The Best Lease Management Software

Lease management software simplifies portfolio oversight for retail, corporate spaces, and manufacturing. We reviewed the top platforms that comply with ASC 842 and IFRS 16 while automating tracking and renewals.

- Built for ASC 842 lease accounting standards

- Many reporting options

- Tight integration with Sage Intacct

- Can manage 50 or more leases

- Integrates with any ERP

- Multi-currency support for global operations

- Compliant with ASC 842, GASB 87, and IFRS 16

- Modules for additional portfolio compliance

- Intuitive and easy to use

Using our software review methodology, we’ve evaluated the most popular providers to find the best solutions on the market.

If you’re a lessor or property manager, you can explore options tailored to your needs on our property management software roundup.

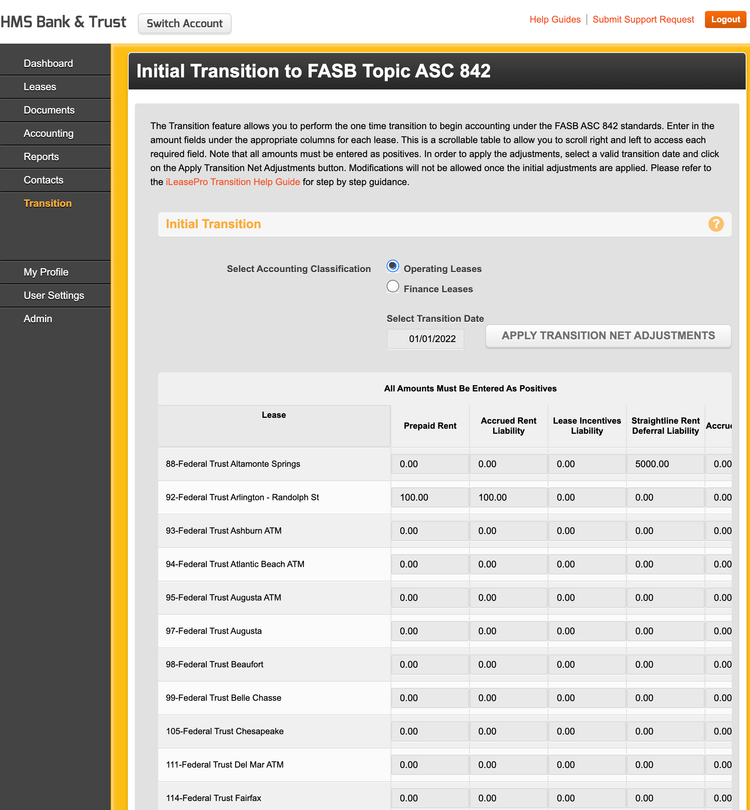

- iLeasePro: Great for Small Lessees

- LeaseQuery: Best for Multi-Asset Lessees

- Visual Lease: Best for Lease Accounting

- Crunchafi: Best Lease Entry Tools

- Leasecake: Best AI-Driven Tools

- EZLease: Best for Equipment Lessees

- Spacebase: Best for Real Estate Expense Tracking

- MRI ProLease: Best for Real Estate Lessees

iLeasePro - Great for Small Lessees

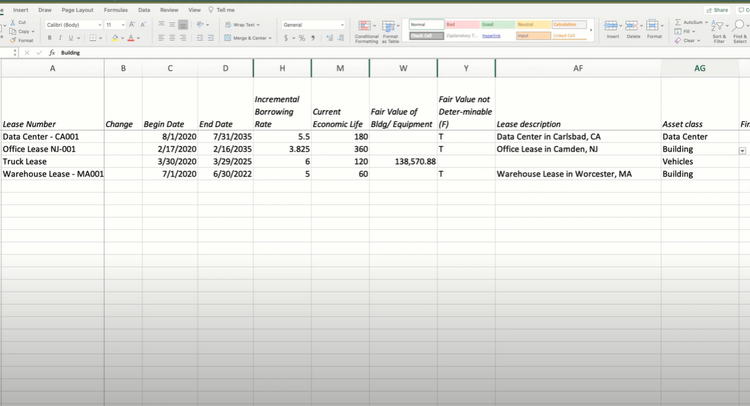

iLeasePro is best for small businesses or lessees with fewer than 20 leases. The platform includes a summarized journal entry tool that helps you handle your accounting quickly and efficiently without a dedicated finance team.

