Easypay Payroll

3 Reviews 4.5/5 ★ ★ ★ ★ ★A Canadian payroll software designed for SMBs.

Product Overview

Easypay is a payroll software developed and supported in Canada, designed for small and mid-sized companies. It offers functionalities to manage payroll processes and tax reporting tasks efficiently. The software includes features like direct deposits, expense management, automated Record of Employment (ROE) processes, and year-end reporting. It allows customization and offers different payment options, including a free trial period.Pros

- Offers various payroll period lengths for both hourly and salaried employees.

- Free 45-day trial

- Capabilities for EI, CPP, and tax calculations across all provinces and territories

Cons

- Lacks features such as garnishments, lifetime accounts, or employee self-service portals

- Limited third-party integrations

- Canadian businesses only

Target Market

Small to medium-sized businesses in Canada. It provides efficient payroll and tax reporting tasks, suitable for these company sizes.Not Recommended For

Larger enterprises or businesses seeking extensive integration capabilities or those requiring a mobile app for payroll management.Features

Usability

- Unlimited number of employees and companies supported.

- Suitable for hourly, salaried, and commissioned employees.

- Supports various pay periods: weekly, biweekly, semi-monthly, monthly, ten, and thirteen pays.

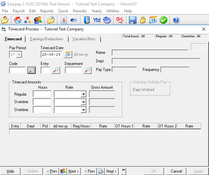

Payroll Processing

- Quick Cheque feature for easy cheque creation.

- Supports direct deposit and cheque printing.

- Compatible with major banks and credit unions.

- Interface with TelPay for alternative direct deposit services.

- Automated Record of Employment (ROE) process.

- Maintains detailed pay history for auditing and reporting.

Deductions and Benefits

- Calculates EI, CPP, and taxes for all provinces and territories.

- Handles various deductions (taxable, non-taxable, flat amount, percentage, or cents per hour).

- 40 user-definable deductions, plus additional earnings options at timecard entry.

- Unlimited hourly and piecework rates.

Departmental Costing

- Multi-departmental expense allocation.

- No limit on the number of departments per company.

Year-End Reporting

- Generates T4, T4A, and Quebec Relevé 1 records.

- Supports electronic filing of T4, T4A, and Relevé 1 information.

Customization

- Customizer Module as an optional add-on.

- Features include time clock record import, ASCII file creation, and import for employee records.

- Ability to generate custom ASCII files from Easypay data.

Pricing

Easypay Payroll is priced at $479, which includes the Annual Support Package with unlimited technical support and tax table updates.

Starting Price

$399

(perpetual license)

Price Range

Learn More

$ $ $ $ $

$ $ $ $ $

Product Overview

Developer Overview

Related Products

User Reviews of Easypay Payroll

Write a Review

Karen Maxwell

Overall

★★★★★

Easypay Payroll Review

February 8th, 2021

• Roles: Purchaser & End User

Software works somewhat seamlessly. Customer support is not good.

Pros

Ease of use; reporting is adequate.

Cons

Rude customer service reps

Dan Murray

Overall

★★★★★

Easypay Payroll Review

June 28th, 2019

• Roles: Purchaser & End User

Of all the payroll systems we’ve used, Easypay is #1. Payroll has become a breeze, it now takes only 30 minutes to run.

Jim Couturier

Overall

★★★★★

Easypay Payroll Review

June 28th, 2019

• Roles: Purchaser & End User

It’s easy to use and we saved over $6,500 in our first year