The Best QuickBooks Alternatives

We tested cloud and desktop-based accounting software to find the top alternatives to QuickBooks.

- Affordable with US-based support

- Unlimited users

- Payroll available for $35/month

- Starts at $25/month

- Navigable, user-friendly interface

- Offers payroll through Gusto

- Desktop-based option

- Can be purchased outright

- Highly customizable

The best QuickBooks alternatives include cloud-based options like CustomBooks and Xero, free software like Wave, and one-time purchases like TallyPrime.

QuickBooks Online faces criticism for complexity, poor customer support, and price hikes. Intuit has also moved QuickBooks Desktop to a subscription model and ended support for Pro and Premier versions in 2023. We used our review methodology to rank our favorites.

- CustomBooks: Best Overall

- Xero: Low-Cost Subscription and Payroll

- TallyPrime: Best Perpetual License Option

- Striven: Top ERP Pick with HR Suite

- Wave: Best Free Option

- FreshBooks: Best for Service-based Businesses

- AccountEdge: Subscription-Based Desktop Option

- DigitBridge: Best for Distribution

- Denali Business: Best for Offline Access

- Connected Accounting: Best for Manufacturing

- FastFund: Best for Nonprofits

- LedgerLite: Desktop-Based with Easy Setup

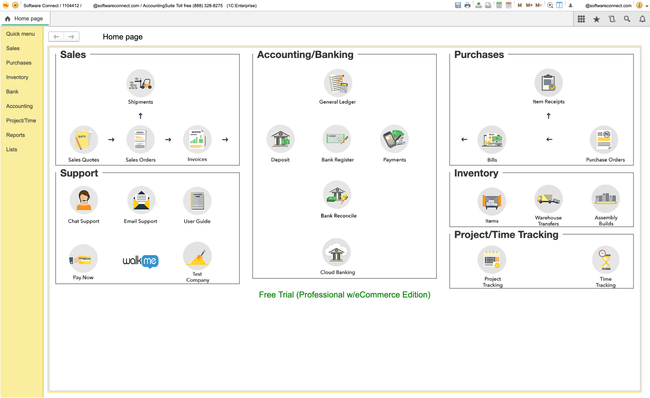

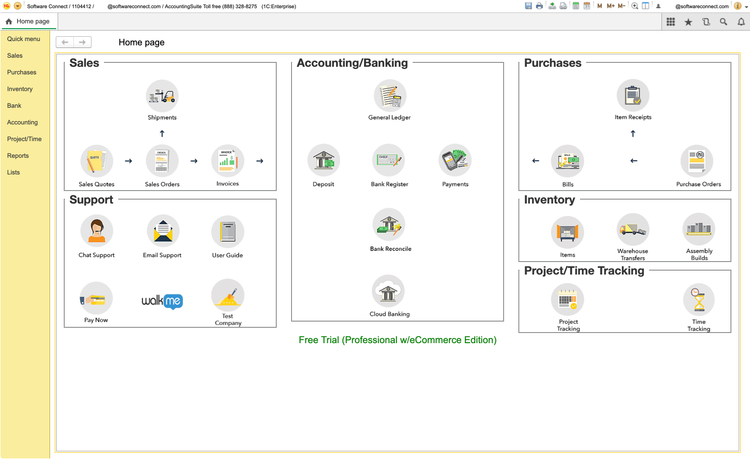

CustomBooks - Best Overall

CustomBooks is a solid QuickBooks alternative, starting at just $19/month for financial management, project and time tracking, and banking. Its accounting and reporting module in particular offers a high degree of customization with instant-drill down capabilities. Choose from a variety of report types, including:

- Cash flow statements

- Balance sheets

- Custom KPI dashboards

- Income statements (comparative & standard)

Plus, you can easily switch between accrual and cash basis accounting. This lets you assess your finances from multiple angles without needing to rely on external spreadsheets or manual adjustments.

Additionally, the accounting and reporting module lets you create unlimited budgets per year, department, or project. In this way, it’s way easier to compare budget vs. actuals and collaborate in real-time without version control headaches.

While CustomBooks’ Business plan ($99/month) is required for sales, purchase tracking, and sales tax features, it has a major advantage: no user limits or hidden fees. Compare that to QuickBooks’ Simple Start Plan, which includes these features but only one user, while its Advanced plan caps at 25 users. With CustomBooks, you’re free to scale without restrictions.

