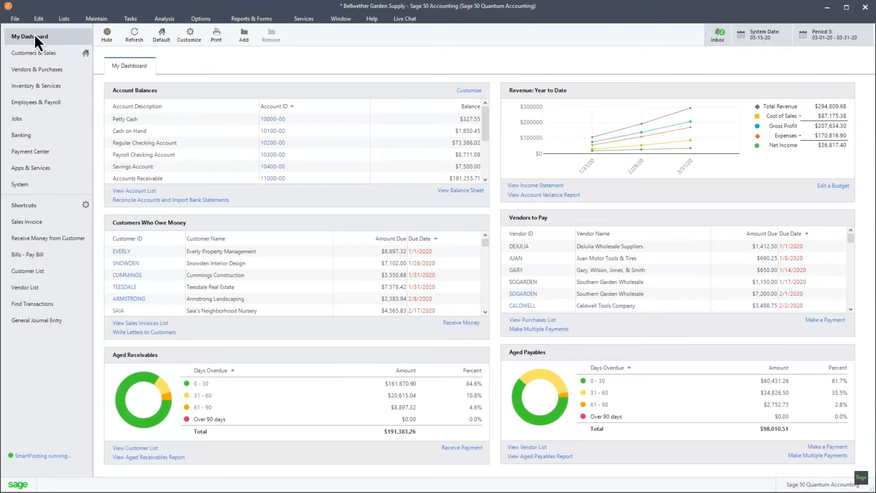

Sage 50cloud Accounting

While it doesn’t have the most modern UI, Sage 50c offers decent job costing. We like that users can customize reports specific to their industries in construction, distribution, and manufacturing. Its accountant-first approach also makes it intuitive for financial professionals.

However, we don’t like the platform’s poor inventory management or the lack of remote access to data without a third-party add-on.

- Great invoice customization

- Strong job costing

- Granular financial reporting

- Poor inventory management

- Dated user interface

- No remote access to data without add-on

- Developer Sage

- Client OS Windows

- Deployment On-Premises

What Is Sage 50 Cloud Accounting Software?

Sage 50c is a desktop-based accounting software with tools for invoicing customers, tracking bills, reconciling bank transactions, and managing inventory. It also handles sales tax reporting, automated W2s, and accurate tax calculations for employee withholding.

Note: Sage 50cloud isn’t actually cloud-hosted. It runs on your local machine, but you can connect it to cloud-based features, like online backups or mobile invoicing, through add-ons.

Our Ratings

| Usability - 5.5 | Gives users a full accounting system with basic inventory control; switching between tabs is difficult; user interface could be more streamlined. |

| Support - 9 | Offers live chat, case submission, and phone support 9 am - 8 pm ET, Mon-Fri; includes access to documentation and videos via Sage Knowledgebase and University; some user complaints cite long hold times. |

| Scalability - 7.3 | Job costing functionality is great for small contractors; sophisticated financial reporting helps growing companies budget accurately; UI and jargon language pose a learning curve for new users; cannot install on a mobile device or tablet. |

| Security - 9 | Allows users to backup data as a PTB file or export financial records in a CSV format; easily adjust user access permissions to specific areas of the software; Sage Group UK experienced a data breach in 2016 but has not since. |

| Value - 5.8 | Other accounting software provides similar value to Sage at lower price; monthly/annual subscription fees tend to increase each year. |

| Performance - 5.5 | Speed and responsiveness could be better optimized; complicated UI can slow processes as users move from screen to screen. |

| Key Features - 7 | Provides high-level customization of invoices; offers bulk bill payment capabilities; allows users to format bills for various blank check paper stock; provides bulk reconciliation functionality at the Pro Accounting level; supports multiple currencies (uses base currency in reporting). |

Who Uses Sage 50 Cloud?

We recommend Sage 50c Accounting for users with financial expertise. Originally known as Peachtree Accounting, Sage 50c helps small to mid-sized companies in the service industries track cash availability and budget more accurately. Businesses with under 20 employees are most likely to review the purchase as a potential option.

