The Best Accounts Payable Automation Software

We’ve reviewed the best AP automation software to help simplify invoicing, payments, and reconciliation. Our top picks cover features like ERP integration, global payment processing, or AI-driven invoice management.

- Integrates with NetSuite, Blackbaud, Microsoft Dynamics, Intacct, MRI, and QuickBooks

- Serves real estate, HOA, construction and financial industries

- Subscription and transaction-based pricing

- HIPAA compliant

- Automated purchase order matching

- Integration with NetSuite, QuickBooks, Microsoft Dynamics GP, Sage, and Xero

- Handles multi-entity

- Integrations with popular accounting software

- Invoice-based and performance-based workflows

We’ve ranked the best accounts payable automation software based on integration options, ease of use, and key features like electronic invoice processing and reporting capabilities. Here’s a rundown of our top products based on our internal review process and user reviews.

- AvidXchange: Best Overall

- MineralTree: Best for Healthcare

- Tipalti: Best for Global Payments

- Ramp: Best for Spend Management

- Stampli: Best Invoice Management

- DOKKA: Best for Document Management

- BILL: Best AI-Powered Invoicing

- Yooz: Best AI-Powered Option

- Procurify: Best Procurement Integration

- Precoro: Best for Three-Way Matching

- Coupa AP Automation: Best for Complex Expense Management

AvidXchange - Best Overall

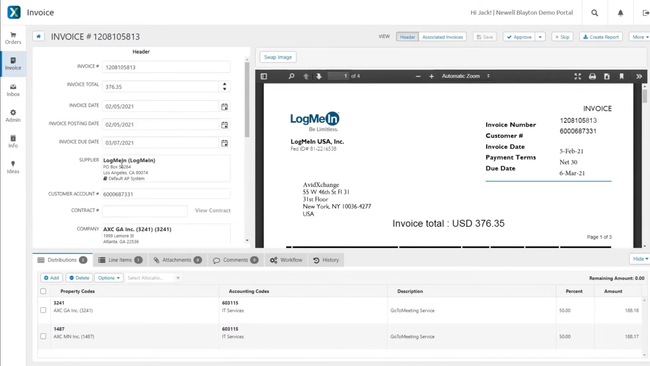

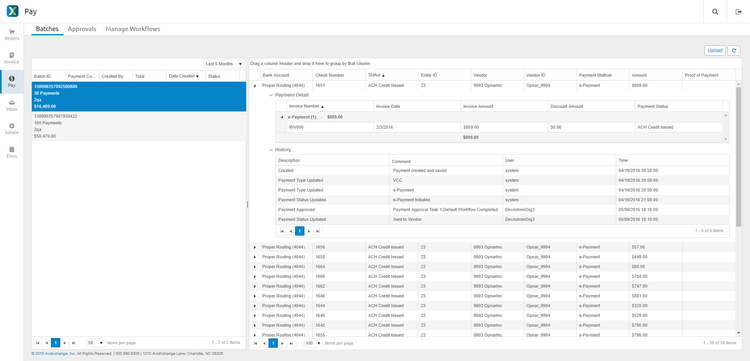

The AvidPay module in AvidXchange helps automate time-consuming tasks like cutting checks, reconciling transactions, and managing supplier relationships. Once invoices are approved, you can initiate payments directly within the AvidPay interface. You have multiple methods to choose from, including:

- Virtual Card Payments: Secure, rebate-generating transactions for greater financial control.

- Paper Checks: Mailed on your behalf with full tracking for vendors requiring traditional methods.

- eCheck/ACH: Direct deposit for faster processing and lower transaction fees.

You can monitor payment statuses from initiation to vendor receipt at any time for total visibility. AvidPay’s automated reconciliation ensures accuracy by integrating with over 225 ERP and accounting platforms. After processing the payment, this module logs the transaction in your accounting software and auto-matches it to the correct invoice. From there, it flags any discrepancies like overages, shortfalls, or missing invoices. Plus, you can generate detailed payment reports to streamline financial audits down the line.