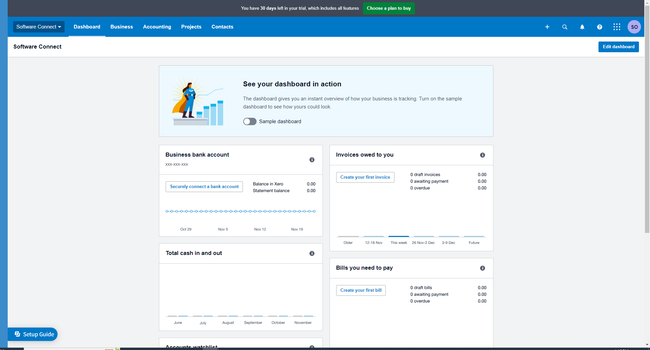

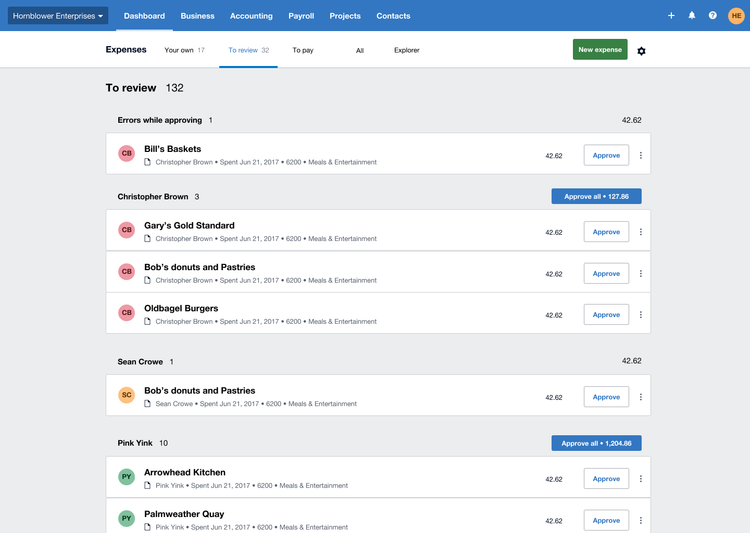

Xero - Low-Cost Subscription and Payroll

Xero is a cost-effective, cloud-based alternative to QuickBooks Online. Starting at $25/month, Xero’s entry-level plan supports 20 invoices and quotes along with 5 bills, offering a competitive pricing structure compared to QuickBooks. Additionally, its payroll integration with Gusto starts at $49/month plus $6/employee. This is cheaper than QuickBooks Payroll at $50/month plus $6.50/employee when bundled with QuickBooks Online.

Additionally, Xero provides automated invoicing and overdue payment management, addressing a common frustration with QuickBooks. With over 40 payment app integrations, including Stripe and PayPal, it offers flexibility, albeit with associated transaction fees. Xero also includes strong reporting functionalities, with over 40 financial reports available and the option to add custom formulas.

While ideal for project-based businesses, Xero may not suit manufacturing or distribution sectors without third-party integrations. Additionally, there’s no customer service phone number. While Xero still allows you to reach out via email or create a support ticket, Intuit provides phone support. However, reaching a live agent can be challenging.

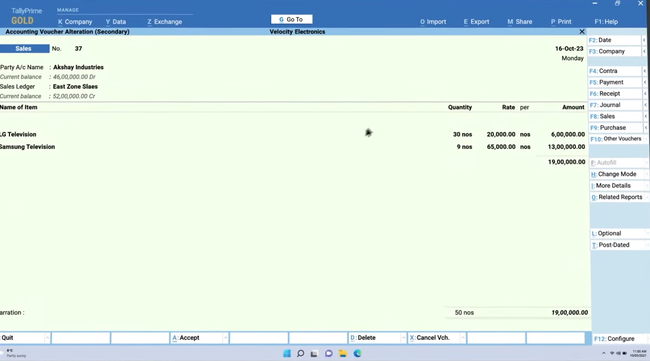

TallyPrime - Best Perpetual License Option

TallyPrime offers a desktop solution that you can buy outright, a stark contrast to QuickBooks Online’s subscription-based model. While TallyPrime may not have all the bells and whistles of QuickBooks Online, it offers a simple setup and lets you customize features to fit your needs. These include tailored reports, invoices, sales orders, and purchase orders.