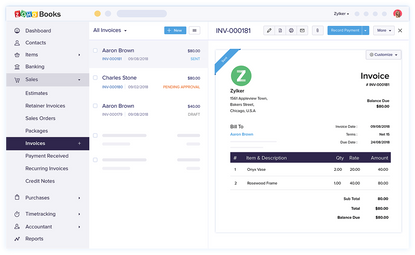

Invoicing Needs Some Work

We think invoicing in Sage 50c could be more streamlined with fewer tabs and less navigation. For example, creating an invoice involves first clicking the “Customers & Sales” link in the vertical navigation pane. Then, after clicking the “Customers and Sales” tasks icon, you’ll find a further list of subtasks to choose from in a dropdown menu.

Many accounting solutions for small businesses have a more pared-down approach to invoice entry, allowing you to choose “new invoice” right from the homescreen. Here is what that complete process looks like in Sage 50c:

- Click the Sales Invoices task in the Customer and Sales dashboard.

- Click the New Invoice option.

- Type the customer’s name or use the magnifying glass to search in the Customer ID field.

- Enter the invoice date, due date, and reference number.

- Click the magnifying glass in the Items field for a dropdown list of inventory.

- Select your product to populate details like Item, Unit Price, Tax, etc. Specify the quantity.

- Click the Save option on the top nav or Print to view a preview and print.

- Click the Receive Money option on the Customers & Sales dashboard.

- Input the relevant customer ID.

- Indicate the amounts paid by clicking the Pay checkboxes on each invoice line below.

Adding and Approving Bills

We would like to see better optimization of billing in Sage 50c. The steps closely mirror the invoicing process, but thankfully, you can add a “Enter Bills” link to your Shortcuts to save yourself from a few additional clicks.

You can create a new bill in Sage 50c like so:

- Click the Enter Bills task on the Vendors & Purchases dashboard.

- Click the Enter Bills option.

- Type the vendor’s name or use the magnifying glass to search In the Vendor ID field.

- Enter the relevant invoice date, due date, and invoice number.

- Click the magnifying glass in the Items field for a dropdown list of inventory.

- Select your product to populate details like Item, Unit Price, Tax, etc. Specify the quantity.

- Click the Save option on the top nav to post the bill.

- Close out of the window to return to the Vendors & Purchases dashboard.

- Click Pay Bills and the Pay Bill option.

- Input the relevant vendor ID.

- Indicate the amounts paid by clicking the Pay checkboxes on each invoice line below.

Bank Reconciliation in Sage 50c

As with billing and invoicing, bank reconciliation in Sage 50c could be simpler and clearer. Most modern accounting solutions streamline this process by auto-matching bank line items and transactions. Sage 50c relies more on manual data entry, which we found cumbersome. That said, we appreciated the option to do bulk reconciliation (a feature not always offered by competitors at the basic plan level).

Here’s how to do bank reconciliation in Sage 50c:

- Click the Tasks button on Sage’s top navigational toolbar.

- Select the Account Reconciliation option.

- Click the magnifying glass next to the Account to Reconcile field. Select the relevant account from the dropdown list.

- Enter the Statement Date in the upper right-hand corner of the Account Reconciliation window.

- Enter your Statement Ending Balance at the bottom of the window.

- Select the Import button at the top of the window to upload a local copy of your bank statement OR

- Click the Bank Feeds button for a dropdown menu. Select Connect to Bank Feed, then follow the steps in the wizard.

- Sage presents a transactions list with deposits and bank credits automatically shown first.

- Reference your bank account line items against the Sage transactions.

- Click the checkmarks in the Status column to indicate which items match.

- Reconcile line items until the Unreconciled Difference at the bottom of the window is 0.

You can unreconcile transactions by clearing their individual checkboxes or by going to the Clear button in the top nav and selecting the All option with the empty checkbox.

What Features Are Missing?

Sage 50c Accounting is a robust platform that allows you to take total control over your finance management. However, some vital features are lacking in Sage 50c, namely in regards to accessing your financial data from anywhere but a Windows workstation:

-

Remote access: Today’s accountants and employees expect instant access to real-time financial data 24/7. However, Sage 50c is locally installed and only accessible remotely if you use the Remote Data Access add-on.

