The Best Bank Reconciliation Software

We’ve reviewed the top bank reconciliation software for businesses of all sizes, from large financial institutions looking for multi-entity reporting to small businesses looking for an affordable option.

- Automated workflows

- Enhance regulatory compliance

- Real-time, reliable MI and comprehensive audit trails

- Match transactions across multiple sources

- Exception management

- Real-time visibility into financial data

- AI-powered automation for less reconciliation breaks

- No-code rules builder

- Transparency with audit trails and exception workflows

When searching for the best bank reconciliation software, a company should look for features that will automate the reconciliation process, minimize manual intervention, and reduce the risk of errors and compliance issues.

We’ve evaluated a handful of options on the market to find the ones that provide real-time visibility into financial data, including detailed reports and analytics, and offer comprehensive audit trails. Top picks are also scalable to support company growth and integrate easily with existing systems.

After researching and comparing 20+ options, here are our top picks for the best bank reconciliation software based on our own independent review process.

- AutoRek: Best Overall

- BlackLine: Best for Large Businesses

- Duco: Best for Process Building

- ReconArt: Most Configurable

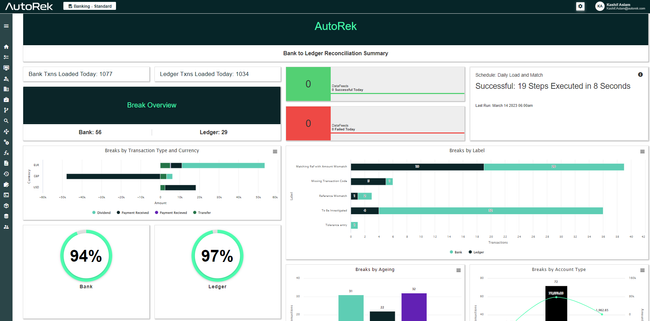

AutoRek - Best Overall

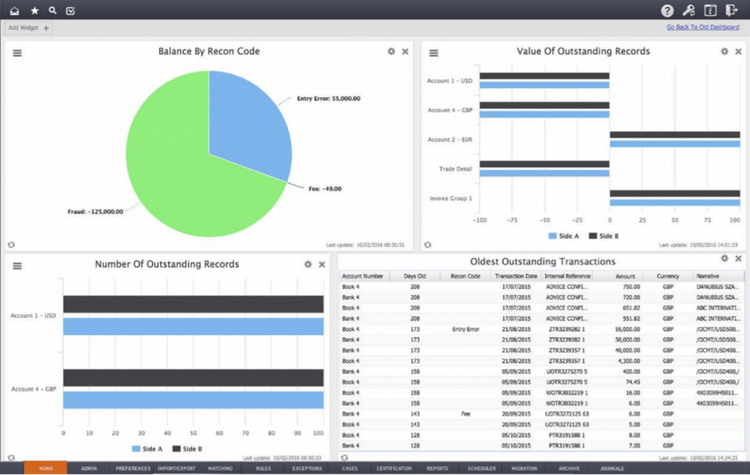

AutoRek’s automated intelligent transaction matching can help save you hours during the reconciliation process. The system recognizes fields and even suggests optimal match rules for better accuracy. You can also configure several fields, like timing or age sensitivity, role segregation, and approval workflows. That way, you can account for every exception and match.

You can select different match sequences, including tiered, one-to-many, or cascading. The latter two are crucial if you’re dealing with high transaction volumes or complex payment structures. It enables the system to make the most confident matches first, so you can be sure those are accurate as you get to manual review of complex scenarios. And you always have the option to manually review for human intervention.

AutoRek is ideal for financial sector organizations, including banks, asset managers, insurance companies, and hedge funds. It includes a full suite of bank reconciliation tools, including data validation, exception management, and compliance with the FCA and the GDPR. Because of the breadth of features, it may be too expensive and complex for smaller organizations.