TallyPrime makes personalizing, printing, and emailing invoices with your logo easy. It also generates various reports covering profit and loss, balance sheets, and general ledger. Additionally, it supports various billing formats and multiple currencies, useful for businesses with diverse products and global operations.

Compared to QuickBooks, TallyPrime is simple and affordable. Its interface isn’t as flashy as cloud-based systems’, but we found it reliable and affordable. It’s worth noting that while support is available, it’s based in India, which may not be ideal for all users.

Striven - Top ERP Pick with HR Suite

Striven is a strong web-based ERP alternative to QuickBooks Online. It’s a versatile system, with tailored versions for manufacturing, distribution, construction, field services, and professional services. And unlike QuickBooks Online, it includes a full HR suite alongside CRM tools.

This built-in CRM enhances contact management, sales tracking, and customer segmentation. It also handles employee time and attendance tracking, features not commonly found in QuickBooks. Additionally, its built-in accounting capabilities cover income tracking, expense management, and custom PnL reporting, invoicing, and billing.

Real-time inventory tracking and mobile payments further enhance Striven’s accounting tools. However, Striven does not provide a mobile app or native payroll system; both of these features are readily available in QuickBooks Online.

Wave - Best Free Option

Wave is refreshingly transparent in its pricing and functionality, making it an ideal choice for freelancers and startups. Its unlimited income and expense tracking, along with multi-company support, also put it near the top of our list. Unlike QuickBooks, Wave offers basic accounting, invoicing, and a mobile app for free, though with slightly higher transaction fees. And receipt scanning now comes at an additional cost of $72/year.

Wave Payments charges 2.9% plus sixty cents per credit card transaction, while Wave Payroll starts at $40/month, with additional costs per active employee. Despite its 14 included reports, Wave may not offer enough depth for larger businesses compared to QuickBooks.

Wave’s limited invoice customization and basic inventory management may not suit complex business needs. Additionally, there’s no phone support number, and the platform is less scalable, with fewer integration options than QuickBooks Online.

FreshBooks - Best for Service-based Businesses

FreshBooks is adept at basic invoicing and time tracking, making it ideal for service-based businesses. It provides a comprehensive “Lite” package with unlimited features like expenses, estimating, and invoicing for up to five clients.

FreshBooks offers a user-friendly interface ideal for non-accountants, contrasting with QuickBooks’ need for training. While it has fewer integrations than QuickBooks, its well-documented API ensures compatibility with third-party tools. It also supports credit card and ACH payments and automated bank imports.

However, unlike QuickBooks Online, FreshBooks lacks inventory features like purchase orders and forecasting. And while it’s well-suited for time tracking, it may not suit project-based companies.

AccountEdge - Subscription-Based Desktop Option

AccountEdge is a straightforward, desktop accounting software for businesses that want full control of their books. While still desktop-based, AccountEdge has transitioned to a subscription model, requiring monthly or annual payments. Despite this change, it remains a longstanding dependable platform covering accounting and business management, even if its features are more basic than QuickBooks Advanced.

Unlike QuickBooks Online, AccountEdge offers tools for multi-company and currency management, project and job tracking, and progress billing built into all plans. For most businesses, this means you can handle different subsidiaries, international operations, or project-based work without relying on external add-ons. Beyond core accounting, it includes customizable invoicing, budgeting, and payment tracking.

That said, AccountEdge requires add-ons to connect your bank to the software, which cost $5 per month. Adding more workstations, like additional computers or users, incurs another $10 per license per month. However, with starting costs at $20/month, small businesses find AccountEdge a solid desktop alternative to QuickBooks Online.

DigitBridge - Best for Distribution

DigitBridge is an omnichannel commerce software that helps distribution, wholesale, and retail companies manage their order fulfillment. It connects with over 250 sales channels like online marketplaces, social media platforms, and national retailers. This allows you to consolidate orders from everywhere you sell, enabling efficient shipping.

The system is an effective QuickBooks Desktop alternative, as its inventory management module is much more flexible for distributors. You can use the style master function to manage complex variations, colors, and sub-styles—something that QuickBooks lacks altogether. It’s ideal for industries like apparel, footwear, or even cosmetics, which are SKU-heavy with intricate product hierarchies.

