The Best Lease Accounting Software

We’ve reviewed the top lease accounting software on the market, evaluating features such as compliance with FASB ASC 842, GASB 87, and IFRS 16. Whether you manage a commercial real estate portfolio or equipment and vehicle leases, we can help you find a system that fits your business.

- Role-based access

- FASB ASC 842, IFRS 16, and GASB 87 reporting

- Integrates with any ERP

- Intuitive and easy to use

- Compliant with ASC 842, GASB 87, and IFRS 16

- Modules for additional portfolio compliance

- Fast implementation time compared to similar products

- Simplifies lease data input processes

- Complies with ASC 842, GASB 87, GASB 96, IFRS 16

Lease accounting software auto-calculates, tracks, and provides reports of lease liabilities and assets. We’ve examined 20+ providers across seven metrics to help CFOs and accountants meet ASC 842, IFRS 16, and GASB compliance requirements.

Our advanced review methodology considers factors such as usability, support, scalability, security, value, performance, and the range of features offered.

- LeaseQuery: Best Overall

- Visual Lease: Best for Large Portfolios

- Crunchafi: Best for CPAs

- Spacebase: Best for B2B Sector

- MRI ProLease: Best for Global Lease Accounting

- Occupier: Best for Commercial Real Estate

- Trullion: Best for Accounting Firms

- Black Owl Lease Accounting: Best for Lessee & Lessor Accounting

- EZLease: Best for Equipment Leases

- Leasecake: Best User Interface

- LeaseAccelerator: Best for Enterprises

LeaseQuery - Best Overall

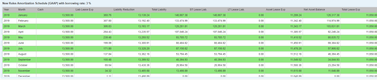

LeaseQuery was purpose-built by accountants for lease accounting. It works best for retail chains, franchises, corporate tenants, and healthcare companies with over ten leases. Overall, LeaseQuery is adept at error-free amortization schedules and journal entries, critical date alert setting, and data entry validation.

We like that LeaseQuery allows you to quickly generate reports based on attributes like location, lease type, and square footage. Additionally, the platform offers role-based access and locked journal entries to keep your company compliant with FASB ASC 842, IFRS 16, and GASB 87.

LeaseQuery integrates with ERP systems like Acumatica, Sage Intacct, and NetSuite to improve your accounting intelligence and reporting. However, it can be difficult at times to change lease details after approval. And lease lookup can be tricky, particularly if you don’t have specific details to input into search.