Unlike self-service e-payment platforms, Avidxchange actively manages your supplier preferences so vendors always receive funds through their requested method. It also automatically updates supplier payment details, reducing the need for manual maintenance and preventing errors in the future. Overall, it’s a solid pick if you’re in real estate and marketing with 10 to 500 employees.

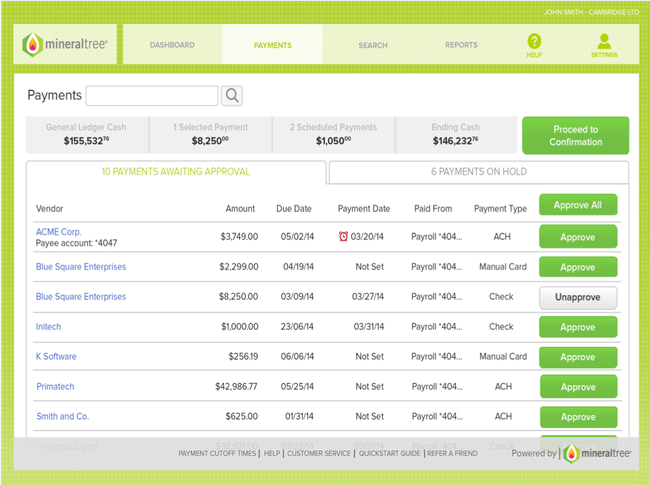

MineralTree - Best for Healthcare

MineralTree TotalAP can help healthcare organizations remain compliant with industry regulations. The system is one of the only AP providers audited and certified for SOC 2 and HIPAA regulations, giving you confidence it meets the industry’s strict security processes. MineralTree ensures all patient refunds, rebates, and checks issued on the platform are secure and approved. It’s a great way of reducing lengthy manual approval workflows for invoices and payments.

Additionally, the system keeps full audit trails of your accounts payable. Every step of an invoice’s journey is documented, from the initial draft to the final approval and send-off. It’s great for hospitals and clinics that process thousands of invoices per year, where miscommunications can cause huge problems for you and your patients. With the audit trail, you can pull up any past invoice in one central location to confirm amounts and easily resolve any issue.

MineralTree is ideal for mid to large-sized healthcare organizations managing multiple locations. It connects with hundreds of ERP systems, so you don’t have to disrupt established processes when integrating MineralTree into your tech stack. These include NetSuite, Sage Intacct, and more. Pricing starts at $200/month but will depend on your transaction volume and organization size.

Tipalti - Best for Global Payments

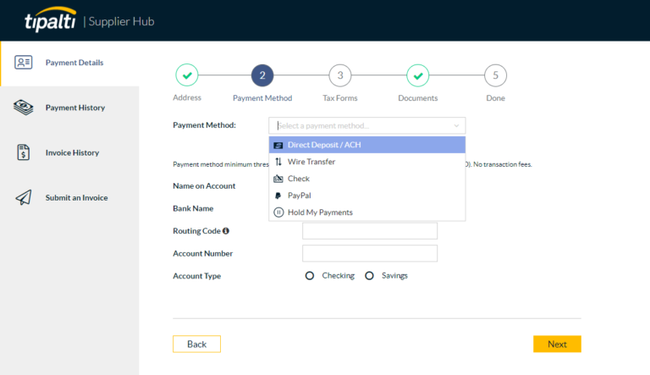

Tipalti supports over 190 countries, 120 currencies, and multiple payment methods. This makes it a solid choice for businesses with international suppliers and partners, as it simplifies cross-border transactions and reduces payment-related errors. It can also support a high transaction volume, which is crucial for

Tipalti’s advanced tax compliance features, including automated tax form collection and built-in regulatory compliance checks, ensure organizations adhere to global financial regulations. Its supplier management portal further streamlines the payment process by allowing vendors to manage their own payment details and preferences.

