The Best Government Software

These solutions offer you tools for project budget tracking, permitting, and compliance. Whether you’re managing finances or keeping departments in sync, you’ll find a system to meet the unique demands of local government and municipal work.

- GASB-compliant annual comprehensive financial reporting (ACFR)

- GIS-integrated property and asset management

- Multi-levle budget entry system

- Web portals and mobile apps for employees, residents, and vendors

- Can customize the system by only selecting specific modules that you need

- Streamlines finance, payroll, clerical work, and utilities operations

- Cloud accounting solution

- Comprehensive training resources

- Modules for accounts payable, receivable, etc

We tested and evaluated the most popular platforms on the market today, factoring in financial management capabilities and support for different levels of government.

- Tyler Enterprise ERP: Best for Mid-Sized Agencies

- Edmunds GovTech: Best for Local Governments

- Blackbaud: Best for Public Works

- Workday: Best for State Governments

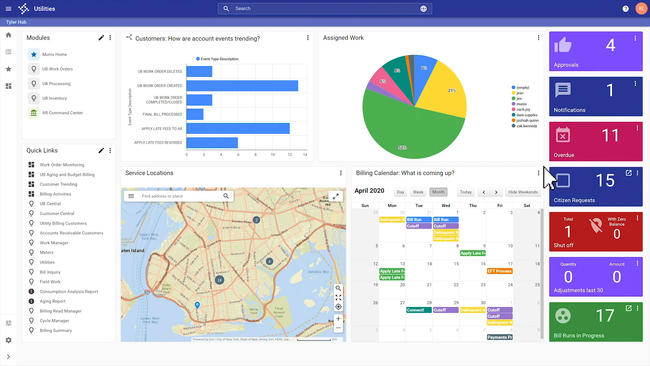

Tyler Enterprise ERP - Best for Mid-Sized Agencies

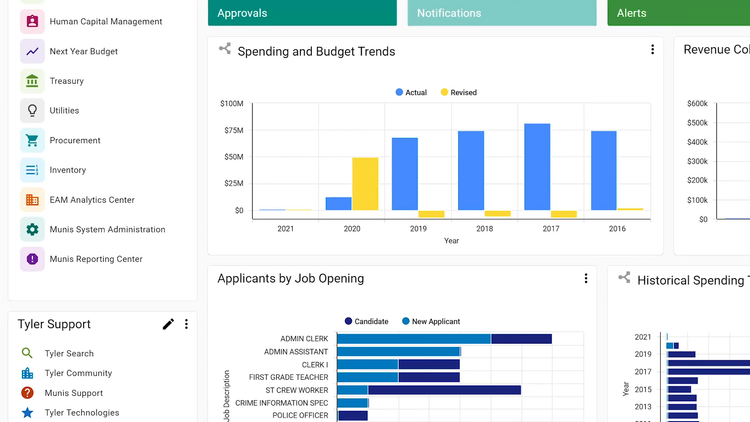

Tyler Enterprise ERP, formerly Munis by Tyler Technologies, makes it easier to coordinate budgets across several departments, from transportation and environmental services to health and public safety. Its multi-level budget entry system lets mid-sized agencies drill down into specific categories.

For example, you can track budget line-item allocations for operational supplies or contracted services, helping you identify trends and respond to seasonal needs. This insight also aids in GASB-compliant annual reporting, essential for presenting accurate financial statements. In addition, this ERP can help project year-end impacts more accurately and minimize budget shortfalls.

Tyler’s tools also let you itemize expenses and add vendors to each individual budget line. Built-in justification fields and audit trails help track and explain adjustments. This approach supports transparent reporting and more consistent data across departments. The system’s categorization features also help separate recurring and one-time expenses so you can prioritize essential allocations without affecting other services.

The platform’s approval workflows allow upper management to review and approve proposed budgets with confidence. With real-time encumbrance tracking, you can monitor spending commitments versus actuals for compliance with state standards. Plus, next-year projections pull from past data, so you can review proposed, adopted, and amended budgets year over year for better financial planning.