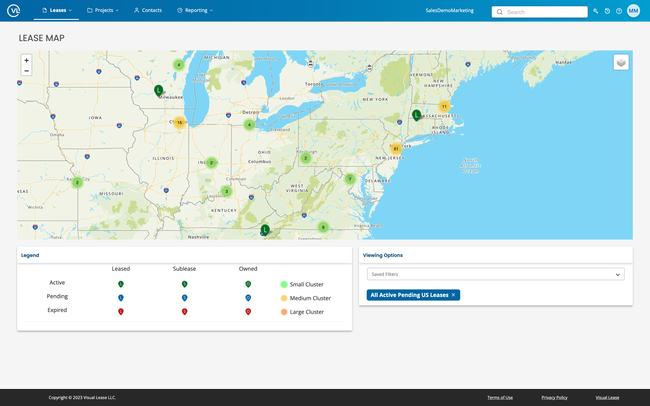

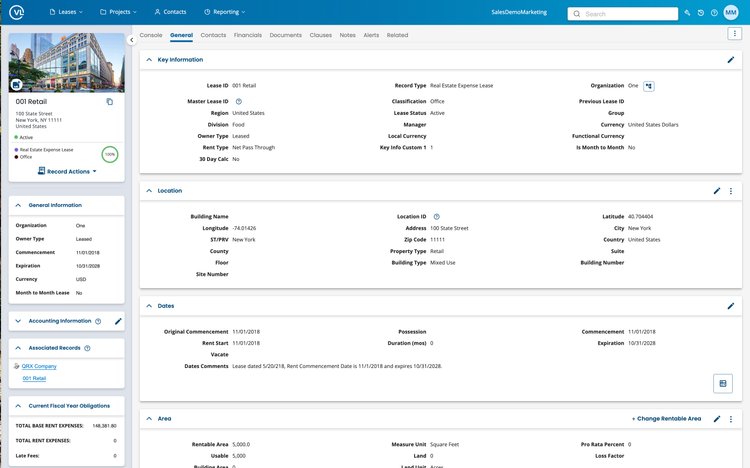

Visual Lease - Best for Large Portfolios

Visual Lease offers an extensive and customizable reporting engine to better manage enterprise-level real estate or equipment portfolios. The system automates report creation for several key reports, such as balance sheets, payment schedules, and amortization tables. This helps you create accurate FASB ASC 842-compliant reports with one click, consolidating data from hundreds of properties.

The reporting engine can be customized anytime, allowing you to configure fields to your exact specifications. For example, you can tailor a report to focus on a specific lease type, like commercial office buildings. This helps your accounting team accurately consolidate lease liabilities, right-of-use assets, and assets across your portfolio.

Visual Lease sets itself apart from other reporting modules through its API, which offers extensive integration options. It syncs with major ERP systems like Microsoft Dynamics 365 and SAP S/4HANA. Other integrations can include any BI tools you use, enabling a bi-directional data flow. The data consolidation lets you better leverage the system’s predictive analytics and create more detailed reports.

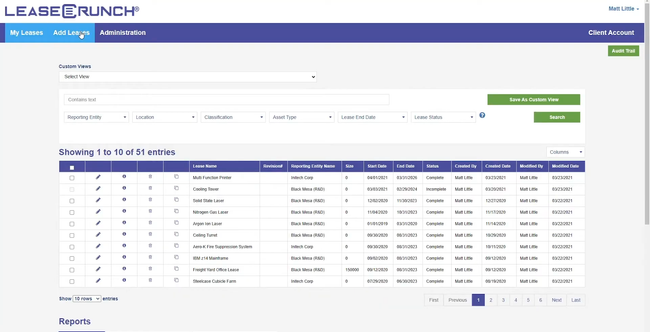

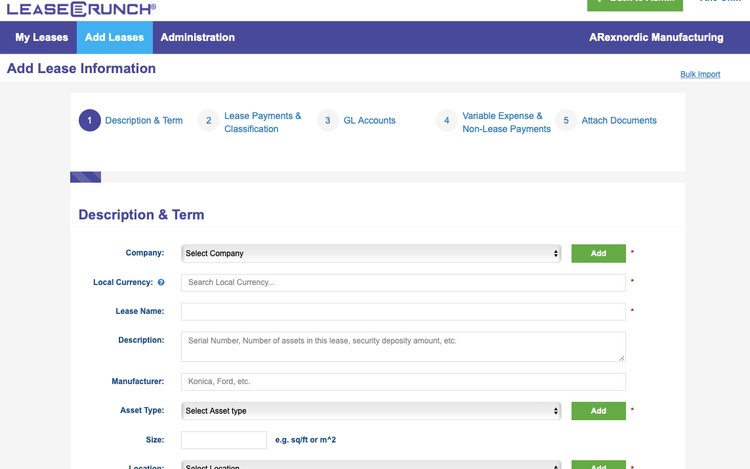

Crunchafi - Best for CPAs

Crunchafi, formerly LeaseCrunch, provides step-by-step lease calculation wizards that comply with new lease accounting standards. It makes it easy for firms managing five to 5,000 leases to organize all their information in one central system. It has built-in compliance with standards like ASC 842, IFRS 16, and GASB 87, 94, and 96.

