PlanGuru

2 Reviews 5/5 ★ ★ ★ ★ ★A budgeting, forecasting, and financial planning software designed for SMBs.

Product Overview

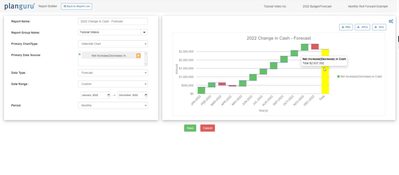

PlanGuru is a forecasting, budgeting, and financial planning software for nonprofits and small to medium-sized businesses. It enables users to create budgets and forecasts for up to 10 years, offering features like cash flow analysis, financial ratios, and integrations with QuickBooks and Xero.Pros

- Budget and forecast for up to 10 years using 20+ standard forecasting methods

- Inegrates with QuickBooks, QuickBooks Online, Xero, and Excel

- Offers numerous training videos

- Includes a free trial and 30-day money-back guarantee

Cons

- Doesn't support Mac computers

- Cloud-hosted version can be a little laggy

- Doesn't offer sample business plan templates

Target Market

SMBs and nonprofits seeking advanced financial planning and forecasting tools, as well as personalized support.Video Overview

Features

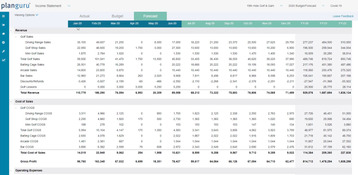

- Automatically integrated balance sheet, income statement and cash flow

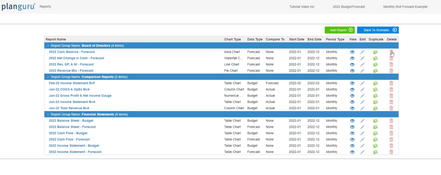

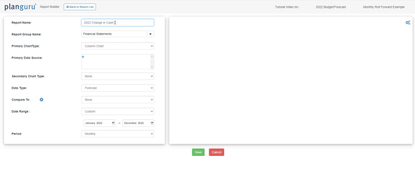

- Customizable financial statements and reports

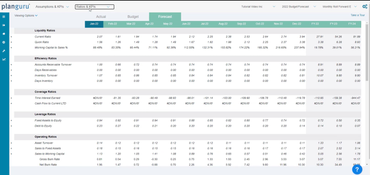

- Automatic financial ratios, including automatic breakeven analysis

- Ability to import from and export to Excel

- Prepare budgets & forecasts for up to 10 years

- Start a financial projection at an interim date

- Unlimited number of companies, budgets, forecasts, non-financial items such as units sold, supporting schedules

- Customization of financial statements and reports

- Integrates with QuickBooks and Xero

- Automatically compute financial ratios and break-even analyses

- Consolidate departments, divisions, and subsidiaries

- Provides over 20 standard forecasting methods

Pricing

PlanGuru offers two plans: Single Entity for SMBs and Nonprofits and Multi-Department Consolidations for businesses with multiple departments, divisions, or locations. Both plans can be billed monthly or annually and come with a free trial and a 30-day money-back guarantee.

- Single Entity: $99/month for one user. Additional users are $29/month.

- Multi-Department Consolidations: $299/month for 3 users. Additional users are $29/month.

Product Overview

Developer Overview

Related Products

User Reviews of PlanGuru

Write a ReviewIt's well worth the fee

Whether you are just now forecasting for a new business or a seasoned professional, this software by PlanGuru is the best in the market. With the amount of time saved and the increased accuracy of my financials, money saved is money earned.

I’ve operated a number of businesses over the years and have only used Excel. The time and effort trying to forecast and verify that your formulas match is a nightmare.

PlanGuru lets me forecast and plan all projects and departments in a few keystrokes. I can enter in my expenses and revenues and enter new estimates within minutes. It used to take hours.

No matter the industry, I thin this is the simplest and easiest way to budget. I chose the launch program and they built all my models for me to get me going. It’s well worth the fee.

The actuals can be incorpoarted into the budgeting forecast

We’re a manufacturer of alluminum castings for various industries. We looked at PlanGuru back in 2010 and we were looking for a product that could help with extended forecasts, that would include balance sheet and cash flows.

We’ve explored Excel as we’ve created many budgets within it in the past, but we never went to the extent of creating balance sheets and cash flows.

We went through some ownership changes and wanted to facilitate what cash we would need. We found PlanGuru to be very helpful with this. The support is good and it’s a very intuitive product. The data was accurate.

Now, we use it to update our budgets and handle rolling forecasts. The actuals can be incorpoarted into the budgeting forecast. The cash flows will reflect our actuals for the first part of the forecast, which helps us fine tune where the cash is coming from.

We can also make assumptions based on what we think our cash will do in accounts payable or accounts receivable. It lets you know what’s happening on a daily basis. I recommend PlanGuru for any company who needs forecasting or budgeting in their business.