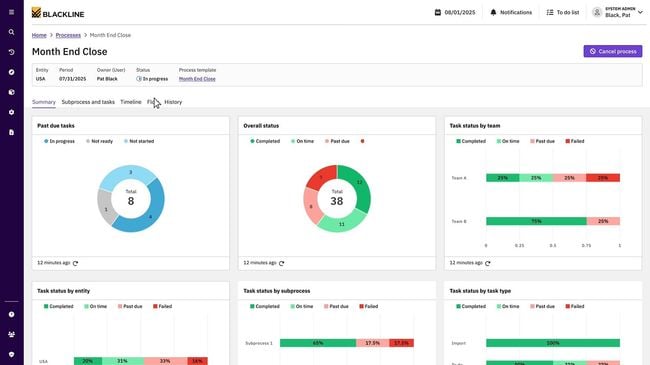

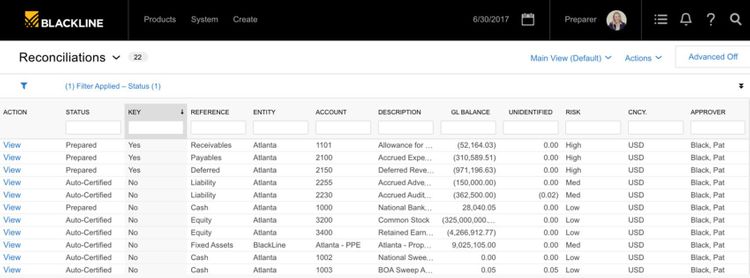

BlackLine - Best for Large Businesses

BlackLine’s account reconciliations module streamlines processes by matching transactions across multiple sources, including bank statements and your ERP or accounting software. It also includes exception management to help identify and resolve discrepancies automatically. This allows large companies with several subsidiaries or divisions to ensure financial statements match their general ledgers.

BlackLine also includes an easy-to-use report writer within the account reconciliations module. The customizable dashboard can include graphs and charts for different metrics, including:

- Status reports: See the percentage of reconciliations that have been completed vs. outstanding and their due dates. It also shows the rejection percentage with the provided reasoning.

- Metrics by entity: Drill down into entity-specific past-due and unreconciled balances to better prioritize workflows.

- Unidentified differences: Report on accounts with unidentified differences above the acceptable threshold and look into the causes.

Blackline does not disclose pricing figures publicly, and its subscription model varies based on the number of users and desired modules. However, compared to simpler systems like ReconArt, implementation can be complex and resource-intensive.

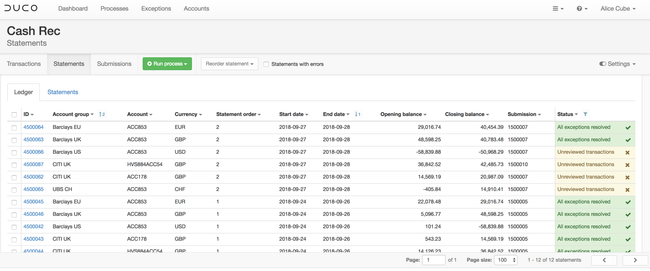

Duco - Best for Process Building

Duco offers a no-code process builder that your financial team can use, not just IT specialists. This lets non-technical users define and configure reconciliation or data-automation processes with minimal coding. It guides you through a wizard where you upload sample files and define which inputs to match and identify the fields. From there, you can apply rule sets, like “match counterparty name first, then symbol,” and build the rest of the logic workflow.

Additionally, Duco also supports Natural Rule Language (NRL) and an Agentic Rule Builder, which uses plain-English prompts to generate rule logic. This further reduces the barrier to building complex workflows for business teams. It’s really great for large businesses managing high-volume data flows, multiple counterparties, and complex data environments, as it speeds up the reconciliation process.

Duco includes several other reconciliation features, including AI-powered data extraction, file-agnostic intake, and integration with BI tools. Due to its extensive suite of features, it’s best suited for large organizations in the financial services and fintech industries. And Duco claims setting up a new reconciliation is fast—anywhere from a few hours to five days—though it may take longer for more intricate processes.

ReconArt - Most Configurable

ReconArt is adaptable to a wide range of business scenarios, making it suitable for businesses of all sizes and industries. It offers various reconciliation capabilities, including banking, credit cards, balance sheets, and more, making it a one-stop solution for managing various financial reconciliation processes. And with a pricing structure starting at $1,500 per month for a 5-user minimum, ReconArt is a cost-effective solution for businesses looking to streamline their reconciliation processes.

One of the key advantages of ReconArt is its full automation capabilities, which lead to significant time savings for finance teams. It enhances control and auditability while improving operational efficiency. Seamless integration with ERPs, internal systems, and platforms makes ReconArt user-friendly, flexible, and configurable to meet specific business needs.

What is Bank Reconciliation Software?