CPAs can also generate and download audit-ready reports using the report center. These include journal entries, footnote disclosures, or amortization schedules. The audit trail helps you eliminate accounting errors and always provides your clients with accurate information. You can even complete annual SOC 1 Type II and SOC 2 Type II reports to reinforce trust in your financial oversight and internal controls.

Crunchafi offers discounted pricing plans for CPA firms. The midsize Professional plan requires an upfront commitment of $1,200 for up to eight leases, followed by $150/lease. Compare this with the regular price for other companies, which is $2,000 for eight leases and then $250/lease. It’s a great deal for small to midsize CPA firms that need cloud-based lease automation.

Spacebase - Best for B2B Sector

Spacebase’s lease accounting module is ideal for managing B2B real estate and equipment contracts. It supports complex arrangements like sub-leases, CPI escalators, and master leases. Start by uploading the lease, and Spacebase’s abstract service pulls renewal options, rent tables, and CPI clauses, instantly prepping schedules for calculation

Spacebase’s embedded schedule generator allows you to fine-tune frequencies and patterns, whether fixed, step-up table, CPI-linked, or usage-based. This means changes flow directly into your amortization and liability computations.

Plus, its expense allocation tools map pass-through costs like CAM and property taxes to the correct accounting periods, auto-posting accruals, and creating export-ready entries for your general ledger. You can tag each charge as billable or payable or choose a rule, and Spacebase auto-schedules the cash flow, posts the accrual, and generates an export-ready invoice.

Spacebase is suitable for companies seeking to comply with ASC 842, IFRS 16, and GASB 87 lease accounting standards. Pricing starts at $300/month/user, and a free trial is available. However, some users reported needing better help guides and documentation while learning the system.

MRI ProLease - Best for Global Lease Accounting

MRI ProLease helps multinational organizations manage lease accounting across different entities, regions, and accounting standards. It supports compliance with the most popular U.S. and international standards, including ASC 842, IFRS 16, and GASB standards.

We like how it’s AI-powered lease abstraction helps global accounting teams intake complex lease agreements at scale and standardize them across multiple currencies and languages. The system then automatically extracts key lease details such as payment schedules, renewal options, and obligations. Once a lease is onboarded, the data flows automatically into amortization schedules, monthly journal entries, and disclosure reports. If a lease is amended due to a change in terms or payments, ProLease automatically recalculates the downstream accounts to reflect the changes. This reduces the need for any spreadsheets or manual rework.

MRI ProLease Enterprise is not a lightweight lease accounting tool, and some users report a steep learning curve due to its complexity and a slightly dated interface when compared to newer platforms. That said, once teams are fully onboarded, ProLease is considered one of the most reliable options for managing lease accounting at scale. MRI also supports non-enterprise teams with ProLease Direct for smaller lean teams and ProLease Central for mid-sized equipment and real estate portfolios.

Occupier - Best for Commercial Real Estate

Occupier supports accounting teams and outsourced CPAs managing commercial lease portfolios Its lease accounting engine takes every key team from your commercial leases–commencement dates, payment schedules, renewal options–and converts them into automated amortization schedules and monthly journal entries. You can export these for your ERP or general ledger and save hours of time on manual calculations each month.

The engine continuously scans your lease data. When your real estate team changes a commencement date, adjusts terms, or makes amendments, Occupier instantly reprocesses the affected journal entries and schedules. From there, it updates right-of-use assets and liabilities, keeping your books accurate and audit-ready across multiple entities and locations.

Occupier provides detailed financial disclosure reports for managing commercial portfolios. However, we found they might be more than what’s typically needed in residential settings.

Trullion - Best for Accounting Firms

Trullion is our top choice for small to large accounting firms, partially due to its AI-driven insights into lease portfolios and financial impacts. Its AI technology complies with ASC 842, IFRS 16, and GASB 86 standards. Additionally, Trillion calculates the Implicit Balance Rate (IBR) instantly across various regions, asset classes, and currencies.