Tipalti is best for mid to large-sized companies that need a comprehensive AP automation system. That said, Tipalti is still affordable, with its lowest Select plan starting at $99/month, with the highest Elevate plan requiring a custom quote. If you’re a small business with a lower transaction volume, a system like BILL will be a better fit.

Ramp - Best for Spend Management

Ramp is a finance platform that combines corporate cards, expense management, and accounts payable automation for small and mid-market businesses. Ramp is one of the newer and more modern systems available, and we often see users praise its ease of use. It centralizes how companies manage employee spending, approve invoices, and process vendor payments.

Ramps card-first spend controls help make spend management simple by letting teams issue virtual and physical cards. Finance departments can set spending limits and merchant restrictions to prevent unauthorized purchases and deny out-of-policy spending. For accounts payable, Ramp also has one of the best supplier onboarding portals we have used. It provides step-by-step instructions for your vendors to complete without any confusing dashboards or workflows, unlike other enterprise systems we have tested. And when it’s time to pay an invoice, Ramp follows your approval workflows and uses OCR to extract the required information without any manual work.

Ramp is best suited for growing small businesses and mid-market organizations. We see it most commonly used by SaaS firms, service companies, agencies, and eCommerce businesses that need a central place to manage employee and vendor spending. Ramp offers a free plan for small teams with basic spend management needs. And paid plans which add advanced AP automation starting at $15/user/month with costs scaling based on team size.

Stampli - Best Invoice Management

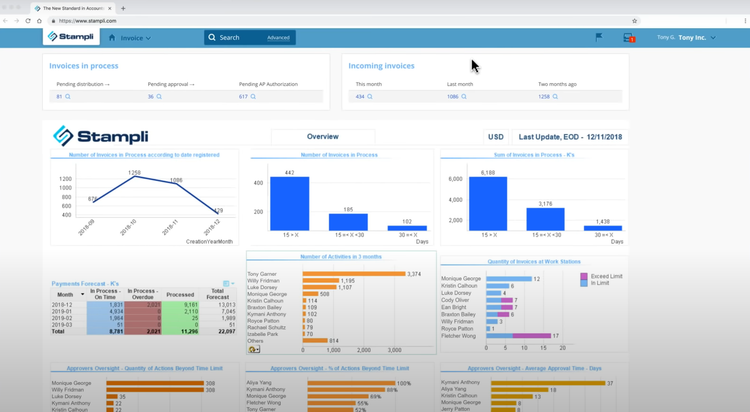

Stampli delivers an AI-driven platform that automates invoice capture, coding, and approval workflows. Its intelligent system, Billy the Bot, reduces manual tasks by learning from user actions to automate repetitive processes and decision-making.

Stampli’s interactive invoice dashboard provides live insights into invoice statuses, approvals, and exceptions, enabling businesses to maintain control over their accounts payable process. The platform’s collaboration tools help team members communicate directly within the invoice, simplifying the resolution of discrepancies and questions.

DOKKA - Best for Document Management

DOKKA stores all your AP documents, like invoices, POs, and receipts, in one central cloud-based archive. The repository has an interface similar to Google Docs, so your team can quickly get up to speed and find any file. From there, you can attach notes with comments, merge or split them, or chat with your team without leaving the hub. This gives you and your employees better communication and a clear audit trail of changes and approvals.

Additionally, the system integrates with several leading ERPs and accounting platforms, including NetSuite, Acumatica, QuickBooks, Sage, and SAP Business One. Once you process and approve documents in DOKKA, it automatically creates journal entries for your ERP using AI, letting you publish them instantly. This helps save a ton of time manually recording and reconciling payments made to suppliers in both systems, and makes your team more efficient.

DOKKA is best for small to midsize companies with 10-200 employees currently using an ERP system. Pricing starts at $650/month, but is based on the number of documents you process monthly. The system also includes several AI automation tools, like invoice management, approvals, PO-matching, and line item extraction.

