The Best Financial Forecasting Software

We evaluated the top financial forecasting software for businesses of all types and sizes, from small financial service companies to enterprise healthcare providers, reviewing features like scenario modeling and AI tools.

- Customizable dashboards

- In-memory data model for faster and more scalable processing

- Supports multiple forecasting models

- Cloud-hosted platform

- General ledger import/export feature

- Easy-to-use by any industry

- Cloud-hosted FP&A platform

- Automates planning, reporting, and consolidation

- Enterprise performance management suite

FP&A (financial planning and analysis) software streamlines strategic planning through forecasting algorithms, budgeting modules, scenario analysis tools, and reporting.

We’ve reviewed 20+ options using our review methodology for the top financial forecasting software on the market today.

- Workday Adaptive Planning: Best Overall

- Budgyt: Best for Small Businesses

- Planful: Best for Professional Services

- Centage: Best for Mid-Sized Companies

- Limelight: Best for Quick Implementation

- Prophix One: Best for Healthcare Providers

- Anaplan: Best for Multinational Corporations

- IBM Planning Analytics: Best AI Tools

- Datarails: Best Scenario Modeling Tool

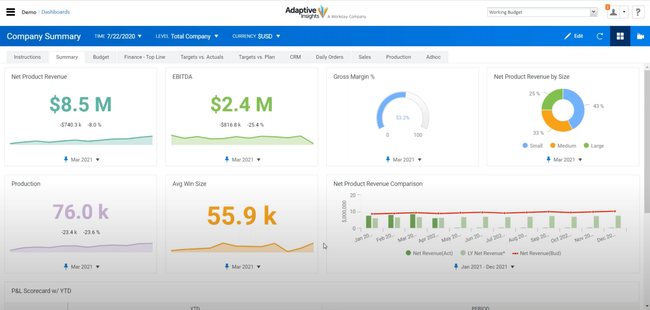

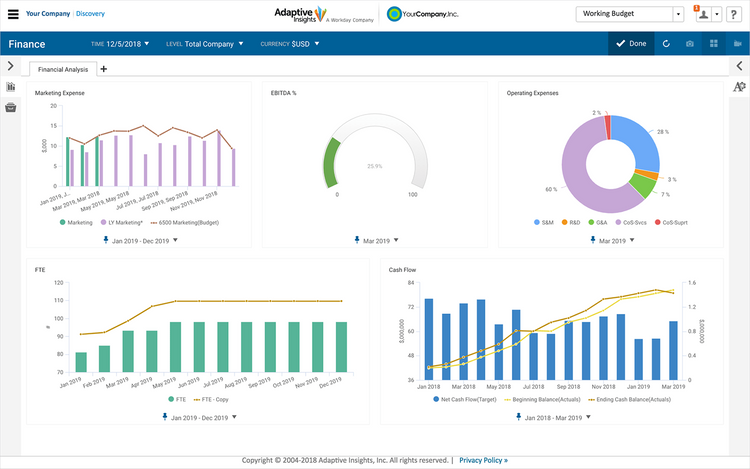

Workday Adaptive Planning - Best Overall

Workday Adaptive Planning’s main edge comes from its ability to transcend traditional siloed systems, allowing businesses to plan, budget, and forecast with agility.

This versatility is underscored by its rolling forecasts, which give businesses a real-time operational view and make reacting to shifts easier. Further flexibility is offered through a gamut of budgeting approaches, from top-down to zero-based, ensuring businesses can tailor the software to their needs. Additionally, Workday delivers predictive analytics and multiple pre-built visualization formats, including heat maps and scatter plots.

Workday integrates with other enterprise-level software like NetSuite and Sage Intacct. While Workday doesn’t provide pricing on its website, we know that the total cost depends on the length of your contract, integrations needed, desired package, and number of user licenses.

