Sage Fixed Assets

1 Review 3/5 ★ ★ ★ ★ ★A fixed asset management software for midsize to enterprise organizations with tax compliance and depreciation tracking. Formerly Sage FAS Fixed Assets.

Product Overview

Sage Fixed Assets offers over 50 depreciation methods for accurate financial reporting and tax compliance. It also enables efficient project management and asset tracking, reducing the risk of lost assets and overpayment on taxes and insurance. With customizable reporting capabilities, businesses can generate tailored reports to meet their specific needs.Pros

- Calculates depreciation over the entire asset lifecycle

- Offers customized reports and data point tracking

- Popular with small to mid-size businesses

Cons

- Might be too complex for smaller businesses

- Initial setup and customization can be time-consuming

- Pricing requires consultation

Target Market

Medium to large businesses that have a significant number of assets to manage and track, including government and nonprofit organizations.Not Recommended For

Businesses needing a cloud-native system with mobile capabilities for field service, or organizations with fewer than 100 assets.Sage Fixed Assets provides a complete fixed asset management suite with an intuitive interface. It features integration among accounting, inventory, and reporting applications. It links directly to general ledger systems and offers comprehensive reporting features. Sage Fixed Assets provides targeted fixed asset software solutions for business, government, and nonprofit organizations.

Video Overview

Key Features

Sage Fixed Assets can be broken down into four core modules:

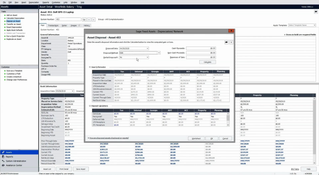

Depreciation

- Fixed asset lifecycle management

- Over 50 depreciation formulas

- Bulk edit asset depreciation methods

- Multiple company support

- MACRS 150 percent and 200 percent (formulas and tables), ACRS, straight-line, modified straight-line (formulas and tables), declining balance, sum-of-the-years-digits, and user-defined depreciation methods.

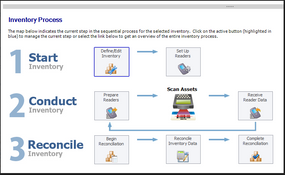

Tracking

- Efficiently create and track multiple physical inventories of assets.

- Eliminate lost or stolen assets

- Built-in inventory and reconciliation functionalities

- Print and scan asset barcodes via Android mobile device

- Check assets in and out

Planning

- Track project budgets and statuses

- Control and visualize all project costs

- See future fixed assets that are line items

- Send completed assets to the depreciation module

- Compare actual spending vs. original budget

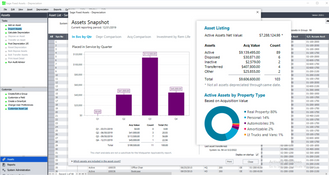

Reporting

- Create several different custom reports

- Gain total control over the format, appearance, and context of all depreciation and fixed asset management reports

- Share with other programs using PDF, XLS, HTML, and XML formats

- Compliance with IRS regulations with annual tax compliance updates

- Built-in tax forms

- Over 300,000 IRS tax rules

Cloud Hosting

Sage does not offer in-house cloud hosting services, but instead partners with WebHouse to offer the service.

Integrations

- Sage Intacct

- Sage 100 & 300

- Microsoft Dynamics

- Plex

- SAP

- Oracle

Product Overview

Developer Overview

Related Products

User Reviews of Sage Fixed Assets

Write a Review- Manufacturing

- 5K-10K employees

- Annual revenue $1B-$10B

Sage Fixed Assets Review

The system works well for asset records and straightline depreciation. However beyond that, we have found working in the system somewhat painful. We have an extensive request process for our assets and have resorted to using a generic Micorosft tool to try to manage the documents. Sage was not able to adequately manage the request process. We also did not have confidence that the system could handle tax depreication and opted to use a third party.