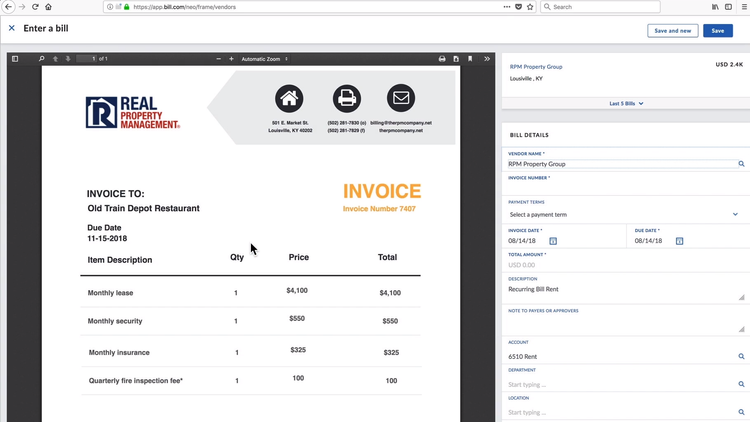

BILL - Best AI-Powered Invoicing

BILL Accounts Payable & Receivable, formerly Bill.com, features an inbox and AI-powered bill creation module. It captures invoices through mobile uploads, email, or direct vendor submission; from there, it instantly extracts key details like supplier names, invoice amounts, and due dates. Its AI engine even remembers recurring preferences, like which departments approve which vendors, so the system grows more efficient over time without any manual input.

As BILL pulls invoices into the platform, it automatically flags duplicates and splits bundled PDFs into individual records. It also pre-fills fields based on historical data; so if you receive regular invoices from an advertising agency, BILL learns to associate that vendor with the marketing department and auto-fills the GL account for professional services.

Once the bill is created, it’s routed through a customizable approval workflow built around your company’s policies. You can tailor these workflows to vendor, department, or dollar thresholds that run autonomously once you’ve set them. BILL provides a timestamped audit trail for every invoice and payment. And once payments are processed, it auto-syncs then with your accounting platform, including QuickBooks, Xero, NetSuite, Sage Intacct, and Microsoft Dynamics 365.

BILL starts at $49/user/month, though you’ll need the Corporate plan at $89/user/month for AI-driven invoicing and customizable approval workflows. While the AI does streamline data entry, some users report that it occasionally misses fields or fails to auto-populate invoice details. These issues are more likely with image-based or poorly formatted documents, so using clean, structured PDFs can help improve accuracy.

Yooz - Best AI-Powered Option

Yooz leverages advanced technologies like AI, machine learning, and optical character recognition to offer a highly automated and intelligent accounts payable solution. It also includes smart data capture technology, which ensures accurate invoice processing and reduces manual data entry.

Yooz’s dynamic workflow automation adapts to organizations’ unique processes, providing customized approval routes and automated matching of invoices, purchase orders, and delivery receipts. The platform’s intuitive interface and ease of use make it accessible to users of all technical levels, enhancing adoption and efficiency.

Procurify - Best Procurement Integration

Procurify provides a centralized platform for managing the procurement and accounts payable processes. This is great for finance teams looking for a single system to control the entire procure-to-pay process.

For the purchasing process, Procurify handles everything from request creation and management to real-time status updates and notifications. It also has the ability to request items from a product catalog or through online shopping via PunchOuts. Overall, it simplifies expense creation and submission, accelerating reimbursement.

Procurify also automates accounts payable processes, including automatic OCR invoice capture and 2-way and 3-way matching for reconciliation. Overall, it enhances AP reconciliation with capabilities to sync approved bills to ERP and accounting systems, track and report accruals, and reconcile deposits and prepayments.