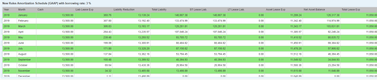

Start by consolidating all your operating leases in the portfolio accounting module. Then, you can filter your leases by year and month; for example, select “2024” and “all months” to gather all your lease-related transactions. From there, iLeasePro generates a CSV file with all relevant journal entries for that time frame, which you can then use to create a pivot table. This way, you can group transactions by general ledger account and description, making it easier to keep track of your finances.

The portfolio accounting module also helps you account for variable lease payments, essential if your business has fluctuating costs. Additionally, it simplifies short-term and financial lease classifications according to accounting standards. By automating these categorizations, your small business can adhere to regulations more easily. Plus, the tool lets you sum up debits and credits, providing a comprehensive overview of your financial position at year-end.

Essentially, this lease software keeps things simple by focusing on core features, such as portfolio management, without overwhelming you with too many options. iLeasePro is one of the lower-priced products on the market, offering a free plan for one user and a maximum of five leases. Paid plans start at $99.95/month for one user and 10 leases. This makes it attractive if you’re a smaller company needing vital lease management tools without high costs.

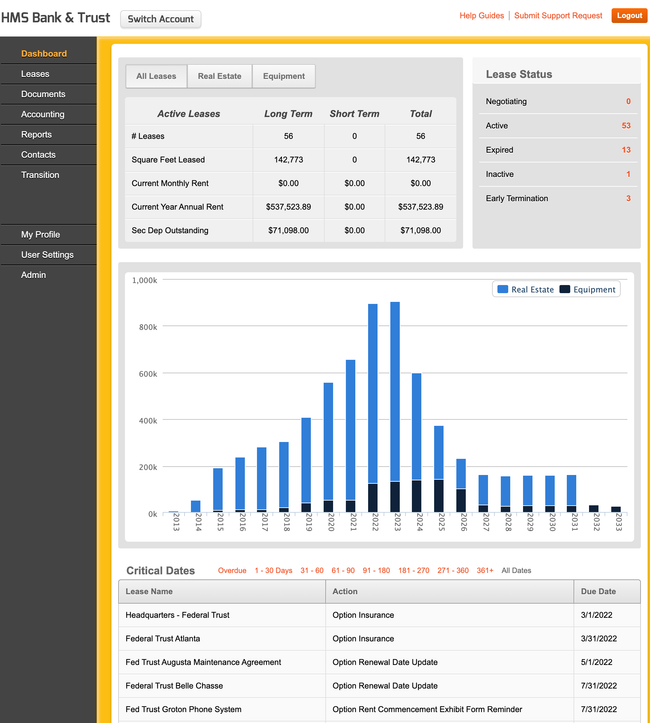

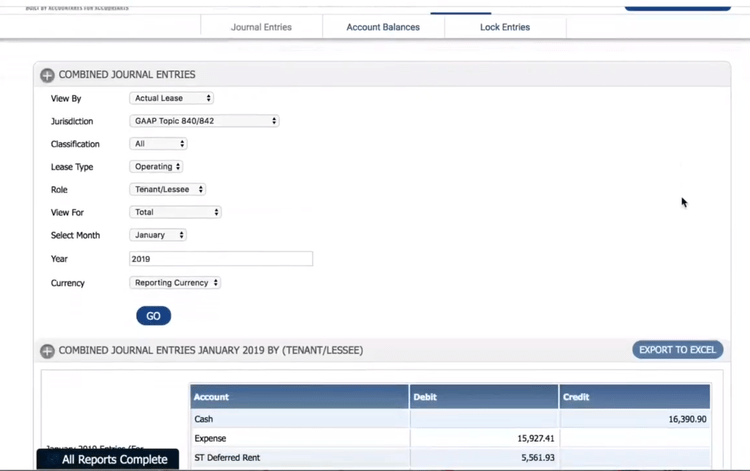

LeaseQuery - Best for Multi-Asset Lessees

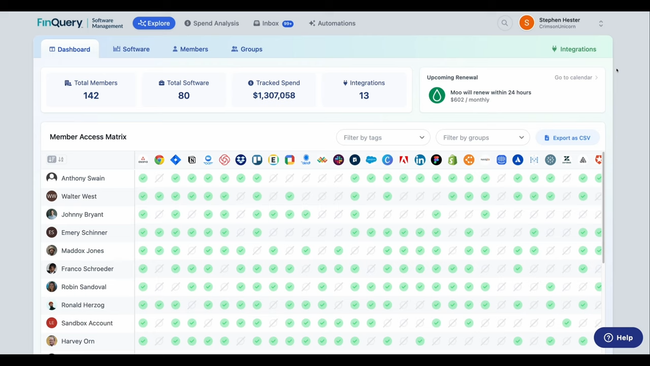

LeaseQuery, powered by FinQuery, can manage a diverse range of buildings, equipment, or other assets through its lease administration tools. Its AI-powered lease abstraction and data entry, trained on 1000s of leases, automatically extracts dates, payment streams, and clauses from your documents. While you can still review and confirm this data, you’re no longer building everything from scratch.

