How to Read and Understand an Income Statement

An income statement provides business owners with a digestible way to review revenue and expenses over a period of time. Individual transactions are grouped into specific categories to show the total income, total cost of goods, gross profit, total expenses, total other income and expenses, and net income of a business. This guide will help you read and understand the components of an income statement:

What is an Income Statement?

An income statement, also known as a profit-and-loss statement, is a financial document that outlines a company’s expenses, revenues, and profitability typically over a monthly, quarterly, or annual period. This sheet, alongside a balance sheet and cash flow statement, are the three primary sources providing insight to a company’s financial performance.

What’s Included on an Income Statement?

An income statement shows you the high-level categories of revenues and expenses in a number of specific categories. These categories are:

- Total Revenue: The total or gross income a company makes from selling products or services.

- Cost of Goods Sold (COGS): The direct costs necessary for producing goods, calculated by adding initial inventory to purchases and then subtracting the ending inventory from that sum.

- Gross Profit: The profits a company makes after subtracting the costs of production.

- Operating Expenses: Any costs incurred from normal business operations, such as utilities and employee salaries.

- Operating Profit: Company profit before taxes and interest are deducted.

- Interest Expenses: All interest costs related to borrowed money based on what the original lender charges, the sum of net income, interest, and taxes.

- Earning Before Interest and Taxes (EBIT or EBITDA): A company’s earnings before interest and taxes.

- Income Tax Expense: The total taxes owed by a company.

- Net Profit: The total profits of a company after paying all its expenses, such as taxes, aka “the bottom line”.

Together on a financial statement, these metrics communicate performance during the current period and year-to-date. Net income shows the literal bottom line of a company’s profits by subtracting expenses from total revenue.

Businesses may have more or less on their income statements, depending on whether they have additional sources of revenue or expenses.

Tips for Reading an Income Statement (with Examples)

Start with the Bottom Line

It’s counterintuitive, but with income statements, you need to start at the bottom.