We particularly like Trullion’s AI tools, which generate accurate journal entries, amortization schedules, and disclosure reports. The system automates audit logs to verify and track changes for internal and external stakeholders. Additionally, Trullion auto-verifies numbers against reporting and compliance requirements using proprietary models and third-party data.

However, our research indicates that some users desired more robust customization in Trullion. Specifically, they wanted more capabilities catering to specialized accounting needs. We also found that the onboarding process can be complex and time-consuming.

Black Owl Lease Accounting - Best for Lessee & Lessor Accounting

Black Owl Software offers a streamlined lease change tool that makes it easy for CPAs to quickly make modifications. You can modify fields like asset adjustments, associated fees, pay frequency, or amount within any lessee detail. This gives you total control over every agreement throughout the entire lifecycle. Plus, the user-friendly interface makes it easy to navigate and get tasks done faster.

Once changes are made, they go through an approval workflow, so nothing slips through the cracks. Black Owl keeps a reliable audit trail for every lease change, so any mistakes can be traced back and accounted for.

Black Owl is a great option for both lessee and lessor accounting, complying with ASC 842, IFRS 16, and ASPE 3065. However, the system is not GASB 87 compliant, so governments and public-sector organizations may need to look elsewhere. Pricing is based on your number of leases, and there are different packages to support companies of all sizes. Every plan includes unlimited users.

EZLease - Best for Equipment Leases

EZLease is well-suited for larger organizations managing a substantial number of leases. It ensures compliance with intricate accounting standards while offering bulk lease data uploading features, automated validations, and custom report generation. This makes EZLease a compelling choice for equipment leases, where maintaining accuracy and efficiency in lease accounting is crucial.

Additionally, EZLease is proficient at managing various lease types, including fair market value, bargain purchase options, SBITA, and TRAC leases. It also handles end-of-term lease events like renewals, buyouts, and returns. The software’s extensive range of over 15 pre-built accounting and disclosure reports minimizes manual effort for generating reports across a company’s lease portfolio.

EZLease facilitates compliance with lease accounting standards, but the process for extending or revising leases isn’t always intuitive. The Essential plan is free and supports up to five leases for two users, which may not suffice for larger operations with many equipment leases. Pricing starts at $4,000/year for 6-49 leases with unlimited users, and for over 50 leases, pricing is determined via a consultation.

Leasecake - Best User Interface

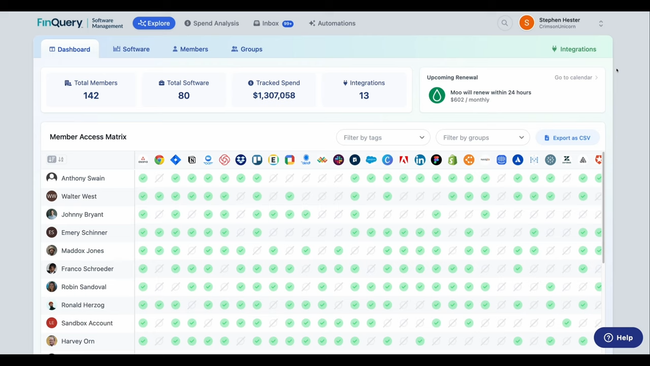

Leasecake offers an easy-to-use user interface that helps mid to large-sized companies navigate high data volumes fast. You can configure customizable dashboards that help you view KPIs at a glance to help make informed decisions without sifting through spreadsheets or reports. KPIs can include upcoming renewals, compliance deadlines, and contract information. This can save you and your team a ton of time, especially when managing tens or even hundreds of assets.

Additionally, Leasecake can help you keep track of all of your assets from a central hub. Because if you managed leased assets, like vehicle fleets or manufacturing equipment, they still fall under ASC 842 and IFRS 16’s right-of-use (ROU) recognition rules. So for high volumes, the system’s assets module streamlines the processes of classification, status, and accounting. The intuitive navigation makes it easy to set filters, drill into individual items, and input all essential info.