From there, the system monitors dates, tasks, and payments and sends automated notifications so renewal and rent-abatement deadlines don’t creep up on you. Plus, everything sits on a cloud-based subledger, so every lease integrates into a standardized reporting structure. You can pull over 100 standard reports, including more complex documents like roll forwards and historical reporting. Executive reporting on location, square footage, storage details, and other aspects for budgeting and forecasting becomes way easier.

LeaseQuery can generate complete amortization schedules and journal entries, all in compliance with:

- ASC 842

- IFRS 16

- FRS 102

- GASB 87

- GASB 96

- SSFAS 54

You can grant unlimited users access without incurring licensing penalties, allowing everyone from auditors to finance to access what they need. While pricing details aren’t public, LeaseQuery bases final costs on your total number of leases.

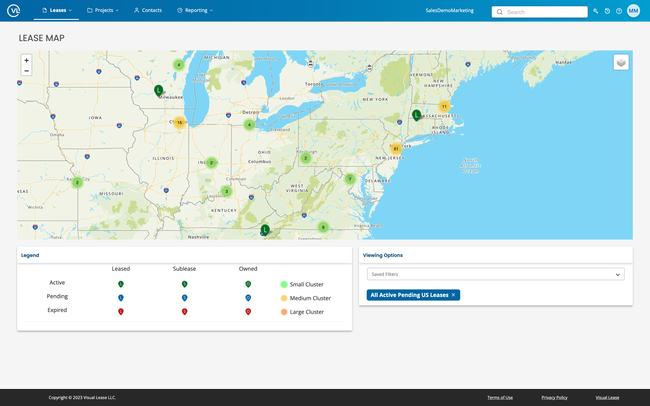

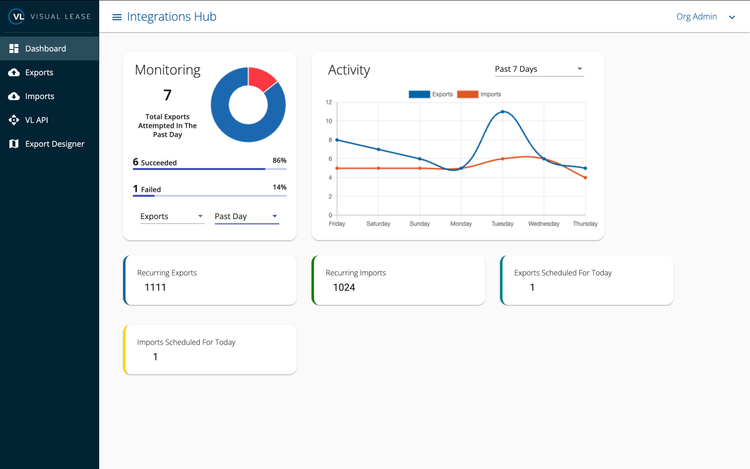

Visual Lease - Best for Lease Accounting

Visual Lease supports lease tracking and accounting together in one platform. It meets several compliance requirements, including FASB ASC 842, GASB 87 & 96, and IFRS 16 through its detailed financial reporting. Its customizable ad-hoc reports let you monitor KPIs by location, asset type, or department. You can even add their own reporting templates to maintain consistency with past records.

Additionally, Visual Lease auto-generates clear audit trails and documentation. It records the entire lease lifecycle for even the most complex scenarios, including modification, termination, impairment, and abandonment. Every change is recorded and put through approval workflows, ensuring the audit trails are accurate. This gives you more accountability for when your team makes edits, and lets you trace any errors back to the source.

