The Best Business Budgeting Software

Budgeting software makes managing finances easier, whether you’re running a retail store or manufacturing products. We’ve reviewed a range of tools with features like QuickBooks integration, advanced forecasting, and support for different budgeting scenarios–whether it’s top-down, bottom-up, or zero-based.

- Cloud and on-premise implementation

- Spreadsheet-style interface

- Supports all types of financial and non-financial budgeting

- Budget and forecast for up to 10 years using 20+ standard forecasting methods

- Inegrates with QuickBooks, QuickBooks Online, Xero, and Excel

- Offers numerous training videos

- Automates planning, reporting, and consolidation

- Integrates with QuickBooks, Sage Intacct, etc.

Business budgeting software includes tools such as strategic planning, projections, budgeting, data automation, and team collaboration. We used our advanced review methodology to evaluate top solutions for businesses of all sizes.

- Prophix: Best for Enterprises

- PlanGuru: Best for Small Businesses

- Planful: Best AI-Driven Tools

- OneStream: Best for Corporate Finance

- Datarails: Best for Mid-Sized Companies

- Workday Adaptive Planning: Best Scalability

- Budgyt: Best Usability

- Planning Maestro by Centage: Best for Multi-Location Companies

- Anaplan: Best Sales Module

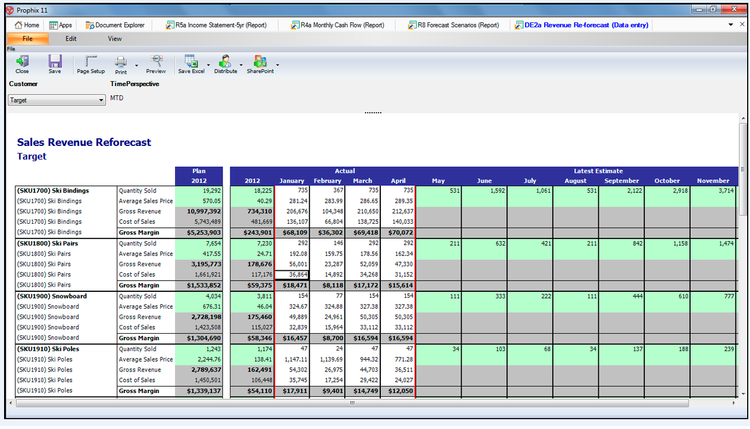

Prophix - Best for Enterprises

Prophix is an effective budgeting software for enterprises due to its features designed to streamline complex processes. These include Online Analytical Processing (OLAP) technology, as these databases are built to handle large amounts of information typical for larger companies. Enterprises can use this tech for multi-dimensional planning across business variables, from account type to organization, on a spreadsheet-style interface. It also automates data collection and consolidation with top-down and bottom-up capabilities for greater flexibility in budgeting.

The software fosters team collaboration, offering functionalities like task ownership and deadline reminders to keep everyone aligned. Additionally, Prophix uses AI to automate reporting and provide deep data insights, freeing up more time for managers. It also features automated maintenance and updates, providing actionable insights through personalized dashboards. While its tools are effective, we don’t like that Prophix’s pricing details are not readily available.

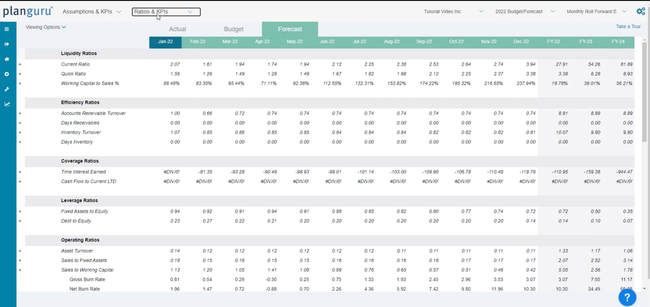

PlanGuru - Best for Small Businesses

PlanGuru works best for small businesses that require effective budgeting and planning tools on a limited budget. It features cash flow projections, financial ratios, and debt modeling, allowing users to manage budgets using real-time cash flow data. Companies graduating from Quickbooks Online can easily integrate into PlanGuru, ensuring a smooth transition.

PlanGuru is one of the most affordable budgeting software on the market. Its annual plan for a single-entity business is $83/month. For multi-department companies, it’s $250/month billed annually. However, it does have its flaws; the interface is slightly outdated, and modules lack scalability as the business grows.