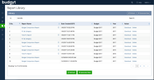

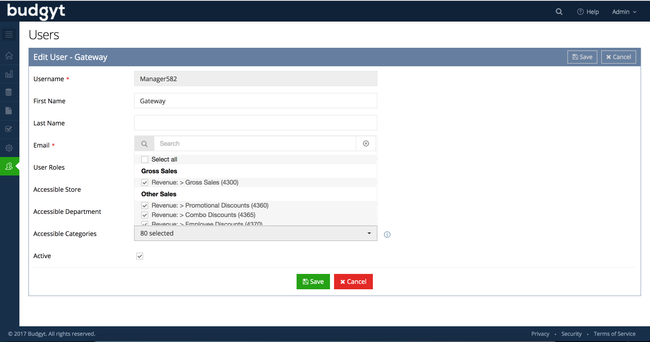

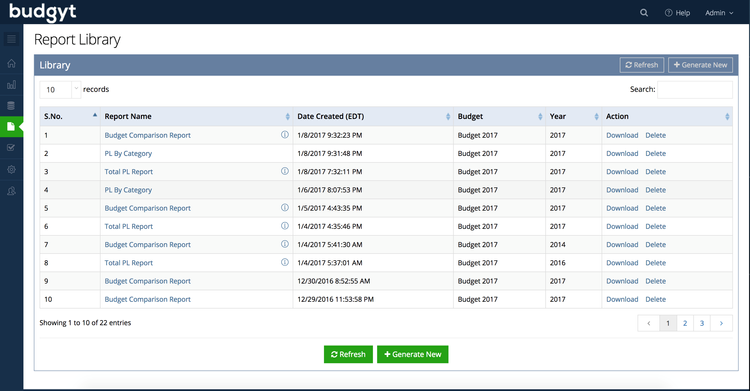

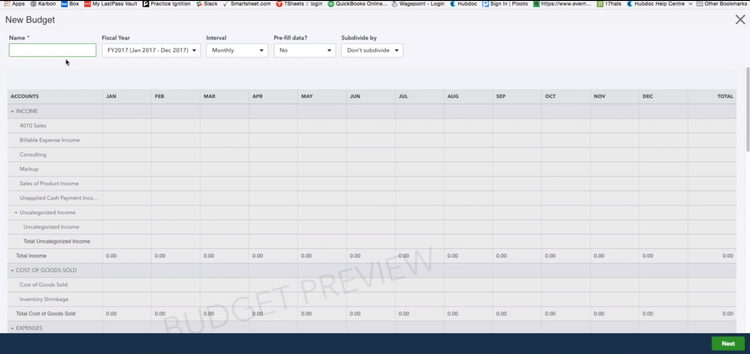

Budgyt - Best for Small Businesses

Budgyt is best for small to medium-sized businesses due to its ease of use and quick setup, ideal for smaller teams. Implementation spans five to ten days for most companies, minimizing disruption and downtime. Plus, it’s usually the next logical step from cumbersome spreadsheets, offering a more automated and reliable budget creation process.

This solution rolls up individual budgets and delivers comprehensive reports. Budgyt simplifies budgeting by allowing companies to consolidate based on department, sub-department, or entity. Additionally, its formulas are designed to handle structural changes across multiple departments without needing to learn codes or syntax.

Budgyt easily integrates with existing accounting software, like Xero and QuickBooks Online. However, users report issues with tedious item code tracking and slow data import from QuickBooks. These drawbacks could be time sinks for small businesses using QuickBooks, especially those with limited time and resources.

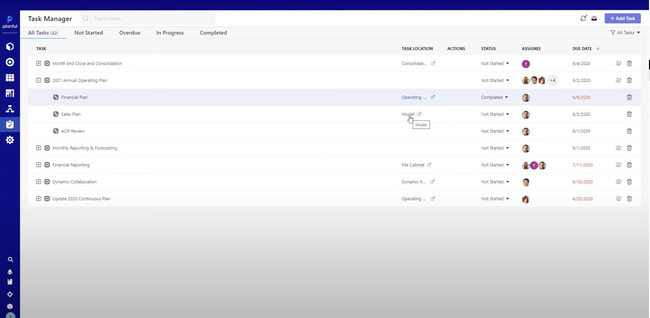

Planful - Best for Professional Services

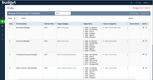

Formerly known as Host Analytics, Planful is a cloud-based FP&A suite specifically designed for continuous planning. It’s ideal for professional services like consulting and accounting firms because it handles project-based budgeting. Using flexible modeling and scenario analysis, the software helps plan projects down to resources and deliverables.

Planful helps automate financial close, reporting, and compliance with GAAP and IFRS standards. Users can also customize dynamic reports with drag-and-drop dimensions, attributes, and report sets on the page, row, and column axes. Additionally, the software’s planning tools enable interactive queries, financial modeling, and spotlight reporting.

However, Planful occasionally experiences performance issues when retrieving or processing large data sets. Finally, setting up the software requires either direct implementation assistance from Planful or from a consulting firm within their partnership network.

Centage - Best for Mid-Sized Companies

Centage is best for medium-sized enterprises, particularly in construction and real estate. This choice stems from its tailored tools for project financial modeling and capital expenditure planning. The system also simplifies budgeting processes, making it ideal for managing large budgets and numerous line items in these sectors.