Visual Lease is best for mid to large-sized businesses with mixed portfolios, like real estate and equipment leases. It offers extensive integrations with leading ERPs, helping you automate period-end reporting. Unfortunately, you’ll need a custom quote for exact prices based on your size, lease amount, and required features.

Crunchafi - Best Lease Entry Tools

Crunchafi, formerly LeaseCrunch, lets you attach original lease documents and any supporting files directly into the lease record. You can either enter the term in months or just the end date, if you know the start date.

Crunchafi then adjusts the calculations, like payment schedules, based on the information you provide. Plus, if your lease involves renewal options or early termination, the built-in wizard can guide you through how to handle these situations.

The lease term wizard can also help you classify leases. It asks you questions to determine the non-cancellable period, which is essential for identifying terms accurately. It also asks whether you’re certain about exercising an early termination or renewal option. Additionally, it refines the lease term by factoring in economic incentives or the presence of cancellation clauses.

Once you’ve entered your details, Crunchafi can instantly generate journal entries, amortization schedules, and footnotes. This helps you maintain precise financial records for each lease and keeps them up-to-date.

Read our full Crunchafi product overview.

Leasecake - Best AI-Driven Tools

Leasecake includes an AI-powered assistant called Cakebot that simplifies lease abstraction. It pulls details from lease agreements, providing you with an accessible view of your obligations and terms.

Cakebot also helps prevent missing important dates like renewals or rent adjustments. It sends reminders via email, mobile alerts, and in-app notifications so you can stay proactive and make more informed decisions.

Plus, the AI assistant can help you analyze lease data across different locations. You can ask Cakebot for customized reports that focus on specific properties and rent-to-revenue analysis. With easy access to data for each site, this streamlines lease negotiations and makes them more efficient.

You can also ask Cakebot questions about your lease, such as upcoming rent changes or specific clauses. This means you’ll get the answers you need instantly without rifling through paperwork. While Leasecake is a solid pick for retail, food and beverage, and franchise businesses, it’s less optimal for government entities and private companies.

Learn more about Leasecake in our full review.

EZLease - Best for Equipment Lessees

EZLease is adept at managing equipment leases, providing simplified tracking for shorter terms and smaller lease portfolios. This system offers 15 ready-to-use reports, including lease summary reports, amortization schedules, and lease classification reports. Users can customize these using different fields like asset types, payment amounts, and lease terms. They can also filter reports based on various criteria like lease type, start and end dates, monetary values, or any custom-defined categories.

Additionally, users can create custom calculations or apply specific formulas within the reports and export them in various formats like Excel, PDF, or CSV. These reports assist businesses in effectively managing their equipment leases, ensuring compliance with accounting standards, and providing insightful data for strategic decision-making.

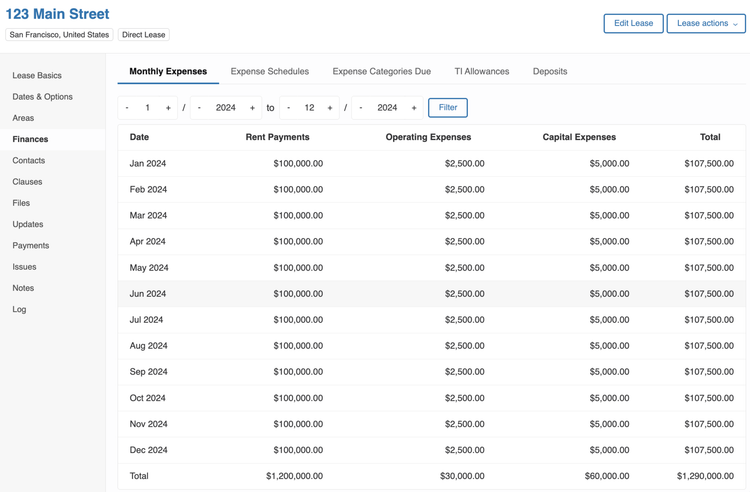

Spacebase - Best for Real Estate Expense Tracking

Spacebase offers a strong expense tracking module to make sure you stay on top of every cost. This extends beyond basic rent payments, including:

- Operating Expenses: This includes any extra costs the lease will have, including common area maintenance, insurance, repairs, and utilities. Spacebase supports both planned and unplanned expenses, and lets you compare properties across your portfolio.

- Capital Expenditures: You can categorize and budget all capital expenditures, including physical goods, services, or upgrades to the space. It compiles all of these in one place, making it easy to track depreciation and overall project costs.

