CenterPoint Payroll Review: Pros, Cons, Reviews

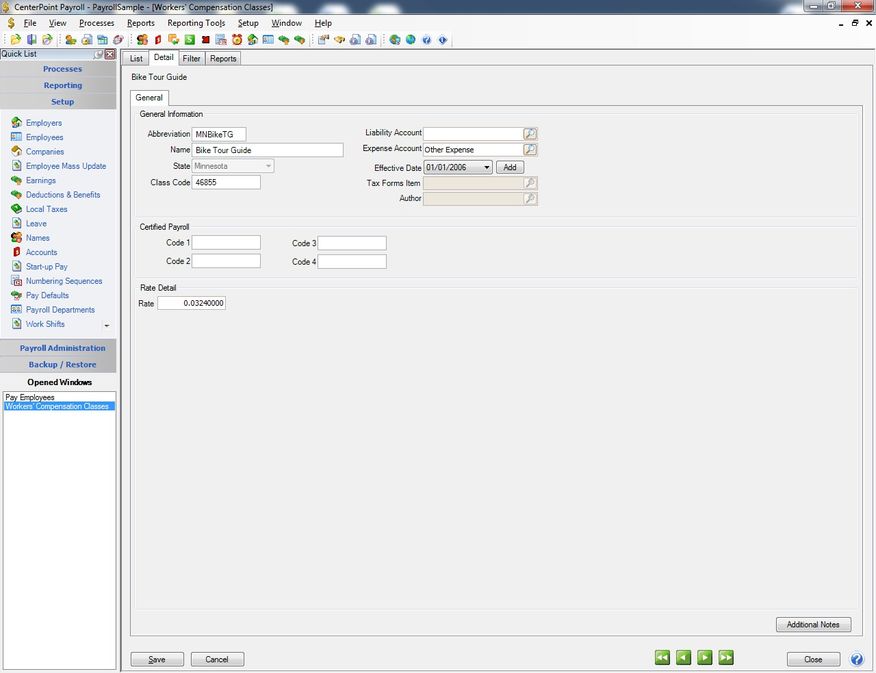

We recommend CenterPoint Payroll for businesses operating in multiple locations due to its multi-state payroll and complex payroll codes. This includes garnishments, benefits, and overtime calculations. Its strong reporting and customization options are also a nice touch.

However, CenterPoint Payroll isn’t the best fit for businesses with more than 500 employees. It also doesn’t track employee hours and PTO but has a separate, web-based timesheet add-on for an additional cost.

- Multi-state payroll capabilities

- Manages complex payroll codes

- Direct deposit functionality

- Pricing requires consultation call

- Limited scalability for larger companies

- Time tracking system is separate

- Developer Red Wing Software, Inc.

- Client OS Windows, Web

- Deployment Cloud or On-Premises

What Is CenterPoint Payroll?

The platform helps small to mid-sized businesses manage and streamline their payroll processes efficiently. CenterPoint Payroll offers various features, including customizable payroll processing, time tracking, tax management, direct deposit, and detailed reporting.

Additionally, it supports multiple pay rates and integrates seamlessly with various accounting systems. Companies can deploy the software on-premises or in the cloud, providing flexibility and scalability to meet their evolving payroll needs.

Our Ratings

| Usability - 10 | Highly customizable, Windows-based navigation; menus reflect individual user preferences; offers an employee portal for accessing pay stubs and making personal info updates; offers a mass update wizard to make changes to multiple employee records simultaneously. |

| Support - 7.5 | Phone support available 8 am - 5 pm CST Mon-Fri with guaranteed response times; email submission available 24 hours a day, responses limited to normal support hours; offers searchable help guide and subject-driven videos; works closely with users to provide guidance on customization and pricing details. |

| Scalability - 7 | Can import and export data to and from other accounting software; limited scalability for businesses over 500 employees; integrates with JobBOSS², Conservis, etc.; compatible with a wide range of business types. |

| Security - 10 | Uses latest client/server technology from Microsoft, ensuring data security and reliability; provides company- and menu-level security; allows you to keep multiple copies of backups to restore data; includes validation checks to prevent errors in data entry; provides alerts for potential discrepancies in Social Security numbers and other crucial employee data to minimize risk of fraud. |

| Value - 7.6 | Has tiered pricing based on user count rather than users per month; does not charge for direct deposit, but the bank may charge their own fees for sending funds; offers additional modules based on customer requirements. |

| Performance - 7.5 | Occasional system lag when retrieving employee salary data, but reasonably fast and responsive when moving from functionality to functionality; delivers reliable and efficient performance for payroll processing. |

| Key Features - 10 | Supports creating and managing custom reports with interactive drill-down capabilities; provides federal and state tax forms management with options for local tax tracking; offers eFiling directly out of the platform; provides essential features such as employee record management and earnings and deduction tracking. |

Who Uses CenterPoint Payroll?

CenterPoint Payroll is best for small to medium companies ranging from 10 to 500 employees across diverse industries. The software works well for businesses with multi-state employees or operations, including agriculture and those with H2A employees. CenterPoint Payroll is ideal for organizations that require customizability in payroll codes, deductions and benefits, and pay structures.

Accurate Multi-State Payroll

The system simplifies complex payroll management in multiple states, each with its own tax regulations and requirements. It also has functionalities to detect data entry errors and discrepancies in employee information, ensuring accuracy and preventing costly mistakes down the road.