By leveraging built-in financial intelligence and business rules, Centage minimizes the risk of errors. Any adjustments to estimates or assumptions are automatically reflected, ensuring consistency across the board. Moreover, it supports multiple currencies, entities, and users, catering to businesses with diverse operations or managing several projects concurrently.

With 50 customizable reports that comply with GAAP and IFRS standards, Budget Maestro offers a comprehensive solution. However, due to its advanced features, new users may need time to implement the system and fully grasp its functionalities.

Limelight - Best for Quick Implementation

Limelight is a cloud-based FP&A system built to get teams up and running in weeks, not months. Its rapid deployment is driven by a library of prebuilt planning templates, removing the need to build custom models from scratch. Templates are available for industries like nonprofits, education, professional services, manufacturing, and healthcare, and include standard models for expenses, revenue, and workforce planning.

Limelight also offers native integrations with major ERPs like Sage Intacct, NetSuite, and Microsoft Dynamics, allowing for real-time data syncing that works. Its Excel-style interface shortens the learning curve for finance teams switching over, and tools like user permissions and controls streamline collaboration for tight planning cycles.

While some users have noted occasional slowdowns with complex dashboards, Limelight stands out for how quickly teams can launch financial planning models. It’s a strong fit for companies prioritizing speed to market without compromising functionality.

Prophix One - Best for Healthcare Providers

Prophix One offers national and global healthcare providers a consolidated dashboard to view essential KPIs. These include:

- Average Census and Occupancy Percentage

- Revenue by Region

- Revenue by Service

- Payer Mix (Medicare, Medicaid, etc.)

The dashboard pulls data from every channel, like your EHR and medical billing platforms, so you can see it all in one place. It’s a great way for large, multi-entity providers to eliminate data silos and gain a broad overview of intercompany financials.

You can also drill down into specific financial reports to gain deeper insight into just one hospital or facility. Using ad hoc analysis, compare budgets to actuals at the department level to see exactly what’s causing revenue variance. You can then adjust the forecast, which will automatically update throughout the system. This lets you stay flexible at the granular level, even if you’re an enterprise operation.

Unfortunately, Prophix does not disclose prices publicly, so you’ll need a custom quote for exact pricing. Because of the platform’s size and depth, it’s only suitable for large to enterprise-size healthcare organizations with over 200 employees.

Anaplan - Best for Multinational Corporations

The Anaplan Connected Planning platform is ideal for multinational corporations needing multi-geographical financial modeling. The system supports multi-dimensional planning across time, location, product, customer, currency, or expense. In this way, Anaplan connects data, people, and plans throughout an organization, enabling large and fast-growing businesses to make informed decisions in real time.

While traditional BI systems only focus on historical data, Anaplan’s modeling engine evaluates the expected outcomes of different decisions before implementing them. This provides a combination of backward and forward-looking data for more precise decision-making. The platform’s Hyperblock engine, capable of detailed planning at various levels of granularity, adds to its appeal by enabling “high-fidelity planning” based on real-time data.

There are three pricing plans, but prospective buyers must request a quote for exact details. Due to its complexity and cost, we don’t recommend this software for smaller organizations with under five users.

IBM Planning Analytics - Best AI Tools

IBM Planning Analytics offers an AI-driven BI tool for financial services and banks. It can handle budgeting, forecasting, and basic planning but also supports more advanced predictive modeling, integration with statistical packages, and report-sharing tools.

IBM Planning Analytics provides scoreboards and dashboards, personal and multidimensional scenario modeling, and real-time data access. This includes internal and external data from ERP and CRM systems. IBM Planning Analytics also provides automated visualizations and integrates with Excel, SAP Business Warehouse, Oracle Hyperion, and TM1.

Planning Analytics lacks a dedicated mobile app. Although generating reports is relatively straightforward, creating advanced calculations and reports requires some technical expertise. We also found a number of user reviews describing the UI as complex and challenging to learn.

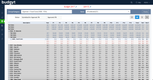

Datarails - Best Scenario Modeling Tool

Datarails’ scenario modeling feature allows you to generate and compare multiple scenarios within a single Excel-based framework. This addresses one of the biggest pain points in FP&A: tracking and comparing financial outcomes across different business environments. You’ll have greater agility when responding to unexpected market shifts, all without having to manually update multiple Excel sheets.

Start by creating a centralized assumption table; here you can define key variables like expected sales growth, economic factors, and cost changes. You can add different layers of assumptions based on department or region, providing flexibility to the model at both a macro and micro level.

You can then create and label distinct scenarios like best case, most likely, and worst case. These segmented views of the core model have different assumptions applied to each. By clicking the filtering function, you can quickly switch between scenarios for quick comparisons.