The expense tracking module works with your core accounting module, which Spacebase ensures is GAAP compliant. You can view data in regular or GAAP format, allowing you and your accounting team to see the data the way you want. This makes it easy to ensure expenses align with payment and invoicing dates to keep the books accurate.

Spacebase is best for mid to large-sized companies needing both lease management and accounting. The system complies with standards like ASC 842, IFRS 16, and GASB 87. Pricing starts at $300/month, but you’ll need a custom quote for exact figures.

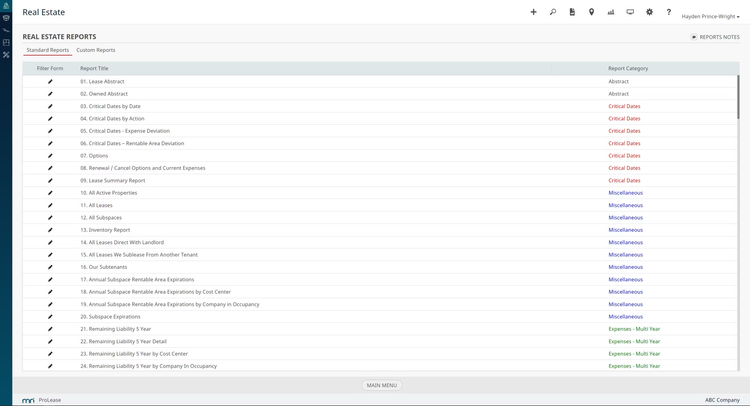

MRI ProLease - Best for Real Estate Lessees

MRI ProLease is designed to help manage various lease types like retail locations, office space, and industrial properties across multiple locations. It stores lease agreements for centralized tracking, making it easier for you to stay on top of key dates, obligations, and terms.

ProLease offers customizable reports to monitor financial performance, lease renewals, and rent escalations. This gives you a clear view of your lease portfolio’s financial health. Additionally, the software offers lease abstraction, summarizing key terms and clauses from full lease agreements into concise, easy-to-read documents. This helps you quickly refer to specific terms, like allowable usage, subleasing options, or maintenance obligations.

What is Lease Management Software?

Lease management software (also known as lease administration software) is a modern digital solution designed to optimize tracking lease agreements for businesses and organizations. This software offers a range of tools and features for centralizing lease data, monitoring important dates, and calculating financial obligations. In essence, lease management software simplifies lease administration, helping lessees maintain organization, ensure compliance, and comply with standards like:

- FASB ASC 842: A US accounting standard requiring lessees to recognize most leases on the balance sheet as assets and liabilities to provide a clearer picture of lease obligations.

- GASB 87: A US governmental accounting standard that requires state and local government entities to recognize leases as liabilities and right-of-use assets for more accurate financial reporting.

- IFRS 16: An international accounting standard that mandates lessees to report all leases on their balance sheets as right-of-use assets and lease liabilities.

Lease management typically goes hand in hand with lease accounting solutions to streamline control over your entire lease lifecycle. Lease management software keeps track of lease details, automates renewals, and manages lease terminations and buyouts. Lease accounting software tracks income and expenses and creates reports in accordance with the Financial Accounting Standards Board (FASB), Governmental Accounting Standards Board (GASB), and International Accounting Standards Board (IASB) standards.

How to Choose Software

Evaluate Pain Points

Identify the challenges the organization aims to address, such as lease complexity, lease types, lengths, and the need for specific features like lease classification, modification tracking, and automated calculations.

Consider Lease Portfolio Size

The size of the lease portfolio is crucial, as more complex portfolios require enterprise-grade solutions, while smaller ones might get by with simpler tools.

Identify Must-Have Features

Determine key features essential for lease management needs, such as financial oversight, critical date alerts, expense tracking, lease classification, modification tracking, and automated calculations.

Compliance and Regulatory Requirements:

- Ensure the software complies with relevant accounting standards (like IFRS 16, ASC 842) and other regulatory requirements.

- Consider the software’s ability to adapt to changes in regulations.

Integration Capabilities

- Evaluate how well the software integrates with existing systems, such as ERP or accounting software.

- Check if it supports data import/export in formats your organization uses.

Vendor Evaluation

Take into account aspects like the vendor’s market standing, the quality of customer service, the software’s user-friendliness, and the breadth of functionalities provided by the software.

User Support Training

- Ensure your vendor includes onboarding programs to guide new users through the initial setup.