Precoro - Best for Three-Way Matching

Precoro is an accounts payable and procurement platform that helps businesses manage purchase orders, invoices, and vendor payments. It’s designed to keep finance teams in control of daily purchasing and simplify the approval process.

Precoro does this with its three-way matching tools, which cross-check purchase orders, receipts, and invoices before any payments are released. This helps reduce the risk of overbilling and fraud by automatically flagging discrepancies and alerting the appropriate stakeholder. For organizations with high purchase volumes, this helps save hours of manual and tedious work daily.

Precoro is the best fit for organizations with formal purchasing processes, typically mid-sized companies. And with pricing starting at $499/month for the core plan, the system may be overkill for very small businesses without any structured AP workflows.

Coupa AP Automation - Best for Complex Expense Management

Coupa AP Automation’s expense management module helps enterprises reduce errors and streamline workflows. The system automatically imports expense line items and receipts from multiple sources, helping you consolidate all your data into one repository. This is useful for large companies that require company-wide expense reports without manually crunching the numbers.

Coupa AP Automation also helps global companies prevent fraud for global expenses. Its advanced audit algorithms can identify suspect or fraudulent patterns based on employee history and current report details. It also includes multi-currency support so global office and travel expenses can be audited as well. This helps ensure proper expense reporting across the entire company.

Additionally, Coupa leverages AI to analyze travel and expense programs. The system generates tailored recommendations for expense-saving opportunities. It integrates travel with all other company expenses for full visibility into spending trends, ensuring that unnecessary costs are minimized. This can greatly impact large companies, as manual processes cannot monitor such large volumes of data simultaneously, leading to expense programs becoming inflated.

What is Accounts Payable Automation Software?

Accounts payable (AP) automation software is designed to help businesses reduce the time spent on invoicing tasks. By automating your payment processes, you can cut down on costly accounting errors and common invoicing delays.

Additionally, AP automation software streamlines the payment process on both ends. Vendors and suppliers can receive your payments faster when you submit digital invoices. And it’s easier to confirm payment was sent when you have an electronic trail.

Key Features

- AP purchase order and invoice records: Generate and organize records for all your business transactions, starting with the original purchase order

- Optical character recognition (OCR): Scan physical invoice documents into a digital system to maintain a standardized digital formatting

- Electronic payments: Simplify the payment process by using ACH or EFT formats; coordinate your online accounting capabilities

- Check-writing: Create and print individual or batch check runs for your business payments

- Recurring payments: Avoid late payments by sending out automated reminder notifications when payment is due to vendors, suppliers, and distribution partners

- Contact database management: Organize all your contact information for vendors, suppliers, distributors, customers, and employees

- Account lookup: Keep digitized records of all transactions; easily search records to determine which accounts are on time and which are outstanding by date, vendor, or other factors

- Tax form documenting: Process W-2s, 1099 and other tax forms electronically

- General accounting: Balance your AP against your accounts receivable (AR) in a general ledger to ensure your company finances stay in order

Benefits

There are many incredible benefits to automating your payable processes:

Reduce Payment Errors

Traditional accounts payable processes increase the chances of human error. Even the most skilled accountant on your AP team can accidentally move a decimal place when calculating invoices. It’s simply a matter of statistics, as the more manual tasks there are, the more chances there are for small mistakes to add up. Automated AP processes cut down on the potential for mistakes.

By reducing invoice processing mistakes, AP automation helps drive down costs from potential errors. Since the software records the original purchase order, the applications always check the payment price against the agreed-upon costs.

Avoid Late Payments (and Penalties)

Payments always have due dates. Missing a payment or being a few days late can lead to fees. Worse, it can damage your relationship with your suppliers. To protect your vendor relationships, you need to make timely payments. But even if you mail out a physical check on time, there’s always the chance the mail could delay the delivery.

Electronic payments don’t take days to deliver - they’re virtually instantaneous. Automated reminders can notify your billing department whenever a payment is due. You can even set a timeline for how far in advance you get these reminders based on your accounts receivable schedule.