Leasecake has a scalable architecture, which is best for organizations with 30 to 200 commercial locations in retail and food and beverage. It offers a pricing plan that adjusts based on the number of locations you have. However, if you need just standalone accounting, you may want to look at something like Spacebase, since you need the base lease management platform before purchasing the accounting and asset management add-ons.

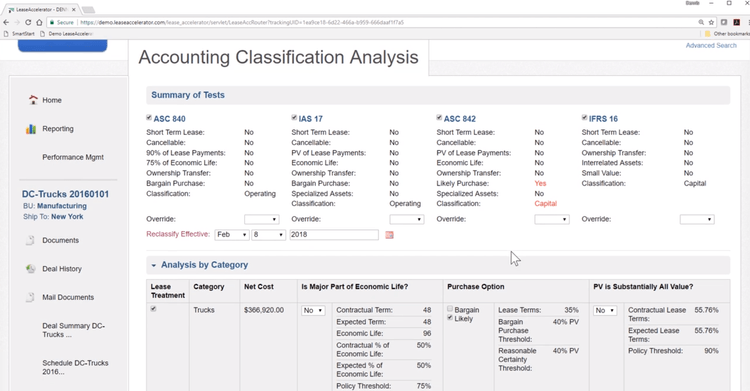

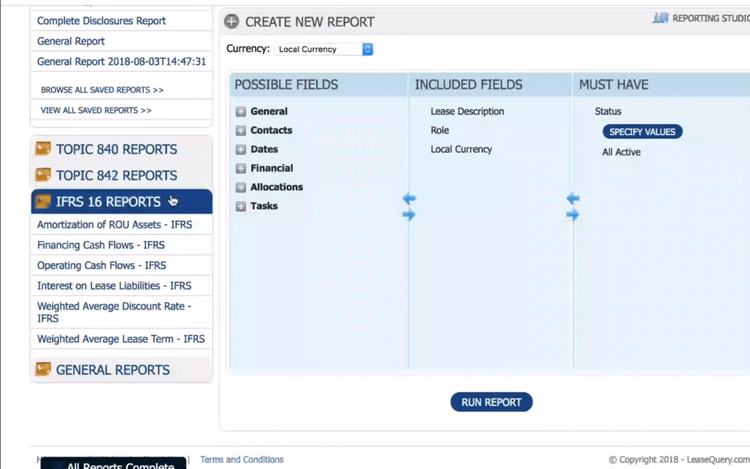

LeaseAccelerator - Best for Enterprises

LeaseAccelerator is a good fit for large organizations managing anywhere from under 10 to over 150,000 leases. The software offers detailed reporting capabilities for global operations. These include full reports for lease data, accounting, and management, with many built-in controls that ensure data integrity and compliance.

Overall, LeaseAccelerator streamlines lease management throughout its lifecycle and ensures compliance with both US GAAP and IFRS standards. We particularly like its asset-level accounting and audit trail documentation, useful for audit readiness. It simplifies real estate lease administration with centralized contract management, rent payment tracking, and the ability to monitor contract modifications and rent changes.

However, our research shows that many users found the implementation process time-consuming and resource-intensive. They also recommended thorough training, as LeaseAccelerator is feature-rich. Fortunately, LeaseAccelerator University provides courses on entering leases, managing your end-of-term, and configuring master data.

What is Lease Accounting Software?

Lease accounting software is a specialized financial management system that helps businesses comply with lease accounting standards like ASC 842, GASB 87, and IFRS 16. These systems will automate the tracking, calculation, and reporting of leased assets, liabilities, and disclosures for both lessees and leesors.

It is primarily used by accountants, CFOs, real estate professionals, and consultants to replace manual spreadsheets and determine which leases must appear on the balance sheet. Lease accounting software typically works alongside lease management solutions to track lease details, automate renewals, and manage terminations or buyouts.