Remote Data Access is a cloud service that provides a secure connection to your company accounts from anywhere, including at home. However, the data isn’t stored on the cloud. Remote Access just connects you to data stored on another computer using the cloud. If you’re looking for a truly web-based Sage product, we recommend Sage Intacct. It offers anytime, anywhere user access via your browser using a SaaS delivery model.

-

Mobile app: The lack of a mobile app is unsurprising, as remote access to Sage 50c is limited. However, most accounting software users today expect to have a mobile option to access data from their phones or tablets.

-

Modern interface: We found Sage’s user interface overwhelming and unintuitive. A complicated navigation menu, few visual or graphic aids, and a lack of contextual help within the software could confuse a beginner. That said, financial professionals will likely adapt without issue, as Sage 50c tends to structure its platform using core accounting terminology and concepts.

Pricing Plans

| Plan | Pricing | Features |

| Sage 50c Pro Accounting | $61.92/month or $625/year |

|

| Sage 50c Premium Accounting | $103.92/month or $1,043/year | Includes all Pro features, plus:

|

| Sage 50c Quantum Accounting | $177.17/month or $1,780/year | Includes all Premium features plus:

|

Every plan includes unlimited access to phone and online chat support. All plans are what Sage refers to as “payroll-ready.” However, the application does not have built-in payroll functionality, which is not uncommon for most accounting software. Instead, you must integrate a do-it-yourself payroll module.

The payroll module also allows you to create W2s and tax forms, set up employee vacation/sick time, and more. Pricing for the payroll module is unavailable online, so you should contact Sage for further details. However, their website indicates that the subscription is tiered based on your current plan and the number of employees.

Can I buy Sage 50c without a subscription?

No, Sage 50c is only available via a subscription license. Before 2021, Sage 50c offered subscription or perpetual licensing, but this is no longer the case. Pricing for Sage 50c accounting starts at $57.17/month or $578/year for one user with the Pro Accounting subscription plan.

Can I use Sage 50c without the Internet?

No, Sage 50c requires Internet access to activate and maintain support and services. The subscription service requires Internet connectivity at least every 20 days to verify entitlement and complete product upgrades. Sage is not able to offer subscription services to users without Internet access.

When did Peachtree become Sage 50c?

Sage Group purchased Peachtree Accounting in 1999 and rebranded the software as Sage 50 - US Accounting in 2013. Sage would later develop cloud-connected features for the application and renamed the application Sage 50cloud to reflect this change.

Alternatives

Summary

We recommend using Sage 50c Accounting if you are a small to mid-level company with financial expertise. This software features robust job costing, accounts payables, receivables, and general ledger reporting.

Sage 50c provides limited inventory management capabilities, so there are better options out there for companies based in manufacturing or retail, for example. The software’s user interface could be better optimized, posing a greater learning curve for the layperson. However, accountants should be able to jump into the software without issue.

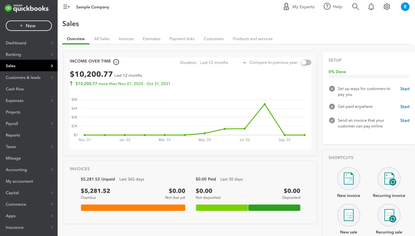

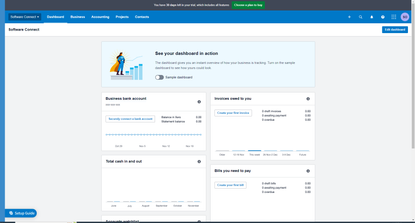

Organizations using Sage 50c must integrate an add-on service to receive remote access to their data. No mobile app is available for using this software from your phone or tablet. Overall, Sage 50c does not offer the same value as accounting software at similar price points. We recommend alternatives like QuickBooks Online or Xero for small companies looking to optimize their financial processes.

User Reviews of Sage 50cloud Accounting

Write a ReviewSwitch to QuickBooks for less hassle

said

Pros

i already purchased and paid for this software 2 times in past 7 years, always being told that the old version is no longer supported and was asked to pay for a new one. switch to Quick Book for hassle free!!!

Cons

nothing

- 1-10 employees

- Annual revenue $0-$1M

Have used it for over 20 years

We have been using Sage 50 for over 20 years here at our manufacturing business. Sadly this program does not integrate with our shop floor program but it does offer some decent accounting capabilities.