DigitBridge is best suited for companies selling products across several online and in-person channels. It supports several types of distributors, including 3PLs, dropshippers, and wholesalers. Because of its advanced features, the system will be more expensive than entry-level QuickBooks plans, starting at $299/month.

Denali Business - Best for Offline Access

Denali Business is a desktop software tailored for SMBs needing offline accessibility. Despite a higher price point than some alternatives, Denali can be deployed in an on-premise configuration, allowing businesses to access their accounting data without an internet connection.

With three available bundles – Basecamp, Ascent, and Summit – all plans include a general ledger, audit trails, bank reconciliation, global reports, and accounts payables and receivables. The Ascent plan provides functionalities like inventory management, order entry, and Crystal Reports. The Summit plan delivers an unlimited payroll module, multi-location inventory, and local, state, and federal Aatrix Tax Forms.

While its interface may appear dated, Denali Business caters to general businesses and nonprofits with a tamper-proof audit trail. Unlike QuickBooks Desktop, which supports over 200 third-party apps, we also found Denali Business’s integration options somewhat limited.

Connected Accounting - Best for Manufacturing

Connected Accounting and ERP offers both desktop and cloud-based versions, presenting an affordable alternative to QuickBooks Online and Desktop. The platform provides modules tailored for distribution, light manufacturing, and retail operations. These include capabilities like MRP reporting, multi-level BOMs, FIFO costing, and detailed stock tracking.

Connected Accounting’s core financial tools are quite comprehensive. These include flexible account numbering with department segments, five years of detailed financial history, and budgeting by period and account. It also enables customer and vendor management with multiple addresses, advanced email templates for statements and invoices, and support for various payment methods like ACH. Additionally, it provides an optional consolidation plug-in for managing multiple entities.

Unlike QuickBooks, Connected Accounting doesn’t include native payroll features. However, it offers partnerships with payroll service providers in the US and Canada, or users can continue using their existing payroll systems.

FastFund - Best for Nonprofits

FastFund is a cloud or on-premises software catering to nonprofits. FastFund offers true fund accounting, unlike QuickBooks, which merely renames divisions as funds. During our firsthand demo, we found it proficient at tracking fund origins and allocations down to the cent.

FastFund provides a user-defined, customized chart of accounts. You can tailor the structure with six account segments to reflect your organization’s setup. Managing and creating budgets for grants, departments, programs, and funds is quick and simple. Additionally, FastFund provides automatic roll-up, strict internal controls, and compliance with NPO fiscal requirements like FASB 116 and 117.

With unlimited report sets for consolidation and access control, FastFund allows users to personalize financial statements and budget reports. However, the software requires a basic understanding of fund accounting. And unlike QuickBooks Online, no mobile app is available.

Check out our Best Accounting Software for Nonprofits page for more options.

LedgerLite - Desktop-Based with Easy Setup

LedgerLite is a desktop-based accounting software priced at $149 with full ownership rights. It’s relatively basic compared to QuickBooks, but it’s an attractive option for those seeking affordability and autonomy. Setup is also straightforward, requiring no intricate installations or database configurations; simply download the .EXE file to begin.

Like QuickBooks Desktop, the software adheres to double-entry bookkeeping principles. LedgerLite offers a customizable chart of accounts and cashbooks, complemented by simple bank statement reconciliations. We also found its reporting capabilities useful for SMBs, generating anything from account statements to balance sheets.

The software’s scalability allows for expanding client/server functionality and creating subentities for project or division tracking. However, it lacks features like extensive inventory management and advanced reporting. LedgerLite also has a limited transaction description field and requires users to have basic accounting expertise.

Other Systems We Like

Zoho Books is another strong option for small businesses looking for an easy-to-use QuickBooks Online alternative. It integrates with other Zoho products, so it makes sense if you’re already using their ecosystem for CRM or inventory. It’s also generally more affordable than QuickBooks Online, especially if you only have a few users.

QuickBooks Desktop vs. Online

The accounting software landscape is rapidly shifting, with QuickBooks Desktop transitioning to subscription-based pricing and the discontinuation of QuickBooks POS and some Desktop versions. The only real options are to switch to QuickBooks Online or explore alternatives.