Key Features

| Feature | Description |

|---|---|

| Centralized lease database | A centralized database stores all lease-related data, such as asset-level terms, payment schedules, location details, and critical dates. This ensures everyone is working off the same up-to-date data. |

| Lease liability calculations | Automatically calculate right-of-use (ROU) assets and lease liabilities in accordance with accounting standards. Software handles complex variables like lease terms, payment frequency, and discount rates. |

| Compliance with lease standards | Ensure every lease is reported in accordance with ASC 842, IFRS 16, or GASB 87. Software supports proper classification, journal entries, and disclosures required for full compliance. |

| Automatic notifications | Get alerts for upcoming renewals, expirations, required reassessments, and other critical lease events. Notifications help prevent missed deadlines and ensure timely accounting updates. |

| ERP and software integrations | Integrate directly with your general ledger, ERP, or accounting system to automate journal entries, reduce manual input, and keep financial records synchronized across platforms. |

| Footnote disclosures | Generate standardized reports and disclosures for financial statements, including roll-forward tables, maturity analyses, and weighted average calculations required by auditors and regulators. |

| Document management | Store and organize lease contracts, amendments, and supporting files in one place with version tracking and audit trails. Easily retrieve documents for review, compliance, or internal records. |

| Reporting and dashboards | Visualize key metrics such as lease obligations, asset balances, and compliance status through built-in dashboards. Reporting tools provide real-time insights into portfolio performance, audit readiness, and financial impact. |

Lease Accounting Standards

Your lease accounting solution will ensure that existing and new leases are reported correctly in accordance with various domestic and international accounting standards. Two of the latest and most important standards are the FASB ASC 842 and IFRS 16.

FASB ASC 842

The Financial Accounting Standards Board (FASB) released an update to ASC 840 known as ASC 842. Lease accounting systems help create ASC 842-compliant reports, including amortization of right-of-use (ROU) assets, cash flows, interest on lease liabilities, variable lease costs, complete disclosure reports, and more.

Lease classification is very similar to the new FASB ASC 842 standard compared to ASC 840.

Both standards classify leases as either a financial lease (capital lease) or an operating lease. Previously, operating leases were not required to be recorded on the balance sheet. In ASC 842, any lease longer than a 12-month term limit must be reported on your balance sheet—including operating leases.

Defining an operating lease and capital lease under ASC 842:

| Operating Lease | Capital Lease | |

|---|---|---|

| Asset ownership is transferred to the lessee at the end of the term. | No | Yes |

| Option to purchase the asset under fair market value after the lease term ends. | No | Yes |

| The lease term is a major part of the economic life of the leased asset. | No | Yes |

| The minimum lease payments are a substantial part of the asset’s fair market value. | No | Yes |

Public companies were required to implement the new standards from ASC 842 in December 2018, while private companies followed suit on December 15, 2019.

IFRS 16

IFRS 16 is a new standard from the International Accounting Standards Board (IASB). Lease accounting software ensures your reports are compliant with these international standards. Under IFRS 16, assets valued over $5,000 and lease terms over 12 months must be included on the balance sheet. However, short-term leases and low-value assets still need to be disclosed.

The IFRS 16 lease standard was enacted for reporting periods starting on or after January 1st, 2019. This standard replaced IAS 17 to improve balance-sheet transparency. Previously, many leases that were considered operating leases could be left off of the balance sheet while finance leases were required. IFRS 16 treats almost all leases as finance leases and virtually removes lease classification.

Portfolio-Level vs. Asset-Level Lease Accounting

Lease accounting software can record transactions on a portfolio-level or asset-level basis. In portfolio-level lease accounting, transactions for a single lease contract are reported as a whole. This type of accounting is ideal for leases with only one asset per contract.

Asset-level lease accounting keeps track of every individual asset stated on a contract. For example, one lease contract contains multiple segments or offices within a building. ASC 842 and IFRS 16 require each asset within a lease contract to be included in financial statements.