Standardized Payment Forms

Financial data is tricky enough to manage when presented in a standardized format. Yet every business partner you have has their own preferred invoicing method. You can’t modify your payment processes to accommodate every single one. Instead, electronic data interchange (EDI) and optical character recognition (OCR) applications let you scan invoices from all your vendors and suppliers into one digital format.

By standardizing invoices as they arrive, you can reduce data entry. An accounting system with EDI and OCR tools will automatically import the invoice data you need to optimize the payment process. Then, your AP team can focus on making payments instead of manual data entry.

Mobile Access Anywhere

AP automation solutions generally include mobile apps for extra accessibility during approval. If you are in charge of payment authorizations, you must be accessible even on the go. With mobile apps, you can provide approval to your AP team at your convenience. And this can lower your processing costs as you don’t have to waste time going into the office to give invoice approval.

Keep Accurate Payment Records

Whenever you pay a vendor or supplier, you update your records to show that your account has been paid off. Once the vendor receives your payment, they will update their accounts receivable balance. Unfortunately, your payment is vulnerable once it leaves your hands until it arrives in theirs. Unless you want to pay more for delivery confirmation, you cannot track your payments through traditional shipping methods. If the payment never arrives, it’s your word against theirs.

Paying electronically adds a layer of protection to your vendor interactions: Automated AP software tracks your electronic invoice payments, so you always have a record of when invoices were paid. If there are ever any discrepancies with a vendor, you’re covered by your digital records.

Additionally, these AP reports provide valuable bargaining information when it’s time to negotiate with vendors. Looking at your past payments can help you set up better terms. And in the long run, you can use your AP records to see which vendors have historically offered you the best purchase prices. An integrated ERP system will allow you to track your AP payments and locate potential invoicing bottlenecks.

Fraud Protection

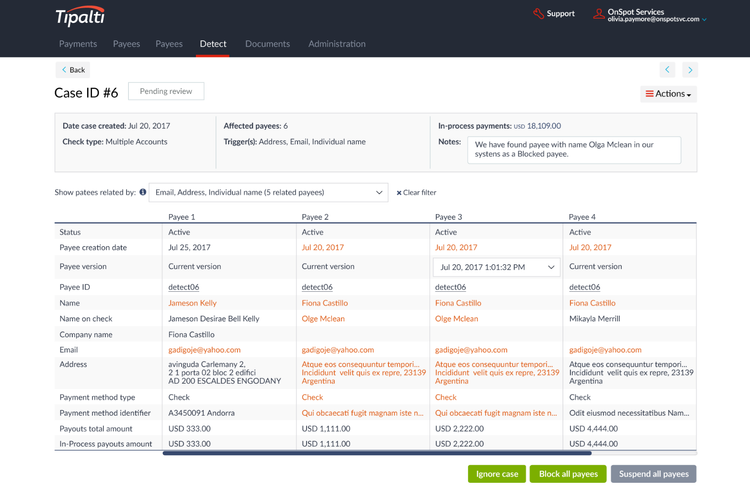

Finally, automated AP helps protect your company from fraud. Since all payments are automatically recorded, it’s easy to generate an audit trail to find any discrepancies from potentially fraudulent actions.

Pricing Guide

AP automation software costs can range from $8,000 to over $250,000 per year depending on your company size, user count, and desired features:

| Tier | Company Size | Total Cost of Ownership | Example AP Automation Software |

|---|---|---|---|

| Entry-Level | 1–20 employees | $8,000–$15,000 per year | Melio, Plooto |

| Mid-Tier | 20–100 employees | $15,000–$35,000 per year | Stampli, MineralTree, AvidXchange |

| High-Tier | 100–500 employees | $35,000–$100,000 per year | Tipalti, Yooz |

| Enterprise Tier | 500+ employees | $100,000–$250,000+ per year | SAP Concur Invoice, Coupa |