All scenario data is live, meaning if you change one assumption, you can see its impact cascade across all scenarios with a simple refresh. Plus, dynamic visualization tools like graphs and dashboards present complex scenarios to stakeholders in a digestible format. Just export these scenarios directly into your PowerPoint slides or PDFs for a more professional presentation.

Unlike lighter platforms like Budgyt, Datarails offers complex financial planning, making it ideal for larger companies with intricate FP&A needs. This added complexity comes at a higher cost, with pricing starting at $1,250/month.

What is Financial Forecasting Software?

FP&A software helps businesses create and manage financial plans, and predict future revenue and expenses. It centralizes forecasting activities, making it easier for department managers and accountants to collaborate.

The software typically offers advanced features like scenario modeling and integrates with other systems such as accounting software and ERP systems. It’s often part of larger corporate performance management suites but tends to focus more on financial planning rather than proactive KPI management. By automating data import and reminders, the software minimizes human error, improves data reliability, and streamlines the budget approval process.

Budgeting vs. Forecasting Software

While both budgeting and forecasting software aim to inform financial decision-making, they serve different functions and rely on distinct methodologies.

- Budgeting software focuses on setting financial targets based on historical data and current commitments. It helps businesses plan how to allocate resources—like salaries, overhead, and marketing spend—across departments. The budget acts as a roadmap, guiding the company toward its financial goals for a specific period.

- Forecasting software predicts future financial performance by analyzing a range of variables such as historical data, market trends, and economic indicators. Unlike a budget, which is often fixed, forecasts are more fluid and can be updated as new information becomes available. This allows businesses to adapt to changing conditions, like market volatility or unexpected expenses.

For instance, a company might budget for $20M in revenue but later find that the forecast predicts only $18M. With this insight, the company could decide to cut variable costs or adjust its expense plan to meet cash targets.

A budget sets your financial targets and allocates resources to meet them, while a forecast uses real-time data to predict future outcomes. Budgets serve as a performance baseline, and forecasts help businesses adapt and fine-tune their financial plans.

Can Budgeting and Forecasting Software Handle Demand Planning?

These solutions are sometimes confused with sales forecasting software, which specifically predicts expected sales. If you need a way to measure inventory metrics to forecast customer demand, you’re better off looking at demand planning software.

Key Features

The two key features offered by financial forecasting software include:

- Budgeting: Calculate what your company’s budget(s) should be based on historical data and future projections

- Forecasting: Make future projections on how funds should be allocated at your company

Accurate financial modeling cannot truly be achieved without both budgeting and financing, hence why they so frequently operate together as one software. The key difference lies in their intended purposes: budgets try to determine what a company can afford to spend, while forecasts predict potential income. Since both are aimed at improving business financials, they have features like:

| Functionality | Purpose |

|---|---|

| Departmental forecasting | Departmentalized forecasting provides the ability to create hierarchically categorized budgets organized by units such as business department, location, or cost center; can be extra specific to differentiate budgets for multi-company or multi-department projects |

| Budgeted versus actual comparisons | Compare budgeted figures versus actuals by comparing imported general ledger data against income or profit/loss statements; enable real-time monitoring of corporate performance against goals |

| Collaborative forecasting | Support document management functionality to allow multiple individuals to contribute to forecast creation |

| Approvals | Allow for the authorization of operational planning budgets by users at predefined user privilege levels |

| Version control | Use versioning capabilities to create non-destructive storage of multiple versions and track document changes to forecasting plans |

| Rolling budgets | Generate dynamic revision/extension of budgets for a consistent period of time from the present moment for real-time accuracy |

Benefits

Financial forecasting software streamlines planning by providing accurate forecasting data, reducing human error. It helps you make informed decisions based on KPIs and forecast demand, revenue, and expenses.

Key Benefits:

- Accurate Forecasts: The software combines historical data and expert input to create reliable financial projections. It replaces rough estimates with detailed, error-controlled calculations, letting you compare actuals against predictions.

- Time Savings: Skip the labor-intensive, error-prone manual budgeting on Excel. Reuse past data and import directly from accounting software like your general ledger. Auto-fill features prevent mistakes that come from manual data entry.

- Real-Time Adjustments: Adapt budgets for unforeseen events like inflation on the fly, saving you the hassle of time-consuming recalibrations.

- Cost-Efficient: Software minimizes errors and saves executive time, effectively reducing costs.

- Enhanced Collaboration: Forecasting software centralizes data for team access. It integrates well with enterprise performance management systems, keeping departments aligned on financial goals.

