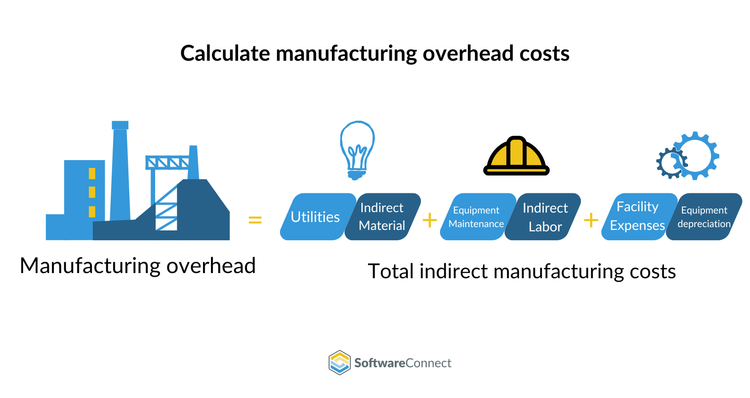

How to Calculate Manufacturing Overhead Costs

Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. You can calculate manufacturing overhead costs by simply adding your indirect expenses, such as direct materials and labor, into one total.

What goes into Manufacturing Overhead?

Manufacturing overhead includes expenditures outside of raw materials or direct labor costs. Also known as “indirect costs,” these common resources benefit the production process but are not traceable to any specific product. Some examples of indirect costs include:

-

Indirect materials - The cost of consumables not directly attributable to finished goods, like cleaning supplies and industrial lubricants for factory equipment

-

Indirect labor - The cost of labor not directly attributable to finished goods, like salaries for janitorial and quality control staff, security guards, accountants, and office workers

-

Cost of equipment repairs

-

Depreciation on manufacturing equipment - The value your equipment loses each year.

-

Operating expenses - Property taxes, rent, insurance policies for your manufacturing facility

-

Utilities - Electrical, gas, water, and other basic utilities

Types of Overhead Costs

In activity-based costing methodology, the expenses and costs that make up manufacturing overhead fall into these three categories:

Fixed Costs

- These costs remain constant regardless of an increase or decrease in products manufactured. Factory overhead might include mortgage or rent payments, business insurance, and property taxes, which are the same monthly.

Variable Costs

- Variable costs will fluctuate depending on increased or decreased activity in your factory. Generally, these costs increase the more a company produces products. For example, the cost of electricity will be higher for 10,000 units produced than for 100 units produced.

Semi-Variable Costs

- These expenses are not dependent on the number of units produced in your facility but are subject to fluctuating circumstances. For instance, equipment repairs and maintenance are indirect semi-variable costs.

3 Steps to Calculate Manufacturing Overhead Rate

Determining your manufacturing overhead expenses and rate will allow you to monitor your company’s expenditures and the efficiency of your production. It can help create more accurate budgets and ensure your business with cash flow.

-

Identify the indirect costs - First, you must examine all your manufacturing expenses and determine what indirect costs enable your facility to operate. If you are unsure which costs are indirect, refer to our What goes into Manufacturing Overhead section above.

-

Calculate the total manufacturing overhead - Next, add up all the indirect expenses together. This will determine your total manufacturing overhead for the selected time period.

-

Apply the formula - Plug these overhead costs into the manufacturing overhead rate formula: Overhead Costs / Sales x 100 = Manufacturing Overhead Rate

The overhead rate is expressed as a percentage of revenue. A low percentage suggests the production process is efficient, While a higher percentage could indicate a lagging or inefficient production process.

A Guided Example of Manufacturing Overhead Costs and Rate

Your factory has brought in $750,000 in sales this year and has identified these indirect expenses associated with your production process:

| Indirect Cost | Expense Total |

|---|---|

| Factory Mortgage | $85,000 |

| Factory Property Taxes | $4,500 |

| Staff Salaries | $65,500 |

| Equipment Repairs & Maintenance | $15,000 |

| Depreciation on manufacturing equipment | $30,000 |

Altogether, your plant’s total overhead costs total $200,000 annually. Your facility brought in $750,000 in sales that same year. You would calculate the overhead rate using this manufacturing overhead formula:

Overhead Costs / Sales x 100 = Manufacturing Overhead Rate

$200,000 / $750,000 x 100 = 26.66%

26.66% is your manufacturing overhead rate. Generally, your company should have an overhead rate of 35% or lower, though this can be higher or lower depending on your circumstances. A lower percentage indicates efficient operating procedures.