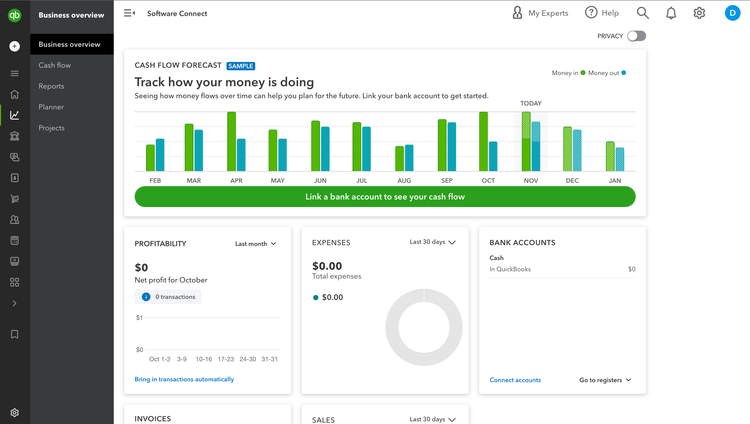

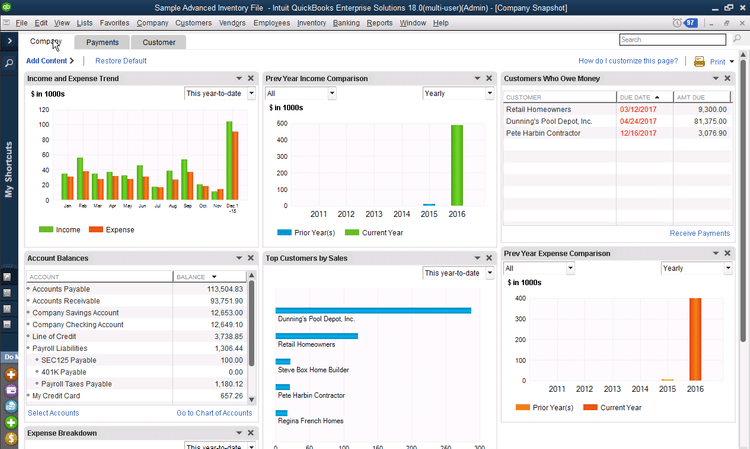

However, QuickBooks Online Payroll has a considerable price hike, a deterrent for many users accustomed to Desktop’s pricing. Additionally, QuickBooks Desktop is known for its ease of use. We’ve received many complaints from reviewers that QuickBooks Online is not user-friendly and takes ample training to use properly. You can see the difference in the screenshots below:

That’s why so many are opting to explore both desktop and cloud-based alternatives instead.

Why Choose an Alternative to QuickBooks?

Companies choose QuickBooks alternatives because of cost increases, usability issues, and customer support challenges.

- Complexity and Usability Issues: Users find QuickBooks Online significantly more difficult to use than QuickBooks Desktop. It requires a deeper understanding of accounting, which was not necessary with the Desktop version. Additionally, QuickBooks Online’s UI is not always user-friendly, making it challenging for small business owners to perform basic tasks without frequent support calls.

- Support Challenges: Support quality is a concern, with remote interactions sometimes leading to additional issues rather than resolving the original problem. Support is provided by overseas teams, which might affect the understanding and resolution of issues.

- Data Accessibility and Security: There are reports of users being unable to access their own financial data until they settle payments, which some customers perceive as being held “hostage” for their data.

- Cost Increases: There is a significant cost increase when moving from QuickBooks Desktop to Online. Users have experienced a shift from an annual fee to a much higher monthly fee, with some reporting doubling costs without any perceived improvements in the software.

- Accounting and Reporting Errors: Users have faced serious issues with bookkeeping accuracy, such as incorrect coding of line items and difficulties generating accurate end-of-year reports. These errors have even led professionals like CPAs to advise businesses to discontinue using the software.

Understanding QuickBooks and Its Limitations

While QuickBooks offers a wide range of functionalities, it has its limitations too. Selecting an alternative accounting system may be more suitable for your company’s individual requirements, such as cash management and other financial aspects.

QuickBooks Online Limitations

- Pricing and Add-on Costs: While QuickBooks Online is accessible and user-friendly, it can become expensive if you need more advanced features. For instance, adding many users or leveraging extensive customization and report features requires subscribing to the most expensive plans.

- Limited Historical Data Restoration: Users cannot revert to previous versions of their data unless they subscribe to the highest plan, which offers consistent backups. This limitation can be restrictive for businesses needing historical transaction data.