Financial Forecasting Methods

The most well-known financial forecasting methods compile important information about past, current, or upcoming financial decisions.

Static Budgets vs. Rolling Forecasts

Static Budgeting: Static budgets are typically set once a year and are not intended to deviate for the remainder of the budget period. Before the year starts, an estimate of the upcoming fiscal year’s expenses and revenue is formulated.

- Rolling Forecasting: Rolling forecasts predict revenue and expenses over a set period of time. The time period continuously rolls over to always cover the same timeframe (i.e. 12, 24, or 36 months). The predictions are based on year-to-date results and your original budget. Rolling forecasts are constantly updated to reflect events and sudden changes in your business.

Regardless of method, templates included with budgeting and forecasting software make it easy for users to compile the resulting data into visualizations that can be shared with key decision-makers throughout the financial planning process.

Does Financial Forecasting Software Work For Small Businesses?

- Startups and small businesses should look for a lower-cost forecasting solution that will help them manage and track revenue and expenses. Most startups won’t have historical data, so forecasting functionality isn’t a requirement. If you already have an accounting software system in place, you’ll also need a solution that will easily integrate with it.

- Mid-market companies should look for a software solution with predictive forecasting and financial reporting capabilities so you can better track business workflows to plan ahead.

- Large enterprise-level businesses with multiple departments or facilities to manage should look for software featuring departmentalized and collaborative forecasting. The former creates a separate forecast to track and report on the financial progress of specific departments or locations. The latter allows multiple individuals to contribute to the creation of budgeting plans—particularly useful if you have multiple locations worldwide.

Types of Forecasting Software

Forecasting software comes in various flavors, each designed to tackle specific aspects of business operations and planning. Here’s a breakdown:

1 Financial Forecasting Software

Financial forecasting software focuses on projecting your company’s financial health, diving deep into revenue estimates, budgeting, and expenses. It’s a staple for finance teams but can also be a standalone feature within broader accounting software.

Key Functions:

- Revenue projection

- Expense planning

- Budget management

2 Sales Forecasting Software

Sales forecasting software uses historical sales data to set realistic sales targets, helping you adapt your marketing strategies like discounts or bundling. It’s not just for the sales team–supply chain folks use it to plan inventory and production.

Key Functions:

- Accurate sales targets

- Marketing strategy analysis

- Inventory planning

3 Demand Forecasting Software

Demand forecasting software zeroes in on consumer behavior and market trends, letting you adjust your inventory before demand peaks or valleys hit.

Key Functions:

- Consumer behavior tracking

- Seasonal demand planning

- Inventory optimization

4 Capacity and Workforce Forecasting Software

Capacity and workforce forecasting software integrates demand and sales projections to help you determine staffing levels, workflow, and even production capacity.

Key Functions:

- Staffing level optimization

- Workflow planning

- Production capacity planning

5 Enterprise Resource Planning (ERP) Software

The jack-of-all-trades, ERP software can do a bit of everything. It combines features of many other types of forecasting software into one platform but usually comes with a hefty price tag.

Key Functions:

- Centralized planning

- Comprehensive feature set

- High configurability

6 Specialized Software

Specialized forecasting software targets unique needs like cash flow, revenue, or budget-specific forecasting.

- Cash Flow Forecasting Software: Gives you the play-by-play on money coming in and going out.

- Revenue Forecasting Software: Makes educated guesses on your future earnings based on past revenue.

- Budget Forecasting Software: Helps you sketch out your financial game plan by projecting future budgets.

Can QuickBooks Handle Financial Forecasting?

QuickBooks, a popular accounting solution, can handle basic forecasting. Startups and small businesses looking to move away from Excel spreadsheets can use this to set up budgets and then monitor current and historical data for the business’s revenue and expenses.

Pricing Guide

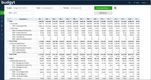

Pricing for financial forecasting systems varies based on your business size and the number of users you need. Some offer per-user models, while others have tiered packages that add more features as you upgrade. Generally, software is priced as follows:

| Tier | Company Size | Average Cost per Year | Example Software Products |

|---|---|---|---|

| Low Tier | 1–10 employees | $2,000–$8,000 | PlanGuru, Budgyt, Jirav |

| Mid Tier | 10–50 employees | $8,000–$30,000 | Centage Planning Maestro, Dynac CPM, Vena |

| High Tier | 50–200 employees | $30,000–$100,000 | Prophix One, Workday Adaptive Planning, Cube |

| Enterprise Tier | 200+ employees | $100,000+ | Anaplan, Oracle Cloud EPM, SAP Analytics Cloud |