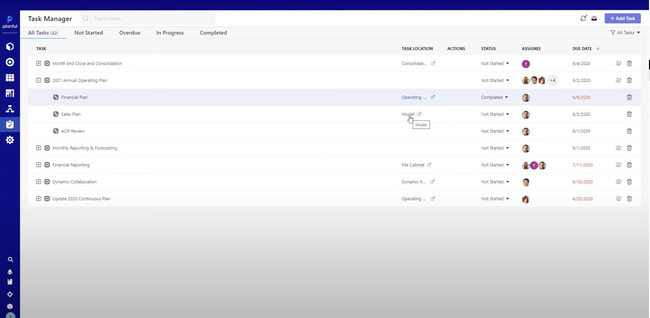

Planful - Best AI-Driven Tools

Planful, formerly Host Analytics, offers the built-in Predict Suite, which blends artificial intelligence with forecasting tools. These tools shift your company from reactive budgeting to a continuous planning cycle, helping your team spot trends and anomalies early for quick resolution.

First, Planful Predict: Signals tool uses AI to scan budget lines for discrepancies that deviate from historical patterns. For example, with just a click, the “Check All Lines” function highlights any unexpected variances across your budget. Click on the flagged numbers to drill down into the Signal Context screen, where historical actuals, forecasted data, and variance are all displayed for comparison.

From there, it’s easy to leave questions for budget owners or tag colleagues. You can also select the “Resolve Signals” option to show this is a known issue, whether it’s a clerical error, formula miscalculation, or immaterial difference. Integrating AI into the budgeting process means your finance team can spend less time manually combing through reports and spreadsheets for errors, which means shorter planning cycles.

Additionally, the Planful Predict: Projections feature leverages AI to analyze your past data with as little as three years of trends. Then, you can automatically fill budget cells with predictions using historical trends and auto-creating baseline forecasts for expenses, revenue, and workforce planning.

With such granular features, Planful can cost anywhere from $15,000 to $20,000 per year, making it more applicable for mid-market companies.

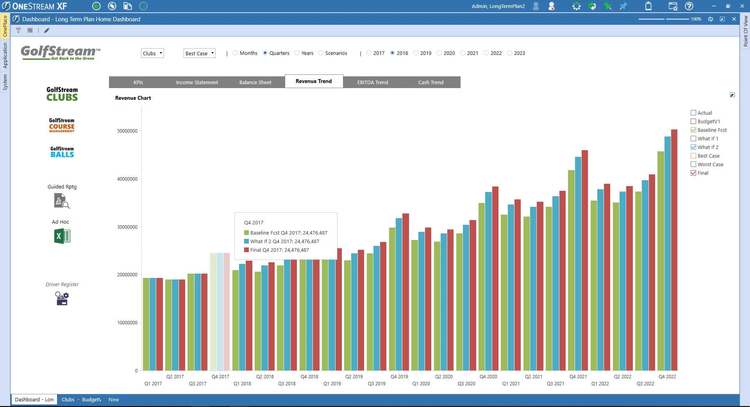

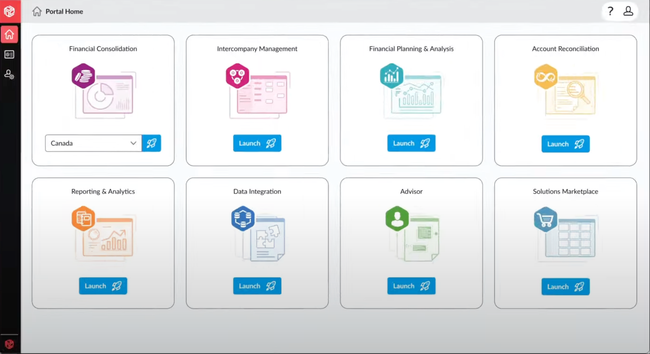

OneStream - Best for Corporate Finance

OneStream is a good choice for corporate finance because of its features that support extended Planning and Analysis (xP&A) across multiple departments like sales, marketing, and supply chain. The software offers a unified platform for data-driven insights, allowing continuous planning and performance management. Features like agile planning and scenarios help corporations adapt to market changes, while its predictive analytics instantly generate budgets and forecasts without requiring technical expertise.

We also like Onestream’s “extensible dimensionality” tool, which enables granular operational plans to coexist with corporate and line-of-business plans, providing a comprehensive solution for complex corporate financial needs. Its “what-if” driver-based planning immediately displays the impact of decisions, enabling faster and more decisive choices. However, new users may be overwhelmed during the initial setup because of the abundance of features and complex dashboards.

Datarails - Best for Mid-Sized Companies

Datarails best offers financial planning and analysis (FP&A) tools and project collaboration. It automates tasks like preparing balance sheets and cash flow statements while consolidating data from all departments into one place. The consolidation helps growing businesses save time and resources by analyzing metrics like sales or key variance drivers.

For businesses that don’t wish to leave Excel, Datarials Flex is a direct Excel add-in for FP&A. It includes analysis tools such as variance analysis and drill-down without leaving the program. This feature also helps with onboarding, as users can keep all existing spreadsheets without moving them. Datarails isn’t the best fit for enterprises, as it can have issues handling large data volumes.