- Internet Dependency: Being a cloud-based solution, QuickBooks Online requires a stable internet connection to access data, which could be limiting in areas with poor connectivity.

- Limited Mobile App Functionality: The mobile app primarily supports basic functions like receipt capture and mileage tracking, which may not suffice for users needing full mobile management tools.

QuickBooks Desktop Limitations

- Integration and Accessibility: QuickBooks Desktop has limited integration capabilities with third-party apps compared to its online counterpart. It also requires remote desktop software for access outside the main installation site, which could complicate remote work scenarios.

- Manual Updates and Backups: Unlike QuickBooks Online, Desktop versions need manual intervention for updates and data backups, which can be cumbersome and time-consuming for users.

- Scalability and Customization: Though highly customizable and suitable for a broad range of industries, QuickBooks Desktop might be overkill for very small businesses or those that don’t require advanced features.

- Subscription-based Pricing: QuickBooks Desktop has transitioned to a subscription-based pricing model. This change means users pay an annual or monthly fee to use the software instead of a one-time purchase.

The best QuickBooks alternatives will be user-friendly and allow for the core bookkeeping capabilities. They will also fill a need QuickBooks may fall short in, such as industry preference, hosting preference, or even the size of your business.

You can weigh the pros and cons of QuickBooks Online in our review:

Key Factors to Consider When Choosing a QuickBooks Alternative

For former QuickBooks users looking to switch to new accounting software, there are specific considerations to ensure a smooth transition and continued functionality:

- Pricing Structure: Examine the pricing plans carefully. Software like Wave offers free core services with pay-as-you-go features for additional services like payroll and credit card processing.

- Data Migration: Assess the ease with which you can transfer data from QuickBooks to the new system. This includes historical financial data, customer information, and past transactions. Ensure the new software supports a straightforward migration process or offers tools and services to assist with the transition.

- Familiarity and Learning Curve: Consider the user interface and operational similarities to QuickBooks. Choosing software with a similar interface can reduce the learning curve for you and your team, allowing for a smoother transition.

- Feature Compatibility: Check that the key features you regularly use in QuickBooks are available and function similarly in the new software. This includes capabilities like payroll processing, inventory management, and tax preparation. For instance, if you heavily utilize QuickBooks for payroll, ensure the new software offers payroll solutions or integrates well with third-party payroll providers.

- Customer Support for Transitioning Users: Some software providers may offer specialized support for businesses transitioning from popular platforms like QuickBooks. This can be beneficial for addressing specific concerns that arise during the migration process.

- Customization and Add-ons: If your business used numerous customizations or add-ons in QuickBooks, check the availability and compatibility of similar customizations in the new software. This is particularly important for maintaining continuity in business processes and reporting.

However, different accounting systems have varying price points, and additional costs may be necessary for customization or optional features.

Is QuickBooks Desktop Being Discontinued?

Yes and no. QuickBooks Desktop is undergoing changes, but is not completely being phased out. The Desktop versions have shifted to subscription-based models instead of one-time purchase licenses.

Currently, the only version of Desktop being sold is Desktop Enterprise–you can no longer purchase Pro or Premier.

While Desktop is still available, Intuit is pushing existing users to the new cloud-based Intuit Enterprise Suite platform, which will be its flagship platform for multi-entity and enterprise companies.

Non-subscription versions of QuickBooks Desktop Pro and Premier will receive support for about 3-4 years; for instance, the 2021 version was supported until May 2024, and the 2022 version until May 2025. It will still technically work once the support is gone, but it will become incompatible with modern OS updates. Plus, you won’t have access to external services like payroll or credit card processing. Users looking to switch to online platforms can migrate from QuickBooks Desktop to QuickBooks Online or choose an alternative software.

Summary

In conclusion, selecting the right accounting system will optimize your business processes and let you achieve success in your industry.

QuickBooks has long been one of the most popular accounting software options. Products such as QuickBooks Online or Desktop have been a preferred bookkeeping choice for small business owners since Intuit’s inception in 1998. Today, the program has over 3 million subscribers.

However, there is an observable trend of customers moving away from QuickBooks to other accounting solutions. By considering the key factors discussed, such as industry and business requirements, budget, and scalability, you can make an informed decision in choosing the perfect accounting solution for your business.