Wave Accounting Review: Pros, Cons

We like Wave for its ease of use, free features, and low barrier to entry for non-accountants. We also found it cost-effective with unlimited income and expense transactions.

We don’t like that Wave provides online support but no phone number. Though it offers accounting functionality at no cost, Wave isn’t for businesses requiring budgeting, time tracking, job management, and more industry-specific features.

- Accounting features are free

- Multi-currency invoicing

- Unlimited bank accounts and credit cards

- Unlimited income/expense transactions

- Multiple companies per subscription

- Collecting online payments is "pay-per-use"

- Payroll costs extra

- Payroll is a monthly add-on

- Limited report customization

- No support phone number

- Developer Wave Accounting

- Client OS iOS, Android, Web

- Deployment Cloud Hosted

What Is Wave Bookkeeping?

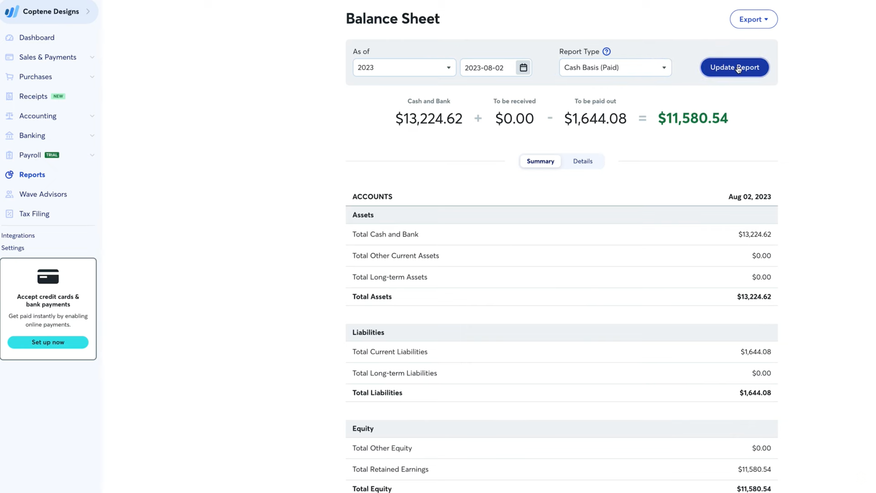

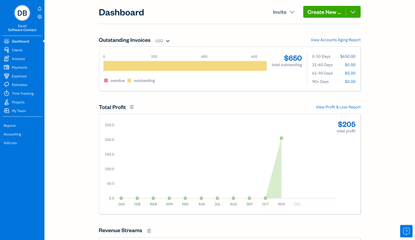

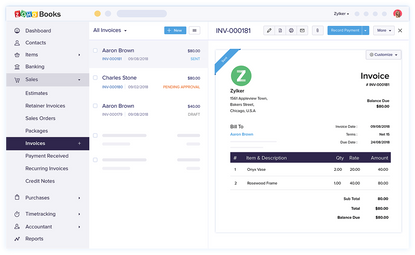

Wave is a free, cloud-hosted accounting software that lets you track income and expenses, reconcile your bank accounts, snap photos of receipts, and send professional-looking invoices in a few clicks. This platform also provides customers with basic financial reporting and automated payment reminders.

Having shifted from an entirely free model to a tiered pricing structure, Wave now offers the free Starter plan and the paid Pro plan at $16/month. This change sparked frustration among some users, especially as features like automatic transaction imports were placed behind a paywall. However, the free plan still offers unlimited invoices, bills, and bookkeeping records, making it a solid option for those with basic accounting needs.

Our Ratings

| Usability - 8 | Offers a user-friendly design with point-and-click capabilities; can edit vendor and customer info directly in billing and invoicing screens; dashboards are less streamlined than Xero or FreshBooks. |

| Support - 7 | Live chat and email support available Mon-Fri 9 am-4:45 pm EST; offers automated chatbot but no support phone number. |

| Scalability - 8.1 | Includes mobile app for receipt scanning and invoice payment reminders; fewer integrations compared to QuickBooks; fewer options to expand your feature set as your company grows. |

| Security - 8.7 | Currently does not offer multi-factor authentication; allows you to export financial reports in CSV and PDF formats; can export all transactions in Excel and CSV formats; provides basic user roles for Admin, Editor, Payroll Manager, Viewer, and H&R Block Advisor. |

| Value - 10 | Unlimited income and expense tracking and bank and credit card connections; allows you to track multiple companies through one subscription, unlike QuickBooks Online. |

| Performance - 8.5 | Typing in transaction dates rather than selecting them can result in unexpected behavior; some instances where invoices and bills do not load correctly; dashboards update with transactions in real-time. |

| Key Features - 8.4 | Extensive invoice customization; easy to copy transactions and trigger recurring invoices; offers option to set up recurring payments during invoice creation; limited report customization. |

Who Uses Wave Accounting?

We recommend Wave for small businesses, freelancers, and startups with less than ten employees. This light, user-friendly software is ideal for accounting and information technology services organizations. Users will not need an accounting background to learn Wave, which features in-app contextual guidance to explain common financial processes.