Workday Adaptive Planning - Best Scalability

Workday Adaptive Planning provides versatile planning capabilities and real-time adaptiveness. It supports expansion and can handle complex data inputs from organizations with thousands of users. The software breaks down silos with features like rolling forecasts and various budgeting approaches (top-down, bottom-up, incremental, and zero-based), allowing for a more cohesive and agile planning process.

Its driver-based expense planning and seamless integration with other enterprise solutions ensure effective, real-time data visualization. We like its different planning modules, which include financial, workforce, and operational, enabling businesses to gain insights into all facets of the company. One downside is that the initial implementation can be time-consuming while creating complex business models.

Budgyt - Best Usability

Budgyt has a user-friendly interface and solid budgeting features, making it ideal for small—to mid-sized businesses. All data can be controlled from one place, enabling easy navigation. Also, it hyperlinks all budgeted data so users can search for specific terms. Budgyt exports all reports to Excel and formats them into particular categories, like departments.

Additionally, Budgyt allows unlimited users on every plan, allowing collaboration from every department and team member. It also automates budget creation and tracking processes, saving businesses time and reducing errors caused by manual data entry. One sticking point we found is that due to its organizational tools, users may need to clean up their data while entering it into the system.

Planning Maestro by Centage - Best for Multi-Location Companies

Why We Chose It: Planning Maestro, previously known as Budget Maestro, efficiently consolidates P&Ls for multi-location businesses. It offers data integration with real-time access and allows businesses to view all P&Ls in one place. This is ideal for multi-entity companies such as hotel chains gathering financial data from dozens of different properties.

In addition, its forecasting model is quite effective. It offers testing and predicting multiple scenarios, evaluating budgets, and visualizing financial data. Its forecasting tools help businesses predict outcomes and set realistic budget goals. While its tools are helpful, a significant downside to Centage is audit trails are only available in the most expensive “enterprise” plan.

Anaplan - Best Sales Module

Anaplan offers strong budgeting and planning modules, as well as its other features that go beyond, such as sales, marketing, and compensation modeling. Specifically, the sales module lets businesses gain insight into sales performance with models using specific metrics like account size, individual rep history, and account potential.

Anaplan’s long-range planning and scenario modeling can help companies predict their financial future based on data. Its xP&A feature lets enterprises consolidate financial information into one place, allowing CFOs to make more educated decisions. Anaplan best suits enterprise-level businesses, as it offers extensive features at a high price tag.

What is Business Budgeting Software?

Business budgeting software is a digital tool designed to automate and streamline the budgeting process. It provides a centralized platform for financial planning, tracking income and expenses, and forecasting future financial scenarios.

Unlike traditional methods such as spreadsheets, which are often error-prone and time-consuming, these tools offer advanced features like real-time data updates and integration with other financial tools to make financial management more accurate and efficient.

How to Choose Software

Choosing the correct software for your business hinges on several factors, including features, pricing, scalability, financial complexity, and integration options.

Don’t forget to take advantage of free trials and discounts, evaluate the complexity of your finances, and review integrations to find the best fit for your business.

- Ease of Use: Look for interfaces that are intuitive and don’t require a steep learning curve. You don’t want to spend weeks training your team to use the software.

- Integration: The ability to sync with other tools you’re already using (like QuickBooks or even Excel) is a big plus. The smoother the integration, the less hassle you’ll have transferring data.

- Scalability: You want software that will grow with you. If you’re a small business now but plan to expand, choose software that offers additional features you can unlock as you grow.

- Customization: The software should allow you to customize reports, dashboards, and other features according to your needs.

- Real-Time Updates: Real-time data can provide you with the most current financial picture, which is crucial for making informed decisions.

- Affordability: Watch out for hidden costs like set-up fees, additional charges for premium features, or limits on the number of users. Get a full understanding of the pricing model.

- Security: Your financial data is sensitive. Ensure the software follows best practices for data encryption and security protocols.

- Customer Support: Effective customer support can make the transition much easier, especially if you’re new to budgeting software.

- Trial Period: A free trial period or a money-back guarantee can give you peace of mind and ensure the software suits your needs before fully committing.

Key Benefits

- Automated Data Collection: Say goodbye to manual data entry. These tools pull in financial data automatically, reducing the chance of errors.

- Comprehensive Reporting: Generate budget variance reports, cash flow forecasts, and other key performance indicators (KPIs) at the click of a button.

- Time Savings: Automation and real-time updates free up your time for more strategic tasks, like long-term financial planning.

- Enhanced Collaboration: Cloud-based solutions allow for easy sharing and collaborative editing so everyone on the team can access up-to-date information.

- Strategic Planning: With data and analytics at your fingertips, you can make more informed decisions faster.

- Financial Health: Regular, precise tracking of income and expenditures helps you understand your financial standing and adjust as needed.

- Scalability: Good budgeting software will adapt as your business grows, providing more features to meet new demands.