-

Streamlined compliance: The software automates the calculation and withholding of taxes at the federal and state levels. It provides accurate calculations based on specific tax laws, ensuring compliance and eliminating the need to research obligations for each state manually.

-

Error prevention: The platform has built-in validation checks to limit errors in payroll processing. For example, it can detect and warn users of inconsistencies or errors in Social Security or Medicare numbers, ensuring accurate reporting and reducing the risk of penalties or fines.

The software’s multi-state payroll and validation checks address tax regulation complexities, eliminate errors, enhance employee convenience, and minimize the need for tax return amendments. These aspects contribute to a seamless and compliant payroll process, making it a noteworthy choice for multi-location businesses.

Dynamic Tasks Panel

Introduced in March 2025, the Tasks Panel allows users to track and manage time-sensitive tasks, much like a to-do list. CenterPoint highlights past-due tasks, upcoming tasks, and notifies users when tasks are due. Users can track payroll liabilities, A/P invoices, and create custom tasks for any payroll-related activity. The intuitive dashboard allows users to launch actions such as generating reports or submitting direct deposits right from the dashboard. And any workflows or automation you create will be saved to make running payroll the next time that much easier.

What Features Are Missing?

- Customizations: Custom development for specific integrations may come at an additional cost. For example, Red Wing Software will charge a company to create a custom report for 401k providers. However, this is a one-time expense; if the report should need to be modified, Red Wing Software will make changes at no further charge.

- Local tax tracking: The system does not automatically track local taxes, so these fields will require user input. Employers can retrieve municipal tax tables for items like school district taxes and manually enter them into the platform.

Pricing

The system offers personalized pricing tailored to each client, ensuring they are billed only for their specific, required features. The software’s pricing structure features tiered options, grouping clusters of users instead of charging per user per month. Additionally, CenterPoint Payroll does not impose any charges for direct deposit functionality, although banks may have their own fees associated with fund transfers.

Alternatives

Summary

We like CenterPoint Payroll for its customizability and multi-location support. The software excels in handling multi-state payroll, complex payroll codes, and customizable reports. Its ability to manage multiple pay rates and benefit accruals benefits businesses with diverse employee contracts. Additionally, the flexibility to choose between cloud-hosted or on-premises deployment can cater to varying IT infrastructures and preferences.

However, we don’t recommend the platform for larger businesses seeking scalability. If a company operates globally with employees in different countries, it may need a payroll system with more sophisticated international payroll and compliance features. Pricing is unavailable on the website, necessitating direct contact with the company for details.

Overall, we think CenterPoint Payroll is a great choice for small—to medium-sized companies needing an adaptable payroll solution.

User Reviews of CenterPoint Payroll

Write a Review- Industrial Conglomerates

- 11-50 employees

- Annual revenue $1M-$10M

CenterPoint Payroll Review

Love the payroll no need for a outside service

Pros

It does everything for you and is very user friendly

Cons

Where you can archive old years and do it yourself

- Industrial Conglomerates

- 11-50 employees

- Annual revenue $1M-$10M

Love it would not use another payroll

Love it would not use another payroll and it does everything you need. Will save you money and no need to use outside service payroll company

Pros

It does everything you need, payroll, direct deposit, qrtly reports and W2's and is user friendly and efficient

Cons

Would be nice if you could archive old employees that is no longer with the company

CP Payroll is very easy to use

CP Payroll is very easy to use. Advertised to be able to reprint a check; however, not possible. Have to void the check and re-do the payroll

Pros

Being able to copy previous payroll

Cons

If making an error have to void the entire payroll and start over.

- Construction & Engineering

- 1-10 employees

- Annual revenue $1M-$10M

CPPR is a great Payroll program and the support at Redwing has been wonderful

I have been in business for 40 years using the Red Wing Products. CPPR is a great Payroll program and the support at Redwing has been wonderful. I have just recently out sourced my payroll as I am going into retirement mode and seeing what I had and what I am going to has been an eye opener.

Pros

I like everything except I have learned not to be the "tester" when the new PR versions come out I try to wait a bit and hope the first bugs (if any) are dealt with before I download it.

Cons

Maybe just me but I really struggled with the set up of the ex: child support and the pretax set ups. Seems so confusing back in that section

- Commercial Services & Supplies

- 1-10 employees

- Annual revenue $0-$1M

Mark is WONDERFUL and so patient with me

I am a NEW user so I can’t give it 5 stars yet. There is so much I don’t understand but I’m learning.

Pros

First of all, I must tell you that Mark is WONDERFUL and so patient with me, I wish that I could meet him in person. I have been calling him once a week and probably should again today but I am going to try and solve my problem.

Cons

I don't understand the filters at all. For some reason, I can't get reports out properly . I've wasted so much paper getting only a heading on the page and no report. It's me, I know, but it is annoying.

- Automotive

- 1-10 employees

- Annual revenue $0-$1M

I have been impressed with the reporting capabilities

I have been impressed with the reporting capabilities. I really like the ability to create a report with so many options and possibilites. The other impressive part is the support. The support staff is quick to respond knowledgeable and provide answers beyond the text book statement.

Pros

Support staff

Cons

I would like to be able to have a "template" payroll. Majority of our weeks payroll entry, deduction are the same. The only difference is the hours many vary.