Sage’s payroll module does not let me go back and review old pay per hour reports. Sometimes i want to go back and see when someone got a raise but I am not able to.

Otherwise if you understand bookkeeping and accounting and feel comfortable with what you can do, Sage 50 is a soid accounting program.

Cons

Not able to generate Pay per Hour report from the past payrolls.

- Diversified Financial Services

- 11-50 employees

- Annual revenue $1M-$10M

The software is very slow and is just not set up

The software is just terrible, atleast from the persepctive of a medium sized business. The software is very slow and is just not set up to support the financial needs of a medium sized operation. I also do a great deal of work/data collection on Excel and it does not work well with Excel uploads.

A known evil is better than an unknown good

I’ve been using it for 20+ years. Small business. Lots of features are useless, reports are too limited and it’s too expensive. Why then do I still use it? “A known evil is better than an unknown good.”

Pros

Nothing.

Cons

First, it is overly expensive since they changed it to a subscription. Second, it crashes constantly. Have to "repair" the software once every 2 months more or less. Third, they ask for suggestions, but they never follow them; OR, these suggestions are features you can find in other countries' versions! Why then they don't put them in the US version?

Five times over priced

We were happy when you could renew every 3 years. This annual renew is VERY VERY much overpriced.

Pros

Sage 50c is difficult to use.

Cons

The cost is Five times over priced. Ridiculous. Quick books is easier and much less costly.

Very expensive for small business

Very expensive for small business, have to purchase yearly even though you are having accountant do payroll and monthly IRS reporting. I only need to invoice customers, track inventory and customer activity. Sage 50 does a great job at this but not economically feasible. Sales and tech support very hard to contact.

Pros

selling and invoicing inventory and services

Cons

expense and aggravation

- Industrial Conglomerates

- 1-10 employees

- Annual revenue $0-$1M

Terrible service. Bugs everywhere

Terrible service. Bugs everywhere. As a 10 year user, I am so disappointed with the latest version Sage Quantum 2020. Horrible. Just had to reinstall it after only using it for a month since it got corrupted. I tried to ‘chat’ with them but they were useless. Tried having them call me back but it was over two hours and I was in another meeting. I finally decided to call and wait on hold and after 2 hours and 20 minutes, I hung up and decided to write this review.

Use any other software other than Sage. It’s beyond terrible.

Pros

I know it because I've used it 10 years.

Cons

Crashes. Terrible customer service. No material improvements in the software in the past 10 years.

- Real Estate

- 1-10 employees

- Annual revenue $0-$1M

Sage 50cloud Accounting Review

Very user friendly.

Pros

Very user friendly.

Cons

nothing so far

- Insurance

- 11-50 employees

- Annual revenue $1M-$10M

Using this program is frustrating

I have used Quickbooks and Peachtree now Sage 50 and it doesn’t compare to Quickbooks. Using this program is frustrating and to get support is even more frustrating. Sage City and the chat assitant Peg are useless

Pros

It is very slow and simple things like credit memos or linking credits is a daunting process. Making templates and recurring expenses isn't easy. The dashboard for each process has too many icons you don't need and not easy to revise. Not intuitive or easy to use.

Cons

Using other accounting software prior to this there is really nothing that would make me recommend this program.

- Diversified Consumer Services

- 1-10 employees

- Annual revenue $0-$1M

Sage 50cloud Accounting Review

Good for Accounting, not so good for Fund Accounting

- Media

- 51-250 employees

- Annual revenue $10M-$50M

Sage 50cloud Accounting Review

Not customizable at all, we quickly outgrew it as a solution

- Professional Services

- 51-250 employees

- Annual revenue $10M-$50M

Constantly dump data into Excel to create reports

We find ourselves having to constantly dump data into Excel to create the reports that we want. I feel that if there are too many people in the system or you try and run a report it crashes the system. Don’t even get me started on trying to work remotely with this solution because it just doesn’t work.

Sage 50cloud Accounting Review

A lot of what Sage 50 does is it more of an inventory system, but doesn’t allow us any assistance in the manufacturing process. We have no reporting availability

Sage 50cloud Accounting Review

Sage 50 is not enough for us. It’s not GAAP compliant and too simplistic to use and have no structure to them.

