated development and deployment platform with tools to rapidly extend and create new services. It is ideal for those seeking subscription-based access to leading Oracle applications, middleware, and database services, all hosted and expertly managed by Oracle. These application services are designed for ease of use, allowing business users to manage the solution directly without IT involvement.

It includes a broad suite of capabilities such as general ledger, accounts payable, accounts receivable, fixed assets, expenses, collections, and cash management, as well as centralized accounting, tax, payment, and intercompany engines.

Features

Some of the key features of Oracle ERP Cloud include:

Financials

- Accounting hub

- Reporting and analytics

- Payables and Assets

- Revenue management

- Receivables

- Collections

- Expense management

- Joint venture management

- U.S. Federal Financials

Project Management

- Project management

- Resource management

- Task management

- Project cost control

- Project billing and contracts

- Grants management

- Analytics

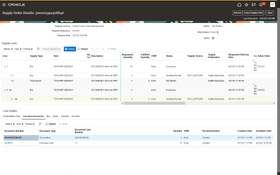

Procurement

- Procure-to-Pay

- Supplier management

- Sourcing

- Contracts

- Business Network

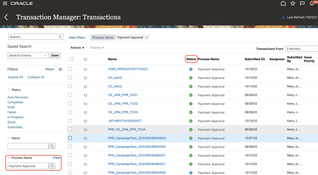

Risk Management and Compliance

- Security design during ERP implementation

- Automated segregation-of-duties compliance reporting

- Continuous user security monitoring

- User access certification workflows

- Continuous monitoring of configuration changes

- Continuous monitoring of critical transactions and payments

- SOX, audit, and certification workflows

- Enterprise risk management (ERM) workflows

Enterprise Performance Management (EPM)

- Planning

- Profitability and cost management

- Account reconciliation

- Financial consolidation and close

- Tax reporting

- Narrative reporting

- Enterprise data management (EDM)

Supply Chain and Manufacturing

- Supply chain planning

- Inventory

- Manufacturing

- Maintenance

- Order management

- Logistics

- Product lifecycle management

- Procurement

- IoT and blockchain

Artificial Intelligence

Oracle ERP Cloud includes built-in artificial intelligence to help businesses predict, detect, and act on new situations. Recent developments include:

- Over 50 AI assistants for answering user queries and automating tasks in finance, supply chain management, and HR

- AI-generated financial performance narratives and predictive cash forecasting

- AI-powered call and chat summarization for Oracle Fusion Cloud Service and Field Service

These core capabilities have existed in Oracle Fusion Cloud for years, but they’re now framed in a more conversational, GenAI-driven experience.

Oracle Cloud ERP Pricing

The standard term length for Oracle Cloud Service subscription services is three years. There is a 10-user minimum.

- Enterprise Resource Planning Cloud Service is $625/hosted named user/month.

- Risk Management Cloud Service starts is $180/hosted named user/month.

- Procurement Cloud Service starts is $625/hosted named user/month.

- Supply Planning Cloud Service starts at $1,250/hosted named user/month.

- Fusion ERP Analytics starts at $450/hosted named user/month.

- Financial Reporting Compliance starts at $175/hosted named user/month.

- Additional financial controls an added $80/hosted named user/month.

- Access controls an added $150/hosted named user/month.

- Contact software provider for more details.

Product Overview

Developer Overview

Related Products

User Reviews of Oracle Fusion Cloud ERP

Write a ReviewCloud-enabled scenario planning

Here are some of my team’s favorite features of Oracle Cloud ERP that help us democratize information and make better decisions:

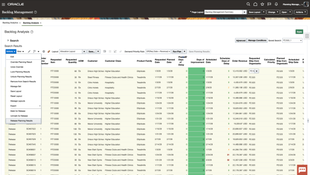

Cloud-enabled scenario planning: With the pandemic, it’s been especially important for us to run multiple scenarios. Different geographies have different quarantine requirements, so our sellers have been impacted in different ways. Oracle Cloud EPM offers powerful scenario planning so we can see how new product launches and existing products might perform under different conditions. And with a single source of truth accessible to everyone, we don’t need to spend time building consensus around the right numbers.

Turnkey reporting: As Square continues to innovate, we’re always looking at user feedback to see how we can improve our products while maintaining profitability. Decision makers need to monitor KPIs without waiting for IT’s help to run reports. With Oracle Cloud ERP, our business users can create and automate their own reports, so they get the data they need to make timely, informed decisions, whenever they need it and wherever they may be working.

Supply chain management: Before migrating to the cloud, we lacked end-to-end visibility into our supply chain. Instead, we cobbled together a number of tools that didn’t offer a complete perspective on costs and revenue. Everything was batch processed, so we weren’t getting real-time visibility into how our hardware products were performing. Meanwhile, coordinating supply across different contract manufacturers around the world was a time-consuming manual process. Now, we can see the levers that drive demand and build a supply chain to quickly meet customer needs in the most efficient and cost-effective manner; this information flows directly into our financials for complete visibility.

Helps us quickly adapt to unexpected conditions

The foundation we’ve built with Oracle Cloud EPM for our budget processes has enabled us to quickly adapt to unexpected conditions, especially when building budgets and financial plans for the coming years. We have been able to model scenarios to increase efficiency, reduce risk, and provide our school leaders with the correct information to allow them to make informed decisions.

Drill-down capabilities and projecting your balances is great

Compared to other systems, the drill-down capabilities and projecting your balances is great. I have not seen that level in other systems before. Integrations between other modules and the GL is great.

It’s a 6-12 months implementation depending on the modules and the complexity of what you’re implementing. 9 months is a target to have something completed in your project, maybe as a phase 1 like financials.

Ahead of the curve with Oracle ERP Cloud

We wanted to be ahead of the curve so we were one of the first to go live on the ERP Cloud Financial system from Oracle.

By utilizing technology, we were able to maintain our efficiency ratio which gives us a huge advantage over our competitors.

We rely on Oracle to develop the best practices rather than follow the best practices.