Bank reconciliation software helps automate the financial close process and replaces it with a centralized online system. Preparers using the software can retrieve real-time balances from a general ledger, carry information and open items from prior periods, and compare data from the bank statement and invoices. These account reconciliations can then be signed electronically by the preparer before being sent to a reviewer for approval. Once approved, the data can be stored in the software’s database as an audit trail.

Many account reconciliation software providers provide unified templates to highlight this reconciliation data and provide a layer of automation to grab financial data from your banks, general ledger, and other accounts. Users can upload supporting documents, leave comments, view company policies and procedures, and electronically view and sign off on bank reconciliations. Rules-based certification tools can help management monitor the process and create dashboard reconciliation reports that illustrate your company’s cash flow.

Key Features

- Account transaction matching: Match bank transactions and internal account transactions from multiple sources to each other. Establish matching rules specific to one account or company-wide. Can create matching transactions to solve differences within predetermined tolerances.

- Reporting: Create reconciliation statement reports that list unmatched records. View suggestions for getting your account into balance. Store reports for future historical reporting and compare the differences in financial statements from previous periods.

- Issue Management: Identify exceptions, track follow-up attempts, and roll forward issues into subsequent periods, and resolve via a manual matching clean-up method.

- Classifications: Match records correctly by assigning appropriate type classes and using that as an attribute during the matching process. Classes can be user-defined or set automatically.

Benefits

Both large and small businesses will benefit from the use of reconciliation software. Automated algorithms, full bank and ERP integration, and in-depth reporting are a few of the immediate benefits offered to a company looking to implement bank reconciliation software. Larger businesses will benefit even more as they begin to handle multi-entity accounting or multi-currency accounting, and require managing multiple bank accounts across different stores and regions.

Fully Automate Your Bank Reconciliation

Account reconciliation software provides a level of automation that relies less on manual input from your employees, leaving you more time to analyze reports and improve other areas of your business. Automation will lead to stronger compliance, decreased costs, and speed up the financial close process.

The controls embedded within reconciliation software will improve automation by decreasing the risk of errors. This is accomplished by ensuring all connected balance sheet accounts are reconciled (including new or recently added accounts), sending alerts to the appropriate users for approval or rework, template creation, and storing documents in the right place.

When it comes to inter-company transaction processing, bank reconciliation software will automatically post transactions across different entities at the same time. This will ensure your accounts always balance with one another. Other types of activities that can be automated include journal entries as well as the creation of checklists that can point your staff in the right direction at the month-end close.

Standardize Your Reconciliation Process

Account reconciliation software will help optimize how your reconciliations are presented, which will help improve the quality and accuracy of your financial data. Many companies that perform manual reconciliations will deal with non-standardized methods. This means that their documentation is being recorded in a variety of formats and data is spread thin between different locations. This downside is in addition to the amount of manual labor that is required to perform the reconciliations, meaning their full-time employees are tied up with handling more important tasks.

Reconciliation software will enforce standardized rules for every reconciliation type. When it comes to auditing, bank reconciliation software will give a standardized presentation of your reconciliations and also provide a centralized document repository. Management staff handling approvals will be able to easily monitor the activity of the staff handling the reconciliations.

Reduce Errors and Enhance Internal Controls

Internal controls in your accounting process will assure your organization is being as effective and efficient as possible by providing reliable financial reporting and compliance with any laws, regulations, and policies. Balance sheet reconciliation software will compare your accounts and adequately explain the differences between accounts.

The biggest benefit of the internal controls provided via account reconciliation software is the reduction of risk that is prevalent with manual paper-based methods. Electronic processes will help segregate duties between your staff, automatically sync with any accounting software or ERP systems, and detect missing or duplicated transactions.

Pricing Guide

Low-Cost

- Business Size: 1–2 users, low transaction volume

- Annual Cost: $1,500 – $5,000

- Example Products: QuickBooks Online, Xero, Zoho Books

Mid-Range

- Business Size: 3–10 users, moderate transaction volume or multiple accounts

- Annual Cost: $5,000 – $20,000

- Example Products: Sage Intacct, AutoRek, BlackLine Essentials

High-End

- Business Size: 11–50 users, high transaction volume, or multi-entity

- Annual Cost: $20,000 – $75,000

- Example Products: NetSuite, FloQast, BlackLine Mid-Market

Enterprise-Tier

- Business Size: 50+ users, enterprise reconciliation and compliance needs

- Annual Cost: $75,000 – $250,000+

- Example Products: BlackLine Enterprise, Trintech Cadency, Fiserv Frontier Reconciliation