What Features Are Missing?

-

Report customization: Wave offers essential financial reports like the balance sheet, income statement, and general ledger. However, users can only change account type, date range, and accrual vs. cash basis.

-

Scalability: Wave offers fewer integrations than its competitors, typical for a free platform geared toward smaller businesses. Wave provides the option to add on payroll, customer relationship management (CRM), and eCommerce modules. However, users wishing to expand into inventory management or warehousing will likely need another solution.

Pricing Plans

| Plan | Pricing | Features |

| Starter | Free |

|

| Pro | $16/month billed monthly; $170/year billed annually |

All features in Starter, plus:

|

Add-Ons

| Plan | Pricing | Features |

| Payments | Credit Cards: 2.9% + $0.60 per transaction; 3.4% + $0.60 per AMEX transaction; Bank Transactions: 1% per transaction ($1 min fee) |

|

| Payroll | Tax Service States: $40 monthly fee; Self Service States: $20 monthly fee |

|

| Advisors | Bookkeeping Support: $149 monthly fee; Accounting and Payroll Coaching: $379 one-time fee |

|

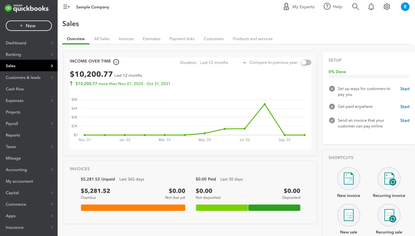

Wave vs QuickBooks

Wave is a more affordable accounting solution than QuickBooks’ paid platform. Both programs feature invoicing, banking, and accounting capabilities, but Wave charges fees for accepting credit card and bank payments from customers.

Wave allows you to track multiple businesses, while QuickBooks charges you for an additional subscription. However, QuickBooks offers a more advanced feature set and report customization than Wave.

Both solutions offer add-on modules for running payroll that incur an additional monthly fee. Finally, Wave connects to H&R Block, while QuickBooks connects to TurboTax.

How Much Does Wave Charge Per Transaction?

Wave charges 2.9% + $0.60 per credit card transaction and 3.4% + $0.60 per AMEX transaction. Additionally, it charges 1% per transaction ($1 min fee) for bank transactions.

Does Wave Accounting Do Payroll?

Wave does not have a free, built-in payroll module. However, you can choose one of two payroll packages for an additional monthly fee. Payroll for Tax Service States is $40 per month, and payroll for Self Service States is $20. For both packages, there is an additional $6 fee per active employee or independent contractor paid.

Alternatives

Summary

We recommend Wave for startup and small business owners looking to take financial management from spreadsheets to a semi-automated solution. Wave is a top pick for the accounting and information technology industries, and it’s one of the lower-priced options for its capabilities.

We don’t think Wave is the best choice for growing or mid-market organizations. Because Wave is free software, it does not offer the intricate capabilities of a paid platform. Additionally, it’s limited in integrations, so it does not provide the scalability for more popular financial software like QuickBooks.

Overall, Wave is a smart, inexpensive choice for new companies that plan to stay relatively small. Should you need to upgrade to a more advanced solution, Wave makes it easy to migrate your data into another system.

User Reviews of Wave

Write a ReviewWave Review

Other than the chargeback issues, I really liked WAVE

Pros

Easy to set up and use

Cons

If there is a chargeback, WAVE will not contest it. The business (WAVE’s client) cannot pursue the chargeback as the WAVE Merchant Processing’s bank was the one that is the bank on record where the original payment was sent. Nevertheless, WAVE will expect the merchant (the business) to reimburse them, immediately. WAVE will cause immediate debiting the WAVE client’s account. If the chargeback exceeds funds in the account, they continue to debiting for weeks, incurring an overdraft fee by the merchant client for each attempt to collect. Currently I have a superior court case against the person who chose to chargeback over 20K to my WAVE account. WAVE basically told me it was my problem and has sent me to collections.

Weird that Wave couldn't deal with inventory

Weird that Wave couldn’t deal with inventory as QB does! It doesn’t allocate the purchased goods under the inventory! It allocated them as COGS directly which means I need a JE every time I sell any of my goods. When I created a ‘Product’, It showed my only one price which is the selling price.

Love your program, thanks for everything you do

Love your program, thanks for everything you do and making accounting easy - hoping one day you will ad a VAT number field and a Description field so when looking at a list of all your invoices you can actually find a specific job without having to open every invoice till u find it

Wave Review

New design is …very good… As a accounting professional… Some features still missing… But new start is very good…

I always share your platform to my clients

I am an ambassador of you guys - I always share your platform to my clients - be it business people or general people - I love your work and I am very very very glad that I came across Wave! Please keep up the great work and level of excellence, from South Africa with Love!

I really love it

I’ve been using Wave Apps for a couple years now. It’s free except for the fees that come along with the payment processing. I use it for quotes and invoices and receipts and accounting, the end of year reports for my taxes. I really love it.

If you need a payment processor or you need a software that will handle all of your financials, I recommend this one.

You can also get it as a mobile app to take pictures of receipts and upload them, send reminders for invoices you have out.