Peachtree generally works well for accounts receivable

Peachtree generally works well for accounts receivable and the GL. We need more ability to give individual customers discounts on line items, without additional key strokes when invoicing. The canned reports are not the best and you are somewhat limited in the changes that can be made. The biggest issue is from purchasing thru to inventory. Another major problem, the inventory. Its inability to reconcile pieces and cases is the problem.

- Health Care Providers & Services

- 1-10 employees

- Annual revenue $1M-$10M

The cost continues to increase

We used to be able to renew every 3 years, they changed that a few years ago and now it has to be every year. We’ve gone from upgrading to November to July then to April. The cost continues to increase as we upgrade and has gone from $499 to $950 annually

I have four different companies that I switch back and forth with

I now have the Sage 50 Premium 2018 program and am not happy with it. I have four different companies that I switch back and forth with. The main page is different with two of them and I can’t seem to get them to look the same with the blocks. Also when I enter the invoices it use to tell me if I already entered them and now it doesn’t. When I try to put a vendor in to enter a bill it used to show me the list as soon as I would enter a letter now it doesn’t. I have to go down the list every time I want to look up a vendor to enter a bill. Also when I enter a general ledger number there too I have to enter the whole number instead of just the first few.

If you are a small business DO NOT go with Sage

If you are a small business DO NOT go with Sage. I’ve used them since 2003, and they were OK when I could purchase the software and use the same version for multiple years (I don’t need to update annually.) Now, with the new annual subscription only, it’s way too expensive for a small business. Then when I told them I was going with QuickBooks they transferred me to a manager named Kiree (spelling?) who basically told me I was stupid for changing and that I wouldn’t have access to my software any longer, even though the actual program told me I had 14 days to use it. He wasn’t interested in listening to my reasons, just trying to get me to pay an extra $65 for one additional month of access. VERY UNPROFESSIONAL. I am very disappointed in a company that I have been using for 14 years now. By the way, I only had to update 3 times in the 14 years when I could purchase the product. Now you have to pay them the full price every year, definitely NOT WORTH IT.

Pros

It was easy to use.

Cons

Having to pay them every year to use the program. Their switch to a subscription basis sucks.

Works great until the contact nears the end

Works great until the contact nears the end.

Pros

Have been using Peachtree for close to 20 years. I have no complaints when it works.

Cons

I have a small company. I don't need or want updates, just for the software to work for more than a few months or have it fixed. Seems like the problems may be designed to start when it knows you no longer are in a contract paying for support

It seems as though it is getting very commercialized

It is an eary accounting program to use. I never had any problems with it or the upgrades until this past year. It seems as though it is getting very commercialized and they are nickel and dimimg customers.

Pros

I have used Peachtree Accounting for over 15 years and never had a problem until this past year. It has always been very easy to use.

Cons

The fact that there is a yearly fee to use their software and they keep terms and conditions hidden from customers until it is too late to get out of the contract.

- Internet Software & Services

- 1-10 employees

- Annual revenue $0-$1M

Lots of bang for the buck

Few packages in this price range present a consistent user interface to payroll, manufacturing, sales and purchase orders, job cost, and the usual suspects of GL,AP,AR, Bank recs. Lots of bang for the buck

Pros

You can do many things and only have to learn one user interface. Also, they implemented importing from external files to automate data entry a long time ago. (E.g. import 50 sales orders from a spreadsheet)

Cons

Monthly close is awkward and unlike a lot of other packages. Its a good discipline once you understand it.

- Construction & Engineering

- 1-10 employees

- Annual revenue $0-$1M

Sage 50cloud Accounting Review

n/a

Pros

More for the accounting person, than a person unfamilar with accounting

Cons

Peachtree by Sage use to be an awesome product and I would have highly recommended it in the past, but now that they have implemented a yearly fee, we are currently looking for another software system. Not my 1st choice, but it will have to do.

- Paper & Forest Products

- 1-10 employees

- Annual revenue $1M-$10M

Sage 50cloud Accounting Review

Very versatile and can have many add-on’s

Pros

Ability to do trending, and overall cost

Cons

Having yearly fees after purchasing the software.