- Check for resources like training sessions, video tutorials, and online knowledge bases with articles and troubleshooting guides.

- Evaluate customer support, including email and SMS functionalities, in addition to ongoing support.

Key Features

| Feature | Functionality |

|---|---|

| Document Management | Log and maintain all signed lease agreements, amendments, tax forms, maintenance contractors, and compliance records |

| Date Tracking | Track lease start dates and expiration dates, payment due dates, and renewals. Receive automatic notifications for important deadlines to avoid late fees and missed renewals. |

| Financial Reporting | Create granular reports for lease liabilities, right-of-use assets, and lease payments to comply with ASC 842, IFRS 16, and GASB 87 standards. |

| Compliance Monitoring | Adhere to accounting standards and generate reports that streamline regulatory audits and internal reviews. |

| Lease Payment Management | Monitor and manage payment schedules and record them against your financial obligations for better cash flow management for leased assets. |

| Lease Renewal Automation | Automate renewal by tracking approaching end dates and receiving early alerts for renegotiations or terminations. |

| Multi-Currency Support | Allows international lessees to manage leases in multiple currencies for more accurate financial reporting. |

Types

Lease management software is used by a variety of businesses as an all-in-one way to manage their lease data, including:

Equipment Lease Management Software

Lease management software stores lease information and data about all types of leased assets, such as tools, vehicles, and machinery. The system logs details like the current condition of your equipment. You can also use these platforms to monitor equipment maintenance and depreciation for better compliance with regulations.

Real Estate Lease Management for Lessees

This software helps lessees of office spaces, warehouses, and retail properties better track payment obligations, renewal dates, and compliance with lease accounting standards. It streamlines managing complex portfolios of leased real estate and allows you to negotiate renewal terms. These systems also ensure all lease liabilities are accurately reflected in your financial statements for full compliance.

Benefits

Automated Lease Management

Automatically track deadlines, manage payments, and monitor lease renewals to reduce the risk of missing important dates and optimize your leased assets.

Centralized Data

Store all lease agreements, financial reports, and payment records in one place so you can access lease data quickly and collaborate on tasks.

Compliance and Audit Readiness

Ensure compliance with accounting standards and generate accurate, up-to-date reports; this simplifies audits and financial disclosures, helping you avoid legal risks or penalties.

Financial Transparency

Get a clear picture of your payments, upcoming renewals, and lease obligations. This helps you manage your cash flow and long-term financial commitments related to leases.

Integration Options

Lease management solutions can be paired with other software to provide even more ways to manage your workflow:

Leased Asset Management

This software keeps records of your leased assets, including who is using them, their condition before and after use, and important preventative maintenance deadlines. For lessees, tracking an asset’s condition before and after renting is important for avoiding damage-related penalties and complying with the agreement terms. It’s especially helpful for tracking equipment, vehicles, and other assets that require careful oversight throughout their usage.

Lease Accounting Software

Lease management software often integrates with lease accounting software or at least includes basic accounting functionality. These integrations assist lessees in tracking their payments, logging leased equipment or property-related costs, and generating reports that comply with international standards. These regulations require lessees to report their leases on balance sheets, ensuring they stay compliant and have clear insights into their financial positions.

Pricing

Pricing typically factors in your lease portfolio size, user count, and the complexity of your business needs.

Low-Tier

- Company Size: 1-25 employees; managing up to 10 leases

- Average Yearly Cost: $1,000 to $5,000 per year

- Examples: iLeasePro, Crunchafi

- Included Features: Basic lease tracking, reminders, and simple reporting tools.

Mid-Tier

- Company Size: 25-150 employees; managing 10 to 50 leases

- Average Yearly Cost: $5,000 to $30,000 per year

- Examples: Spacebase, Visual Lease

- Included Features: Includes advanced reporting and integration with accounting systems.

High-Tier

- Company Size: 150-500 employees; managing 50 to 200 leases

- Average Yearly Cost: $30,000 to $150,000 per year

- Examples: Trullion, MRI ProLease

- Included Features: Multi-currency support, advanced customization, and compliance tools for managing leases across multiple jurisdictions.

Enterprise

- Company Size: 500+ employees; managing over 200 leases

- Average Yearly Cost: $150,000+ per year

- Examples: LeaseQuery, CoStar Real Estate Manager

- Included Features: The highest level of customization and dedicated support for global organizations.