Get more details on Tyler Enterprise ERP on our product page.

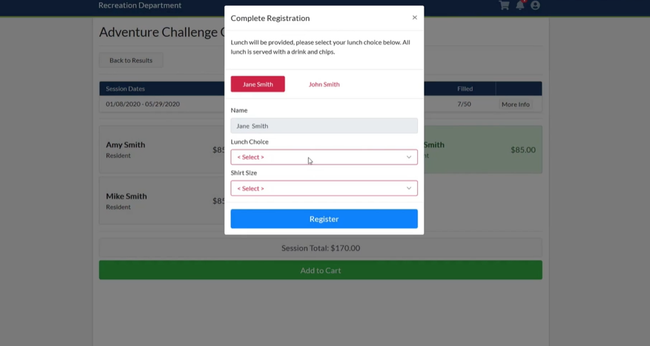

Edmunds GovTech - Best for Local Governments

Edmunds GovTech offers a strong permitting and inspection module to help better manage building permits, inspections, and code enforcement. The interface is fairly easy to navigate, letting you quickly add contractor details and use codes to new permits. With automatic data fill for license numbers and addresses, GovTech also cuts down on redundant data entry.

Once you activate a permit, you can schedule inspections and assign any violations. The system tracks each inspection, creating a digital audit trail for historical reference. This setup reduces project delays and helps maintain compliance with local ordinances and safety standards. Plus, staff can upload inspection results and compliance certificates to each permit record, helping you better understand community needs and assess performance metrics.

This module automates fee calculations based on work descriptions, like structural changes and subcode requirements. You can either enter custom details or use pre-filled amounts for standardized charges. With the “calculate fees” option, it’s easy to review all fees for different subcodes before finalizing. This makes municipal fee scheduling more streamlined and keeps everything compliant.

Finally, the system includes built-in payment collection for contractors and residents. After calculating the fee, users can generate an invoice and auto-assign a unique permit number. This helps your municipal staff keep financial records organized and streamlines the whole process from permit request to payment completion.

Learn more about Edmunds GovTech and its capabilities.

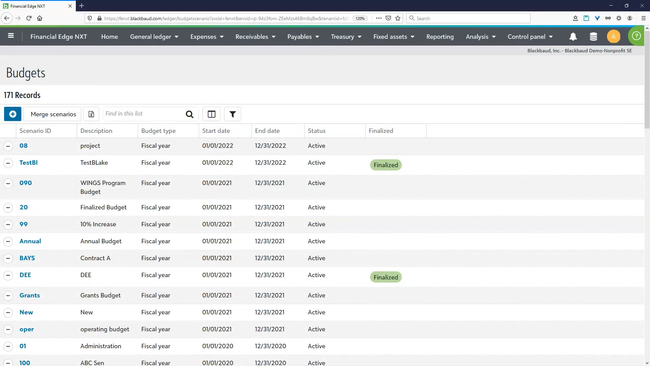

Blackbaud - Best for Public Works

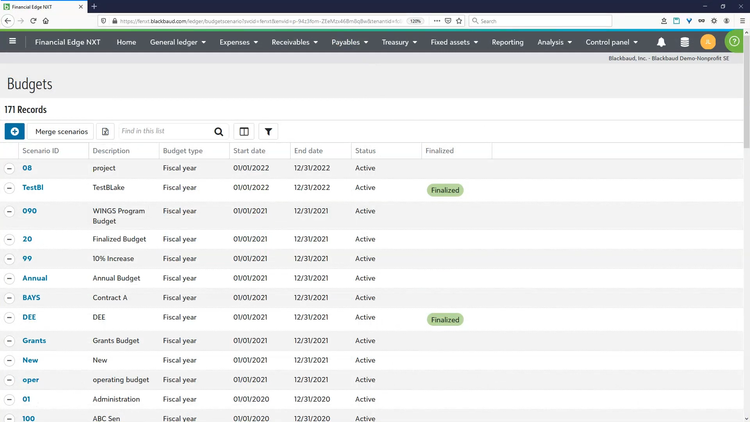

Blackbaud Financial Edge NXT is ideal for managing multi-phase projects like facility upgrades and road maintenance. Its project tracking tools capture all key details, from initial budgets to expenses, contractor invoices, and regulatory permits, so you always have a clear picture of your project’s financials.