Lease Management Software

Lease accounting software often integrates with lease management and administration software to form an all-in-one solution. The lease management system helps you track and maintain lease portfolios, tenants and customers, documents, deadlines, and more.

Lease data stored within the system can be updated easily. Important information like lease term length, rate, expiration, and tenant or customer information is stored within the solution. Lease contracts and other important documents can also be added, so you can easily pull them up as needed.

The system will automatically notify you of upcoming deadlines and other important dates. For example, if a payment is missed or a lease contract is coming up for renewal, the system will send you a notification.

Lease Accounting vs. Lease Management

Many solutions also include lease management as part of the accounting system. Lease accounting software allows you to create reports for public financial disclosures, as well as record income and expenses. Lease management software, on the other hand, tracks lease details and automates lease renewals, termination processes, and buyouts. Having both lease accounting and management in one system ensures you meet all accounting standards and keep track of lease terms in one place. The system can automatically update the accounting side when leases are signed, renewed, or ended.

Types of Leases

Lease accounting software is beneficial to anyone who rents out their assets. Some leases you can manage with lease accounting software include:

Residential and Commercial Real Estate Leases

Real estate lease accounting software tracks rental income from commercial properties, apartments, duplexes, and other property rentals. The system also stores lease agreements so you can keep track of agreed-upon terms. The software also notifies you of late payments, contract terminations, and lease renewal deadlines.

All-in-one property management software can also be used for commercial or residential real estate leasing. These solutions handle accounting, tenant management, work order management, and more.

Equipment Leases

Advanced lease management software can include features like GPS tracking and asset management. These allow you to track the location of your equipment in real time. The condition of your equipment is also stored within the system. Knowing when your equipment was serviced and important upcoming dates for preventative maintenance will keep it running longer.

Industry-specific software is also available, including equipment rental software and fleet management software. These solutions feature lease management, accounting, asset tracking, and more.

Employment and Service Contracts

Lease accounting software helps businesses keep track of income and expenses from contracted services. For example, small—to medium-sized businesses sometimes contract work through a professional employer organization (PEO), also known as an employee leasing company. The PEO contracts employees to help businesses with tasks like training, payroll processing, recruiting, and performance management.

The lease accounting software will track payments from the business for services rendered and contractual agreements. If money is spent on additional equipment for the service, those costs can be factored into the total cost for the final invoice.

Pricing Guide

Lease accounting software can start anywhere from $2,000 to $35,000 annually. Pricing varies across four distinct tiers, each catering to different types and sizes of organizations.

Basic Tier ($1,000 - $5,000 annually)

- Target Market: Small retail businesses, independent landlords, and new startups with up to 10 leases. These users typically have straightforward lease management needs, often with several property or equipment leases.

- Common Use: Ideal for entities needing basic compliance and reporting without extensive customization or integration requirements.

Standard Tier ($5,000 - $30,000 per year)

- Target Market: Mid-sized companies in sectors like manufacturing, healthcare, and small to mid-sized commercial real estate firms. These companies often have 25-150 employees and manage 10 to 50 leases.

- Common Use: Suitable for businesses needing enhanced functionality to manage a moderate lease portfolio with greater emphasis on compliance, reporting, and operational efficiency.

Premium Tier ($30,000 - $150,000 annually)

- Target Market: Large entities in industries such as retail chains, extensive healthcare networks, and multinational corporations with anywhere from 150 to 500 employees and up to 200 leases.

- Common Use: These organizations typically face complex leasing scenarios and require comprehensive management, reporting, and analysis tools to support strategic decision-making across different regions and currencies.

Enterprise Tier (over $150,000 annually)

- Target Market: Very large or multinational enterprises with more than 500 employees and over 200 leases; these are generally in sectors such as global financial services, large-scale manufacturing, and international retail and hospitality groups.

- Common Use: Tailored for entities that manage extensive, global lease portfolios with sophisticated needs, including advanced compliance management, integration capabilities, and predictive analytics for forecasting and risk assessment.