How to Allocate Costs Using Predetermined Overhead Rate

Most businesses typically follow Generally Accepted Accounting Principles (GAAP) for their accounting. Under GAAP, total manufacturing overhead costs must be allocated to each unit produced.

To assign these costs to your products, divide your total manufacturing overhead by an allocation base. Your allocation base could be any of the following:

-

Direct labor hours

-

Direct materials costs

-

Direct machine hours

-

Number of units produced in one quarter

Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. Whichever you choose, apply the same formula consistently each quarter to avoid misleading financial statements in the future.

For example, your current inventory required $50,000 in factory overhead with 5,000 direct labor hours last quarter. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation:

$50,000 / 5,000 = $10

You will spend $10 on overhead expenses for every unit your company produces. Therefore, you would assign $10 to each product to account for overhead costs in your financial statements. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don’t match reality.

This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Applied overhead usually differs from actual manufacturing overhead or the actual expenses incurred during production.

These two amounts seldom match in any accounting period, but the variance will generally average to zero after multiple quarters. If this variance persists over time, adjust your predetermined overhead rate to align it more closely to actual overhead figures reported in your financial statements.

Frequently Asked Questions

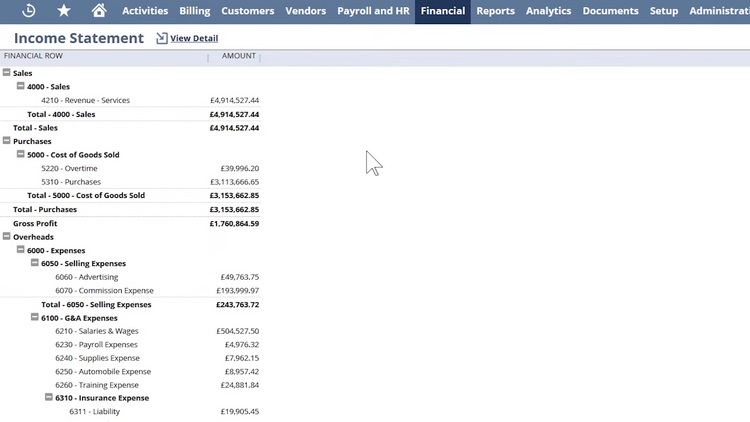

Where do you find manufacturing overhead in financial statements?

Manufacturing overhead is not typically listed as a separate line item on standard financial statements like the income statement or balance sheet. However, it is included in the Cost of Goods Sold (COGS) section on the income statement, which covers all production costs, including overhead. Also, on the balance sheet, manufacturing overhead is found in the inventory account as raw materials, work-in-progress, and finished goods, which will reflect the overhead costs that were allocated to inventory during production.

To find the detailed breakdown of manufacturing overhead, you would need to refer to your company’s internal cost accounting records.

Don’t have any accounting records, or are your records convoluted? Find a manufacturing ERP for your business here: The Top Manufacturing ERPs

Why is it important to calculate manufacturing overhead?

Adding manufacturing overhead expenses to the total costs of products you sell provides a more accurate picture of how to price your goods for consumers. If you only take direct costs into account and do not factor in overhead, you’re more likely to underprice your products and decrease your profit margin overall.

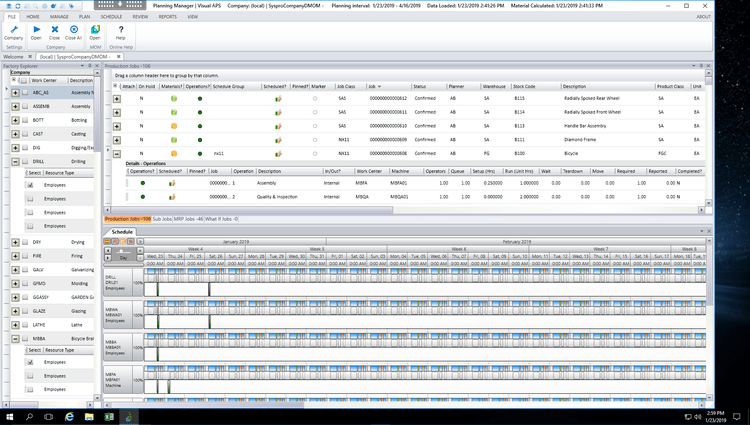

How do I automate production cost reporting?

Manufacturing Resource Planning (MRP) software provides accurate primary and secondary cost reporting on overhead, labor, and other manufacturing costs. MRP software also tracks demand forecasting, equipment maintenance scheduling, job costing, and shop floor control, among its many other functionalities.