With real-time budget-to-actual dashboards, you can easily spot spending patterns across large projects, so you’re less likely to overspend. You can tailor reports for different stakeholders, including infrastructure planning boards and government oversight bodies. Additionally, the software includes budget compliance business rules that alert you if expenses risk exceeding the budget.

For long-term project planning, Financial Edge NXT supports multi-year budgeting to better plan for future needs. You can track diverse revenue sources like municipal funds, grants, and bonds for compliance with funding requirements. Additionally, Blackbaud includes project forecasting and scenario planning so you can adjust your funding strategies based on changing project timelines or resource costs, ensuring your projects always stay on track.

Find out more about BlackBaud Financial Edge NXT and its key features.

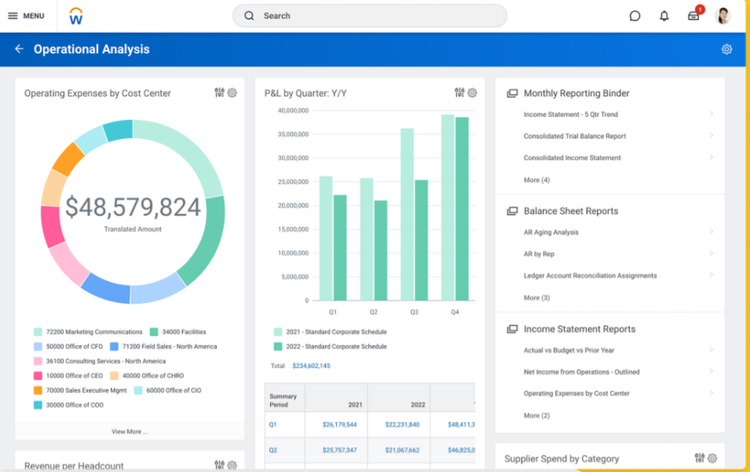

Workday - Best for State Governments

Workday for the public sector’s spend management module allows state governments to streamline procurement processes across all departments. It comes pre-built with a full supplier portal to simplify sourcing and make the RFx process more efficient. The portal also has shared access, so you can choose which departments can use it and which employees can see order and inventory data. It’s great for keeping data secure while allowing for faster supplier ordering.

Additionally, you can improve the expense management across all departments. The system tracks every expense automatically, leaving a full audit trail to ensure transparency. You can configure rules for your state’s spending policy, allowing you to see all out-of-policy purchases. The tool gives your agency more insight into where the state allocates taxpayer money and private funds, providing more accountability.

Because of Workday’s ERP capabilities, it has a pretty high cost. State government agencies should expect to pay over $100,000/year on average. The price is based on the size of your agency, how many users you need, and the specific modules you require.

See our Workday page for more info.

Organizations in the public sector support many of the same accounting activities as commercial companies: cash management, analytical report tracking, creating budgets, and identifying and tracking operational costs. However, solutions designed exclusively for commercial use often fall short of supporting the full needs of government and public administration organizations. Support for fund accounting practices and GASB compliance set certain accounting systems apart as particularly applicable for use in the public sector. Discover more about your options for government accounting software in this article.

What is Government Software?

Government software is designed to better manage your local government, municipality, or whatever jurisdiction you may be overseeing. This is accomplished through proper fund accounting, grant management, strict departmentalized budgeting, utility billing, code enforcement, licensing, inspections, permitting, and more. Government software can include strictly financial management (government accounting software), or something that encompasses financials plus operations (a government ERP software).

Governments need software to track the financials and funds for the following areas:

- General: General areas of the government needing accounting, such as tracking expenses incurred and payments received for goods and/or services

- Special Revenue: Tax revenues earmarked for a particular project

- Capital Projects: Construction of buildings or roads

- Debt service: Paying off long-terms debts taken on by the government to finance various projects

- Internal service: Paying departments within the government for work that benefits other departments

- Utilities: Water, sewer, electric, etc.