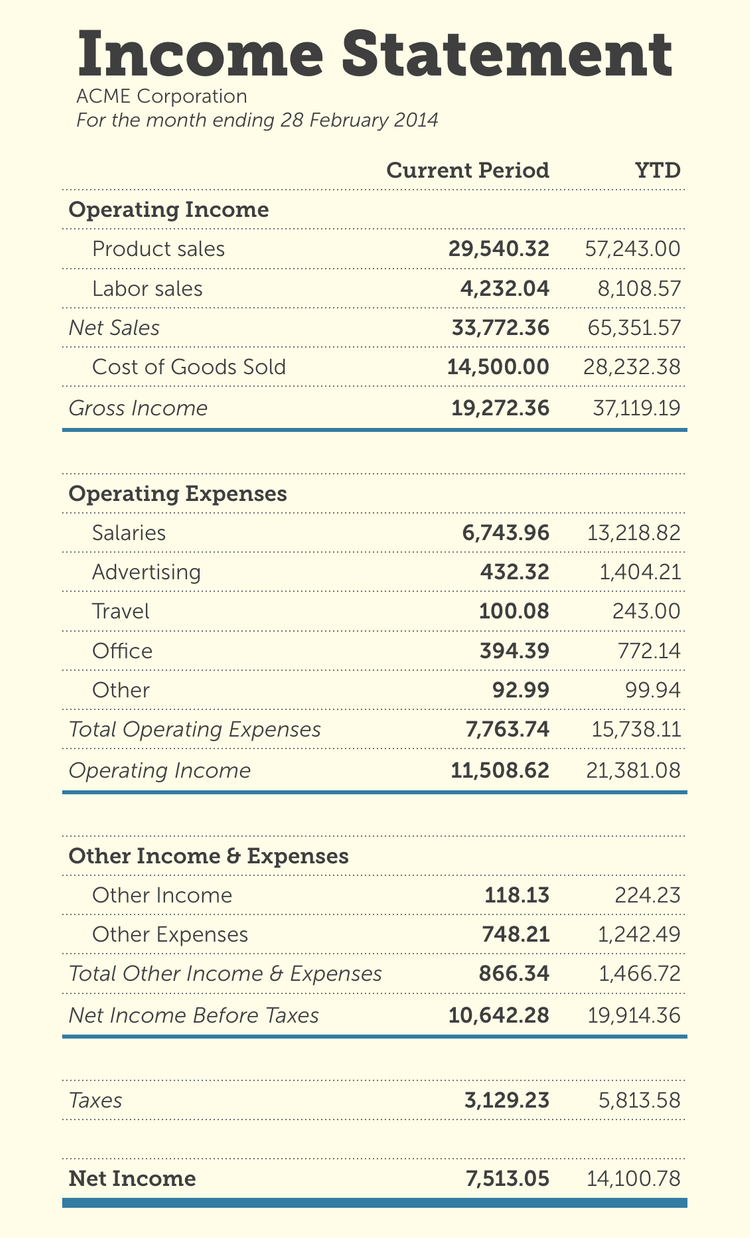

The literal “bottom line” shows net profits, one of the best indicators of a company’s performance. The bottom line above is a positive $7,513.05, showing the business made a profit last month.

Know Your Metrics

Basic metrics such as the total income, total cost of goods, gross profit, total expenses, total other income and expenses, and net income provide a common language to communicate performance.

Knowing these metrics is critical for reading and understanding income statements.

Using the above example:

- The net sales shows combined labor and product sales are $33,772.36.

- The cost of goods sold was $14,500. That gets subtracted from the operating income above to reveal a gross income of $19,272.36.

- The overhead or total operating expenses reached $7,763.74.

- The net income before taxes was $10,642.28. Subtracting $3,129.23 in taxes leads to the $7,513.05 bottom line.

Perform Trend Analysis

Comparison is at the heart of financial analysis. One of the most critical comparisons a business can make is by looking at past results to determine if performance in each recorded financial dimension is better or worse. Knowing how finances have changed reveals whether future adjustments are needed, or processes can stay the same.

For example, the above financial statement was made in February. How might operating costs differ in warmer months?

Why Do You Need an Income Statement?

There are many compelling business reasons to make sure you’re able to produce an accurate income statement–beyond just understanding your net income or net loss. To start, GAAP requires public companies to provide income statements. You’ll need an income statement for the following:

- Loan qualification

- Investor contributions

- Tax preparation

Income statements are also required for public companies under GAAP (Generally Accepted Accounting Principles). Additionally, income statements provide a window into your company’s financial health to guide better business decisions.

Advanced Usage

Companies use income statements to compare performance and find trends over different periods. The more income statements you have, the more comparisons you can make to identify new opportunities or trends in your operations.

Month-to-Month

Month-to-month statements compare fiscal performance every month.

The shorter timespan gives a clear view of a company’s immediate financial situation. Business owners can use the gathered information to identify problems with the company’s financial performance before they grow out of control. It’s also quite common for analysts to compare specific months when looking at year-to-year data.

These month-to-month statements are often more relevant for seasonal businesses because they are primarily used during a certain time of year. Some obvious examples include lawn care services, which are busier in spring and summer, and ski resorts, which only operate in fall or winter.

Quarter to Quarter

Quarterly statements cover a company’s finances for 3-month periods:

- Quarter 1: January, February, and March

- Quarter 2: April, May, and June

- Quarter 3: July, August, and September

- Quarter 4: October, November, and December

With slightly longer reporting periods, quarterly reports show the beginnings of long-term financial changes at a company.

Both monthly and quarterly reports may include an additional column showing year-to-date totals.

Year over Year

Year-over-year income statements provide even more value by showcasing how a company’s finances have changed over a 12-month period or fiscal year. These annual reports can reflect long-term success or reveal problems. Year-end income statements are also popular for reflecting on the last calendar year.

Income Statements vs. Balance Sheets

An income statement is a financial report detailing net profits and losses over a period of time. A balance sheet is a snapshot report that details how much worth or value a business has in assets, liabilities, and shareholder equity.

Along with the cash flow statement, these documents are needed for a full overview of a company’s financial health. Accounting software can automate report generation with custom templates to keep all financial data in one location for easy sharing with stakeholders.