Governments must adhere to strict budgets as their funding may be limited. Typical expenses you’ll want tracked in government software include salaries, benefits, supplies, housing or operating expenses of government facilities, upkeep of public services such as parks and libraries, and maintenance of roadways and other public transport systems.

Department heads will want to organize their expected revenues and estimated expenditures for the current and next fiscal year. Higher-ups in the organization can further analyze these budgets for approval and see where money is potentially being wasted.

Key Features

While government organizations aren’t typically engaged in the standard commercial enterprise of generating profits, there is still a need to make financial management as efficient and accurate as possible. The pressure to lower operating expenses and maintain error-free books is just as real for public sector organizations as for any business.

Fund Accounting

Government entities use fund accounting practices to track the allocation of funds for specific purposes. Funds are essentially accounting entities with self-balancing accounts designed to record cash and other assets, as well as related balances and liabilities. A fund accounting approach allows government entities to track all expenditures back to specific fund sources.

Financial Management

Typical financial management functions included in government and public administration systems include general ledger, accounts payable, accounts receivable, and budgeting. Additional modules frequently include applications such as billing programs, job costing, project management, licensing, inventory control, and purchasing.

One of the challenges of meeting government accounting requirements is that there are so many different types of public sector organizations. Local, county, state, and federal levels represent just one aspect of the variety. In terms of which accounting software is appropriate, the more relevant difference can be seen in the multitude of functions that public sector bodies serve. Without attempting a comprehensive list, it’s clear to see that there are major differences between the type of accounting features needed by fire and police, health care and social service departments, tax-related groups, public works departments, the courts, and various elected officials.

The challenge of meeting such disparate needs is compounded by the fact that there a major benefits to using a comprehensive system for organizations with a number of different departments. Integrated information allows public sector entities the ability to lower the total cost of ownership by creating efficiencies associated with keeping all relevant information within one centralized database. Hardware requirements are significantly reduced when records are not duplicated across multiple systems. There is a major time savings impact, as well, when staff can access information easily from within a single system.

GASB Compliance

Government and public administration organizations also need software that is compliant with GASB (Government Accounting Standards Board) regulations. While the GASB is not actually a government-run program—it’s a non-profit standards board—many states require compliance with it. It is generally considered to be the gold standard for defining government accounting practices. One of the standards that GASB sets is actually a requirement for a fund accounting approach to managing financial data.

Pricing Guide

Pricing for government software varies based on your organization’s size, the number of users you have, and the features you need. Here’s a breakdown of the average cost based on employee count:

| Tier | Size | Average Cost | Examples |

|---|---|---|---|

| Entry-Level | 1–20 employees | $3,000–$10,000 per year | Edmunds GovTech Basic Suite, Blackbaud Financial Edge NXT Essentials, Zobrio Fund Accounting |

| Mid-Tier | 20–100 employees | $10,000–$50,000 per year | Edmunds GovTech Full Suite, Tyler Technologies Incode, Blackbaud Financial Edge NXT, CityView Essentials |

| High-Tier | 100–500 employees | $50,000–$200,000 per year | Tyler Technologies Munis, CentralSquare Finance Enterprise, OpenGov, CityView Enterprise |

| Enterprise | 500+ employees | $200,000–$1 million+ per year | Oracle Public Sector Cloud, SAP S/4HANA for Public Sector, Tyler Technologies Enterprise ERP, Workday for Government |

Taking the Next Steps

Most government agencies require three bids when purchasing. Locating three software solutions that can meet your needs can be time-consuming. Save some time, and let us do the legwork of identifying three or more appropriate solutions for you to include in the bid process. Whether you are looking for a complete ERP system or specific functionality to augment existing software, through a brief phone call, our software specialists will look to better understand your business and software needs to help you locate the most relevant solutions for your requirements. Get started today!